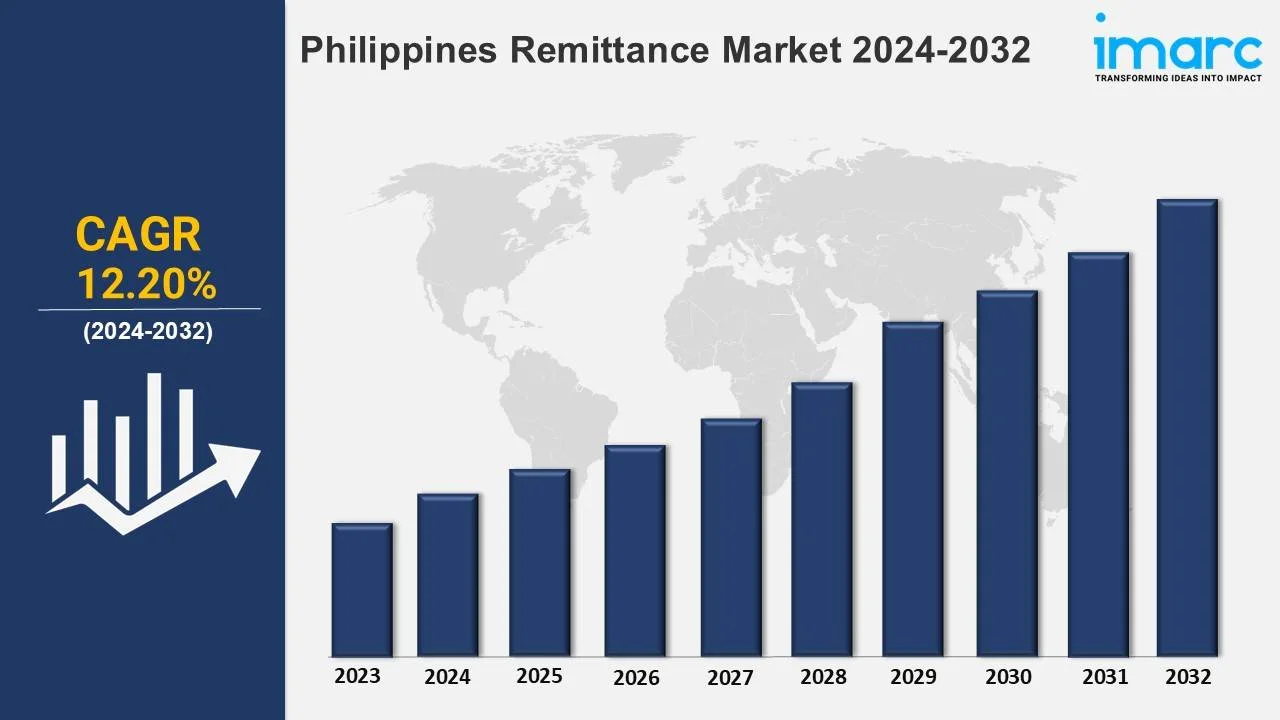

Philippines Remittance Market 2024-2032

According to IMARC Group's report titled "Philippines Remittance Market Report by Mode of Transfer (Digital, Traditional (Non-digital)), Type (Inward Remittance, Outward Remittance), Channel (Banks, Money Transfer Operators, Online Platforms (Wallets)), End Use (Migrant Labor Workforce, Personal, Small Businesses, and Others), and Region 2024-2032", the market is projected to exhibit a growth rate (CAGR) of 12.20% during 2024-2032. The remittance market in the Philippines is experiencing significant trends as a result of technology innovation, changing demographics and evolving consumer behavior. Digital remittance platforms are taking off as Filipinos working abroad leverage quicker, cheaper and convenient ways to send money home. Mobile wallets and blockchain transfers are gaining traction as senders decrease their reliance on traditional physical services.

In addition, the increase in size of the Filipino diaspora, especially by the US, Middle East and Europe, is driving the remittance inflow. Also beneficial to the growth rate of remittance inflow are government initiatives that include partnerships with fintech firms and regulatory reforms to make cross-border transfer opportunities efficient. The rise of non-bank financial institutions is also transforming the market by providing consumers with competitive exchange rates and, often, lower fees than others. Besides which, remittance senders are increasingly concerned about methods of transfer that are considered secure and transparent, leading service providers to develop preventative measures against fraud and identity theft. Seasonality in remittance sends caused by holidays, holidays and emergencies create opportunities for more remittances and emphasize flexibility within the remittance market. The trends underlying remittance exchanges within the Philippines are indicative of the growing digitization and fragmentation of remittances channels for overseas Filipino workers (OFWs) and their families.

Request Free Sample Report: https://www.imarcgroup.com/philippines-remittance-market/requestsample

Philippines Remittance Market Scope and Growth Analysis:

The remittance market in the Philippines has substantial potential for growth. It is built on the foundation of the Philippines' ongoing dependence on foreign-sourced income and its highly developed financial services segment. Remittances are an important part of the Philippine economy, accounting for a large portion of GDP and household consumption, and the continuing growth in the number of overseas Filipino workers (OFWs), will keep the demand for remittances strong. Additionally, due to financial inclusion efforts such as mobile banking and continued growth of agent networks, remittances are becoming increasingly available in poorer and rural areas.

Global and local competitors in the remittance market are getting more competitive by adding user-friendly apps, loyalty programs, and other innovations to gain market share. The remittance market also enjoys favorable government policies, such as tax benefits for OFWs and collaboration with international payment systems. Growth is also occurring in the remittance market because of efficiency resulting from increased access to digital transfer over cash, and the lower operating costs associated. The remittance market also has good cultural connections due to the high priority Filipinos abroad put on financial support for their families. Overall, the remittance market is well-positioned for gradual growth due to maintaining high demand, increased digital banking and continued connection to families.

Philippines Remittance Market Research and Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Philippines remittance market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Mode of Transfer Insights:

- Digital

- Traditional (Non-digital)

Type Insights:

- Inward Remittance

- Outward Remittance

Channel Insights:

- Banks

- Money Transfer Operators

- Online Platforms (Wallets)

End Use Insights:

- Migrant Labor Workforce

- Personal

- Small Businesses

- Others

Country Insights:

- Luzon

- Visayas

- Mindanao

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=24332&flag=C

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145