Canada Payments Market 2024-2032

According to IMARC Group's report titled "Canada Payments Market Report by Mode of Payment (Point of Sale, Online Sale), End Use Industry (Retail, Entertainment, Healthcare, Hospitality, and Others), and Region 2024-2032", The report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the Canada Payments Industry ?

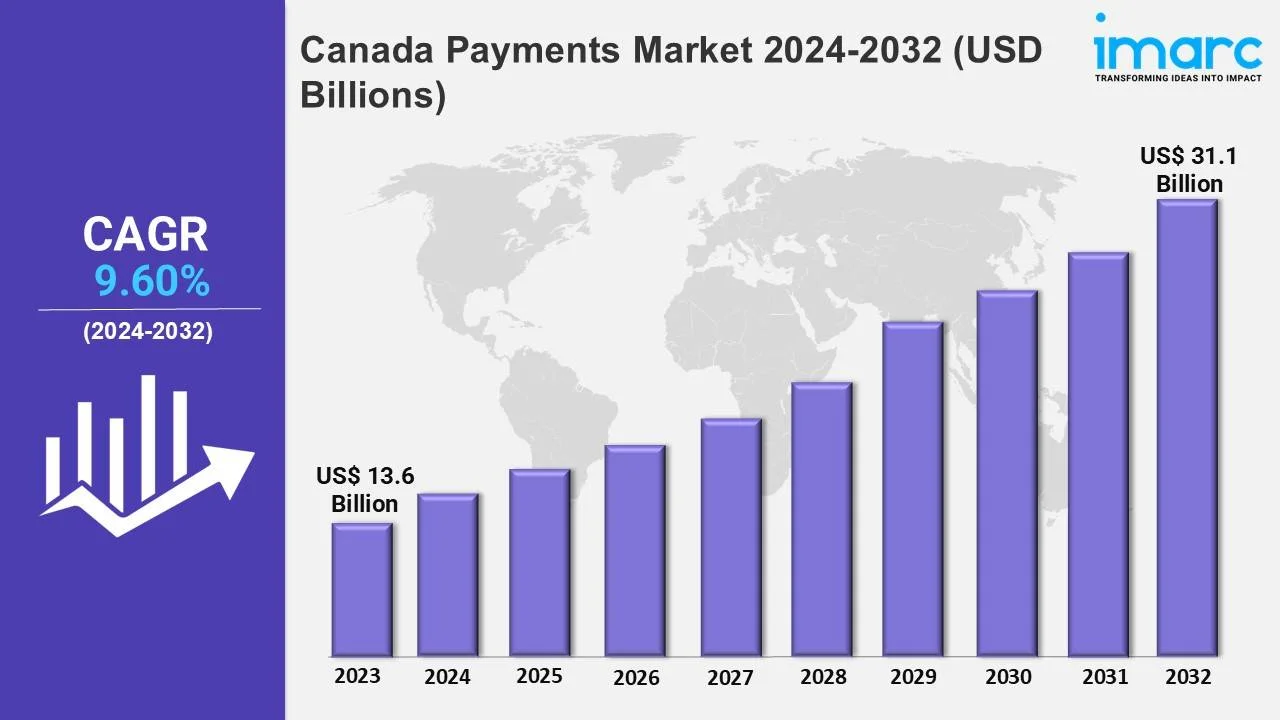

The Canada payments market size was valued at USD 13.6 Billion in 2023 and is projected to grow to USD 31.1 Billion by 2032, with an expected compound annual growth rate (CAGR) of 9.60% from 2024 to 2032.

Canada Payments Market Trends:

The payments market is experiencing a significant transformation in Canada due to a combination of advances in technology, regulatory changes, and changing consumer behaviours. Digital payments, in particular contactless and mobile wallets, have gone mainstream. The reliance on smartphones, coupled with the preference for faster and more efficient way of payment, has transformed the payments landscape in Canada. Further, the increase in e-commerce, as well as omnichannel retail experiences, has simultaneously increased demand for convenient and seamless payment methods. New payment methods, traditional debit and credit cards, are having an impact on consumer preferences. Furthermore, the expected launch of real-time payments through Canada’s Real Time Rail (RTR), will fundamentally change the transaction landscape by facilitating funds that transfer instantly. However, consumer demand can only be solved through innovation.

The advent of open banking is leading to innovative possibilities in payments examples of fintech companies and traditional banks collaborating on next-generation payment solutions. As a result, Canada's payments landscape is becoming wider, as alternative payment methods, such as buy-now-pay-later (BNPL) programs and cryptocurrency adoption are increasingly accepted by commerce retailers. On a wider scale, digital payments are flexible and are becoming more inclusive as consumers want new payment options. Ultimately security remains a top priority for consumers when choosing to make purchases through digital payment. See Levin et al. (2022), as consumers rightfully have concerns regarding the security of their data. As a mechanic for building greater trust in digital payments is through the advent of more robust security credentials, whether that be through biometric security mechanisms to access accounts, or AI-modeling techniques to avert identity fraud and rand access attempts, the overall consumer experience is becoming exponentially secure. Therefore, the payments ecosystem is becoming increasingly secure for businesses and consumers alike.

Request Free Sample Report: https://www.imarcgroup.com/canada-payments-market/requestsample

Canada Payments Market Scope and Growth:

The Canada payments market appears to be positioned for significant growth supported by strong financial infrastructure, digital adoption Trend and regulatory initiatives. The growth of e-commerce and the increasing popularity of subscription and on-demand services are driving demand for a greater variety of payments services including cross-border and recurring payments. In addition, there is greater use of digital payments by small and medium sized enterprises (SMEs) to manage cash flow and improve customer experience which is also stimulating growth.

Additionally, support from governmental bodies to reduce cash dependence and stimulate financial inclusion are providing growing opportunities to further accelerate digital payments across FORS regions. Finally, the integration of new technologies such as blockchain and AI enhance payment systems by improving transactions transparency, fraud reduction and speed. With fintech innovation seemingly never ending, opportunities abound for banks, payments companies and tech providers to meet rapidly changing consumer expectations and changing industry developments in the Canada payments market to stay relevant and build competitiveness and treated as long-term options.

We explore the factors propelling the Canada payments market growth, including technological advancements, consumer behaviors, and regulatory changes.

Canada Payments Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Canada payments market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Mode of Payment Insights:

- Point of Sale

- Card Payments

- Digital Wallet

- Cash

- Others

- Online Sale

- Card Payments

- Digital Wallet

- Others

End Use Industry Insights:

- Retail

- Entertainment

- Healthcare

- Hospitality

- Others

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=23898&flag=C

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145