Market Estimation & Definition

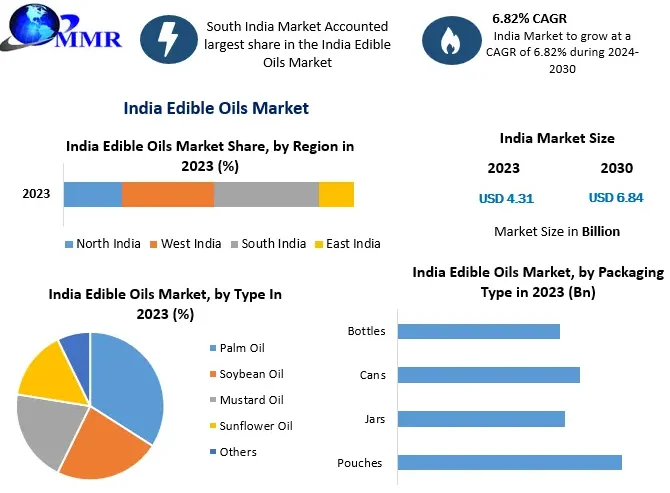

The India Edible Oils Industry was valued at approximately USD 4.31 billion in 2023 and is projected to reach USD 6.84 billion by 2030, growing at a CAGR of 6.8% over the forecast period. Edible oils are essential household and industrial products derived from plant, animal, or synthetic fat sources, used in cooking, frying, and food processing. The market includes a range of oil types such as palm, soybean, mustard, sunflower, olive, rice-bran, and sesame oils, delivered through varied packaging formats like pouches, bottles, cans, and jars.

Ask for Sample to Know US Tariff Impacts on India Edible Oils Industry @ https://www.maximizemarketresearch.com/request-sample/125654/

Types of Oils usually in use in Country:

India is privileged in consuming a wide variety of oilseeds crops grown in its various agro-climatic areas. Groundnut, Sesame, linseed, castor are the main usually cultivated oilseeds. Soybean & sunflower have also been considered major places in the edible oil market. Coconut is the most significant amongst the farm crops. Efforts are being made to raise oil palm in AP, Karnataka, Tamil Nadu & North-Eastern parts of India in adding to Kerala & Andaman and the Nicobar Islands. Among the non-conventional oils, rice bran oil & cottonseed oil are the supreme. In addition, oilseeds of tree & forest sources, which raise mostly in tribal populated zones, are also a major source of oils. Figures relating to the expected production of key cultivated oilseeds, obtainability of edible oils from all local sources during the past 10 years & the current year are as below.

Market Growth Drivers & Opportunities

Several factors are propelling the growth of India’s edible oils market. Rising health awareness among consumers has boosted demand for oils with functional health benefits, including cholesterol-lowering and heart-friendly properties. Oils such as rice-bran, olive, and fortified variants are gaining favor among urban consumers.

Government initiatives encouraging oilseed cultivation and palm oil plantation expansion are expected to reduce import dependency and strengthen domestic production. Furthermore, growth in rural consumption continues to play a significant role, as increasing disposable incomes and awareness drive demand even in tier 2 and tier 3 towns.

The recent revision of import duties on crude edible oils and supportive policies aimed at improving refining capacities have also enhanced market prospects. Additionally, opportunities lie in value-added products, packaging innovations, and the rising adoption of online retail channels.

Segmentation Analysis

By type, the market is dominated by palm oil, followed by soybean, mustard, sunflower, and rice-bran oils. Olive oil and niche variants are gradually expanding their market share in premium segments. In terms of packaging, plastic pouches hold the largest share due to affordability and convenience, followed by bottles, jars, and metal tins. Distribution-wise, supermarkets and hypermarkets remain dominant, while online platforms and convenience stores are rapidly growing, especially in metro cities.

Explore key trends, innovations & market forecasts: https://www.maximizemarketresearch.com/market-report/india-edible-oils-market/125654/

MMR Viewpoint:

According to the MMR report study, the Indian edible oils market is anticipated to improve at a significant rate with South India & East India holding the supreme development potential throughout the forecast period in the overall edible oils market. A rise in inventions in equipment & the growth of new items like organic & low-cholesterol oils together with health welfares is motivating the demand for edible oils throughout the globe. Market companies are capitalizing in M&A, and are using their knowledge in the use of the new technology will deliver gain profitability & momentum in the worldwide edible oils market. However, the extra costs related to the processing of oils could hamper the development of the edible oils market.

Country-Level Analysis: USA & Germany

In the United States, the edible oils market is driven by soybean, palm, and increasingly olive oils, with applications expanding beyond food to cosmetics and pharmaceuticals. Germany, a mature market, maintains steady consumption, favoring sunflower and olive oils. The country’s demand is aligned with health-conscious trends and sustainable product preferences, reflecting broader European market patterns.

Competitor Analysis

Major market players include

1. KSE

2. Ruchi Soya Industries Ltd

3. Gokul Agro Resources Ltd.

4. Gujarat Ambuja Exports Ltd.

5. Gokul Refoils And Solvent Ltd.

6. Vijay Solvex Ltd.

7. BCL Industries Ltd.

8. Agro Tech Foods Ltd.

9. Anik Industries Ltd.

10. Kriti Nutrients

11. Fortune by Adani Group

12. Sundrop by Agro Tech Foods

13. Dhara by Mother Dairy

14. Dalda by Bunge Limited

15. Cargill (Gemini, Nature Fresh and Sweekar).

Conclusion

India’s edible oils market is entering a dynamic growth phase, fueled by shifting consumer preferences, policy reforms, and increased domestic production. With health-driven innovations, packaging enhancements, and rising rural and urban demand, the market offers ample opportunities for both local players and multinational companies. The future landscape promises robust growth for investors, manufacturers, and distributors committed to delivering quality and value-added edible oil products to diverse consumer segments.

Frequently Asked Questions:

1) What was the market size of India Edible Oils Market markets in 2023?

2) What is the market segment of India Edible Oils Market markets?

3) What is forecast period consider for India Edible Oils Market?

4) Which are the worldwide major key players covered for India Edible Oils Market report?

5) What was the market size of India Edible Oils Market markets in 2030?

About Us