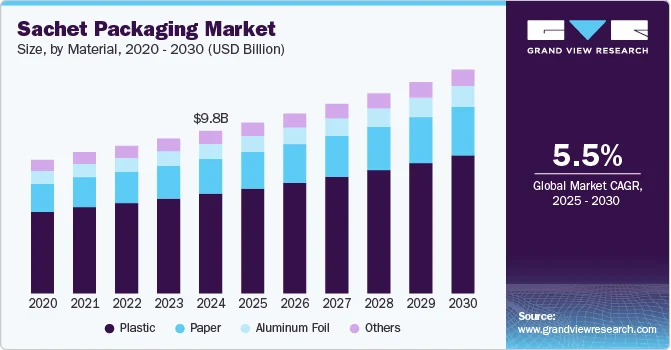

The global sachet packaging market size was valued at USD 9.82 billion in 2024 and is anticipated to reach USD 13.52 billion by 2030, expanding at a CAGR of 5.5% from 2025 to 2030. The market's growth is primarily fueled by increasing demand for economical and convenient packaging options, expansion in the fast-moving consumer goods (FMCG) sector, and continuous innovations in packaging technologies.

Sachets are widely adopted across industries such as food & beverages, personal care, pharmaceuticals, and household products due to their low cost, portability, and efficiency in preserving product freshness. A growing preference for single-use and compact packaging formats, especially in developing regions, continues to drive market expansion.

The rising demand for affordable packaging solutions in emerging economies significantly boosts the market. In regions like Asia-Pacific, Latin America, and Africa—where price sensitivity is higher—sachets provide an economical way for consumers to purchase everyday products in smaller quantities. Countries such as India and Indonesia have witnessed increased usage of sachets for shampoos, detergents, and sauces among lower and middle-income populations. Major FMCG companies, including Unilever and P&G, have capitalized on this trend by offering sachet versions of their products, enabling wider market penetration into rural and semi-urban areas.

Moreover, the growing trend of on-the-go consumption is a key market driver. Increasing urbanization and fast-paced lifestyles have led to rising demand for easy-to-carry and disposable packaging. Sachets offer the perfect solution for single-serve products like condiments, instant coffee, and dietary supplements. The food & beverage industry has particularly benefited, using sachets for products such as ketchup and coffee to meet consumer needs. Additionally, the rise of e-commerce and food delivery services has contributed to the growing use of sachets due to their portion control benefits and reduced packaging waste.

Advancements in packaging materials and printing technologies have further supported the growth of the sachet packaging market. Manufacturers are now producing high-barrier films that help extend product shelf life while preserving freshness. With increasing environmental concerns, innovations in sustainable packaging—such as biodegradable and recyclable sachets—are gaining momentum.

For example, in April 2022, Mondi partnered with French machine supplier Thimonnier to introduce recyclable sachets for liquid soap refills. These berlingot sachets, made from recyclable mono-material coextruded polyethylene (PE), reduce plastic use by over 75% compared to traditional rigid bottles and offer a recyclable alternative to non-recyclable multilayer PVC containers.

Order a free sample PDF of the Sachet Packaging Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific held the largest market share at over 38.0% in 2024 and is expected to register the fastest CAGR of 6.0% through 2030.

- The U.S. market is supported by a strong consumer packaged goods (CPG) sector and shifting consumer preferences.

- In terms of materials, the plastic segment led with over 61.0% revenue share in 2024.

- By end-use, the food & beverage segment accounted for more than 41.0% revenue share in 2024 and is projected to expand at a CAGR of 6.0%.

Market Size & Forecast

- 2024 Market Size: USD 9.82 Billion

- 2030 Projected Market Size: USD 13.52 Billion

- CAGR (2025–2030): 5.5%

- Leading Region (2024): Asia Pacific

Regional Insights

In Asia Pacific, sachet packaging is widespread due to lower income levels and the need for cost-effective options. Consumers in countries like India, Indonesia, and the Philippines regularly purchase premium goods in small, budget-friendly sachets. Products such as shampoo, detergents, and personal care items are frequently sold in sachets priced at 1–2 rupees or pesos. Companies like Unilever and P&G have successfully adopted sachetization strategies to reach rural markets.

China's sachet packaging market has surged, driven by a massive population, urban expansion, and a growing middle class seeking convenience. The personal care and food sectors are notable contributors. Additionally, China’s strong manufacturing infrastructure and investment in flexible packaging technologies—particularly in provinces like Guangdong and Zhejiang—support market growth.

In North America, the pharmaceutical sector is a major adopter of sachet packaging, especially in the U.S. Regulatory compliance and the need for precise dosages have led to the widespread use of sachets for medicines, vitamins, and supplements. Companies such as Abbott Laboratories and Johnson & Johnson rely on sachets to meet FDA standards while enhancing product shelf life. Meanwhile, U.S. consumers' increasing preference for single-serve products has encouraged brands like Starbucks and Nestlé to offer coffee and beverages in sachet formats.

Europe’s sachet packaging market is largely influenced by environmental regulations. Companies like Amcor plc and Huhtamaki have made significant investments in recyclable and biodegradable sachets. Moreover, the region's developed cosmetics industry extensively uses sachets for samples and travel-sized products, with luxury brands such as L'Oréal and Beiersdorf leading the way. Germany, in particular, emphasizes sustainable personal care packaging, with firms like Constantia Flexibles at the forefront of eco-innovation.

Key Sachet Packaging Company Insights

The sachet packaging industry is highly competitive, featuring a mix of global giants and regional players who emphasize innovation, affordability, and environmental sustainability. Leading firms such as Amcor plc, Mondi, Huhtamaki, Constantia Flexibles, and Graphic Packaging International, LLC dominate through diversified product lines and strategic investments in R&D. Material innovation—particularly in recyclable and biodegradable films—is becoming a key differentiator. Meanwhile, local manufacturers remain competitive in emerging markets by focusing on cost-effective, tailored solutions.

Major Sachet Packaging Companies:

- Amcor plc

- Huhtamaki

- Constantia Flexibles

- Mondi

- Graphic Packaging International, LLC

- RATTPACK

- Amber Packaging

- ePac Holdings, LLC

- Glenroy, Inc.

- Sachet Solutions

- Greendot Biopak Pvt. Ltd.

- The Sachet Company

- Budelpack

- Polysack Flexible Packaging Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion:

The sachet packaging market continues to grow steadily due to rising demand for convenient, affordable, and single-use packaging formats, particularly in emerging economies. The expansion of e-commerce, urbanization, and technological innovations in sustainable packaging materials are reinforcing market demand across regions. As regulatory pressures and environmental awareness increase globally, companies investing in eco-friendly and recyclable sachet solutions are likely to secure a competitive edge. With diverse applications across industries and evolving consumer behavior, the market is poised for consistent growth through 2030.