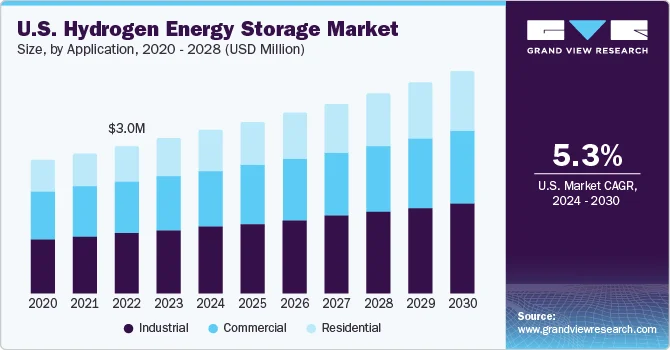

The U.S. hydrogen energy storage market size was estimated at USD 3.17 billion in 2023 and is anticipated to grow at a CAGR of 5.3% from 2024 to 2030. This growth is attributed to the rapid industrialization in the country and the growing popularity of alternate energy sources. Due to ongoing research and development, as well as the construction of large-scale storage projects, the U.S. market is expected to witness significant expansion during the forecast period.

Hydrogen energy storage involves storing large quantities of hydrogen using various technologies. Common methods include utilizing solution-mined salt domes, excavated rock caves, and other geological formations. This storage supports several industries, including transportation, metallurgy, general industrial, chemical, stationary applications, and others. With increasing renewable energy installations and the rising concern over greenhouse gas emissions, the demand for hydrogen storage systems is poised to grow. Additionally, hydrogen storage systems play a vital role in oil refining and utility operations.

Hydrogen is extensively used in industrial processes such as glassmaking, fertilizer production, and metal refining, thereby driving the demand for hydrogen energy storage solutions. Many companies are shifting toward alternative fuels like hydrogen. Hybrid melting technologies, combined with electric furnace boosting, are being employed to reduce harmful emissions. Consequently, the growing use of hydrogen across various industries is accelerating market expansion.

The U.S. stands as a global leader in adopting renewable energy technologies across the industrial, transportation, and power generation sectors. To support the hydrogen economy, the U.S. Department of Energy launched the H2USA initiative, partnering with National Laboratories such as the National Renewable Energy Laboratory (NREL) and Sandia National Laboratories to address technical challenges in hydrogen infrastructure. Additionally, the Hydrogen Fueling Infrastructure Research and Station Technology (H2FIRST) project, spearheaded by the Fuel Cell Technologies Office, focuses on the development of cost-effective and energy-efficient hydrogen stations nationwide. These concerted efforts are expected to fuel growth in the U.S. hydrogen energy storage market.

Order a free sample PDF of the U.S. Hydrogen Energy Storage Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Based on application, the industrial segment led the market and accounted for the largest revenue share of 40.56% in 2023.

- Based on physical state, the solid segment dominated the market and accounted for the largest market share of 51.43% in 2023.

- Based on technology, the material-based segment accounted for the largest market share of 40.15% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.17 Billion

- 2030 Projected Market Size: USD 4.53 Billion

- CAGR (2024-2030): 5.3%

Key U.S. Hydrogen Energy Storage Company Insights

The U.S. hydrogen energy storage market is highly fragmented. Although several established corporations and research institutions are actively developing hydrogen storage technologies, the industry consists of a wide range of companies at various stages of innovation and deployment. This reflects both the technological diversity and the evolving nature of the sector as it transitions from R&D to full-scale commercialization.

Key players in the market include:

- Cummins Inc. – Offers a wide range of products including engines, power systems, emission solutions, and hydrogen-related systems across its five business segments.

- Steelhead Composites, INC. – Specializes in manufacturing lightweight, high-strength cylinders for hydrogen storage applications and provides engineering, machining, and composite production services.

- Air Products Inc. – A major provider of hydrogen infrastructure and technologies.

- Chart Industries

- Plug Power, Inc.

- Worthington Industries

- American Clean Power Association

- GenH2 Discover Hydrogen

- FuelCell Energy Inc.

- Bloom Energy Corp. – Develops solid oxide fuel cells that produce electricity from green hydrogen without combustion or carbon emissions, ensuring constant and reliable energy generation.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. hydrogen energy storage market is positioned for sustained growth as clean energy adoption intensifies across various sectors. Driven by federal initiatives, technological innovation, and industrial decarbonization goals, hydrogen storage is becoming a critical pillar in the country’s transition toward a low-carbon future. With an increasing number of players investing in infrastructure, research, and commercialization, the U.S. is poised to maintain its leadership in the global hydrogen economy.