Semiconductor Market - India

Market Statistics

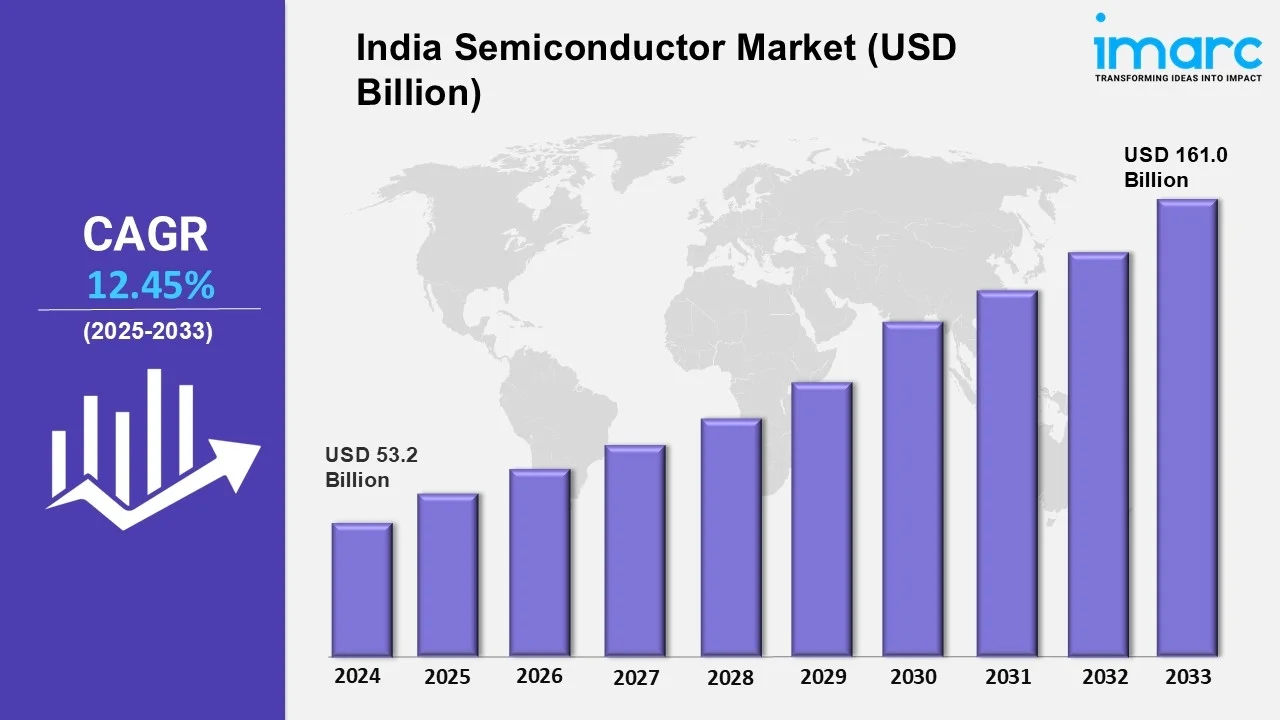

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 53.2 Billion

Market Size in 2033: USD 161.0 Billion

Market Growth Rate (CAGR) 2025-2033: 12.45%

According to IMARC Group's report titled "India Semiconductor Market Report and Forecast 2025-2033," the market reached USD 53.2 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 161.0 billion by 2033, exhibiting a growth rate (CAGR) of during 2025-2033.

Download sample copy of the Report: https://www.imarcgroup.com/india-semiconductor-market/requestsample

India Semiconductor Market Trends and Drivers:

India Semiconductor Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India semiconductor market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Breakup by Components:

- Memory Devices

- Logic Devices

- Analog IC

- MPU

- Discrete Power Devices

- MCU

- Sensors

- Others

Breakup by Material Used:

- Silicon Carbide

- Gallium Manganese Arsenide

- Copper Indium Gallium Selenide

- Molybdenum Disulfide

- Others

Breakup by End User:

- Automotive

- Industrial

- Data Center

- Telecommunication

- Consumer Electronics

- Aerospace and Defense

- Healthcare

- Others

Breakup by Region:

- South India

- North India

- West and Central India

- East India

Request for customization: https://www.imarcgroup.com/request?type=report&id=9343&flag=C

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145