Market Estimation & Definition

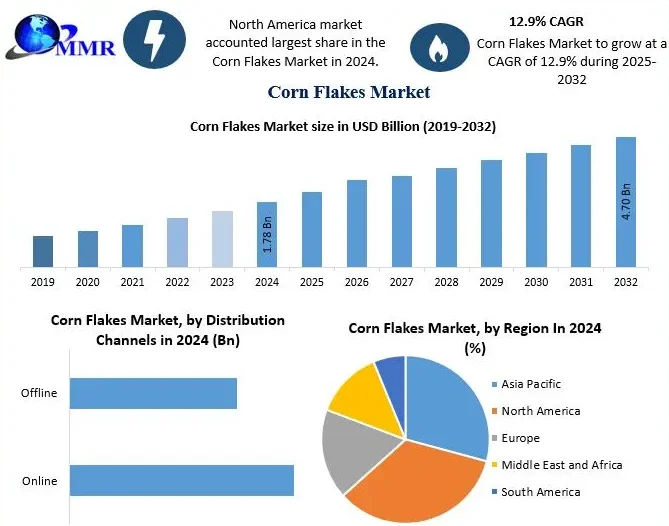

The Corn Flakes Industry was valued at USD 1.78 billion in 2024 and is expected to reach USD 4.70 billion by 2032, growing at a robust CAGR of 12.9% during the forecast period. Corn flakes are a popular ready-to-eat breakfast cereal made from milled corn, enriched with essential vitamins, minerals, and dietary fiber. Widely consumed with milk, plant-based beverages, or yogurt, corn flakes cater to consumers seeking quick, nutritious, and convenient meal options. Increasing health consciousness, busy urban lifestyles, and a shift toward fortified foods have contributed to the steady growth of this market globally.

Ask for Sample to Know US Tariff Impacts on Corn Flakes Industry @ https://www.maximizemarketresearch.com/request-sample/194179/

Market Growth Drivers & Opportunity

The corn flakes market is being propelled by multiple factors. Rising health awareness is a key driver, as consumers actively seek low-fat, fiber-rich, and fortified breakfast options that support heart health, digestion, and weight management. Additionally, the growing popularity of plant-based and gluten-free diets has led to the development of specialty corn flakes catering to vegan and allergen-sensitive consumers.

Another significant driver is the product’s appeal among children, as manufacturers introduce flavored and fun-shaped variants fortified with vitamins and minerals. The surge in online grocery retail and direct-to-consumer subscription models has expanded market accessibility, offering brands new avenues to engage with consumers. Moreover, eco-friendly packaging initiatives and clean-label product launches are creating opportunities for companies to differentiate and build consumer loyalty.

What Lies Ahead: Emerging Trends Shaping the Future

Key emerging trends reshaping the future of the corn flakes market include the growing demand for functional and specialty cereals, particularly plant-based, vegan, and gluten-free variants. Flavor innovation is gaining momentum, with regional, fruit-based, and premium flavor options appealing to a broader demographic.

Sustainability will play a crucial role in shaping purchasing decisions, with consumers increasingly prioritizing eco-conscious packaging and ethically sourced ingredients. Digital retail platforms and subscription services are expected to gain further prominence, allowing brands to personalize offerings and build direct consumer relationships.

Segmentation Analysis

Based on consumer age, children accounted for the largest market share in 2024, driven by product varieties tailored to younger tastes and nutritional needs. In terms of product category, the vegan segment led the market, reflecting increased demand from plant-based and lactose-intolerant consumers. Offline distribution channels such as supermarkets and hypermarkets dominated market sales in 2024, although online platforms are rapidly gaining traction and are expected to capture a growing share in the coming years.

Explore the full report for an in-depth analysis: https://www.maximizemarketresearch.com/market-report/corn-flakes-market/194179/

Country-Level Analysis: USA and Germany

The United States remains the largest market for corn flakes in North America, with high per capita cereal consumption and a strong presence of established brands. Germany leads the European market, driven by health-conscious consumers, a preference for organic and fortified cereals, and a well-established retail infrastructure supporting both domestic and international brands.

Competitor Analysis

1. Kellogg’s

2. General Mills

3. Mondelez International

4. Kraft Heinz

5. JM Smucker

6. Frito-Lay

7. Seneca Foods

8. Quaker Oats Company

9. Nestle

10. Britannia

11. Ralcorp Holdings

12. Post Holdings

Conclusion

The corn flakes market is undergoing dynamic growth, poised to expand from USD 1.78 billion in 2024 to USD 4.70 billion by 2032. Rising health awareness, increasing demand from younger consumers, and evolving product innovations are at the core of this market’s upward trajectory. With robust opportunities in emerging categories like plant-based and fortified cereals, alongside digital and sustainable retail trends, industry leaders are well-positioned to capture value in this rapidly transforming breakfast segment.

About Us