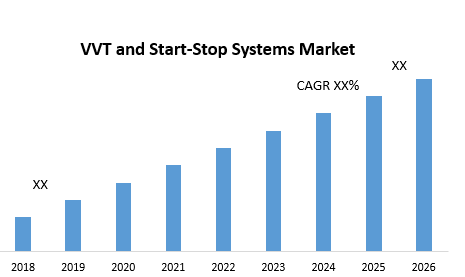

VVT & Start‑Stop Systems Market is expected to reach US$ 53.20 Bn. by 2026, at a CAGR of 5.5% during the forecast period.

Market Size

- Market Value in 2023: USD 60.7 Billion

- Projected Value by 2030: USD 92.0 Billion

- Estimated CAGR (2023–2030): 6.1%

Overview

Variable Valve Timing (VVT) and Start‑Stop systems are advanced technologies increasingly integrated into modern internal combustion engines. VVT allows engines to adjust the timing of valve opening and closing, enhancing performance and fuel efficiency. Start‑Stop systems automatically shut off the engine during idle conditions, such as traffic stops, and restart it when needed, significantly reducing fuel consumption and emissions.

As global regulations tighten and automotive manufacturers prioritize sustainability and fuel economy, the integration of these systems across vehicle types is becoming essential.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/2899/

Market Growth Drivers & Opportunities

Key Growth Drivers

- Stringent Emission Regulations: Governments across the globe are enforcing stricter norms for vehicle emissions, accelerating the demand for technologies that help meet these standards.

- Fuel Efficiency and Cost Savings: These systems contribute directly to lower fuel consumption, which appeals to both consumers and fleet operators.

- Growing Adoption in Passenger and Commercial Vehicles: As manufacturers strive to meet regulatory compliance, even entry-level and mid-segment vehicles are being equipped with VVT and Start‑Stop systems.

- Technological Advancements: The development of intelligent engine control units and integrated systems is enhancing the performance and reliability of VVT and Start‑Stop solutions.

- Hybrid and Electric Vehicle Integration: As the industry shifts toward electrification, these systems are being adapted for use in hybrid vehicles to further optimize engine efficiency.

Opportunities

- Emerging Markets: Rapid urbanization and vehicle ownership growth in Asia-Pacific and Latin America present vast opportunities for system integration.

- Retrofit Potential: Existing vehicle fleets in many regions may adopt aftermarket VVT or Start‑Stop technologies.

- Increased OEM Partnerships: Collaborative product development between automakers and system manufacturers will pave the way for customizable, scalable solutions.

Segmentation Analysis

By System Type

- VVT Systems: Enable optimized valve operations, contributing significantly to engine performance and emission control.

- Start‑Stop Systems: Gain traction due to their fuel-saving capabilities in urban driving conditions.

By Technology

- Cam Phasing: Currently dominates the market due to its cost-effectiveness and proven functionality.

- Cam Phasing + Changing: Offers higher performance and is expected to grow rapidly.

By Starter Type

- Direct Starters: Most common, but seeing competition from newer technologies.

- Belt-Driven Alternator Starter (BAS) and Integrated Starter Generator (ISG): Expected to grow at a higher pace due to smoother operation and better integration with hybrid systems.

By Fuel Type

- Gasoline: Leading segment due to widespread adoption of start‑stop systems.

- Diesel: Still a significant contributor in commercial vehicles.

- Hybrid: Gaining momentum as hybrid architectures become more prevalent.

By Application

- Engine Performance Enhancement

- Fuel Efficiency Optimization

- Emission Reduction

Major Manufacturers

- Robert Bosch GmbH

- Denso Corporation

- Continental AG

- BorgWarner Inc.

- Aptiv PLC

- Valeo SA

- Hitachi Ltd.

- Aisin Seiki Co., Ltd.

- Mitsubishi Electric Corporation

- Johnson Controls International

These key players are focusing on strategic partnerships, product innovations, and expansion into emerging markets to strengthen their market position.

Get More Info: https://www.maximizemarketresearch.com/request-sample/2899/

Regional Analysis

Asia-Pacific

- Largest market share due to high vehicle production, rising demand for fuel-efficient cars, and strong governmental support for green technologies.

- Countries like China, India, Japan, and South Korea are major contributors.

North America

- Strong presence of automotive OEMs and established regulatory framework.

- Consumer awareness and high fuel prices support the adoption of VVT and Start‑Stop systems.

Europe

- Stringent emission standards like Euro 6/7 push manufacturers to integrate advanced systems.

- OEMs in Germany, France, and the UK are highly active in deploying these technologies.

Latin America & Middle East and Africa

- Gradual adoption fueled by urbanization and vehicle electrification efforts.

- Government incentives and import substitution policies are creating new growth avenues.

COVID‑19 Impact Analysis

The automotive sector experienced a temporary slowdown during the pandemic due to production halts and supply chain disruptions. However, post-pandemic recovery has been rapid, with OEMs doubling down on R&D and regulatory compliance. The emphasis on fuel economy and emissions post-COVID has accelerated the integration of VVT and Start‑Stop systems in new vehicles.

Commutator Analysis

VVT and Start‑Stop systems are comprised of the following key components:

- Cam Phasers & Actuators: Enable real-time control of valve timing.

- Starter Motors: Designed for high durability to support frequent stop/start cycles.

- Integrated Starter Generators (ISG): Used in hybrid applications to combine generator and starter functionality.

- Engine Control Units (ECU): Manage timing, sensors, and operational logic.

- Battery Systems: Advanced batteries support the electrical load generated by frequent engine restarts.

- Sensor Arrays: Detect engine load, speed, and environmental conditions to optimize timing.

Together, these subsystems form the backbone of modern internal combustion engine efficiency strategies.

Key Questions Answered

| Question | Answer |

| What is the current market size? | USD 60.7 Billion (2023) |

| What is the projected market size? | USD 92.0 Billion (2030) |

| What is the CAGR for the forecast period? | 6.1% |

| Which region leads the market? | Asia-Pacific |

| Which technology is fastest growing? | Cam Phasing + Cam Changing |

| What is driving market growth? | Emission mandates, fuel efficiency, hybrid integration |

| Who are the key players? | Bosch, Denso, Continental, Valeo, BorgWarner |

Conclusion

The global VVT & Start‑Stop Systems Market is set for steady growth as the automotive industry transitions toward cleaner, smarter, and more fuel-efficient technologies. These systems are no longer optional but essential for OEMs to meet regulatory demands and consumer expectations. Players investing in innovation, durability, and hybrid compatibility will capture significant value in the coming decade.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com