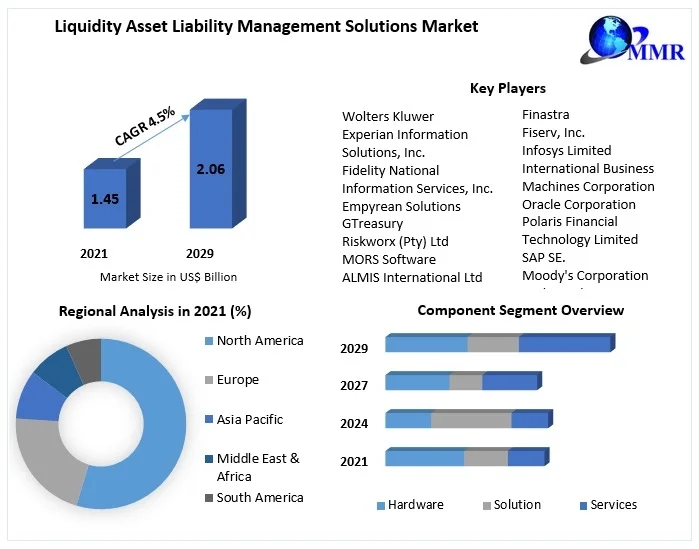

Asia Pacific region held the highest share in 2021.

Liquidity Asset Liability Management Solutions Market size is expected to reach nearly US $ 2.06 Bn by 2029 with the CAGR of 4.5% during the forecast period.

Liquidity Asset Liability Management Solutions Market Overview:

The latest study from Maximize Market Research, Global Liquidity Asset Liability Management Solutions Market, is beneficial for understanding the market's competitors. The study offers a wide and fundamental evaluation of the market, as well as an examination of subjective aspects that may provide readers with critical business insights. The study offers a market overview, including the value chain structure, regional analysis, applications, market size, and forecast. The study will be used to make a more accurate evaluation of the existing and future circumstances of the global Liquidity Asset Liability Management Solutions Market .

Request Sample Link For More Details: https://www.maximizemarketresearch.com/request-sample/40493/

Liquidity Asset Liability Management Solutions Market Scope:

Throughout the projected time, the research gives an analytical picture of the business by evaluating numerous aspects such as global Liquidity Asset Liability Management Solutions Market growth, consumption volume, market trends, and corporate pricing structures. Extensive research is included in the report to investigate the market's intricacies. The study gives an overview of the global Liquidity Asset Liability Management Solutions Market, including market characteristics, market segmentation analysis, market size, the customer landscape, and the geographical landscape. In its research, the study takes into account growth drivers, current trends, innovations, prospects, and the competitive landscape. This market has been investigated in a number of ways, including productivity and manufacturing base.

Liquidity Asset Liability Management Solutions Market Segmentation:

by Component

• Hardware

• Solution

• Services

by Institution Type

• Banks

• Broker Dealers

• Specialty Finance

• Wealth Advisors

Get to Know More About This Market Study: https://www.maximizemarketresearch.com/market-report/global-liquidity-asset-liability-management-solutions-market/40493/

Liquidity Asset Liability Management Solutions Market Key Players:

It then goes into great detail about the main competitors in the global Liquidity Asset Liability Management Solutions Market , as well as emerging players, including market share based on revenue, demand, high-quality product producers, sales, and service providers. Furthermore, the study evaluates capacity utilisation, raw material sources, import-export, the value chain, pricing structure, and the industrial supply chain. The following players are featured in this report:

• Finastra

• Fiserv, Inc.

• Infosys Limited

• International Business Machines Corporation

• Oracle Corporation

• Polaris Financial Technology Limited

• SAP SE.

• Moody's Corporation

• Wolters Kluwer

• Experian Information Solutions, Inc.

• Fidelity National Information Services, Inc.

• Empyrean Solutions

• GTreasury

• Riskworx (Pty) Ltd

• MORS Software

• ALMIS International Ltd

• iRTM

Request Sample Link For More Details: https://www.maximizemarketresearch.com/request-sample/40493/

Liquidity Asset Liability Management Solutions Market Regional Analysis:

The report has analyzed the global Liquidity Asset Liability Management Solutions Market in the following regions:

- America, North (the United States, Canada, and Mexico)

- European Union (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

- Asia-Pacific region (China, Japan, Korea, India, Southeast Asia, and Australia)

- Latin America (Brazil, Argentina, Colombia, and Rest of South America)

- Africa and the Middle East (Saudi Arabia, UAE, Egypt, South Africa, and Rest of the Middle East & Africa)

The study includes in-depth insights into multiple development possibilities and difficulties in the aforementioned regions, depending on various types of commodities, applications, end-users, and nations, among others. The study also contains essential aspects of the global Liquidity Asset Liability Management Solutions Market , such as sales growth, product pricing and analysis, growth potential, and recommendations for addressing market difficulties in the provided areas.

COVID-19 Impact Analysis on Liquidity Asset Liability Management Solutions Market :

COVID-19 is a worldwide public health disaster that has touched virtually every firm, and the long-term effects are projected to have an impact on industry growth during the forecast period. Our ongoing research broadens our research methods to address core COVID-19 problems as well as prospective future steps. The study sheds light on COVID-19 by taking into consideration changes in consumer behavior and demand, purchasing patterns, supply chain re-routing, the dynamics of modern market forces, and significant government efforts. The updated research includes insights, analysis, estimates, and predictions based on COVID-19's market impact.

Key Questions Answered in the Liquidity Asset Liability Management Solutions Market Report are:

- Who are the leading players in the Liquidity Asset Liability Management Solutions Market ?

- In terms of the region, what is the potential market for Liquidity Asset Liability Management Solutions Market ?

- In the next five years, which application area of Liquidity Asset Liability Management Solutions Market is likely to develop at a substantial rate in the market?

- What opportunities exist for new market entrants?

- How big will the Liquidity Asset Liability Management Solutions Market ?

- What are the Liquidity Asset Liability Management Solutions Market growth prospects?

- What is the base year taken into account in the Liquidity Asset Liability Management Solutions Market report?

- In the Liquidity Asset Liability Management Solutions Market , which region has the biggest market share?

- What are the variables that are expected to boost the Liquidity Asset Liability Management Solutions Market ?

About Maximize Market Research:

For additional reports on related topics, visit our website:

Tool Steel Market https://www.maximizemarketresearch.com/market-report/tool-steel-market/221365/

Solvent Recovery and Recycling Market https://www.maximizemarketresearch.com/market-report/solvent-recovery-and-recycling-market/227590/

Health & Hygiene Packaging Market https://www.maximizemarketresearch.com/market-report/health-and-hygiene-packaging-market/228446/

Prefabricated Homes Market https://www.maximizemarketresearch.com/market-report/prefabricated-homes-market/230638/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.