Mordor Intelligence has published a new report on the “Global UAE Oil and Gas Market”, offering a comprehensive analysis of trends, growth drivers, and future projections.

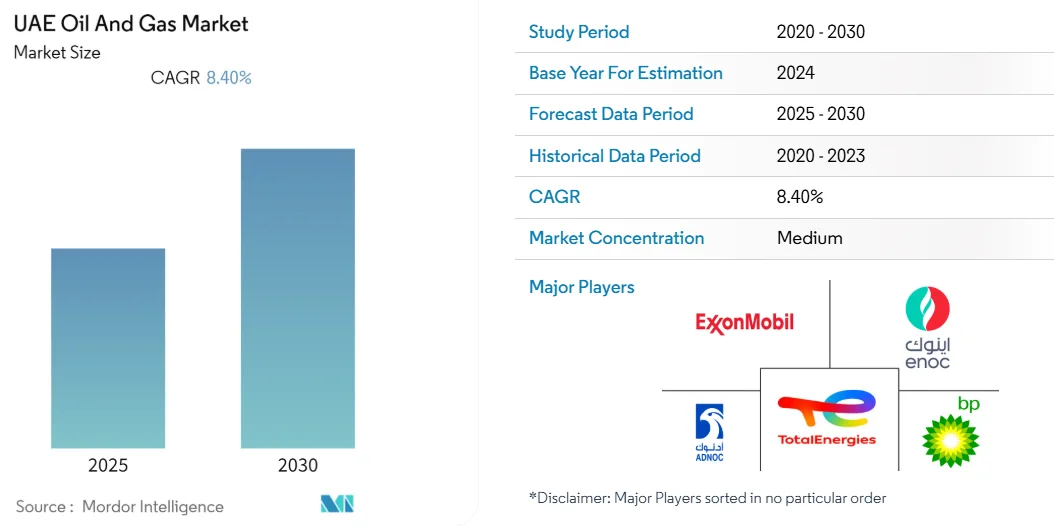

The United Arab Emirates oil and gas market is expected to grow at growth rate of 8.4% CAGR, This sector remains vital to the UAE’s economy, with most hydrocarbon reserves situated in Abu Dhabi, supplemented by production from Dubai, Sharjah, and Ras al-Khaimah.

The country continues to attract significant domestic and foreign investment into upstream activities, balancing these efforts against broader government strategies to diversify the energy mix and expand downstream capabilities. At the same time, the nation’s steady growth in natural gas demand and LNG exports has begun to influence infrastructure and policy decisions.

Browse Full Report Details on "UAE Oil and Gas Market Report"@ https://www.mordorintelligence.com/industry-reports/united-arab-emirates-oil-and-gas-market?utm_source=globbook

Key Trends

Strong Upstream Activity

Investment in exploration and production remains the main driver. The upstream segment is expected to lead growth through ongoing drilling and enhanced oil recovery (EOR) projects, both onshore and offshore. Crude output was approximately 3.04 million barrels per day in late 2022, with most of the reserves concentrated in Abu Dhabi.

Natural Gas Demand and LNG Expansion

The UAE is experiencing rising domestic gas demand—forecast to grow around 6% annually—while investing in LNG export infrastructure, such as the Ruwais LNG project, expected to double its export output. Major oil and gas firms are upgrading gas processing and LNG handling capabilities to meet both domestic and global demand.

Smart Infrastructure and Technology Uptake

Operators across the sector are integrating smart infrastructure into existing LNG infrastructure and midstream networks to boost efficiency and support expansion. These improvements include digital monitoring, automation, and advanced processing facilities.

Government Policy and Diversification Pressure

While oil and gas remain central to GDP and export revenues, the UAE is actively encouraging alternative energy pathways. Policies promoting renewables and energy efficiency are expected to slow growth in oil and gas in the longer term.

Oil Production Quota Shifts

Recent decisions by OPEC+ to raise quota allocations including an extra 300,000 barrels per day for the UAE starting September 2025 could increase oil output significantly. This move reverses earlier cuts and may create short-term oversupply risks.

ADNOC’s Role and Investment Strategy

ADNOC Gas is projecting a more than 40% rise in EBITDA by 2029, supported by substantial capital deployment (about USD 15 billion over five years) and expanding LNG operations. ADNOC continues to supply a majority of domestic gas and is pursuing offshore gas field developments. At the same time, its global arm XRG plans to invest in U.S. gas assets, covering everything from exploration to distribution

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/united-arab-emirates-oil-and-gas-market?utm_source=globbook

Market Segmentation

The UAE oil and gas market can be broken down by sector and geography as follows:

By Sector

- Upstream: Focused on exploration, well development, drilling, and recovery methods. Expected to dominate overall market growth.

- Midstream: Transport via pipelines, LNG terminals, storage, and processing facilities. Growing due to LNG expansions.

- Downstream: Refining, petrochemical processing, gas treatment, and fuel distribution. As of 2022, this sector made up roughly 30% of GDP and accounted for 13% of exports

By Deployment Location

- Onshore Projects: Extensive reserve development primarily in Abu Dhabi’s desert fields and northern emirates.

- Offshore Projects: Significant production from marine deposits, including recent notable gas discoveries in Abu Dhabi waters.

By Infrastructure Types:

- Conventional oil production fields

- Enhanced oil recovery zones

- LNG processing and export terminals

- Pipelines and storage facilities

Browse More Info : https://www.mordorintelligence.com/industry-reports/united-arab-emirates-oil-and-gas-market?utm_source=globbook

Top Key Players:

- Abu Dhabi National Oil Company (ADNOC): The country’s flagship energy firm, spanning upstream, midstream, and downstream assets. ADNOC leads exploration, production expansions, and gas export initiatives via ADNOC Gas and the Ruwais LNG project.

- Emirates National Oil Company Group (ENOC): Active in refining, fuel retail, and LPG distribution. Plays a role in regional downstream infrastructure.

- Exxon Mobil Corporation, BP PLC, TotalEnergies SE: Key international partners engaged in upstream contracts, JVs, and pipeline operations within the UAE’s oil and gas sector.

Conclusion

The UAE oil and gas market stands poised for steady growth, expanding from an estimated USD 9.77 billion in 2025 to USD 12.59 billion by 2030. Growth is fuelled by increased upstream investment, LNG expansion, and smart infrastructure upgrades. The upstream segment is expected to remain the largest contributor, while offshore and onshore drilling activities continue to generate returns. Simultaneously, rising gas demand and LNG export capabilities present new growth avenues.

That said, renewable projects, energy diversification goals, and OPEC+ production dynamics may temper long-term oil and gas expansion. Additionally, geopolitical tensions and global oil market shifts could influence investment and output decisions.

Large state-owned companies like ADNOC and ENOC, along with global majors, remain central to delivering large-scale development, while policy shifts and infrastructure modernization challenge the industry to evolve. In sum, while the UAE maintains its oil and gas legacy, the next phase is marked by measured expansion aligned with increasingly sophisticated demand and infrastructure strategies.