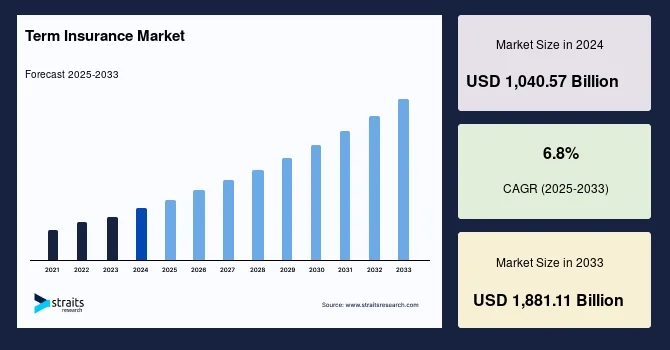

The global term insurance market was valued at approximately USD 1,040.57 billion in 2024 and is projected to grow to USD 1,111.33 billion in 2025, ultimately reaching USD 1,881.11 billion by 2033. This reflects a solid CAGR of 6.8% during the forecast period (2025–2033). Asia-Pacific currently holds the largest market share, while Europe is anticipated to be the fastest-growing region.

Request a Sample Report@ https://straitsresearch.com/report/term-insurance-market/request-sample

Key Restraints

Despite the robust growth outlook, the market grapples with low consumer awareness and a general lack of understanding around term insurance products. For instance, surveys indicate that a significant portion of individuals are either unaware of insurance or confused about term policies. This educational gap limits adoption and underscores a pressing need for awareness initiatives.

Opportunities Ahead

Two pivotal developments are reshaping market dynamics:

-

Government initiatives—such as social security and financial inclusion programs—are enhancing accessibility and awareness of term insurance.

-

Technological advancements—including AI and robotic process automation—are improving customer experience, risk assessment, and cross-sell opportunities. For example, AI-powered chatbots are being deployed for personalized product guidance and support.

Brief on Market Segments

By Type:

-

The market segments into individual-level, group-level, and decreasing term life insurance.

-

The individual-level segment registers the highest share, while group-level term insurance is anticipated to grow at a rapid ~14% CAGR from 2022 to 2030.

By Distribution Channel:

-

Channels include tied agents & branches, brokers, bancassurance, direct, and others.

-

Tied agents and branches currently dominate, but the bancassurance segment is forecast to post a robust ~16% CAGR.

Purchase the Full Report@ https://straitsresearch.com/buy-now/term-insurance-market

Key Players & Revenue Insights

Top industry players include MetLife, Aegon Life Insurance Company, Prudential Financial, Northwestern Mutual, State Farm, MassMutual, AIG, Lincoln National, John Hancock, China Life, Bajaj Allianz Life, as well as major Indian players like LIC, HDFC Standard Life, ICICI Prudential, Kotak Life, and others. While specific revenue figures differ by company, these firms represent global and regional market leaders with strong distribution networks.

Latest Developments & Collaborations

Recent trends highlight strategic technological adoption—particularly AI-based customer solutions—alongside expanding bancassurance networks. Additionally, government-backed policies and cross-industry partnerships underscore collaborative models between public and private sectors.

Frequently Asked Questions (FAQs)

1. What’s the current size of the market?

Estimated at USD 1,111.33 billion in 2025, with a projected value of USD 1,881.11 billion by 2033.

2. Which distribution channel leads the market?

Tied agents & branches currently lead, while bancassurance is the fastest-growing channel.

3. Who are the major players?

Global players include MetLife, Aegon, Prudential, and others, alongside regional leaders such as LIC, HDFC Standard Life, and ICICI Prudential.

4. Which region is dominant?

Asia-Pacific dominates, with Europe expected to see the fastest growth.

5. What’s driving growth?

Government schemes and AI-driven innovation are key growth levers, while low awareness remains a critical barrier.

Conclusion

The term insurance market is poised for resilient growth over the coming decade, powered by rising demand, supportive regulatory frameworks, and technological advancements. To harness this potential:

-

Stakeholders—insurers, intermediaries, and regulators—must prioritize consumer education to bridge awareness gaps.

-

Digital tools like AI chatbots and streamlined bancassurance models offer promising pathways to reach underserved segments.

-

Strategic collaborations—public-private partnerships, insurtech alliances, and new distribution models—can further strengthen market outreach and efficiency.

As this market continues evolving, professionals in insurance, fintech, and risk management have a valuable opportunity to highlight success stories, challenge misconceptions, and advocate for inclusive, tech-enabled protection solutions.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Contact Us

Phone: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com