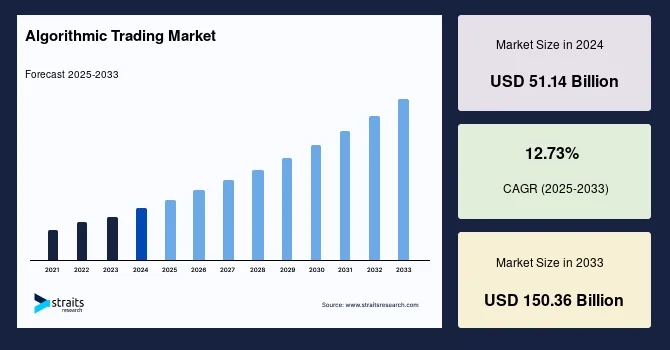

The global algorithmic trading market has witnessed rapid expansion in recent years. Valued at USD 51.14 billion in 2024, it is projected to grow to USD 57.65 billion in 2025 and is expected to reach USD 150.36 billion by 2033, registering a CAGR of 12.73% from 2025 to 2033.

Algorithmic trading also known as automated or black-box trading uses computer programs to execute orders based on pre-set instructions like price, timing, and volume. It eliminates human intervention to a large extent, increasing efficiency, speed, and accuracy in financial markets. The solutions segment, which includes trading platforms and software suites, dominates the market, supported by both cloud-based and on-premise deployment models.

Request a Sample Report@ https://straitsresearch.com/report/algorithmic-trading-market/request-sample

Restraints and Challenges

Despite its rapid growth, the algorithmic trading market faces several challenges:

-

Regulatory pressures: Governments and regulators across regions have tightened scrutiny of automated trading, particularly due to concerns around market manipulation and flash crashes.

-

Technological risks: Algorithmic trading depends heavily on low-latency systems. Even minor glitches can cause large-scale disruptions and unexpected losses.

-

High costs: Building and maintaining high-performance computing infrastructure can be expensive, creating barriers for smaller firms and retail traders.

Opportunities

The market holds tremendous opportunities, driven by advancements in technology and changing financial landscapes:

-

AI and machine learning integration: Algorithms that learn and adapt in real-time can improve predictive accuracy and trading performance.

-

Cloud adoption: Cloud-based solutions are growing in popularity as they provide cost-effective scalability for firms of all sizes.

-

Expanding asset classes: Beyond equities and forex, algorithmic strategies are being applied in ETFs, derivatives, bonds, and even cryptocurrencies, opening up broader opportunities.

-

Digitalization of financial services: The global shift towards digital financial ecosystems is creating fertile ground for algorithm-driven trading models.

Market Segmentation Snapshot

-

By Component: Solutions (platforms/software) vs. Services (professional and managed services). Solutions dominate.

-

By Deployment: Cloud vs. On-premise. Cloud is witnessing faster growth due to its cost advantages and flexibility.

-

By Trading Type: Forex, equities, ETFs, bonds, cryptocurrencies, and others.

-

By Trader/Organization Size: Institutional traders, long-term traders, short-term traders, and retail participants.

-

By Geography: North America leads, followed by Asia-Pacific, Europe, South America, and the Middle East & Africa.

Purchase the Full Report@ https://straitsresearch.com/buy-now/algorithmic-trading-market

Key Players and Revenue Highlights

Several companies and proprietary trading firms are shaping the future of algorithmic trading:

-

Hudson River Trading (HRT): Generated around USD 8 billion in trading revenue in 2024, driven by diversification across asset classes and expansion into medium-frequency strategies.

-

Jane Street: Reported revenue of over USD 10.1 billion in Q2 2025, showcasing its dominance in global markets. Its India operations have also contributed significantly to overall growth.

-

XTX Markets: Achieved a net profit of £1.3 billion and revenues of £2.74 billion in 2024, executing over USD 250 billion in trades daily. The firm is investing in large-scale data centers to support future growth.

-

Virtu Financial, Citadel Securities, DRW, Susquehanna International Group, and others continue to play critical roles in expanding automated trading globally.

Latest Developments and Collaborations

-

Regulatory oversight: Authorities are increasing surveillance on algorithmic trading practices to reduce systemic risks.

-

Infrastructure investments: Leading firms are building high-capacity data centers to support the next generation of trading strategies.

-

Strategy diversification: Proprietary firms are moving beyond high-frequency trading to include mid- and long-frequency models, ensuring sustainable profitability.

-

Market leadership shifts: With record revenues reported in recent quarters, firms like Jane Street, HRT, and XTX Markets are steadily outpacing traditional investment banks in terms of trading efficiency and profitability.

Frequently Asked Questions (FAQs)

1. How large is the algorithmic trading market in 2025 and its future size by 2033?

The market size is estimated at USD 57.65 billion in 2025 and is projected to reach USD 150.36 billion by 2033.

2. Which segment dominates the market?

The solutions segment, comprising trading platforms and software suites, holds the largest share.

3. What are the main restraints?

Regulatory challenges, risks of system failures, and high infrastructure costs are the primary restraints.

4. What drives future growth in algorithmic trading?

The integration of AI and machine learning, adoption of cloud-based systems, and application across diverse asset classes are major growth drivers.

5. Who are some leading firms in the market?

Major players include Hudson River Trading, Jane Street, XTX Markets, Virtu Financial, Citadel Securities, and Susquehanna International Group.

6. What trends are shaping the market today?

Tighter regulatory compliance, infrastructure upgrades, and diversification of trading strategies are among the most significant trends.

Conclusion

The algorithmic trading market is undergoing a phase of strong expansion, supported by technological innovation and the increasing digitalization of financial services. From AI-powered predictive algorithms to scalable cloud solutions, the market is positioned for significant growth rising from USD 51.14 billion in 2024 to USD 150.36 billion by 2033.

While challenges around regulations, costs, and systemic risks persist, opportunities are immense. Market leaders such as Hudson River Trading, Jane Street, and XTX Markets are redefining global trading with record-breaking revenues and strategic advancements. As automation continues to reshape the global financial landscape, the balance between innovation and regulation will be key to ensuring sustainable growth in this dynamic market.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Contact Us

Phone: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com