Airborne fire control radar remains a cornerstone technology in modern aerial defense and combat systems, furnishing aircraft with critical target detection, tracking, and engagement guidance capabilities. As multi-domain warfare intensifies, innovations in radar precision, electronic scanning, and artificial intelligence integration are dramatically improving situational awareness, lethality, and survivability for military forces globally. This growth reflects high defense modernization spending amid evolving threat landscapes, including unmanned aerial systems, hypersonic weapons, and network-centric combat environments.

According to Straits Research, "The global airborne fire control radar market size was valued at USD 3.24 billion in 2024 and is expected to grow from USD 3.43 billion in 2025 to reach USD 5.51 billion by 2033, growing at a CAGR of 6.10% during the forecast period (2025-2033)."

Technological Advances and Market Growth Drivers

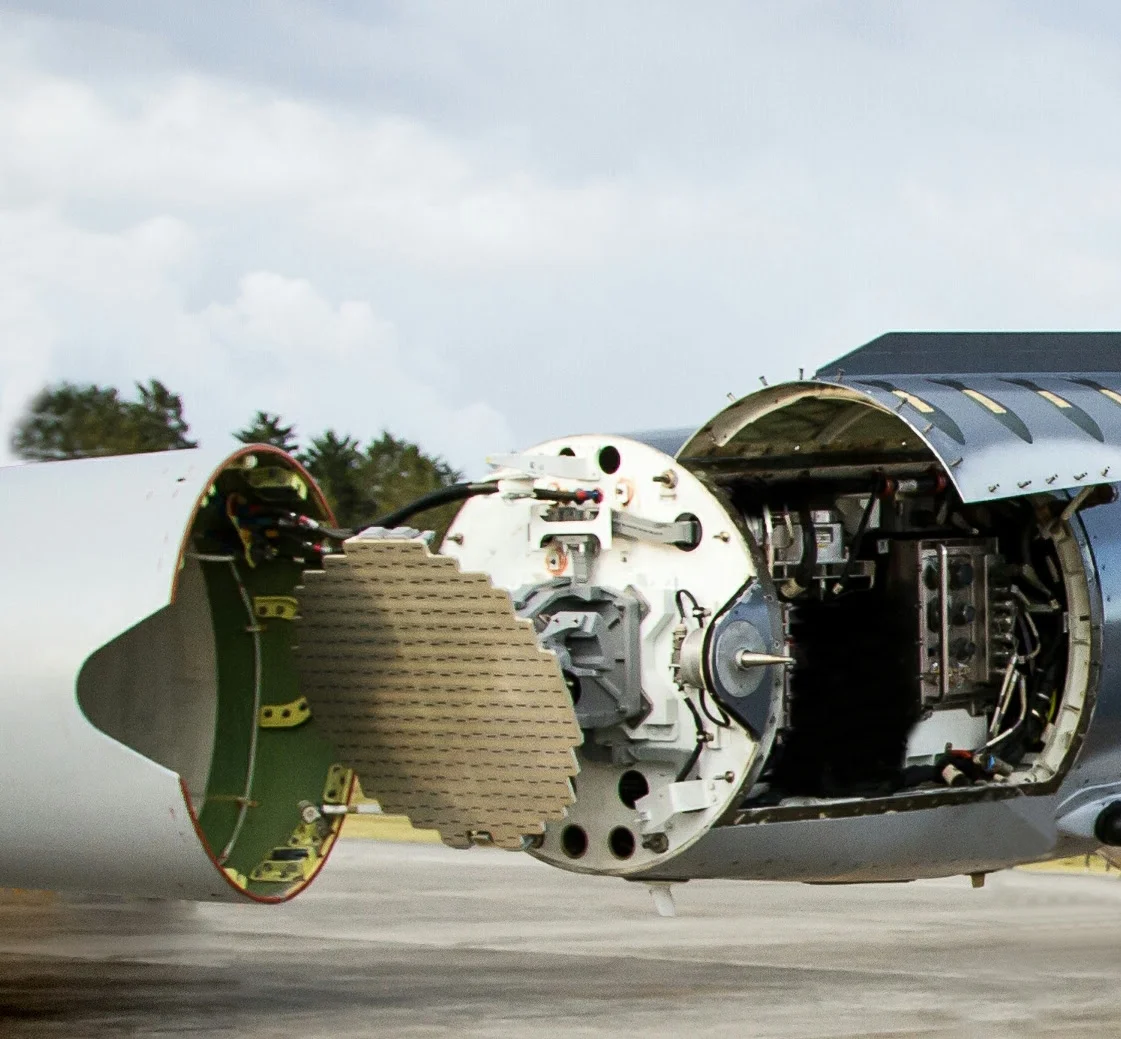

Key technical advancements such as Active Electronically Scanned Array (AESA) technology, multi-band frequency operation, and digital beamforming drive the evolution of airborne fire control radars. AESA radars provide superior range, resolution, and target discrimination while enabling simultaneous multi-target tracking critical for complex air-to-air and air-to-ground missions. Enhanced electronic warfare resistance and low intercept probability further strengthen radar effectiveness in hostile environments.

Rising demand for compact, lightweight radar installations suitable for multi-role fighter jets, helicopters, and unmanned aerial vehicles (UAVs) accelerates the adoption of next-generation radar suites. Integrated AI-driven threat detection and automated target prioritization systems reduce operator workload and improve decision latency on the battlefield.

Increasing geopolitical tensions and defense budgets in North America, Asia-Pacific, and Europe drive steady investment in radar modernization programs. High-priority applications include precision ground-mapping, synthetic aperture radar (SAR), ground moving target indication (GMTI), and electronic intelligence (ELINT). Growing asymmetric warfare and counterinsurgency requirements underscore the need for flexible, high-accuracy radar systems adaptable to diverse mission profiles.

Leading Companies and Regional Market Highlights

Key industry leaders include Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, BAE Systems plc, Airbus SE, Israel Aerospace Industries (IAI), Leonardo S.p.A., Saab AB, Thales Group, and Aselsan A.S.. These companies invest heavily in R&D, focusing on AESA technologies, AI integration, and multi-sensor fusion.

Regional insights highlight:

-

North America: The U.S. dominates the adoption of airborne fire control radars with extensive modernization programs funded by the Department of Defense. Lockheed Martin and Raytheon Technologies remain pivotal in supplying radar systems for platforms such as the F-35 Lightning II and F/A-18E/F Super Hornet.

-

Asia-Pacific: China leads the regional charge, driven by robust defense investments and rapid modernization of military aircraft fleets. India is also expanding its indigenous development capabilities through entities like Bharat Electronics Limited (BEL) and Hindustan Aeronautics Limited (HAL), aiming for greater self-reliance in airborne radar technologies.

-

Europe: European manufacturers such as Saab, Leonardo, and Thales focus on NATO interoperability and flexible radar systems tailored for multirole fighters like Gripen and Eurofighter Typhoon.

-

Middle East & Africa: Countries including Saudi Arabia and Israel invest in AESA and multi-mode radar technologies, bolstering regional air defense postures amidst evolving security challenges.

Recent News and Industry Developments

-

July 2025: Lockheed Martin expanded its production of the AN/APG-83 scalable agile beam radar (SABR), enhancing radar fit for the F-16 fleet with simultaneous air-to-air and air-to-ground capabilities.

-

April 2025: Raytheon Technologies showcased the enhanced AN/APG-79 AESA radar’s multi-target tracking and electronic warfare resistance in Indo-Pacific joint military exercises.

-

June 2025: Saab AB announced upgrades to its PS-05/A Mk4 radar for Gripen fighters, increasing detection range and incorporating AI-driven signal processing.

-

May 2025: Israel Aerospace Industries unveiled the EL/M-2052 AESA radar with improved multi-band operation and integration for fifth-generation aircraft.

-

March 2025: Indian government accelerated procurement of airborne radar systems with new contracts awarded to BEL and HAL for next-generation AESA radar suites in indigenous fighter jets.

-

August 2025: Thales delivered the first batch of RBE2-AA AESA radars to the French Air Force for Rafale upgrades, marking Europe’s first operational deployment of an advanced AESA radar system.

Strategic Trends and Challenges

Emerging trends include the integration of AI and machine learning algorithms for autonomous radar operation, automated threat classification, and predictive situational awareness. In addition, there is an increasing focus on reducing radar system lifecycle costs through modular designs and scalable architectures adaptable to various aircraft platforms.

Multi-band radars supporting X, Ku, and Ka frequency ranges are becoming prevalent, allowing multi-mission flexibility, including electronic attack and surveillance. Network-centric warfare concepts drive the development of radars capable of seamless data sharing with other sensors and command units in real time.

Challenges include high development costs, stringent certification requirements, and export controls that limit access for smaller players. However, strong demand for modernization and emerging UAV platforms provides ample opportunities for both established firms and new entrants.

Country-Wise Analysis

-

United States: Heavy investment sustains innovation leadership; focus on next-gen AESA and integration with stealth aircraft.

-

China: Rapid expansion in radar capabilities as part of broader military modernization and regional power ambitions.

-

India: Building indigenous radar programs with BEL and HAL targeting enhanced self-sufficiency.

-

Europe: Advancements driven by multinational programs supporting NATO interoperability and digital battlefield integration.

-

Middle East: Growing emphasis on next-gen radar systems to counter evolving air threats and asymmetric warfare.

Three-Line Summary

Airborne fire control radar technologies are evolving rapidly with AESA, AI integration, and multi-band capabilities, driving enhanced situational awareness and targeting precision worldwide. Leading defense manufacturers and nations are investing heavily in modernization to maintain combat superiority amid shifting geopolitical tensions. The radar sector is poised for solid growth through 2033, underpinning next-gen military aviation.