In 2024, the global packaging coatings market was valued at USD 4,234.7 million. Projections indicate it will grow to USD 6,448.1 million by 2033, reflecting a compound annual growth rate (CAGR) of 4.9% over the period 2025–2033. Demand is particularly strong in flexible packaging applications, driving much of the growth in coatings used across this segment. Regionally, Asia Pacific leads the market in terms of revenue, accounting for the largest share in 2024, with China contributing heavily to that dominance. Among resin types, epoxies hold the largest share, and in terms of applications, rigid packaging remains ahead in revenue share.

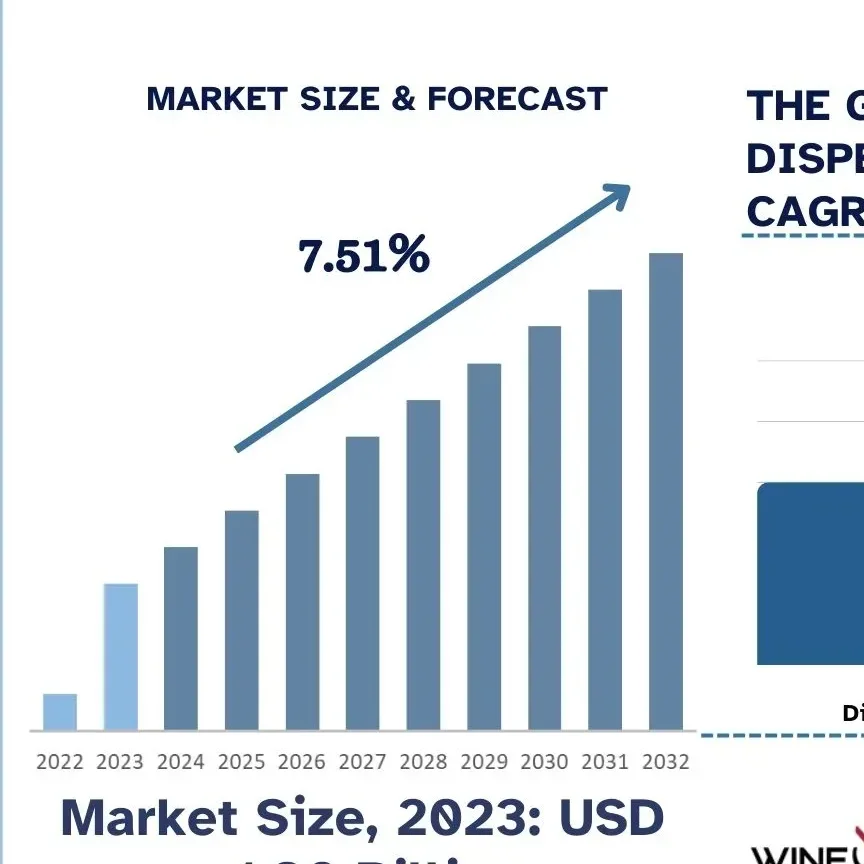

Key Market Trends & Insights; Market Size & Forecast

- Regional Leadership: Asia Pacific dominated in 2024 with a revenue share of approximately 42.5%, and within that region, China held over 62.4% of the Asia Pacific packaging coatings market. Europe is identified as the fastest-growing region in the forecast horizon.

- Product / Resin Breakdown: Epoxy coatings were dominant in 2024, capturing around 50.4% of product share by revenue. Polyurethane coatings are projected to record the fastest growth over 2025-33, due to their flexibility, chemical and moisture resistance.

- Application Types: Rigid packaging led with roughly 58.7% revenue share in 2024, driven by demand for higher protection, perceived value, and strong barrier properties. Flexible packaging, while smaller, is expected to grow at a faster rate over the forecast period, supported by cost-effectiveness and lighter weight.

- Growth Drivers: Key drivers include increasing e-commerce, rising demand from food & beverage industries, and growing consumer and regulatory pressure for sustainable and environmentally friendly packaging. Technological advances and R&D into coatings that offer improved adhesion, durability, barrier functions, and lower environmental impact are also critical.

- Regulatory Factors: Regulations around volatile organic compounds (VOCs), bans on harmful substances like bisphenol A, and consumer demand for low-impact packaging are pushing companies toward water-based, BPA-free and other eco-compliant coatings.

- Forecast & Size Projections: With a market size of USD 4,234.7 million in 2024, the industry is expected to expand to about USD 6,448.1 million by 2033, at ~4.9% CAGR. Asia Pacific will continue to lead in total volume and revenue, while flexible packaging and polyurethane coatings are among the fastest growing segments.

Order a free sample PDF of the Packaging Coatings Market Intelligence Study, published by Grand View Research.

Key Companies & Market Share Insight

The competitive landscape in packaging coatings is moderately concentrated. A relatively small number of firms control a significant portion of revenue due to their strong brand names, established distribution networks, deep technological and regulatory capabilities. These companies compete primarily on product quality, innovation, compliance, price, and ability to deliver sustainable solutions. Regulatory compliance (for example in food contact materials and bans on harmful substances) is increasingly a barrier for smaller or less-resourced firms. Meanwhile, environmental trends and sustainability standards are becoming core differentiators.

Some firms are investing heavily in eco-friendly product lines, low-VOC or solvent-free technologies, bisphenol-free coatings, and in expanding production capacity to meet both regulatory demand and consumer preference shifts. For many of the leading players, R&D is a key strategic area. Also, companies with global reach and capacity to scale quickly tend to capture high market share.

Key Companies List

Here are leading companies in the packaging coatings market:

- Akzo Nobel NV

- BASF SE

- Arkema Group

- Berger Paints India Limited

- Chugoku Marine Paints Ltd

- DowDuPont

- Evonik Industries AG

- HEMPEL A/S

- Henkel AG & Co. KGaA

- Jotun

- Kansai Paint Co. Ltd

- Axalta Coatings

Conclusion

Overall, the packaging coatings industry is set for steady expansion over the next decade, with value growing from about USD 4.2-4.3 billion in 2024 to over USD 6.4 billion by 2033. Asia Pacific, especially China, will remain a dominant contributor, while resin types like epoxy continue to control large shares even as polyurethane and more sustainable alternatives gather momentum. Rigid packaging holds current lead in application, but flexible packaging is expected to grow faster. Leading companies, through innovation and regulatory compliance, are well placed to benefit. The increasing focus on sustainability, regulation of harmful substances, and demand for higher barrier and performance properties will shape both market opportunities and competitive dynamics going forward.

Explore Horizon Databook – The world’s most expansive market intelligence platform developed by Grand View Research.