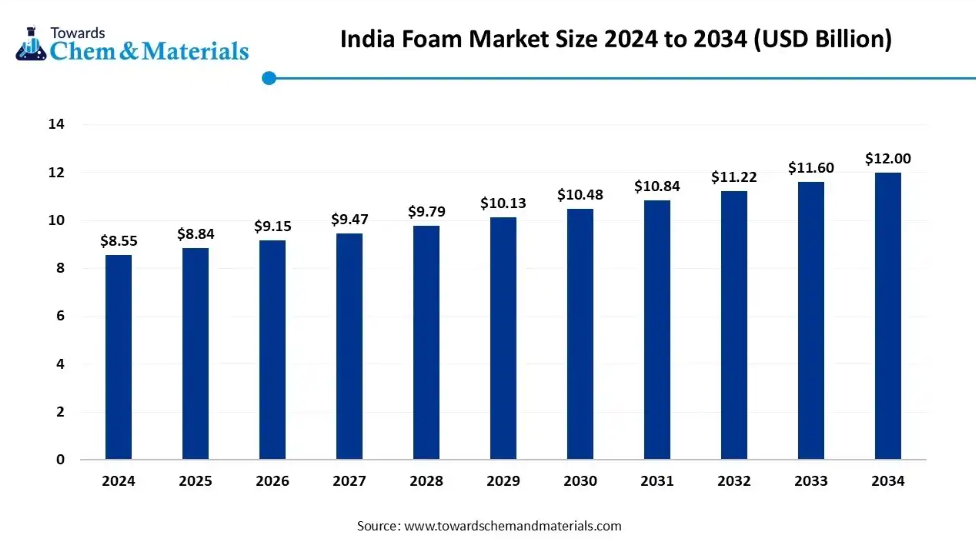

The India Foam Market is witnessing steady expansion driven by surging demand across packaging, construction, automotive, and furniture sectors. According to recent research, the market is projected to grow from USD 8.84 billion in 2025 to USD 12.00 billion by 2034, registering a CAGR of 3.45% during the forecast period. This growth reflects increasing industrialization, urban development, and evolving consumer lifestyles in India.

Download Sample Here : https://www.towardschemandmaterials.com/download-sample/5882

India Foam Market Growth Factors

Several factors contribute to the growth of the foam market in India:

- Rising Construction Activities: Increased investments in commercial and residential infrastructure are boosting the demand for insulation and soundproofing foams.

- Booming Automotive Sector: The growing automotive industry uses foams extensively in seating, insulation, and safety components.

- Expanding Consumer Goods Segment: Demand for mattresses, furniture, and bedding products fuels consumption of polyurethane and latex foams.

- Growth in Packaging Industry: Lightweight, shock-absorbing foams are widely used in food, electronics, and industrial packaging.

India Foam Market Trends

- Shift Toward Sustainable Foams: Increasing adoption of eco-friendly and bio-based foams due to environmental regulations and consumer preference.

- Technological Advancements: Innovations in foam processing technologies, especially in spray foams and specialty foams, are driving performance improvements.

- Rise in Memory and Smart Foams: Popularity of memory foam in bedding, automotive, and healthcare segments is on the rise.

- Customization and Application-Specific Formulations: Manufacturers are focusing on foam properties tailored to specific applications, such as high-density foams for industrial use or open-cell spray foam for insulation.

India Foam Market Future Outlook

The future of the Indian foam market is closely linked to the country’s infrastructure boom, consumer lifestyle upgrades, and a focus on sustainable manufacturing. With new plant establishments and technology upgrades, the market is moving toward greater efficiency, localization of raw materials, and application diversification. Strategic collaborations, government initiatives in affordable housing, and smart city developments are expected to shape the next phase of growth.

India Foam Market Dynamics

Market Drivers

- Increasing demand from automotive, construction, and furniture sectors.

- Urbanization and rising disposable incomes fueling consumer product consumption.

- Expansion in e-commerce and protective packaging needs.

- Government infrastructure initiatives supporting insulation materials.

Market Restraints

- Stringent environmental regulations for petroleum-based foams.

- Volatility in raw material prices such as TDI and MDI.

- Low awareness in rural and semi-urban regions regarding foam insulation benefits.

Market Opportunities

- Innovation in bio-based and recyclable foams.

- Rising demand for premium mattresses and customized cushions in the hospitality and residential sectors.

- Increased usage in medical applications such as surgical supports and cushions.

- Expansion into export markets and niche segments like high-performance acoustic foam.

Market Challenges

- Compliance with Indian Standards (IS) and global safety norms like NFPA.

- Fragmented industry structure with dominance of unorganized players in certain regions.

- Technological gap between large enterprises and small-scale manufacturers.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

More Insights in Towards Chemical and Materials:

· Water & Wastewater Treatment Market: The global water & wastewater treatment market size was approximately USD 371.00 billion in 2025 and is projected to reach around USD 656.68 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 6.55% between 2025 and 2034. Asia Pacific dominated the water & wastewater treatment market with a market share of 34% in 2024.

· Building & Construction Materials Market : The global building and construction materials market size is calculated at USD 2.32 trillion in 2025 and is expected to reach USD 3.90 trillion by 2034, growing at a CAGR of 5.95% from 2025 to 2034. Asia Pacific dominated the building & construction materials market with a market share of 55% in 2024.

· Green Steel Market : The global green steel market size is calculated at USD 763.10 billion in 2025 and is expected to reach USD 1,311.30 billion by 2034, growing at a CAGR of 6.20% from 2025 to 2034. Europe dominated the green steel market with a market share of 40% in 2024.

· Commodity Plastics Market: The global commodity plastics market size is calculated at USD 513.26 billion in 2025 and is expected to be worth around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period 2025 to 2034. Asia Pacific dominated the commodity plastics market with a market share of 48% in 2024.

· Commodity Chemicals Market : The global commodity chemicals market size is calculated at USD 867.97 billion in 2025 and is expected to reach USD 1,549.36 billion by 2034, growing at a CAGR of 6.65% from 2025 to 2034. Asia Pacific dominated the commodity chemicals market with a market share of 49% in 2024.

· Automotive OEM Coatings Market : The global automotive OEM coatings market size is calculated at USD 17.08 billion in 2025 and is expected to reach USD 25.25 billion by 2034, growing at a CAGR of 4.44% from 2025 to 2034. Asia Pacific dominated the automotive OEM coatings market with a market share of 49% in 2024.

· Caustic Soda Market : The global caustic soda market size is calculated at USD 50.12 billion in 2025 and is expected to reach USD 76.11 billion by 2034, growing at a CAGR of 4.75% from 2025 to 2034. Asia Pacific dominated the caustic soda market with a market share of 50% in 2024.

· U.S. Metal Recycling Market : The U.S. metal recycling market size is valued at approximately USD 87.91 billion in 2025 and is projected to climb to roughly USD 121.04 billion by 2034, translating into a compound annual growth rate (CAGR) of 3.25% across the period from 2025 to 2034.

· U.S. Biodegradable Plastics Market : The U.S. biodegradable plastics market size is estimated at USD 2.34 billion in 2025 and is expected to hit around USD 5.27 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.44% over the forecast period from 2025 to 2034.

· U.S. Polyvinylidene Chloride (PVDC) Coated Films Market : The U.S. polyvinylidene chloride (PVDC) coated films market size is estimated at USD 450.80 million in 2025 and is expected to hit around USD 686.84 million by 2034, growing at a compound annual growth rate (CAGR) of 4.79% over the forecast period from 2025 to 2034.

India Foam Market Segments Covered — Insights

By Foam Type

- Flexible Foam: Polyurethane, Polyethylene, Polypropylene, Latex, Memory Foam

- Rigid Foam: Rigid Polyurethane, Polystyrene, Phenolic Foam

- Molded Foam: Expanded Polystyrene (EPS), Expanded Polypropylene (EPP), Expanded Polyethylene (EPE)

- Spray Foam: Open Cell, Closed Cell

- Specialty Foam: Melamine Foam, Silicone Foam

By Material

- Polyurethane

- Polystyrene

- Polyolefins

- Silicone

- Phenolic

- Melamine

By Application

- Packaging: Food & beverage, consumer electronics, industrial, medical

- Building & Construction: Thermal and sound insulation, roof and wall applications

- Automotive: Interior and exterior components, acoustic and thermal insulation

- Furniture & Bedding: Mattresses, cushions, pillows, upholstery

- Footwear: Insoles, padding

- Medical: Cushions, surgical pads

- Industrial: Gaskets, seals, vibration dampening

By Density

- Low Density

- Medium Density

- High Density

Regional Insights

India’s foam production and consumption are concentrated in states like Maharashtra, Gujarat, Tamil Nadu, Karnataka, and Delhi NCR, driven by the presence of large-scale industrial hubs, automotive clusters, and construction projects. These regions are also seeing increasing investments in smart infrastructure, fueling demand for high-performance insulation and packaging foams.

India Foam Market Value Chain Analysis

- Chemical Synthesis and Processing: The majority of foam production relies on chemical polymerization, especially for polyurethane foam.

- Distribution to Industrial Users: Foams are distributed across industries such as packaging, automotive, construction, and healthcare.

- Regulatory Compliance and Safety Monitoring: Governed under IS Codes and international regulations such as NFPA, ensuring product safety, fire resistance, and environmental sustainability.

Leading Companies in the India Foam Market

- Sheela Foam Limited

- Carpenter Engineered Foams

- U-FOAM

- Flexipol Foams Pvt. Ltd.

- Shree Malani Foams

These companies are at the forefront of innovation, sustainability, and high-volume production to cater to both domestic and export demands.

Conclusion

The India foam market presents a dynamic landscape, marked by innovation, shifting consumer demands, and a move toward greener, more efficient materials. With strong growth drivers and strategic opportunities in construction, automotive, and packaging, the industry is well-positioned for long-term expansion.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5882

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044