In 2024, the global plastic compounds market was estimated at USD 80.5 billion, and it is projected to rise to USD 108.2 billion by 2030, growing at a compound annual growth rate (CAGR) of approximately 5.0 %.

Demand is largely fuelled by the packaging sector, especially in major consumer economies such as China, India, Germany, the U.S., and Brazil. Regulatory mandates around food-contact packaging also push the adoption of materials meeting safety and performance criteria. Among resin types, polypropylene (PP) compounds are prized for their cost efficiency and ability to enhance impact strength, clarity, flexibility, and processing effectiveness. Meanwhile, polyethylene (PE) compounds are seeing strong uptake particularly in packaging.

Key Market Trends & Insights & Market Size & Forecast

- The automotive sector currently claims the largest share of revenue among end-use segments and is expected to maintain robust growth in the forecast period. The Asia Pacific region dominated the market in 2024, driven by rising automobile adoption and favorable foreign direct investment policies across countries encouraging electric vehicle deployment.

- Strategic moves like partnerships, capacity expansions, and introduction of new grades are common among industry players. For example, the acquisition of Eurostar Engineering Plastics by Ascend Performance Materials in January 2021 expanded the global reach of compounding offerings.

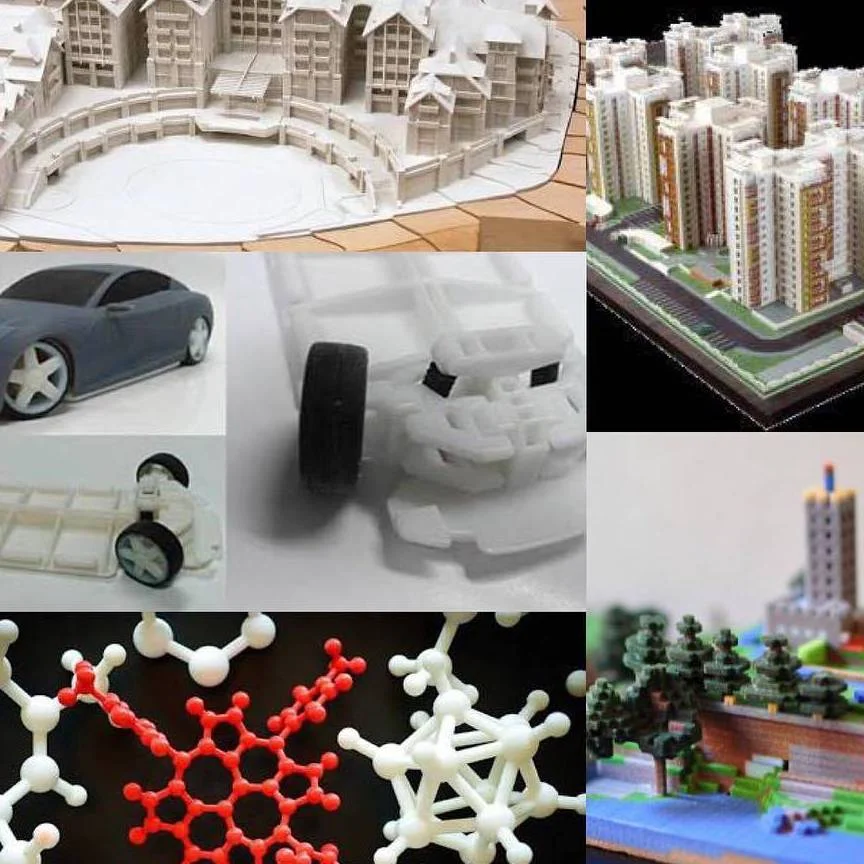

Drivers include accelerating use in packaging, building & construction, electronic devices, and medical applications. Challenges include volatility in raw material costs, especially tied to crude oil price fluctuations. On the opportunity side, advances in additive manufacturing (3D printing) open new use cases for custom compound formulations, while recycled feedstock adoption offers a sustainable alternative to virgin resins.

Key Companies & Market Share Insight

Leading firms in this space position themselves via vertical integration into compounding, acquisitions, geographic expansion, and new product development.

These players compete across multiple resin types (e.g. PP, PE, ABS, PC) and end-use sectors. Their strategies include acquiring compounding operations, investing in capacity, and enhancing regional presence to capture growth opportunities in emerging markets. For example, in January 2025, Arkema entered a distribution tie-up with ALBIS for its medical grade thermoplastic elastomers, polyamides, and PVDF ranges to better access healthcare demand

In terms of market share, PP remains one of the largest resin segments, capturing more than 25 % of revenue in earlier years. Geographically, the Asia Pacific region holds the pre-eminent share, driven by demand from automotive, electronics, and packaging sectors. North America accounts for a significant share, with about 18.5 % of market revenue in 2023 according to some studies

Order a free sample PDF of the Plastic Compounds Market Intelligence Study, published by Grand View Research.

Key Companies List

Here is a more complete list of principal companies active in the plastic compounds market:

- BASF SE

- LyondellBasell Industries Holdings B.V.

- Dow Chemical (Dow, Inc.)

- SABIC

- Asahi Kasei Corporation

- Covestro AG

- Arkema

- RTP Company

- Westlake Corporation

- DuPont de Nemours, Inc.

- S&E Specialty Polymers (Aurora Plastics)

- Washington Penn

- Eurostar Engineering Plastics

- Kuraray Co., Ltd.

- Teijin Limited

- Evonik Industries AG

- Dyneon GmbH & Co. KG

Conclusion

The plastic compounds market is poised for continued expansion, with forecasts placing it between USD 108.2 billion and over USD 112 billion by 2030 under various growth assumptions. The core growth engines include rising demand in packaging, automotive, electronics, and construction sectors. While cost volatility in raw materials poses a constraint, innovation in additive manufacturing and sustainable compound formulations offer promising paths forward. Leaders in the industry are strengthening competitive positions through integration, geographic expansion, and tie-ups in niche application segments such as medical and high-performance resins.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.