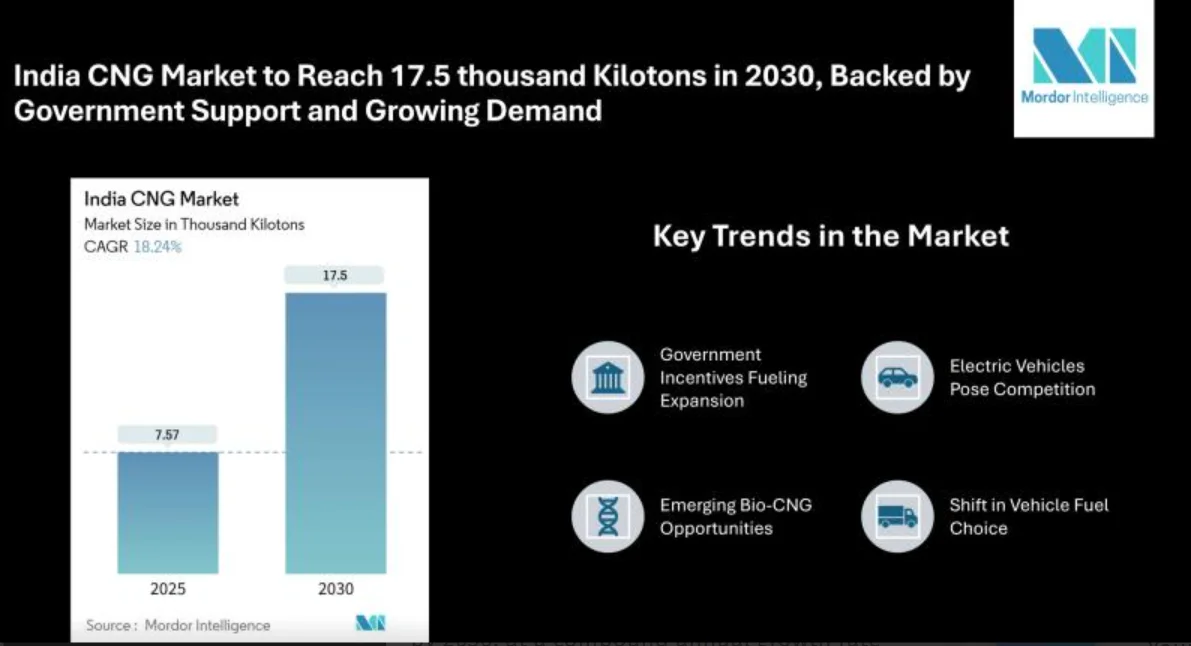

India's compressed natural gas (CNG) sector is slated for sustained growth over the coming years. According to Mordor Intelligence, the CNG market is estimated at 7.57 thousand kilotons in 2025 and is projected to climb to 17.5 thousand kilotons by 2030, at a compound annual growth rate (CAGR) of 18.24% from 2025 to 2030. This rise reflects growing acceptance of CNG as a cleaner, more economical fuel, shaped by policy incentives and rising vehicle adoption.

Get Full Report Details and Insights: https://www.mordorintelligence.com/industry-reports/india-cng-market?utm_source=globbook

Top Key Trends:

Government Incentives Fueling Expansion

Government policies and subsidies, particularly for transportation fuel, are supporting growth in the CNG market. Consumers and fleet operators benefit from reduced-cost conversions and access to cleaner energy sources, pushing CNG demand higher.

Electric Vehicles Pose Competition

Despite the strong momentum for CNG, rising adoption of electric vehicles (EVs) may limit its long-term expansion. Industry watchers note that EVs are the main rival for the CNG market's future share.

Emerging Bio-CNG Opportunities

Beyond fossil-fuel CNG, the push for bio‐CNG (compressed biogas) is gaining traction. That opens new avenues for waste-based gas supply, particularly as the government and municipalities explore bio‐CNG plants.

Shift in Vehicle Fuel Choice

CNG's popularity among Indian drivers is growing sharply. In FY2025, petrol vehicles lost ground as CNG vehicle share more than tripled over five years-driven by high petrol prices and new model availability.

Infrastructure Boost and Commercial Performance:

Companies like Adani Total Gas are expanding rapidly- introducing new CNG stations and reporting increased CNG sales. In Q4 FY2025, CNG volumes rose by 18%, even as supply costs rose; the firm added 42 new CNG stations during that period.

Expansion of Gas Distribution Networks

The city of Guwahati launched its first piped gas connection and new CNG stations, under a major Rs 2,617 crore City Gas Distribution project. The CGD network is poised to connect tens of thousands of households and add new CNG infrastructure across Assam

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/india-cng-market?utm_source=globbook

India CNG Market Segmentation:

While the primary report focuses on volume, we can detail how the CNG market is structured:

By End-Use / Application

Transportation Fuel: The core of the CNG market, as vehicle conversions and fleet use drive majority demand.

City Gas Distribution (CGD): Infrastructure supplying both household piped natural gas (PNG) and vehicle CNG through distribution networks.

Bio‐CNG: A growing area, drawing from agricultural or waste sources, with potential in rural and urban settings.

By Geography

High-CGD Presence: Cities like Delhi NCR, Mumbai, and Gujarat lead due to better pipeline infrastructure and existing CGD licenses.

Expanding Regions: Places such as Assam are now rolling out CGD systems for the first time, marking rising demand across regions

By Supplier Type

Public Sector Dominance: Companies like GAIL, IGL, Mahanagar Gas, Gujarat Gas lead in pipeline and CGD operations.

New and Renewable Entrants: Bio‐CNG plant initiatives in Greater Noida, Manesar, Gurugram, and across Gujarat signal fresh contributors and business models

By Volume vs Value

Volume: Measured in kilotons-7.57 kt in 2025, rising to 17.5 kt by 2030

Value Perspective: Other sources suggest the broader CNG market-including equipment and services-was worth USD 9.69 billion in 2023, with modest future growth

Explore More Related to Energy and Power Research Report: https://www.mordorintelligence.com/market-analysis/energy-power?utm_source=globbook

Top Key Players:

Major Distribution Companies

Indraprastha Gas Limited (IGL) supplies CNG in Delhi NCR, serving over a million vehicles through 425 stations

Mahanagar Gas Limited (MGL) operates in the Mumbai region, managing over 140 stations and supplying thousands of vehicles and households

Gujarat Gas Limited leads in Gujarat as the largest city gas distributor, with extensive reach across the state

GAIL (India) forms the backbone, holding stakes in many regional CGD firms-including IGL, MGL, and others-and overseeing gas pipeline and CGD network expansion

Expanding Players and Services

Adani Total Gas has rapidly scaled its CNG network, adding stations and reporting significant year-on-year volume gains-even amid cost pressures

Emerging Bio-CNG Contributors

Governments and private agencies are setting up bio‐CNG plants in Manesar, Greater Noida, Gurugram, and across Gujarat-bringing new models of supply, waste management, and rural income generation into the CNG landscape

Explore India CNG Market Competitive Landscape: https://www.mordorintelligence.com/industry-reports/india-cng-market/companies?utm_source=globbook

Conclusion

Growth is spurred further by rising CNG vehicle popularity, expanding infrastructure into new regions, and active participation from firms like Adani Total Gas. Meanwhile, bio-CNG expansion introduces a new dimension-enabling waste-to-fuel models and local energy solutions.

India’s CNG Revolution: How Policy Push and Rising Demand Are Powering the 2030 Growth Story