The landscape of payment processing is undergoing a significant transformation. As digital currencies gain traction, businesses are beginning to realize the potential benefits of integrating cryptocurrency payment solutions alongside traditional methods. This shift is not merely a passing trend; it represents a fundamental change in how we conduct transactions and manage finances. In this article, we will explore the future of payments, the advantages of accepting crypto, and how businesses can effectively integrate these solutions into their strategies.

Understanding the Shift to Cryptocurrency Payments

Cryptocurrency has made waves since the introduction of Bitcoin in 2009. Initially viewed as a speculative asset, it has evolved into a viable payment option that many consumers prefer. The rise of digital wallets and the growing acceptance of cryptocurrencies by businesses highlight a broader trend toward decentralization and financial autonomy.

Cryptocurrency payments offer several advantages over traditional fiat transactions. They provide lower transaction fees, faster processing times, and enhanced security. For businesses, the ability to accept cryptocurrencies can open doors to new markets and customer bases, allowing them to expand their reach beyond geographical boundaries.

The Benefits of Accepting Cryptocurrency

- Lower Transaction CostsTraditional payment processors often charge high fees for transactions, especially for international payments. Cryptocurrencies typically have lower transaction fees, allowing businesses to retain more revenue. This is particularly beneficial for small and medium-sized enterprises (SMEs) that operate on thin margins.

- Access to a Global AudienceCryptocurrency is not bound by national borders. By accepting digital currencies, businesses can cater to customers from around the world. This capability is especially relevant for e-commerce platforms looking to tap into international markets.

- Enhanced SecuritySecurity is a top priority for any business, especially those that handle sensitive customer data. Cryptocurrency transactions utilize blockchain technology, which offers a high level of security. Each transaction is encrypted and recorded on a decentralized ledger, making it nearly impossible to alter or forge.

- Improved Customer ExperienceMany consumers are becoming more comfortable with digital currencies. By offering crypto as a payment option, businesses can enhance their customer experience. This flexibility can lead to increased customer satisfaction and loyalty.

- Faster TransactionsTraditional banking systems can take days to process international transactions. In contrast, cryptocurrency payments are processed almost instantly, allowing businesses to receive funds without unnecessary delays.

Integrating a Crypto Payment Gateway

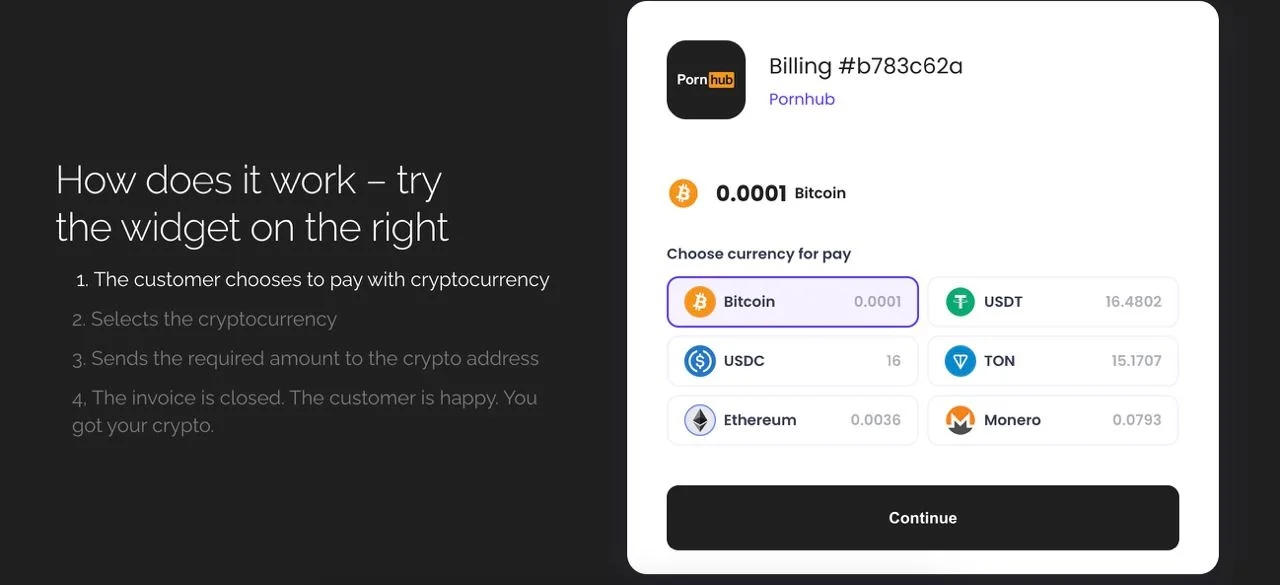

Integrating a cryptocurrency payment gateway into your business is a straightforward process. Here’s how you can get started:

1. Choose the Right Payment Gateway

Not all payment gateways are created equal. When selecting a provider, consider factors such as fees, supported cryptocurrencies, and ease of integration. Look for a solution that offers a user-friendly interface and provides robust customer support.

One option worth considering is https://77.me/. This platform offers a comprehensive suite of tools for businesses looking to accept both fiat and cryptocurrencies, making it a strong contender for your payment processing needs.

2. Ensure Compliance with Regulations

As cryptocurrencies become more mainstream, regulatory scrutiny increases. It's essential to stay informed about the legal landscape regarding cryptocurrency transactions in your jurisdiction. Ensure that your chosen payment gateway complies with relevant regulations to avoid potential issues.

3. Provide Clear Instructions for Customers

When introducing cryptocurrency as a payment option, clarity is key. Provide straightforward instructions on how customers can make payments using digital currencies. Consider creating a dedicated FAQ section on your website to address common questions and concerns.

4. Promote Your New Payment Option

Once you’ve integrated cryptocurrency payments, it’s time to spread the word. Use your marketing channels to inform customers about the new payment option. Highlight the benefits of using cryptocurrency, such as lower fees and enhanced security.

5. Monitor and Adapt

After implementing a crypto payment gateway, monitor its performance closely. Gather feedback from customers to understand their experiences and address any issues promptly. Stay updated on trends in the cryptocurrency space to adapt your strategy as needed.

Addressing Common Concerns

While the potential benefits of accepting cryptocurrency are significant, some businesses may have reservations. Here are a few common concerns and how to address them:

- Volatility: Cryptocurrencies can be volatile, leading to fluctuations in value. To mitigate this risk, consider converting received crypto payments into fiat currency immediately.

- Customer Familiarity: Not all customers are familiar with cryptocurrencies. Providing educational resources can help bridge this gap and encourage adoption.

- Security Risks: While blockchain technology is secure, businesses must implement robust security measures to protect their wallets and transactions. This includes using multi-signature wallets and enabling two-factor authentication.

Conclusion

The future of payments is undoubtedly intertwined with the rise of cryptocurrencies. By integrating crypto payment solutions into their business strategies, companies can unlock new opportunities for growth, enhance customer experiences, and stay ahead of the competition. As the world becomes more digital, embracing this change is not just an option; it’s a necessity for businesses aiming to thrive in an evolving marketplace.

If your business hasn’t yet explored the potential of cryptocurrency payments, now is the time to consider making the leap. Embrace the future and position your business for long-term success in a rapidly changing financial landscape.