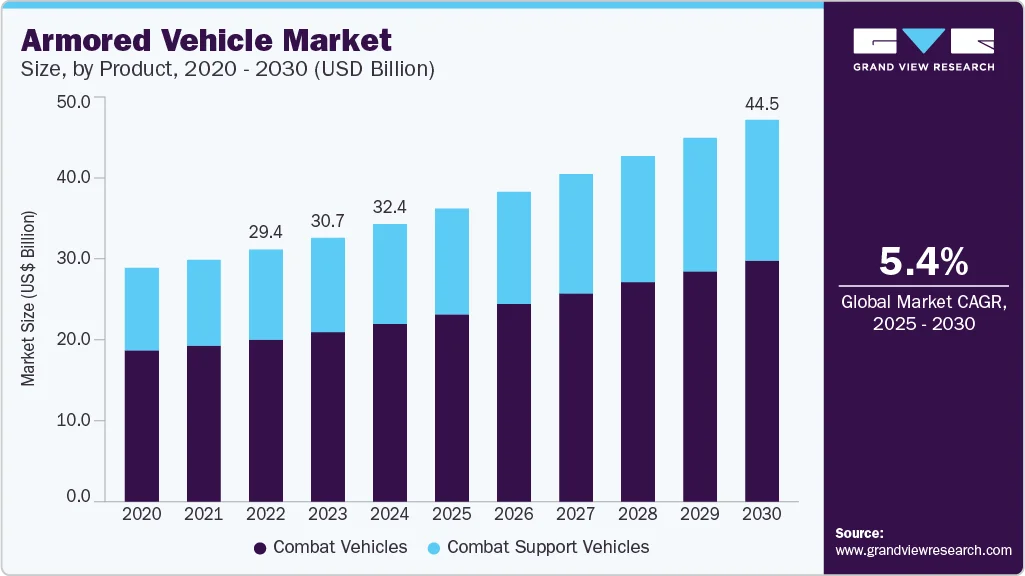

The global armored vehicle market was valued at USD 32.41 billion in 2024 and is forecast to climb to USD 44.56 billion by 2030. This expansion represents a steady Compound Annual Growth Rate (CAGR) of 5.4% between 2025 and 2030.

The market's growth is fundamentally driven by a confluence of geopolitical and technological factors. Mounting geopolitical tensions and sustained global conflicts prompt countries to significantly increase their defense spending, focusing on upgrading and expanding their armored fleets to bolster military capabilities and border security. Furthermore, the persistent threats from terrorism, insurgency, and asymmetric warfare necessitate greater demand for vehicles offering high levels of personnel protection in hostile zones.

Technological advancements are key to market evolution, with innovations like composite armors, active protection systems, and sophisticated weaponry enhancing vehicle survivability and operational effectiveness.

Evolving defense strategies also support market expansion. The growing need for capabilities in urban warfare, counter-terrorism operations, and peacekeeping missions sustains the demand for versatile, multi-role armored vehicles. Future growth will be shaped by emerging trends, including the development of modular armor, lighter materials, autonomous/unmanned features, and hybrid propulsion systems, all aimed at improving crew safety and operational flexibility. The industry is also increasingly prioritizing cybersecurity and data protection in military platforms.

Key Market Trends & Insights

- Regional Dominance: The Asia Pacific region held the largest revenue share, accounting for 33.2% in 2024. This is driven by high defense expenditures, regional geopolitical tensions, and ongoing fleet modernization programs in key countries like China, India, and Australia, often involving joint ventures with global defense firms.

- Product Segment: Combat vehicles dominated the market, securing a revenue share of over 63% in 2024. This segment, which includes the development of advanced armor, weapons, and electronic warfare capabilities, remains critical due to the evolving global threat environment.

- Vehicle Type: The conventional armored vehicles segment held the highest market share in 2024, reflecting substantial, continued investment by numerous countries in their existing armored fleets.

- Mode of Operation: Manned armored vehicles held the largest revenue share in 2024, primarily because their design is essential for protecting occupants from threats like small arms fire, explosive devices, and IEDs in high-risk environments.

- Point of Sale: The OEM (Original Equipment Manufacturer) segment held the largest revenue share in 2024, as increasing demand provides significant opportunities for OEMs to expand product offerings for military, security, and law enforcement customers.

Order a free sample PDF of the Armored Vehicle Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 32.41 Billion

- 2030 Projected Market Size: USD 44.56 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Some key players in the armored vehicle industry, such as BAE Systems, BMW AG, and Daimler AG, are actively working to expand their customer base and gain a competitive advantage.

- BAE Systems is a defense company specializing in designing, manufacturing, and supporting armored combat vehicles, including tracked, wheeled, and amphibious platforms. The U.S. Army's Armored Multi-Purpose Vehicle (AMPV) program replaces legacy vehicles like the M113. It complements the Bradley Fighting Vehicle, offering enhanced protection, mobility, and versatility across multiple mission roles. The AMPV family includes variants such as general purpose, mortar carrier, medical evacuation, and command vehicles, all designed to operate seamlessly within armored brigade combat teams.

- Daimler AG develops and produces military commercial vehicles tailored for logistics and defense applications. Its portfolio includes rugged off-road vehicles like the Unimog and Zetros, designed to operate in challenging terrains with options for protected cabs and various configurations. Daimler emphasizes expanding its defense sector presence by broadening product offerings, enhancing sales and service networks, and forming strategic partnerships to meet diverse military requirements.

Key Players

- AE Systems

- BMW AG

- Daimler AG (Mercedes Benz)

- Elbit Systems

- Ford Motor Company

- General Dynamics Corporation

- INKAS Armored Vehicle OEM

- International Armored Group

- IVECO

- Krauss-Maffei Wegmann GmbH & Co. (KMW)

- Lenco Industries, Inc.

- Lockheed Martin Corporation

- Navistar, Inc.

- Oshkosh Defense, LLC

- Rheinmetall AG

- STAT, Inc.

- Textron, Inc.

- Thales Group.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global armored vehicle market is projected to achieve a robust expansion, growing from USD 32.41 billion in 2024 to USD 44.56 billion by 2030 with a 5.4% CAGR. This growth is underpinned by non-negotiable geopolitical and security necessities, coupled with relentless technological innovation. While Asia Pacific leads regional spending and combat vehicles dominate product demand, the long-term industry outlook is increasingly focused on integrating advanced features like unmanned operations, modularity, and hybrid systems to maximize personnel protection and operational versatility in evolving threat environments.