Executive Summary: Global Peer-to-peer (P2P) Lending Market Size and Share

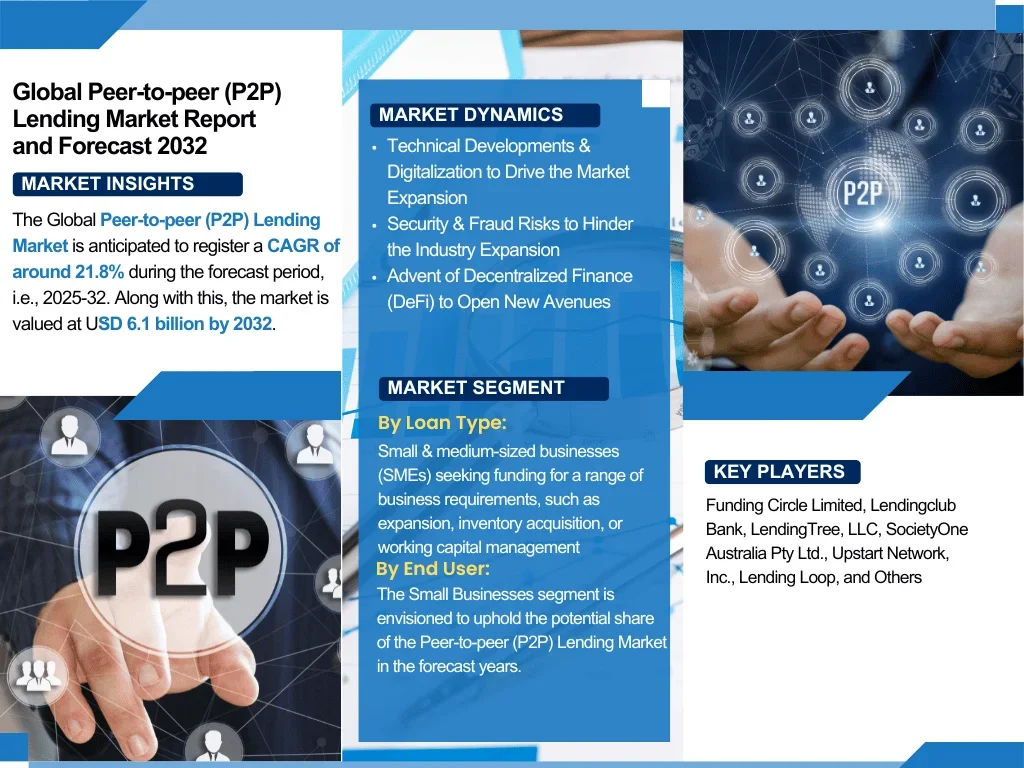

The Global Peer-to-peer (P2P) Lending Market size was valued at USD 1.53 billion in 2025, further projected to be about USD 6.1 billion by 2032, and would register a CAGR of around 21.8% during 2025-32.

The credible Global Peer-to-peer (P2P) Lending Market report covers detailed insights into market size, share, trends, and opportunities. This research helps businesses make informed decisions, strengthen their strategies, and expand their reach in a competitive landscape. The analysis estimates market growth based on evolving dynamics and demand drivers.

Global Peer-to-peer (P2P) Lending Market Overview

The Global Peer-to-peer (P2P) Lending market is an essential part of the global business landscape, contributing to innovation, efficiency, and industry growth. Global Peer-to-peer (P2P) Lending products and solutions are widely adopted across multiple sectors for their role in improving performance, streamlining processes, and supporting research and development activities.

In recent years, the market has gained momentum due to rising demand, growing investment in technology, and continuous advancements that enhance product effectiveness. With organizations focusing on quality, innovation, and compliance, the Global Peer-to-peer (P2P) Lending market continues to offer significant opportunities for stakeholders worldwide.

This market is influenced by evolving customer needs, regulatory frameworks, and competitive dynamics. Understanding the Global Peer-to-peer (P2P) Lending market provides businesses with valuable insights to anticipate future trends, minimize risks, and make informed strategic decisions.

Understanding the Global Peer-to-peer (P2P) Lending market is essential for industry leaders looking to forecast future trends and capitalize on growth opportunities.

Get A sample report: https://www.thereportcubes.com/request-sample/peer-to-peer-lending-market

Market Segmentation

- Market Share, By Lending Type

- Consumer Lending

- Business Lending

- Market Share, By Loan Type

- Secured

- Unsecured

- Market Share, By End User

- Non Business Loans

- Business Loans

- Market Share, By Purpose Type

- Repaying Bank Debt

- Credit Card Recycling

- Education

- Home Renovation

- Buying Car

- Family Celebration

- Others

- Market Share, By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

These companies are investing in product innovation, strategic partnerships, and expanding distribution networks to strengthen their presence in the Global Peer-to-peer (P2P) Lending market.

Market Dynamic

· Technical Developments & Digitalization to Drive the Market Expansion

The introduction of cutting-edge technologies & the widespread digitization of financial services are two of the key aspects driving the P2P Lending Market. P2P lending systems do away with the demand for conventional middlemen, such as banks by connecting borrowers & lenders directly through digital platforms. By enlightening the effectiveness of risk assessment & credit scoring through the usage of complex algorithms & data analytics, lending decisions could be made more quickly & precisely. Moreover, P2P lending is becoming a more appealing option for both lenders & borrowers owing to its digitization, which also lowers operating costs & streamlines the lending process.

Future Outlook

The Global Peer-to-peer (P2P) Lending market holds immense growth potential, supported by technological advancements, rising consumer demand, and industry-specific needs. To thrive in this evolving landscape, businesses must focus on innovation, partnerships, and regional expansion.

Key Questions Answered in the Report

- What is the present market valuation of the Global Peer-to-peer (P2P) Lending market in 2032?

- What is the estimated CAGR during 2025-32?

- Which product types and applications dominate the market?

- Who are the major stakeholders and market leaders?

- Which regions are witnessing the fastest growth?

Read Related Report –

https://www.thereportcubes.com/report-store/copper-rod-and-busbar-market-in-uae

https://www.thereportcubes.com/report-store/concrete-floating-floors-system-market

https://www.thereportcubes.com/report-store/gas-compressor-market

https://www.thereportcubes.com/report-store/thailand-cement-market

About The Report Cube

At Report Cube, we are more than just a market research company; we are your strategic partner in unlocking the insights that drive your business forward. With a passion for data, a commitment to precision, and a dedication to delivering actionable results, we have been a trusted resource for businesses seeking a competitive edge.

We deliver in-depth market research and consulting solutions that empower businesses to identify opportunities, reduce risks, and make data-driven decisions. Established in 2024, we’ve helped clients worldwide uncover trends and build strategies for long-term growth.

📞 Contact Us:

- Phone: +971 564468112 (WhatsApp)

- Website: https://www.thereportcubes.com/