Introduction: Africa’s Food Flavor Industry on a Robust Growth Path

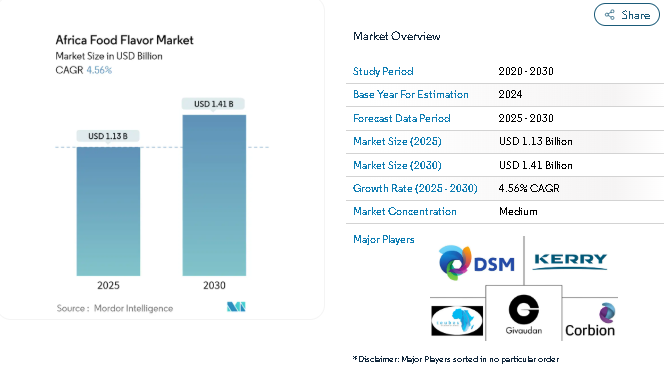

The Africa food flavor market is poised for steady expansion, with its valuation projected to rise from USD 1.13 billion in 2025 to USD 1.41 billion by 2030, growing at a 4.56% CAGR during the forecast period (2025–2030). This growth reflects a dynamic transformation in Africa’s food and beverage landscape, driven by urbanization, rising disposable incomes, and consumer demand for flavorful, convenient, and health-conscious foods.

According to the Mordor Intelligence Africa Food Flavor Market Report, the shift toward clean-label, natural, and international flavor profiles is reshaping consumption across leading markets such as South Africa, Nigeria, Egypt, and Kenya. Food manufacturers are investing in innovation and local sourcing to meet evolving consumer preferences and capitalize on new growth opportunities across the region.

Unlock detailed segmentation, trends, and competitor analysis-click to learn more - https://www.mordorintelligence.com/industry-reports/africa-food-flavor-market?utm_source_globbook

Key Trends Shaping the Africa Food Flavor Market

1. Surge in Demand for Natural and Clean-Label Flavors

The move toward natural food flavors and clean-label ingredients is a defining trend across African markets. Consumers are increasingly scrutinizing product labels and avoiding artificial additives, prompting manufacturers to reformulate their offerings with plant-based extracts, essential oils, and organic compounds.

Companies like Symrise, Kerry Group, and Givaudan are scaling up regional operations to meet this demand, sourcing sustainable raw materials from local farms. This trend aligns with the global push for transparency, wellness, and sustainability, positioning Africa as an emerging hub for clean-label innovation in food and beverages.

2. Growing Popularity of International and Fusion Flavor Profiles

Africa’s culinary landscape is rapidly diversifying as global cuisines influence local food preferences. In urban centers such as Lagos, Nairobi, and Johannesburg, consumers are embracing fusion flavors inspired by Asian, Mediterranean, and Latin American dishes.

Food brands and flavor houses are responding with customized spice blends, sauces, and snack innovations that reflect African taste intensity while introducing global appeal. Leading multinationals like IFF and DSM-Firmenich are investing in regional sensory centers, enabling chefs and technologists to co-create localized flavor solutions for diverse markets.

3. Innovation in Beverage and Alcoholic Flavor Applications

The beverage industry remains a core growth driver for the Africa food flavor market. Local brands are introducing flavored beers, low-ABV cocktails, fruit-based RTDs, and energy drinks infused with indigenous botanicals such as hibiscus, rooibos, and baobab.

This wave of flavor innovation is supported by strategic alliances and investments—such as Heineken’s acquisition of Distell—that enhance R&D and flavor formulation capabilities in the region. As beverage consumption rises among Africa’s youthful population, demand for liquid and natural flavor formats is expected to accelerate further.

4. Sustainable and Circular Sourcing Gains Momentum

Sustainability is becoming a competitive differentiator in Africa’s flavor manufacturing ecosystem. Companies are incorporating upcycled ingredients, including fruit pulps, sugarcane residues, and vegetable extracts, to reduce waste and improve environmental performance.

Emerging African start-ups, especially in Kenya and Nigeria, are building traceable supply chains by partnering with local farmers for ethically sourced feedstocks. These circular sourcing models not only enhance sustainability credentials but also ensure compliance with growing global regulatory expectations.

Explore in-depth insights and regional perspectives, including localized editions like the Japanese market version - https://www.mordorintelligence.com/ja/industry-reports/africa-food-flavor-market?utm_source_globbook

Market Segmentation Insights

The Africa food flavor market report segments the industry by type, application, form, and geography, highlighting how each category contributes to overall growth.

By Type

- Natural Flavors: Fastest-growing category, supported by demand for organic and clean-label formulations.

- Synthetic Flavors: Remains prevalent in price-sensitive regions due to affordability and availability.

- Nature-Identical Flavors: Offer a balanced blend of cost-effectiveness and natural appeal, gaining traction in mid-tier markets.

By Application

- Beverages: Largest and most dynamic segment, powered by flavored waters, cocktails, and soft drinks.

- Bakery and Dairy: Innovations in yogurts, spreads, and pastries targeting the urban consumer segment.

- Confectionery and Snacks: Growth driven by rising snack consumption and preferences for bold, spicy flavors.

- Meat and Processed Foods: Increasing adoption of flavor-enhanced processed meats as urbanization rises.

By Form

- Liquid Flavors: Dominant in beverage formulations for ease of mixing and high precision.

- Powder Flavors: Gaining popularity for long shelf life and easier distribution in regions with limited cold storage.

- Encapsulated & Spray-Dried Flavors: Emerging for extended preservation and controlled flavor release.

By Geography

- South Africa: Most developed market with robust processing and retail infrastructure.

- Nigeria: High-growth market fueled by rapid population growth and FMCG expansion.

- Egypt: Strategic gateway market connecting Africa, the Middle East, and Europe.

- Kenya & Rest of Africa: Emerging players focusing on agricultural value chains and local ingredient sourcing.

Competitive Landscape: Global and Local Players Drive Innovation

The Africa food flavor market is moderately consolidated, featuring a blend of multinational corporations and regional innovators. Global leaders like Givaudan, Kerry Group PLC, DSM-Firmenich, IFF, and Symrise dominate through regional R&D centers, local flavor customization, and sustainable sourcing initiatives.

Meanwhile, regional firms such as Teubes Oils out of Africa and Corbion Purac are leveraging indigenous botanical extracts and cost-efficient production to secure niche market positions. Their agility in adapting to local consumer preferences and maintaining compliance with regional authorities like NAFDAC (Nigeria) and SAHPRA (South Africa) enhances competitiveness.

Recent developments—including IFF’s participation in the Africa Food Show (Cape Town) and expanding regional partnerships—underscore the sector’s momentum toward quality assurance, authenticity, and innovation-driven growth.

Conclusion: Africa’s Flavor Market Positioned for Sustainable Expansion

The Africa food flavor market outlook through 2030 indicates sustained growth driven by urbanization, income growth, and modernization of the food industry. Although challenges such as currency instability, supply chain fragmentation, and import dependency persist, companies investing in local production, technology integration, and strategic collaborations are well-positioned to thrive.

Future growth in the Africa food flavor market will hinge on balancing affordability, authenticity, and sustainability. Manufacturers prioritizing clean-label innovation, circular sourcing, and regional partnerships will capture the greatest value in this rapidly evolving market. As consumer palates diversify and demand for premium, flavored products surges, Africa is set to become one of the most promising frontiers for global flavor innovation.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries, please contact:

https://www.mordorintelligence.com/contact-us