Introduction: Brazil’s Agricultural Backbone Strengthens with Technology and Trade

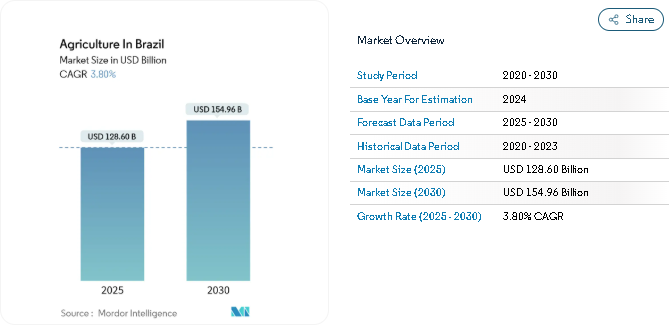

The Brazil agriculture market size is projected to reach USD 154.96 billion by 2030, up from USD 128.6 billion in 2025, reflecting a CAGR of 3.80% between 2025 and 2030. This steady growth is supported by advanced farming technologies, rising international demand, and robust government financing programs. Agriculture continues to anchor Brazil’s economy, accounting for nearly half of total export revenues and serving as a stabilizing pillar for rural employment and development.

According to the latest Agriculture in Brazil Industry Report by Mordor Intelligence, expanding rural credit under Plano Safra, rapid adoption of precision agriculture, and sustainable double-crop expansion across the Central-West region are propelling the sector forward. As the world’s leading supplier of soybeans, corn, sugar, and coffee, Brazil’s agribusiness ecosystem remains globally competitive, balancing innovation, productivity, and environmental responsibility.

Unlock detailed segmentation, trends, and competitor analysis-click to learn more - https://www.mordorintelligence.com/industry-reports/agriculture-in-brazil?utm_source_globbook

Key Market Trends Shaping Brazil’s Agriculture Sector

1. Surging Chinese Demand and Export Diversification

China remains Brazil’s largest agricultural trade partner, driving demand for soybeans, corn, and feed ingredients. Recent diversification into DDG and DDGS exports—once dominated by the U.S.—has opened new opportunities for Brazilian exporters. This growing partnership strengthens long-term trade security and price stability, reducing dependence on domestic market fluctuations. As global feed demand rises, Brazil’s consistent output positions it as a reliable supplier amid changing international trade dynamics.

2. Rising Adoption of Double-Crop Systems

The expansion of safrinha (second-crop corn) acreage has transformed land-use efficiency across Brazil’s Central-West. Farmers now plant short-cycle soybeans followed by corn within the same year, significantly boosting productivity per hectare. This double-cropping model not only increases revenue potential but also minimizes deforestation pressure by repurposing existing farmland. The system’s integration with ethanol and feed industries further amplifies Brazil’s competitiveness, though weather risks and delayed planting windows remain key operational challenges.

3. Rural Credit Programs Driving Farm Modernization

Brazil’s Plano Safra 2024–2025 program continues to provide low-interest loans, subsidies, and credit lines to both smallholders and commercial producers. Funding is particularly directed toward digital agriculture tools, biological inputs, and sustainable irrigation systems. While budget freezes for large producers created temporary constraints, targeted incentives are ensuring technology adoption and productivity gains remain on track. These credit mechanisms are vital for maintaining the momentum of modernization across Brazil’s diverse farming landscape.

4. Digital Transformation and Precision Agriculture Boom

The uptake of precision agriculture has accelerated rapidly, with over 80% of large farms deploying GPS-guided tractors, IoT-based irrigation, and AI-powered crop monitoring. This digital shift enhances yield management, reduces input waste, and strengthens traceability for export compliance. Investments in agtech startups are also soaring, focusing on data analytics, automation, and connectivity infrastructure. The ongoing rollout of rural broadband and 5G connectivity is expected to transform agricultural data integration, setting new standards for efficiency and environmental stewardship.

5. Infrastructure Gaps and Logistics Modernization

Despite record harvests, logistical inefficiencies still pose bottlenecks for the agriculture in Brazil industry. Long transport distances from production hubs to export ports inflate freight costs and reduce profit margins. To counter this, Brazil is investing heavily in multimodal transport systems, including rail expansion, northern export corridors, and advanced storage facilities. These projects aim to reduce logistical costs and improve export competitiveness, particularly for grain and oilseed producers.

6. Market Risks and Price Volatility

External risks such as currency fluctuations, geopolitical tensions, and rising input prices continue to pressure margins. Heavy reliance on a few export destinations—mainly China—heightens exposure to demand shocks. To mitigate these risks, Brazilian producers are adopting hedging strategies, forward contracts, and domestic ethanol-linked demand frameworks. Meanwhile, growing emphasis on climate resilience and soil regeneration ensures the sector remains sustainable in the face of environmental volatility.

Stay ahead of the curve with global and localized reports-now available with detailed coverage of the Japanese market - https://www.mordorintelligence.com/ja/industry-reports/agriculture-in-brazil?utm_source_globbook

Market Segmentation: Brazil’s Diverse Agricultural Portfolio

By Commodity Type

- Oilseeds and Pulses: Soybeans dominate Brazil’s crop portfolio, underpinning both feed and biofuel industries.

- Cereals and Grains: Corn remains a critical crop, supporting food, feed, and ethanol sectors with expanding domestic demand.

- Fiber Crops: Cotton cultivation benefits from advanced irrigation and mechanization, boosting exports.

- Sugar Crops: Sugarcane sustains both sweetener and ethanol industries, aligning with bioenergy goals.

- Fruits and Vegetables: Brazil’s exports of melons, grapes, and citrus oils continue to rise, backed by new logistics routes and processing facilities.

- Coffee and Cocoa: Coffee exports have surged amid global shortages, while sustainable cocoa estates are gaining traction.

By Region

- Central-West: The largest production zone with extensive mechanization and fertile land reserves.

- South: A hub for cooperative-driven farming and advanced equipment integration.

- North and Northeast: Emerging agricultural frontiers, backed by regional infrastructure and family-farming initiatives.

- Southeast: A processing and export powerhouse focused on sugar, citrus, and ethanol production.

Competitive Landscape: Collaboration and Innovation Define Growth

The Brazil agriculture market analysis highlights a diverse mix of domestic cooperatives, multinational agribusinesses, and agtech startups. Leading players collaborate with research institutions like EMBRAPA to advance crop genetics, soil management, and sustainability initiatives.

Global equipment and seed manufacturers continue to expand local operations, while Brazilian tech firms pioneer AI-based crop analytics and precision input management tools. This collaborative ecosystem enhances the efficiency, traceability, and sustainability of Brazil’s agricultural value chain.

Conclusion: Sustainable Modernization and Global Competitiveness Ahead

The agriculture in Brazil market is poised for sustained expansion through 2030, driven by a balanced combination of modernization, sustainability, and export strength. Digital transformation, government-backed rural credit, and diversified crop strategies ensure long-term stability even amid global uncertainties.

Infrastructure upgrades and agtech investments will further strengthen Brazil’s position as a global agricultural powerhouse. The integration of technology, data-driven management, and environmentally conscious practices continues to redefine productivity standards across the sector.

As outlined in the Agriculture in Brazil Industry Analysis, the market’s outlook remains robust—supported by continuous innovation, evolving trade partnerships, and a commitment to sustainable growth that will keep Brazil at the forefront of global agriculture.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries, please contact:

https://www.mordorintelligence.com/contact-us