Introduction: Rising Preference for Eco-Safe Pest Management Solutions

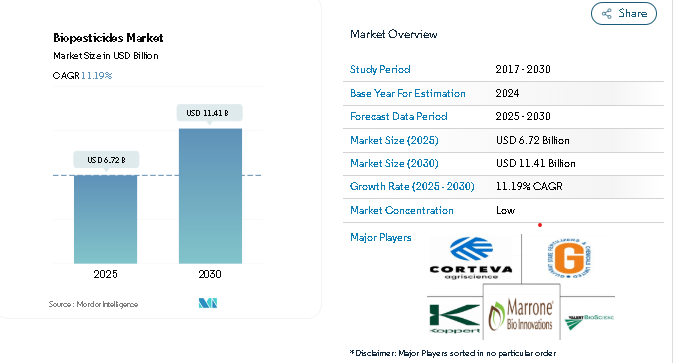

The global biopesticides market is poised for significant growth, with an estimated value of USD 6.72 billion in 2025 projected to reach USD 11.41 billion by 2030, registering a strong CAGR of 11.19% during the forecast period (2025–2030). The growing emphasis on sustainable agriculture, organic food production, and environmentally safe pest control is driving large-scale adoption of biopesticides across global farming systems.

Derived from natural sources such as plants, bacteria, minerals, and certain animal extracts, biopesticides are becoming vital tools in integrated pest management (IPM) programs. Their targeted pest action, low toxicity, and residue-free nature make them a preferred alternative to synthetic pesticides. Farmers worldwide are embracing biological crop protection to safeguard soil fertility, enhance yield quality, and align with the global push toward organic certification and food safety compliance.

Strong policy support from governments and international organizations further accelerates market growth. The European Commission’s streamlined approval pathway for microbial-based biopesticides and organic farming subsidies across Asia and the Americas are catalyzing adoption. Meanwhile, ongoing innovations—such as next-generation microbial strains, biofungicides, and shelf-stable formulations—are enhancing biopesticide performance and accessibility.

Unlock detailed segmentation, trends, and competitor analysis-click to learn more - https://www.mordorintelligence.com/industry-reports/global-biopesticides-market-industry?utm_source_globbook

Key Market Trends Driving Biopesticides Adoption

1. Global Surge in Organic Farming and Chemical-Free Food Consumption

Organic agriculture is experiencing unprecedented expansion worldwide. Supported by consumer awareness and favorable regulations, countries across North America, Europe, and Asia-Pacific are increasing organic acreage to meet surging demand for chemical-free produce.

According to recent data, the U.S. and Germany lead in per capita organic food consumption, while emerging economies like India, Japan, and Australia are rapidly scaling up sustainable farming initiatives. As organic certification standards restrict synthetic pesticide use, farmers are increasingly turning to biopesticides for effective, eco-compliant pest control in cereals, fruits, vegetables, and pulses.

2. Shift Toward Sustainable and Regulated Crop Protection Practices

Sustainability has become a cornerstone of modern agriculture. Excessive dependence on chemical pesticides has led to soil degradation, pest resistance, and ecosystem imbalance, prompting a shift toward biological alternatives.

Biopesticides, being target-specific and biodegradable, support biodiversity and reduce environmental pollution. Policy frameworks like the EU’s Farm-to-Fork Strategy, which aims to cut synthetic pesticide usage by 50% by 2030, are accelerating adoption across Europe. Similarly, governments in Asia-Pacific and the Middle East, including India, Saudi Arabia, and Australia, are investing in sustainable food production systems to achieve food security while minimizing environmental impact.

3. Innovation and R&D Driving Product Efficacy

Technological advancements are transforming the biopesticide landscape. Leading manufacturers and research institutes are developing microbial consortia, nano-formulations, and botanical blends with improved field stability and efficacy across different climatic conditions.

Innovations such as entomopathogenic fungi, bio-nematicides, and biochemical pest repellents are gaining traction due to their reliability and compatibility with existing crop management systems. Industry collaborations—like partnerships between biotech startups, agritech firms, and research centers—are fueling R&D investments and creating new opportunities for market expansion.

Get the latest global trends, with regional highlights including dedicated insights for Japan - https://www.mordorintelligence.com/ja/industry-reports/global-biopesticides-market-industry?utm_source_globbook

Market Segmentation: Form, Crop Type, and Regional Insights

By Form

- Biofungicides: Largest segment globally, widely used against fungal diseases such as Botrytis, Rhizoctonia, and Fusarium. They promote both plant growth and soil microbial health.

- Bioinsecticides: Rapidly growing segment addressing pest resistance to chemicals. Commonly based on Bacillus thuringiensis (Bt) and Beauveria bassiana strains.

- Bioherbicides: Increasingly adopted as sustainable substitutes for synthetic herbicides in organic and transitional farming systems.

- Other Biopesticides: Includes bionematicides and biochemical pest deterrents, gaining importance in specialty and high-value crops.

By Crop Type

- Row Crops: Represent the largest market share, covering key staples like rice, maize, soybean, and wheat.

- Horticultural Crops: Strong demand for fruits, vegetables, and ornamental plants due to consumer focus on residue-free produce.

- Cash Crops: Includes cotton, coffee, cocoa, sugarcane, and tea—where biopesticides support export quality and international compliance standards.

By Region

- North America: Leading market with advanced IPM adoption and regulatory encouragement in the United States and Canada.

- Europe: Strong policy backing for sustainable agriculture, with France, Spain, and Germany leading in organic farmland.

- Asia-Pacific: Fastest-growing region, driven by farmer training programs and supportive government initiatives in India, China, and Australia.

- South America: Brazil dominates regional demand, supported by organic exports and sustainable coffee cultivation.

- Middle East & Africa: Emerging markets such as Saudi Arabia, Egypt, and Kenya are investing in organic systems to reduce pesticide reliance.

Competitive Landscape: Leading Companies and Strategic Developments

The global biopesticides industry is moderately fragmented, featuring a mix of international corporations and regional innovators. Companies are pursuing strategic collaborations, mergers, acquisitions, and product launches to strengthen their portfolios and market presence.

Key Market Players Include:

- Corteva Agriscience – Expanding its biologicals division with acquisitions like Symborg to accelerate microbial innovation.

- Marrone Bio Innovations – Pioneer in developing microbial and botanical pest management solutions.

- Koppert Biological Systems – Global leader in integrated pest management and pollination products.

- Valent Biosciences LLC – Specializes in microbial-based bioinsecticides and biofungicides.

- Gujarat State Fertilizers & Chemicals Ltd (GSFC) – Expanding its biofertilizer and biopesticide range for sustainable crop nutrition.

Recent developments such as Corteva’s partnerships with microbial startups and Seipasa’s launch of biofungicidal formulations underscore a strong innovation pipeline across the sector. Additionally, regional SMEs in Latin America and Asia-Pacific are playing crucial roles in adapting solutions for local climatic and crop conditions, enhancing accessibility for smallholder farmers.

Conclusion: Biopesticides to Redefine the Future of Global Agriculture

The global biopesticides market outlook remains robust, underpinned by global sustainability goals, rising consumer demand for organic food, and ongoing regulatory support. As farmers increasingly adopt eco-safe pest control and reduce chemical dependencies, biopesticides will become integral to mainstream agriculture.

Future growth will hinge on farmer education, R&D investments, government incentives, and efficient supply chains. With innovations improving performance and cost-efficiency, biopesticides are expected to gain a stronger foothold even in developing regions.

The global transition toward climate-resilient, sustainable farming is irreversible—and biopesticides are at the heart of this transformation. By combining environmental stewardship with high agricultural productivity, biopesticides are shaping a safer, greener, and more sustainable food future.

Keywords (semantic & entity-based for ranking):

biopesticides market growth, global biopesticides industry forecast, sustainable agriculture trends, organic farming market, microbial biopesticides, bioinsecticides, biofungicides, green crop protection, organic food demand, eco-friendly pesticides.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries, please contact:

https://www.mordorintelligence.com/contact-us