Introduction: Vision 2030 Fuels Growth in Poultry Meat Production and Food Security

The Saudi Arabia poultry meat market is witnessing strong expansion, with the market value projected to rise from USD 5.30 billion in 2025 to USD 6.91 billion by 2030, growing at a steady CAGR driven by government investment, sustainability initiatives, and evolving consumer preferences.

Backed by the Saudi Vision 2030 framework, the Kingdom aims to achieve 90% poultry self-sufficiency by the end of the decade. The Agricultural Development Fund (ADF) plays a pivotal role by financing up to 70% of poultry project costs, encouraging local producers to invest in modern facilities, automated processing systems, and feed security.

Major projects such as Balady’s SAR 1.14 billion expansion plan and Almarai’s advanced Ha’il poultry complex reflect the Kingdom’s commitment to strengthening domestic food production and reducing import reliance. The growing demand for fresh, halal-certified, and high-quality poultry products aligns with Saudi Arabia’s broader goals of food security, sustainability, and agricultural innovation.

Dive deeper into regional trends and saudi arabia poultry meat market dynamics-visit the full report - https://www.mordorintelligence.com/industry-reports/saudi-arabia-analysis-of-the-poultry-sector-industry?utm_source_globbook

Key Market Drivers and Emerging Trends

1. Vision 2030 Accelerates Domestic Poultry Self-Sufficiency

The poultry meat industry is central to Saudi Arabia’s Vision 2030 food security roadmap, which allocates over SAR 17 billion to agricultural development. This investment is focused on expanding domestic farms, improving feed production infrastructure, and advancing poultry processing technology.

With regulatory backing from the Saudi Food and Drug Authority (SFDA) and the Ministry of Environment, Water, and Agriculture (MEWA), licensing systems have been streamlined, enhancing transparency and compliance. Moreover, international partnerships and foreign direct investments (FDI) are introducing technology transfer and best practices, further boosting production efficiency.

2. Rising Urbanization and Health Awareness Boost Poultry Demand

Saudi Arabia’s rapidly urbanizing population and changing dietary habits are propelling poultry consumption. The country’s growing middle class and young demographic increasingly view poultry as a lean, healthy protein source.

Government-led nutrition awareness campaigns and rising disposable incomes are driving the transition toward value-added poultry products — including marinated chicken, frozen cuts, and ready-to-cook meals. This shift from raw meat to premium, branded, and convenient offerings mirrors global consumer trends toward healthy, time-efficient eating.

3. Retail Modernization and E-commerce Expansion

The Kingdom’s retail sector is undergoing digital transformation, significantly impacting poultry distribution. The proliferation of hypermarkets, supermarkets, and e-commerce platforms like Danube Online, Carrefour, and HungerStation has expanded market reach.

Digital adoption and cold-chain logistics innovation ensure product freshness and enhance consumer trust in online grocery delivery. Producers increasingly leverage direct-to-consumer (D2C) channels, integrating IoT tracking and real-time temperature monitoring to maintain quality standards across supply chains.

4. Strengthened Halal Certification Enhances Domestic and Export Competitiveness

Saudi Arabia’s poultry market is underpinned by strict halal compliance enforced by the Saudi Halal Center (SHC) and SFDA. These institutions have reinforced traceability, hygiene standards, and halal authenticity, improving consumer confidence in domestic brands.

The implementation of advanced certification protocols not only safeguards local consumers but also opens export opportunities across Gulf Cooperation Council (GCC), African, and Asian markets with rising demand for halal-certified poultry.

5. Feed Cost Pressures Spur Investment in Local Feed Manufacturing

Feed remains the single largest cost factor in poultry production, accounting for nearly 60% of operational expenses. Saudi Arabia currently imports most of its corn and soybean meal from Brazil and Argentina, making it vulnerable to global price volatility.

To mitigate this, domestic producers are investing in local feed mills and exploring alternative protein sources such as barley, sorghum, and insect-based feeds. Supported by ADF’s funding initiatives, these efforts aim to enhance feed security, reduce import dependence, and ensure stable poultry meat pricing.

Stay informed with expert-backed research-now including translations and local insights for Japan and other key markets - https://www.mordorintelligence.com/ja/industry-reports/saudi-arabia-analysis-of-the-poultry-sector-industry?utm_source_globbook

Market Segmentation Insights

By Form

- Fresh/Chilled Poultry: Largest market segment, preferred for freshness and taste consistency. Supported by advanced cold-chain infrastructure and strict halal regulations.

- Processed Poultry: Fastest-growing segment, driven by rising demand for ready-to-eat, marinated, and frozen poultry products.

- Frozen Poultry: Popular among foodservice providers and institutional buyers requiring longer shelf life.

- Canned Poultry: Small but steady market share, mainly catering to export and emergency food channels.

By Distribution Channel

- Supermarkets & Hypermarkets: Dominant retail outlets offering product variety, competitive pricing, and brand visibility.

- Online Retail: Rapidly growing channel, fueled by digitalization and changing shopping habits.

- Convenience Stores: Serve urban consumers seeking quick purchases and on-the-go options.

- Foodservice & On-Trade: Restaurants, hotels, and caterers represent a key demand segment for bulk poultry supply.

These segments highlight the diversified nature of poultry consumption across Saudi Arabia, influenced by income growth, modernization, and lifestyle evolution.

Competitive Landscape

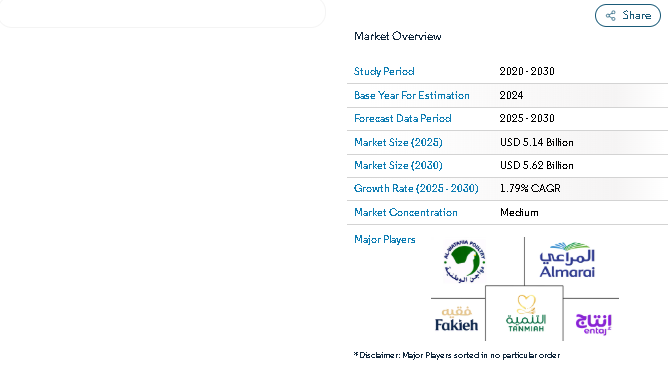

The Saudi Arabia poultry meat market is moderately consolidated, featuring major domestic players alongside international entrants. Leading companies include:

- Al-Watania Poultry: Market leader with large-scale breeding and integrated processing facilities.

- Almarai (Alyoum): Leverages automation, quality control, and nationwide distribution strength.

- Tanmiah Food Company: Focused on sustainability and AI-based smart farming solutions.

- Fakieh Poultry Farms and Entaj: Prioritize premium quality and extensive regional distribution.

- BRF and JBS (Brazil): Expanding local operations to cater to growing processed poultry demand and halal export markets.

These players are adopting digital monitoring systems, biosecurity measures, and renewable energy integration to meet Vision 2030 sustainability benchmarks.

Conclusion: Vision 2030 and Innovation Pave the Way for Sustainable Poultry Growth

The Saudi Arabia poultry meat market outlook remains highly promising, supported by policy-driven investments, private sector innovation, and consumer evolution. Vision 2030’s agricultural diversification strategy continues to attract capital inflows and technological modernization, fostering a self-sufficient poultry ecosystem.

As local feed production expands and cold-chain networks mature, Saudi Arabia is well-positioned to reduce import reliance and become a regional leader in halal poultry production. The synergy of government support, digital transformation, and health-driven consumption trends ensures consistent market growth through 2030.

The latest Saudi Arabia poultry meat market analysis confirms that the sector is advancing toward efficiency, sustainability, and global competitiveness, representing a cornerstone of the Kingdom’s long-term food security and economic diversification agenda.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries, please contact:

https://www.mordorintelligence.com/contact-us