Introduction: Growing Demand for Fruit-Based Alcoholic Drinks Fuels Global Cider Market Growth

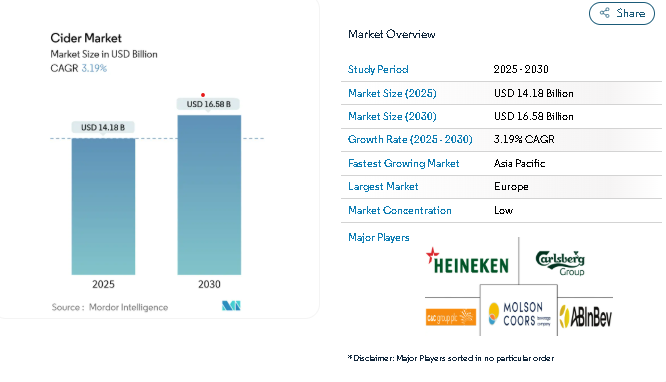

The global cider market size is estimated at USD 14.18 billion in 2025 and is projected to reach USD 16.58 billion by 2030, expanding at a CAGR of 3.19% during the forecast period (2025–2030).

This steady growth is fueled by increasing consumer interest in low-alcohol, gluten-free, and fruit-forward beverages. Cider is gaining popularity as a healthier alternative to beer and traditional alcoholic drinks—particularly among millennials and health-conscious consumers seeking natural and refreshing beverage options.

The market is witnessing significant transformation through sustainability efforts, craft production, and premium flavor innovations. Post-pandemic lifestyle changes have revived on-trade sales, while the adoption of recyclable aluminum cans and smaller packaging formats supports both convenience and environmental goals.

Dive deeper into regional trends and cider market industry dynamics-visit the full report - https://www.mordorintelligence.com/industry-reports/cider-market-industry?utm_source_globbook

Key Trends Influencing the Global Cider Market Industry

1. Surge in Low-Alcohol and Health-Conscious Beverages

One of the strongest growth drivers in the cider industry is the global moderation trend, encouraging consumers to opt for beverages with lower alcohol content and functional health benefits. Cider’s naturally gluten-free composition and moderate ABV (alcohol by volume) make it a preferred choice among those prioritizing balance and wellness.

Manufacturers are innovating with fermentation methods to reduce alcohol without compromising taste and adding botanicals, probiotics, and antioxidants to strengthen cider’s “better-for-you” positioning.

2. Flavor Innovation and Seasonal Offerings

Flavor diversity is redefining the cider market landscape. Producers are rolling out limited-edition, seasonal, and experimental flavors to engage younger demographics seeking novelty and authenticity. Popular innovations include tropical fruit blends, berry infusions, and barrel-aged ciders, offering a premium craft experience.

These seasonal releases—especially during summer festivals and autumn harvest events—enhance brand engagement and boost short-term sales while reinforcing long-term loyalty.

3. Sustainability and Eco-Friendly Packaging Solutions

Sustainability has become a non-negotiable priority for modern consumers. Leading cider brands are focusing on eco-conscious packaging, particularly recyclable aluminum cans, which combine environmental benefits with portability and durability.

Smaller packaging sizes are also aligning with mindful drinking and waste reduction trends. Brands that highlight their use of locally sourced apples, organic ingredients, and recyclable materials are building deeper trust and visibility in competitive beverage markets.

4. Expansion of Craft and Artisanal Cider Production

The rise of craft cider brands is reinvigorating local economies and supporting apple orchard farming across regions like Europe, North America, and Australia. Artisanal producers emphasize authenticity, traceability, and heritage-driven storytelling, connecting with consumers who value craftsmanship and origin transparency.

Through agritourism initiatives, limited-edition production, and regional flavor identity, these craft players are driving premiumization—a trend central to the modern cider industry’s evolution.

Read the full report and access market snapshots that include both global views and Japan-specific analysis - https://www.mordorintelligence.com/ja/industry-reports/cider-market-industry?utm_source_globbook

Detailed Market Segmentation Overview

According to Mordor Intelligence’s cider market analysis, the industry is segmented by ingredient, alcohol content, packaging, category, distribution channel, and region, each shaping global consumption behavior and strategic priorities.

By Ingredient

-

Apple Cider: Dominates the market with a classic profile rooted in traditional production.

-

Mixed Fruit Cider: Gaining popularity among younger consumers for its sweeter, innovative flavors.

-

Others (Pear, Berry, Tropical Blends): Expanding variety and experimentation beyond apple-based formulas.

By Alcohol Content

-

Low Alcohol Ciders: The fastest-growing category, aligning with health and moderation trends.

-

High Alcohol Ciders: Serve niche markets focused on bold, heritage-style flavors.

By Packaging Format

-

Bottles: Associated with premium branding and a traditional drinking experience.

-

Cans: Growing rapidly due to recyclability, lightweight convenience, and on-the-go appeal.

By Category

-

Mass Market: Leads overall volume through affordability and global retail penetration.

-

Premium Segment: Exhibiting strong CAGR, supported by craft branding, unique flavors, and sustainable practices.

By Distribution Channel

-

Off-Trade (Retail & Online): Dominates overall sales, supported by supermarket chains and e-commerce expansion.

-

On-Trade (Bars & Restaurants): Rebounding post-pandemic, boosted by social and experiential consumption.

By Geography

-

Europe: Maintains global leadership, driven by cider traditions in the UK, Ireland, and Spain.

-

North America: Witnessing strong growth through craft innovations and premium flavored ciders.

-

Asia-Pacific: Fastest-growing region, fueled by rising disposable incomes and emerging markets like China and India.

-

South America & Middle East/Africa: Represent untapped potential with evolving drinking patterns.

Leading Companies in the Global Cider Market

The global cider market remains moderately fragmented, featuring both multinational beverage giants and agile craft producers. Key players are expanding through product diversification, sustainability integration, and strategic marketing investments.

Major Companies Include:

-

Heineken N.V. – Expanding its “Inch’s” cider line to cater to both standard and non-alcoholic consumers.

-

Anheuser-Busch InBev – Strengthening its portfolio with premium flavored ciders and responsible drinking campaigns.

-

Molson Coors Beverage Co. – Targeting urban millennials with gluten-free, premium cider offerings.

-

Carlsberg Group – Emphasizing regional branding and sustainability initiatives to enhance market presence.

-

C & C Group Plc. – Leveraging strong distribution networks and marketing partnerships to expand global reach.

Additionally, regional craft producers in the U.S., U.K., and Australia continue to shape innovation through local sourcing, seasonal releases, and experimental fermentation, giving them an authentic edge over mass-market brands.

Conclusion: Premiumization and Sustainability to Define the Future of the Cider Market

The global cider market outlook remains positive through 2030, with opportunities anchored in premium low-alcohol segments, eco-friendly packaging, and functional ingredient integration.

As consumers seek beverages that blend taste, authenticity, and wellness, cider stands out as a versatile option across demographics and regions.

Brands that successfully balance heritage-based storytelling with modern innovation will capture market share and strengthen their long-term brand equity.

Despite challenges like competition from ready-to-drink cocktails and changing alcohol regulations, the cider industry’s resilience, adaptability, and connection to sustainable lifestyles ensure a promising trajectory through 2030 and beyond.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries, please contact: