The global submarine cables market was valued at USD 31.70 billion in 2024 and is anticipated to reach USD 44.33 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. This growth is primarily driven by increasing investments in offshore wind farms and the rising demand for data traffic, particularly from over-the-top (OTT) service providers.

Submarine cables are essential for both power transmission (to offshore oil rigs, wind power facilities, and for grid interconnections) and communication, as they carry nearly 97% of global internet traffic. The growing need for power grid interconnections and the push for integrating renewable energy sources enhance the market's potential. Consequently, there is a significant rise in demand for both power and communication submarine cables.

Specifically, submarine communication cables facilitate around 90% of global data transmission. Their collective capacity is measured in terabits per second, making them indispensable for major communication firms like Google, Amazon, Facebook, and Microsoft. For example, in October 2021, NEC, a Japanese IT company, announced plans for a substantial submarine cable featuring 40 million fiber optics for Facebook, achieving a capacity of up to 500 Mbps across 24 fiber pairs. Many countries recognize these cables as critical economic components and have established regulations to protect them from potential threats. The Australian Communications and Media Authority (ACMA), for instance, has introduced safety zones to prevent damage to cables linked to Australia and mandated voltage regulations for new submarine projects.

Key Market Trends & Insights

- Regional Dominance: Asia Pacific led the submarine cables market with 38.6% share in 2024, spurred by the rising investments from tech giants like Google, Meta, and AWS in infrastructure to support data-heavy applications.

- Application Segmentation: The submarine power cable segment held the largest revenue share of about 61.80% in 2024. The increased need for inter-country and island connections, along with expansions in the offshore wind sector, is contributing to this growth.

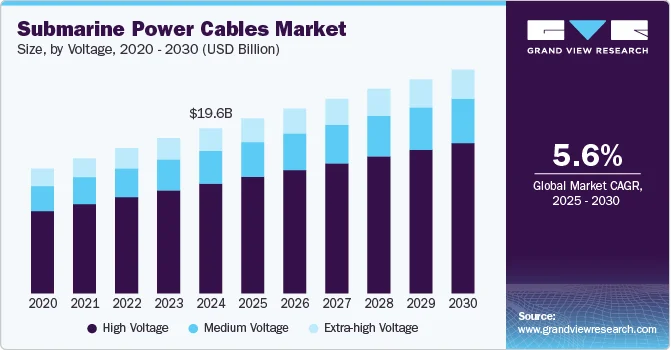

- Voltage Segmentation: High voltage cables, defined as those above 33 kV, represented the largest revenue share in 2024. The increasing demand for High Voltage Direct Current (HVDC) submarine power cables and significant investments in offshore wind projects are key factors driving this segment.

- Component Insights: The dry plant products segment led in submarine communication cables in 2024, driven by the growing adoption of necessary equipment such as power feeding devices, monitoring systems, and transmission terminals.

Order a free sample PDF of the Submarine Cables Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 31.70 Billion

- 2030 Projected Market Size: USD 44.33 Billion

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Prominent players in the submarine cables market in 2024 included Alcatel-Lucent, TE SubCom, and NEC Corporation. Smaller and mid-sized suppliers tend to focus on localized projects while some also engage in offshore oil and gas and other marine infrastructure initiatives. Major companies are pursuing strategic acquisitions and partnerships to penetrate untapped markets; for instance, Nexans acquired Reka Cables in April 2023 to enhance cable quality and safety for Nordic customers.

- NEC Corporation stands out as a key player, having deployed over 400,000 kilometers of submarine cables globally. It provides comprehensive solutions from manufacturing to long-term maintenance, making it a favored partner for international connectivity efforts. NEC is pivotal in significant global cable systems, like the Asia Direct Cable (ADC) and the India-Lakshadweep project, thereby improving digital infrastructure in Asia.

- Microsoft Corporation, renowned for its software and cloud services, has heavily invested in submarine cable systems to bolster global data connectivity, notably through the MAREA cable, co-developed with Meta and Telxius. This 6,600 km transatlantic system links Virginia, USA, to Bilbao, Spain, providing high-capacity and low-latency connectivity across the Atlantic. Microsoft also participates in the Amitié cable consortium, enhancing its transatlantic infrastructure further and ensuring fast access to its cloud services worldwide.

Key Players

- ALE International,

- ALE USA Inc.

- SubCom, LLC

- NEC Corporation

- Prysmian S.p.A

- Nexans

- Google LLC

- Amazon.com, Inc.

- Microsoft

- NKT A/S

- ZTT

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The submarine cables market is poised for significant growth, influenced by the increasing demand for data transmission and renewable energy integration. As players like NEC and Microsoft enhance their infrastructure investments, the industry is expected to evolve, presenting new opportunities and challenges. The focus on regulatory measures to safeguard submarine cables reflects their critical role in global connectivity and economic stability.