The Global Oral Typhoid Vaccine Market, valued at USD 127.10 million in 2023, is projected to reach USD 363.95 million by 2032, growing at an impressive CAGR of 12.40% from 2024 to 2032, according to a new comprehensive analysis by Introspective Market Research. This robust expansion reflects a confluence of global public health imperatives: escalating typhoid burden in low-resource settings, integration of typhoid conjugate and oral vaccines into national immunization programs, and rising prophylactic demand from international travelers and expatriates.

Typhoid fever-caused by Salmonella enterica serovar Typhi-remains endemic across large parts of Asia, Africa, and Latin America, with an estimated 9–27 million cases and over 110,000 deaths annually, primarily among children under 15. The oral typhoid vaccine segment has gained renewed momentum following WHO’s 2017 recommendation and subsequent prequalification of newer live attenuated formulations, which offer longer-lasting immunity, ease of administration without needles, and superior compliance-especially in mass school-based or community campaigns. Strategic investments by Gavi, the Vaccine Alliance, UNICEF, and national governments are now accelerating rollout in high-burden countries like India, Bangladesh, Pakistan, and Nigeria-transforming latent epidemiological need into tangible market growth.

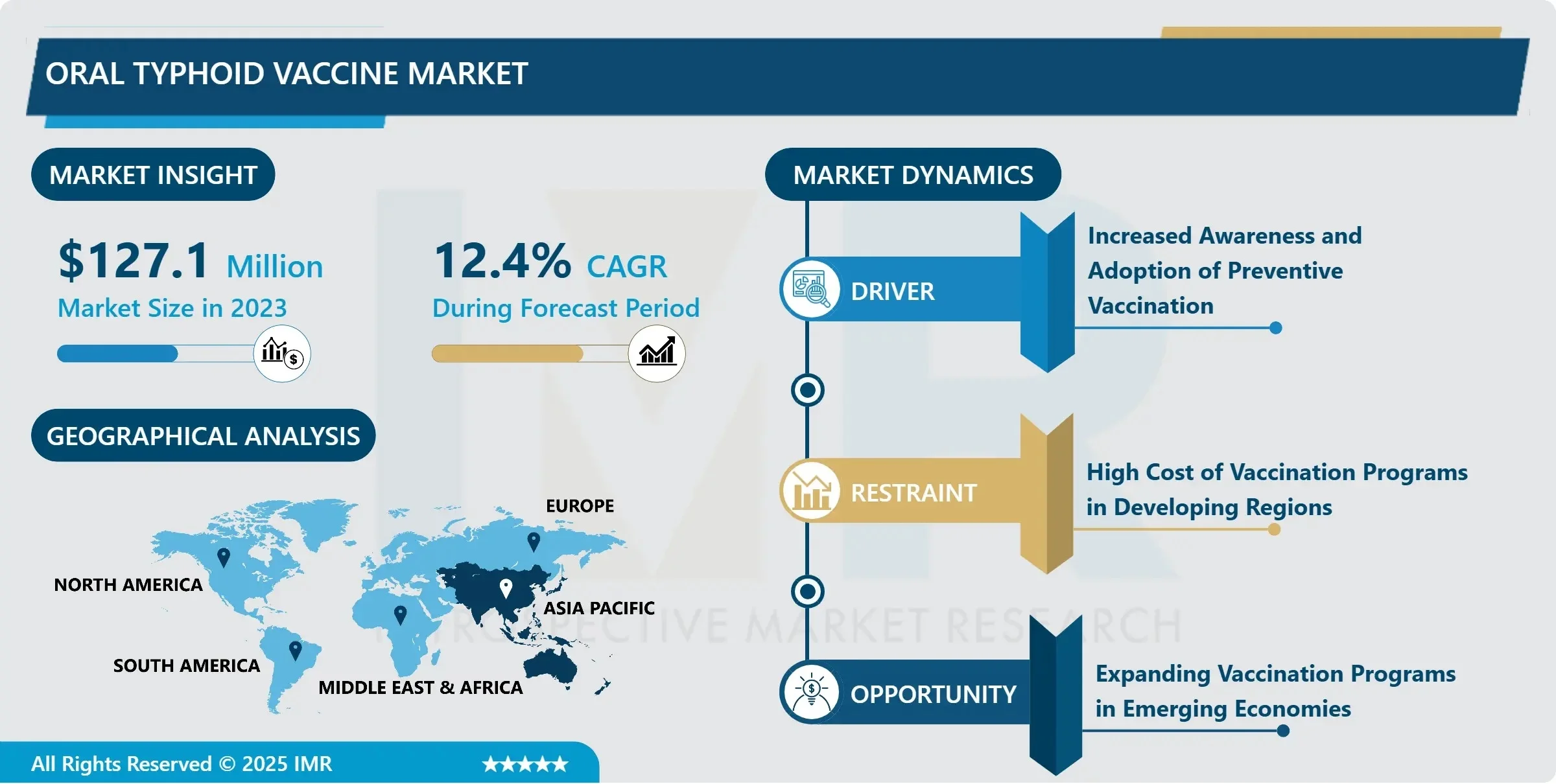

Quick Insights: Oral Typhoid Vaccine Market at a Glance

2023 Market Size: USD 127.10 Million

2032 Projected Value: USD 363.95 Million

CAGR (2024–2032): 12.40%

Dominant Vaccine Type: Live Attenuated Vaccines-accounting for majority share due to single-dose efficacy, long-term immunogenicity, and oral delivery convenience

Largest Application Segment: Prevention in Endemic Areas-driven by national immunization programs and outbreak response

Fastest-Growing Region: Asia Pacific-projected to maintain leadership with over 45% of global volume, led by India, Bangladesh, and Indonesia

Key Industry Players: Bharat Biotech, Serum Institute of India, Zydus Cadila, Bio-Med, GlaxoSmithKline, Sanofi, Emergent BioSolutions, PaxVax, Shanghai Institute of Biological Products, Sinovac Biotech

Why Is Oral Typhoid Vaccination Shifting from Niche Travel Tool to Core Public Health Strategy?

The answer lies in three structural shifts reshaping global typhoid control: First, the WHO’s push for routine typhoid vaccination in children aged 6 months to 15 years in endemic countries has catalyzed policy adoption-India’s inclusion of Typbar TCV in its Universal Immunization Programme (UIP) is estimated to prevent over 350,000 hospitalizations annually. Second, the demonstrated success of oral vaccines in outbreak containment-such as in Hyderabad (2023) and Sindh, Pakistan (2024)-has cemented their role in emergency response toolkits. Third, innovations in stabilization and formulation have dramatically extended shelf life and reduced cold-chain dependency, enabling deployment in remote, infrastructure-limited regions.

Notably, the rise of antimicrobial resistance (AMR) in S. Typhi-particularly extensively drug-resistant (XDR) strains in South Asia-has elevated vaccination from a preventive option to a critical resistance-mitigation strategy. With treatment failures mounting, vaccines are now viewed as the most scalable and cost-effective intervention.

“Oral typhoid vaccines have moved from the periphery to the center of outbreak preparedness,” says Dr. Arunima Sen, Principal Consultant, Global Vaccines & Preventive Health Practice at Introspective Market Research. “What we’re seeing isn’t just volume growth-it’s system-level integration. Ministries of Health are embedding oral vaccines into routine EPI schedules, school health days, and WASH-linked campaigns. Meanwhile, private-sector demand is surging: travel clinics across Europe and North America report 30–40% year-on-year growth in pre-travel typhoid prophylaxis. The convergence of public health urgency and individual risk awareness is creating a uniquely resilient demand profile-one that’s less cyclical and more structural.”

Regional Deep Dive: Asia Pacific Leads, But Global Travel Fuels Premium Segments

Asia Pacific commands the largest market share, underpinned by high disease incidence, dense populations, and aggressive national rollouts. India’s National Typhoid Vaccination Program-targeting 160 million children over five years—has already procured over 60 million doses since 2022. Bangladesh’s school-based campaign in Dhaka and Chittagong divisions achieved 92% coverage in pilot districts, reducing lab-confirmed cases by 67% within 12 months. Indonesia’s integration of oral typhoid vaccines into its Posyandu (integrated health post) network is expanding rural access.

Meanwhile, North America and Western Europe represent high-value, low-volume segments-primarily driven by international travelers, military deployments, and NGOs operating in endemic zones. In the U.S. alone, CDC estimates indicate that over 5,700 typhoid cases are imported annually, with 75% occurring in unvaccinated individuals. Pharmacies and travel clinics now routinely bundle oral typhoid vaccines with hepatitis A and malaria prophylaxis, creating bundled revenue opportunities.

Africa is emerging as a high-growth frontier: Gavi-supported introductions are underway in Liberia, Sierra Leone, and Ethiopia, with Nigeria preparing for phased national rollout. The African Union’s AMR action plan explicitly prioritizes typhoid vaccination as a containment lever-aligning political will with technical feasibility.

Segmentation Analysis: Live Attenuated Platforms Dominate, Endemic Prevention Drives Scale

By Type, the live attenuated segment-including Ty21a-based formulations and next-generation engineered strains-holds dominant market share. These vaccines, administered as capsules over 2–4 days, stimulate mucosal immunity in the gut—the primary site of S. Typhi invasion-offering protection for 5–7 years post-primary series. In contrast, inactivated oral vaccines (still largely in preclinical/early clinical stages) aim to serve immunocompromised populations where live vaccines are contraindicated.

By Application, prevention in endemic areas accounts for over 70% of global demand, supported by donor-funded Gavi eligibility and domestic budget reallocations. Non-endemic applications-travel, occupational (e.g., humanitarian workers, researchers), and military-represent premium-priced, high-margin niches, often using branded formulations with extended stability profiles.

By End User, public health programs and government procurement agencies lead volume, while hospitals, travel clinics, and pharmacies dominate private-market revenue channels-especially in high-income countries.

Innovation & Cost-Efficiency: How Manufacturers Are Scaling Access Without Compromising Quality

Bharat Biotech (India)-Q1 2025: Launched Typhimune® Oral, a room-temperature-stable Ty21a variant requiring no cold chain for up to 90 days-enabling distribution via last-mile delivery networks in rural Bihar and Odisha. Validated in a multicenter Phase III trial (n=8,200), it demonstrated 86.4% efficacy at 24 months.

Serum Institute of India-Partnered with IVI (International Vaccine Institute) to co-develop a low-cost, lyophilized Ty21a formulation priced at USD 0.95/dose for Gavi tenders-making large-scale school campaigns economically viable for LMICs.

Zydus Cadila-Introduced ZyTyph®, a novel single-dose oral live attenuated vaccine candidate (Phase II completed), leveraging a chromosomally deleted S. Typhi strain with enhanced safety and reduced shedding risk-potentially eliminating multi-day dosing barriers.

Sanofi-Revamped distribution logistics for Vivotif® in EU/North America, integrating QR-coded blister packs with digital adherence reminders via app-boosting completion rates from 78% to 94% in pilot travel clinics.

Cost-Optimization Strategies in Practice

Programmatic Bundling: Integrating typhoid vaccination with measles-rubella or HPV campaigns has reduced per-child delivery costs by up to 35% in pilot districts (e.g., Nepal, Malawi).

Local Fill-and-Finish: Technology transfer agreements-like the one between PaxVax and Bio-Med in India-enable regional manufacturing, cutting import duties, freight, and lead times.

Thermostable Formulations: Eliminating the 2–8°C cold chain reduces logistics costs by 22–28% and expands reach to off-grid communities.

Digital Microplanning: GIS-based risk mapping (e.g., using WASH infrastructure and AMR surveillance data) allows targeted prepositioning-minimizing vaccine wastage and stockouts.

Benefits Across Stakeholders

For Governments: High ROI-every USD 1 invested in typhoid vaccination yields USD 11–16 in averted treatment costs and productivity losses (World Bank, 2024).

For Donors & NGOs: Measurable impact-vaccination reduces outbreak response costs and frees up beds in overstretched facilities.

For Travelers & Expatriates: Peace of mind with proven >80% protection-avoiding debilitating illness during critical missions or vacations.

For Manufacturers: Volume growth in public markets balanced by margin resilience in private and travel segments-creating dual-revenue sustainability.

Download the Full Strategic Intelligence Report

The Oral Typhoid Vaccine Market Report (2024–2032) by Introspective Market Research delivers 210+ pages of granular, decision-ready insights:

Country-level disease burden maps, vaccine coverage gaps, and Gavi eligibility tracking

Pipeline tracker: 7 live attenuated candidates, 3 inactivated platforms, 2 novel vector-based oral vaccines in development

Pricing benchmarks (USD/dose) across procurement channels: Gavi, UNICEF, domestic tenders, private retail

Regulatory pathway analysis: WHO PQ, FDA licensure, CDSCO, EMA accelerated review

Competitive positioning: Market share by region, formulation IP landscape, partnership heatmaps

Download a Free Sample Report:

https://introspectivemarketresearch.com/request/20177

About Introspective Market Research

Introspective Market Research(IMR) is a globally trusted provider of strategic intelligence across vaccines, infectious disease control, and global health security. Our team of epidemiologists, regulatory strategists, and health economists combines primary interviews with 300+ ministries, WHO country offices, and vaccine manufacturers—with real-world program data, pharmacovigilance trends, and AMR surveillance—to deliver foresight that informs life-saving procurement and policy decisions.

We don’t just track disease—we help stop it.

Media Contact

Dr. Priya Nair

Senior Director, Global Health Communications

Introspective Market Research.

Call:- +91 91753-37569.

Email:- info@introspectivemarketresearch.com