The global plastic market was valued at approximately USD 647.36 billion in 2024 and is anticipated to reach USD 962.56 billion by 2033, expanding at a compound annual growth rate (CAGR) of 4.6% from 2025 to 2033. This growth is largely driven by increasing demand from the packaging, automotive, and construction industries, attributed to plastics' lightweight, durable, and cost-effective characteristics.

Plastics are recognized for their lightweight, durable, and versatile properties, making them suitable for a wide range of products. In the automotive sector, for example, plastics are increasingly utilized for components such as interior panels, bumpers, and battery casings in electric vehicles. This shift aids in weight reduction, enhancing fuel efficiency and lowering emissions. Similarly, in the packaging industry, single-use plastics, flexible packaging, and PET bottles remain dominant due to their affordability, recyclability, and consumer convenience.

Advancements in polymer chemistry and production methods are also key factors propelling the plastic market. The emergence of high-performance plastics—such as polypropylene (PP), polyethylene terephthalate (PET), polycarbonate (PC), and bioplastics—has broadened their applications across sectors that demand superior strength, heat resistance, or biodegradability. For instance, biodegradable PLA (polylactic acid) plastics are gaining traction in food packaging and disposable cutlery, spurred on by sustainability trends. Additionally, innovations like nano-reinforced plastics and flame-retardant polymers are creating opportunities in electronics, aerospace, and construction, further driving market expansion.

Key Market Trends & Insights

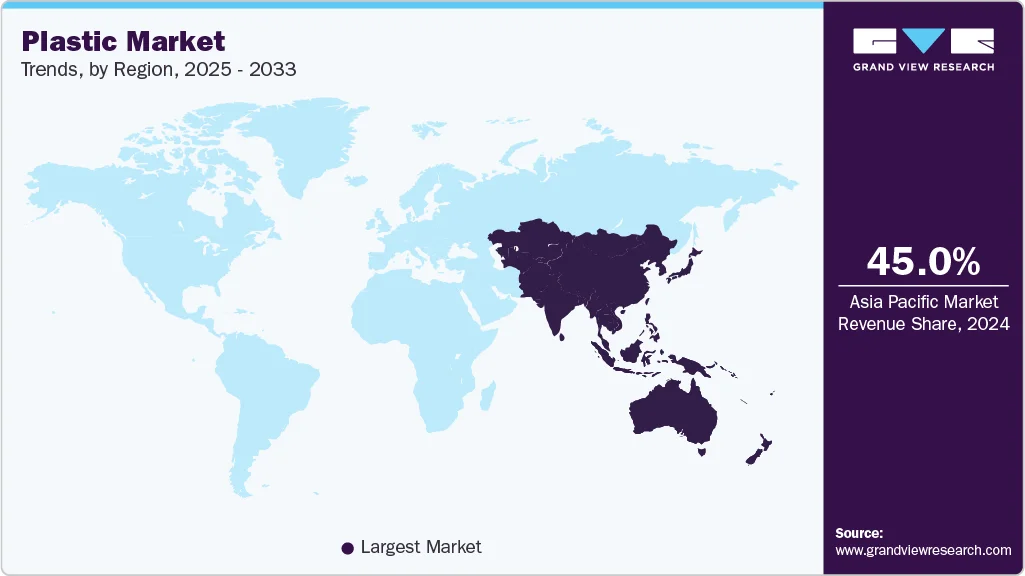

- Asia Pacific: This region dominated the plastic market with over 45.0% of the total revenue in 2024 and is projected to grow at the fastest CAGR of 5.2% during the forecast period, fueled by rapid industrialization, urbanization, and population growth.

- Product Segment: The epoxy polymers segment is expected to experience a significant CAGR of 8.8% from 2025 to 2033, driven by applications in electronics, aerospace, automotive, and construction due to their excellent properties, including adhesion and chemical resistance.

- Application Segment: The roto molding segment is anticipated to grow at a noteworthy CAGR of 6.5% from 2025 to 2033, primarily used to create large, hollow plastic products for applications such as water tanks and playground equipment.

- End Use Segment: The medical devices segment is projected to grow at a considerable CAGR of 6.3% from 2025 to 2033. Meanwhile, the packaging segment is the largest consumer of plastics globally, encompassing various formats like flexible and rigid packaging.

Order a free sample PDF of the Plastic Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 647.36 Billion

- 2033 Projected Market Size: USD 962.56 Billion

- CAGR (2025-2033): 4.6%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

The competitive landscape of the global plastic market is moderately consolidated, dominated by major multinational companies such as ExxonMobil, SABIC, LyondellBasell, Dow Chemical, and BASF. These players have extensive production capacities, global distribution networks, and robust R&D capabilities. Competition is influenced by factors such as raw material price fluctuations, technological advancements in polymer formulations, regulatory compliance regarding sustainability, and customer demand for high-performance or eco-friendly plastics.

While larger companies focus on scale, product differentiation, and backward integration, smaller regional players often compete through niche applications, customization, and cost advantages. Emerging trends like bio-based plastics, recycling technologies, and circular economy initiatives are intensifying competition as firms strive to balance profitability with environmental accountability.

- In September 2025, Mitsui Chemicals, Idemitsu Kosan, and Sumitomo Chemical signed a Memorandum of Understanding to consolidate Sumitomo's polypropylene (PP) and linear low-density polyethylene (LLDPE) businesses in Japan into Prime Polymer, a joint venture between Mitsui and Idemitsu.

- In April 2025, Ube Industries completed the acquisition of Lanxess's polyurethane (PU) business for about USD 2.1 billion, expanding its global presence in PU materials.

- In January 2024, LyondellBasell Industries Holdings B.V. agreed to acquire a 35% stake in Saudi Arabia's National Petrochemical Industrial Company (Natpet) from Alujain Corporation for approximately USD 500 million.

Key Players

- BASF

- SABIC

- Dow Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd

- Arkema

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Co., LLC

- Lotte Chemical Corporation

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Covestro AG

- Toray Industries, Inc.

- Mitsui & Co. Plastics Ltd.

- TEIJIN LIMITED

- INEOS Group

- Eni S.p.A.

- LG Chem

- LANXESS AG

- CHIMEI Corporation

- Huntsman International LLC

- LyondellBasell Industries Holdings B.V.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The plastic market is set for significant growth, driven by increasing demand across various industries such as packaging, automotive, and construction. The attributes of plastics, combined with advancements in technology and materials, facilitate wider applications and enhanced performance. As major companies invest in innovations and sustainability, the market is expected to adapt and thrive, maintaining its relevance in a rapidly changing global landscape.