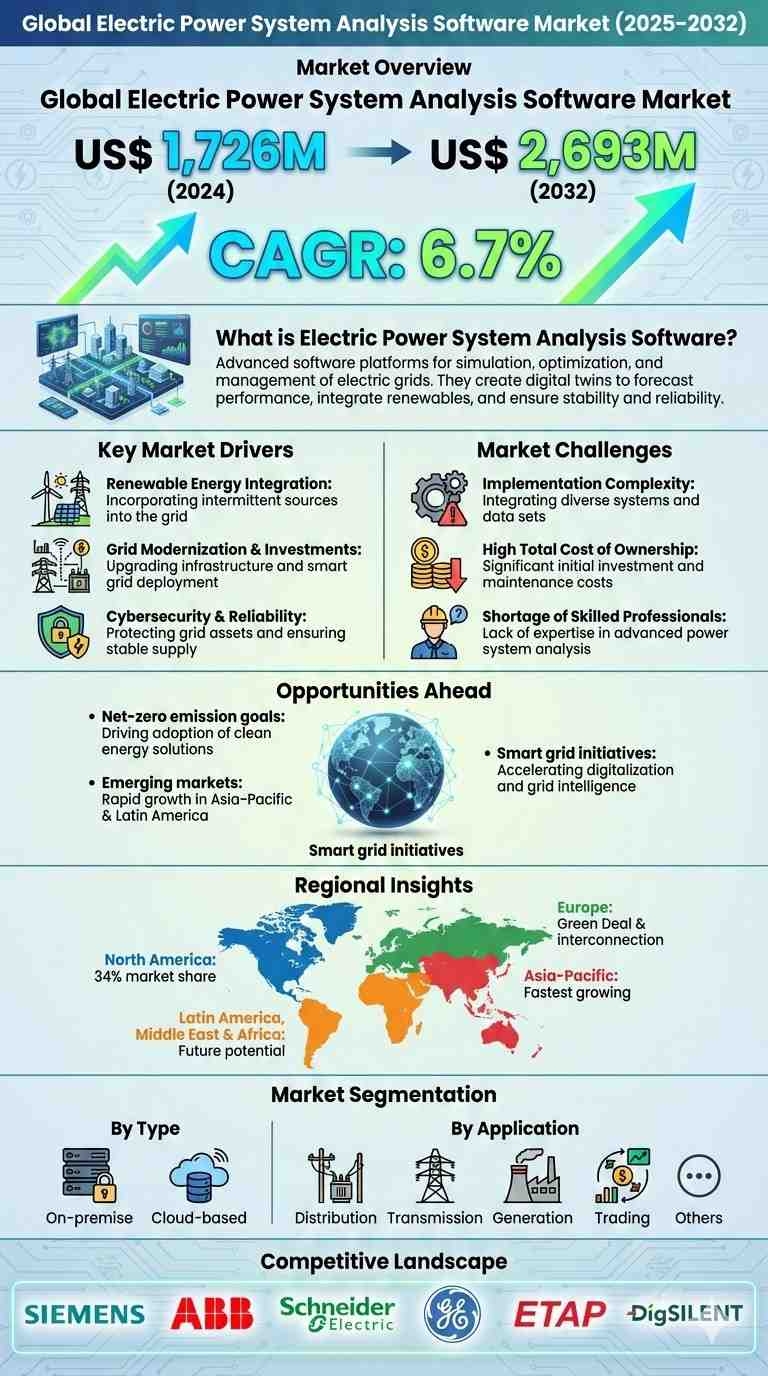

According to a new report from Intel Market Research, the global Electric Power System Analysis Software Market was valued at US$ 1,726 million in 2024 and is projected to reach US$ 2,693 million by 2032, growing at a steady CAGR of 6.7% during the forecast period (2025–2032). This sustained expansion is fundamentally driven by the global energy transition toward renewable integration, rising investments in grid modernization, and the escalating need for operational reliability and efficiency across the entire power value chain, from generation and transmission to distribution and trading.

What is Electric Power System Analysis Software?

Electric Power System Analysis Software is a category of specialized digital tools used by electrical engineers and grid operators for modeling, simulation, and optimization of power systems. This software encompasses critical functions such as load flow analysis, short-circuit studies, transient stability assessment, protection coordination, and market operation simulations. The primary objective is to ensure a secure, reliable, and cost-effective supply of electricity, especially as grids become more complex with the influx of variable renewables, distributed energy resources (DERs), and advanced power electronics.

At its core, this software enables users to create a digital twin of the physical electrical network, allowing them to test scenarios, predict system behavior under stress, prevent blackouts, and comply with stringent regulatory standards. These solutions are indispensable for tasks ranging from feasibility studies for new generation projects to optimizing power flow across transmission corridors and managing the intricate balance of supply and demand in real-time electricity markets.

Key Market Drivers

1. Global Energy Transition and Renewable Integration

The accelerating global shift away from fossil fuels toward renewable energy sources like wind and solar is fundamentally reshaping electricity networks, placing immense strain on legacy grid infrastructure. Because renewable generation is often intermittent and decentralized, it demands a new class of analytical tools. Traditional power systems were designed for one-way power flow from large, centralized plants. However, the modern grid must accommodate bidirectional power flows from millions of rooftop solar panels, leading to phenomena like voltage fluctuations and reverse power flow that older systems cannot adequately manage. The International Energy Agency (IEA) reports that global renewable capacity additions surged by nearly 50% in 2023, reaching almost 510 gigawatts. This unprecedented growth directly escalates the operational complexity that only advanced analysis software can solve.

2. Grid Modernization Investments and Cybersecurity Imperatives

Governments and utility companies worldwide are making massive capital investments to upgrade aging infrastructure and enhance grid resilience. The U.S. Department of Energy's Grid Deployment Office, for instance, is administering over $20 billion in funding from the Bipartisan Infrastructure Law for projects that enhance power grid flexibility and resistance to extreme weather events and cyberattacks.

This software plays a pivotal role in these initiatives by providing:

- Resilience Planning: Modeling the impact of severe weather and identifying vulnerable network sections.

- Distribution System Upgrades: With the largest application segment being electric power distribution, these tools are essential for planning the integration of electric vehicle (EV) charging infrastructure and advanced metering infrastructure (AMI).

- Cyber-Physical Security: Simulating cyberattack vectors and testing defense mechanisms within a safe, virtual environment before they impact the physical grid.

While the demand for renewable integration is a powerful tailwind, the market concurrently faces significant headwinds related to high upfront costs and complex implementation processes, especially for smaller utilities.

Market Challenges

- Implementation Complexity and Data Silos: Effectively deploying these tools requires high-fidelity models of the existing grid, which often involves consolidating disparate, legacy datasets from various operational technology (OT) systems, a process often hampered by legacy system incompatibilities.

- High Total Cost of Ownership (TCO): Beyond the initial software license, significant investments are required for specialized training, ongoing maintenance, and integration with other enterprise systems like SCADA and EMS, which can be a barrier to adoption.

- Shortage of Skilled Professionals: There is a global deficit of power system engineers with the expertise to utilize these advanced platforms to their full potential.

Opportunities Ahead

The global imperative for a digitalized, decarbonized, and decentralized energy system presents a multi-decade growth runway. The drive to achieve net-zero emissions is creating unprecedented demand for software that can manage the complexity of the future grid.

Emerging markets, particularly in the Asia-Pacific and Latin America, where electricity demand is growing rapidly, offer substantial opportunities. These regions are witnessing accelerating momentum through:

- Government-led Smart Grid Initiatives: Policies and funding programs specifically aimed at modernizing national power infrastructure are creating fertile ground for software vendors.

- Public-private partnerships to fund and deploy advanced grid technologies.

- Strategic collaborations between global software vendors and local engineering firms and universities to build regional expertise.

Notably, leading industry players like Siemens and ABB are actively expanding their portfolios through both organic R&D and targeted acquisitions to offer comprehensive, integrated suites.

Regional Market Insights

- North America: Dominates the global market, accounting for approximately 34% of total revenue. This leadership is anchored in a mature regulatory environment, high cybersecurity awareness, and significant utility spending on grid digitalization programs.

- Europe: A key market characterized by ambitious climate targets, such as the EU's Green Deal, which mandates massive investments in grid upgrades and interconnection projects to support its energy transition goals.

- Asia-Pacific: This region represents the fastest-growing market, fueled by massive urbanization, rising electricity demand, and national policies aggressively promoting renewable energy adoption.

- Latin America, Middle East & Africa: While currently smaller in market share, these regions hold immense future potential due to ongoing electrification and the development of new power infrastructure from the ground up, often incorporating the latest digital technologies by default.

Market Segmentation

By Type

- On-premise

- Cloud-based

By Application

- Electric Power Distribution

- Electric Power Transmission

- Electric Power Trading

- Electric Power Generation

- Others

By Region and Country

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Russia

- Nordic Countries

- Benelux

- Rest of Europe

- Asia

- China

- Japan

- South Korea

- Southeast Asia

- India

- Rest of Asia

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Turkey

- Israel

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

- North America

📘 Get Full Report Here:: Electric Power System Analysis Software Market - View in Detailed Research Report

Competitive Landscape

The global market is characterized by the presence of established industrial automation giants and specialized software firms. While companies like ETAP (Operation Technology) and DIgSILENT are renowned for their technical depth and academic rigor, the competitive environment is intensifying as companies expand their offerings.

The report provides in-depth competitive profiling of 20+ key players, including:

- ETAP (Operation Technology)

- Eaton Corporation

- ABB

- Siemens

- DIgSILENT

- General Electric

- Schneider Electric

- Energy Exemplar

- PCI Energy Solutions

- PowerWorld

- Neplan AG

- Atos SE

- Artelys

- PSI AG

- OATI

- ION (Allegro)

- Unicorn Systems

- Electricity Coordinating Center

- Open Systems International (OSI)

- Resource Innovations (Nexant)

- AFRY

- Bentley (EasyPower)

Report Deliverables

- Global and regional market forecasts from 2025 to 2032

- Strategic insights into pipeline developments, strategic alliances, and regulatory trends.

- Market share analysis and SWOT assessments of major market participants.

- Analysis of pricing trends and the evolving reimbursement landscape for advanced grid software.

- Comprehensive segmentation by type, application, end-user, and geography.

About Intel Market Research

Intel Market Research is a leading provider of strategic intelligence, offering actionable insights in biotechnology, pharmaceuticals, and healthcare infrastructure. Our research capabilities include:

- Real-time competitive benchmarking

- Global clinical trial pipeline monitoring

- Country-specific regulatory and pricing analysis

- Over 500+ healthcare reports annually

Trusted by Fortune 500 companies, our insights empower decision-makers to drive innovation with confidence.

📞 International: +1 (332) 2424 294

📞 Asia-Pacific: +91 9169164321

🔗 LinkedIn: Follow Us