Market Overview:

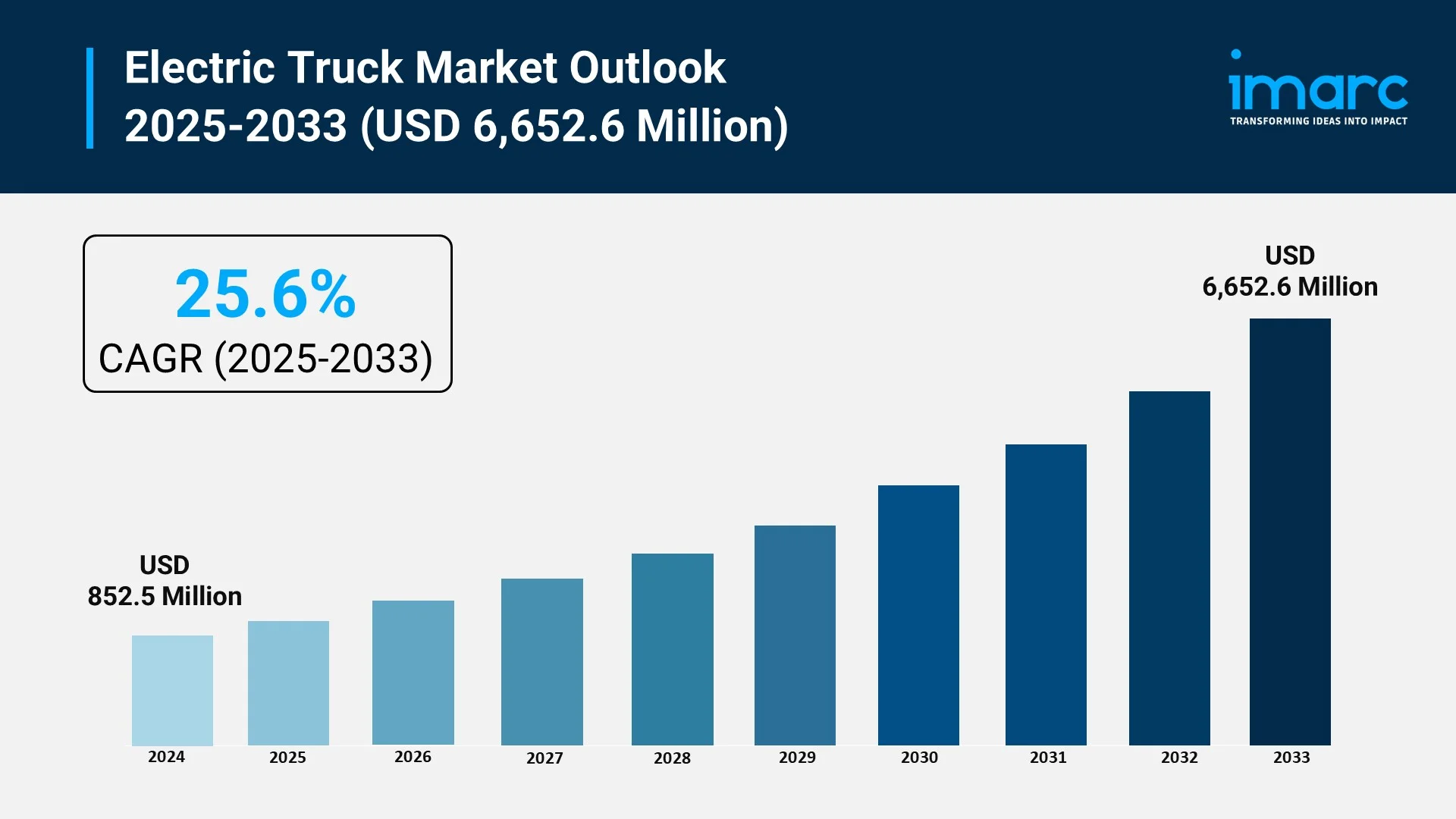

The electric truck market is experiencing rapid growth, driven by stringent environmental regulations and policy support, decreasing battery costs and technological advancements, and logistics decarbonization and corporate fleet commitments. According to IMARC Group's latest research publication, "Electric Truck Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion, Range, Application, and Region, 2025-2033", the global electric truck market size was valued at USD 852.5 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 6,652.6 Million by 2033, exhibiting a CAGR of 25.6% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/electric-truck-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Electric Truck Market

-

Stringent Global Emission Mandates and Decarbonization Policies

Governments worldwide are accelerating the transition to zero-emission transport by implementing rigorous environmental regulations and financial incentives. In the European Union, the Green Deal framework pushes for a nearly 50% reduction in greenhouse gas emissions by 2030, forcing logistics providers to move away from diesel. Similarly, national initiatives like Cameroon’s 2025 Finance Law have slashed taxes on electric vehicles and charging infrastructure by 50% to lower entry barriers. In North America, the United States has focused on significant infrastructure investment, maintaining a ratio of approximately 18 electric light-duty vehicles per public charging point to support fleet adoption. These regulatory pressures are complemented by direct subsidies, such as China’s recent $43 million vehicle purchase stimulus in Guangzhou, which targets year-end sales to ensure climate targets are met. Consequently, the shift is no longer optional for companies operating in regions with low-emission zones.

-

Proven Total Cost of Ownership (TCO) and Operational Efficiency

The economic case for electric trucks has become a primary driver as businesses recognize substantial long-term savings in fuel and maintenance. Electricity costs are consistently estimated to be 45% to 75% lower than diesel, particularly when fleets utilize smart charging during off-peak hours. For example, the annual energy cost for a light commercial electric vehicle in the United States is approximately $850, compared to $3,500 for a traditional internal combustion engine equivalent. Furthermore, electric drivetrains contain fewer moving parts, eliminating the need for oil changes and reducing brake wear through regenerative braking systems. Some fleet operators have reported maintenance savings exceeding 40% after transitioning to electric models. These efficiency gains, combined with the fact that electric motors convert roughly 85% of energy into movement—more than double the efficiency of gas-powered engines—are convincing major logistics firms to overhaul their heavy-duty fleets.

-

Expansion of Corporate Sustainability Initiatives by Industry Leaders

Large-scale commercial adoption is being propelled by the aggressive environmental, social, and governance (ESG) goals of global corporations. Retail and logistics giants like Amazon, PepsiCo, and DHL are integrating hundreds of electric trucks into their daily operations to reach carbon-neutral targets. Amazon, for instance, has recently placed its largest order of electric vehicles to date, building on a successful deployment of heavy-duty units earlier in the year. Meanwhile, PepsiCo has expanded its Fresno facility's charging capacity to 4.5 megawatts, allowing its entire 50-truck fleet to reach a full charge in just one hour. These industry leaders are not only purchasing vehicles but also forming strategic partnerships with manufacturers like Volvo and Tesla to co-develop long-haul solutions. This "first-mover" momentum creates a robust secondary market and encourages the build-out of private and public charging networks necessary for industry-wide scaling.

Key Trends in the Electric Truck Market

-

Integration of High-Power Megawatt Charging Systems (MCS)

As the industry moves from urban last-mile delivery to long-haul freight, the development of Megawatt Charging Systems has emerged as a critical trend to minimize vehicle downtime. Unlike standard chargers, MCS technology is designed to deliver ultra-high-power connectors that can charge a heavy-duty truck’s massive battery during a driver’s mandatory break. Real-world applications are already surfacing in "charging corridors" across Europe and North America, where hubs are being equipped with multi-megawatt capacities. For example, some facilities now support charging 50-truck fleets in under 60 minutes, mirroring the convenience of traditional refueling. This trend is vital for heavy-duty models like the Tesla Semi, which boasts a 500-mile range but requires rapid energy intake to remain viable for regional haulage. The shift toward MCS ensures that electric trucks can maintain rigorous delivery schedules without the productivity losses previously associated with long charging cycles.

-

Rapid Advancement of Hydrogen Fuel Cell Range Extenders

For heavy-duty applications requiring extreme range and minimal payload compromise, the market is seeing a surge in Fuel Cell Electric Vehicles (FCEVs). Hydrogen tanks are significantly lighter than the battery packs required for long-distance travel, which can weigh several hundred kilograms and reduce a truck's available cargo capacity. Companies like Nikola and Hyundai are leading this trend, with Nikola delivering 88 hydrogen-powered Tre FCEVs to customers in late 2024. These trucks offer a range advantage of approximately 150 kilometers over battery-electric versions and can be refueled in less than ten minutes. This technology is particularly gaining traction in the "hard-to-abate" heavy-duty sector where consistent power is needed for 1,000-mile routes. By combining battery power with hydrogen fuel cells, manufacturers are creating "future-proof" zero-emission solutions that handle the most demanding logistics tasks without the weight penalties of traditional batteries.

-

Implementation of Autonomous and AI-Driven Fleet Telematics

The convergence of electrification and automation is transforming electric trucks into highly connected, intelligent assets. Emerging models are increasingly featuring Level 4 autonomous capabilities, which allow trucks to operate with minimal human intervention on highways. Beyond self-driving features, AI-driven telematics platforms now provide real-time data on battery state-of-charge, predictive maintenance flags, and route optimization. For instance, companies like Schneider National have used advanced telematics to surpass 1 million zero-emission miles, leveraging data to maximize energy efficiency and reduce downtime. This trend extends to "Vehicle-to-Grid" (V2G) capabilities, where parked electric trucks act as mobile energy storage units, feeding power back into the grid during peak demand to generate revenue for the fleet owner. This digital integration ensures that electric trucks are not just vehicles, but active, data-producing components of a modernized, smart energy and logistics ecosystem.

Leading Companies Operating in the Global Electric Truck Industry:

- VolvoGroup

- BYD Company Ltd.

- Mercedes-Benz Group AG

- China FAW Group Co. Ltd.

- Isuzu Motors Ltd.

- Navistar Inc.

- PACCAR Inc.

- Rivian Automotive Inc.

- Volkswagen AG

- Tata Motors Limited

- Tesla Inc.

- Tevva Motors Limited

Electric Truck Market Report Segmentation:

By Vehicle Type:

- Light-duty Truck

- Medium-duty Truck

- Heavy-duty Truck

Light-duty trucks dominate the market in 2024 with approximately 63.8% share, favored for urban deliveries due to their zero emissions, lower operating costs, and maneuverability.

By Propulsion:

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

Hybrid electric trucks lead the market by combining an internal combustion engine with electric propulsion, enhancing fuel efficiency and reducing emissions while maintaining long-distance capability.

By Range:

- 0-150 Miles

- 151-300 Miles

- Above 300 Miles

The 0-150 miles range category is the market leader, ideal for urban deliveries and short-haul transportation, offering zero emissions and compliance with stringent urban regulations.

By Application:

- Logistics

- Municipal

- Construction

- Mining

- Others

Logistics holds a 38.7% market share in 2024, with electric trucks preferred for urban deliveries, driven by sustainability trends and supported by improved charging infrastructure.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America represents over 37.8% of the market in 2024, bolstered by advanced EV charging infrastructure, government investments, and favorable regulatory incentives for electric truck adoption.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302