Market Overview:

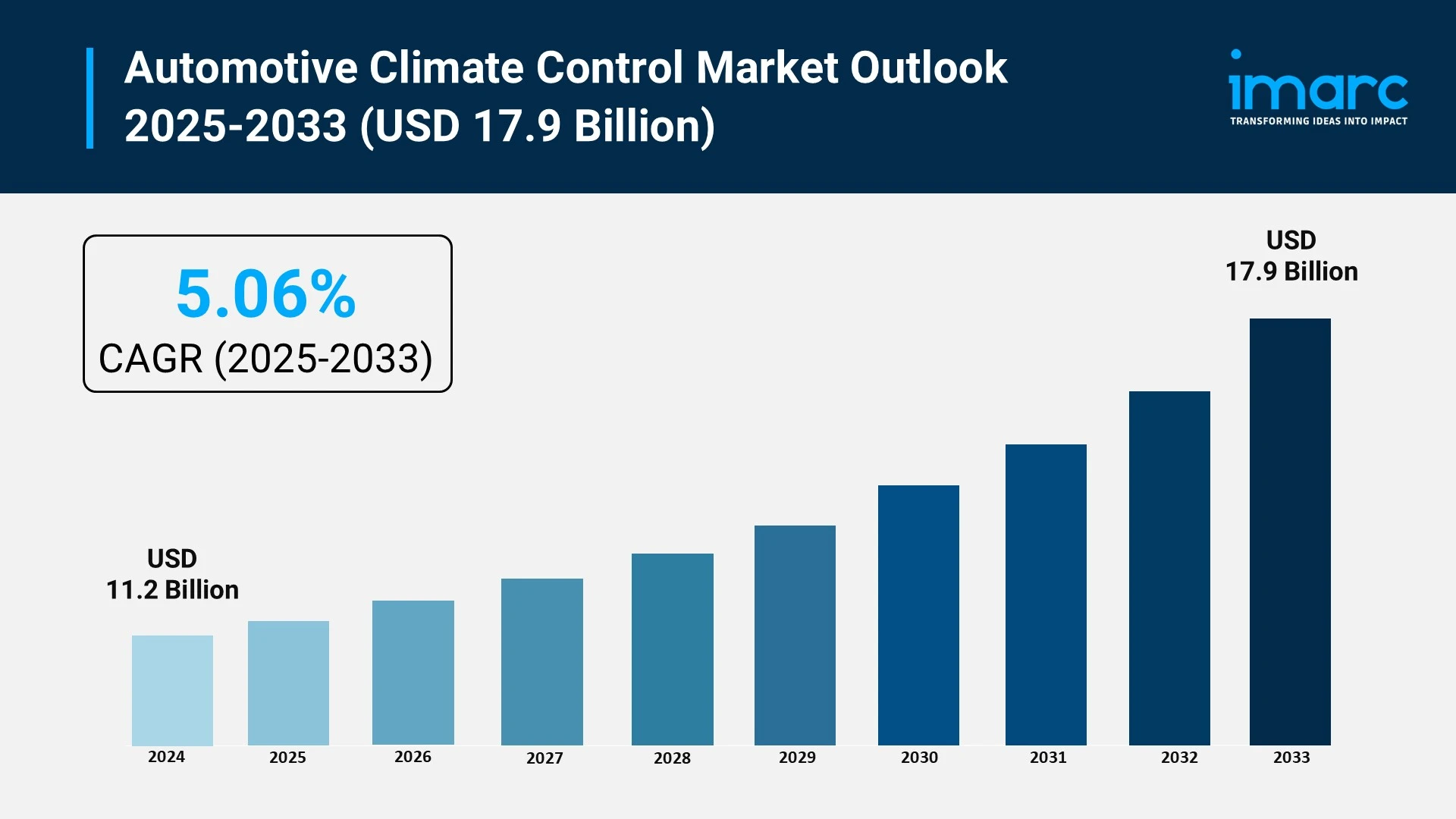

The automotive climate control market is experiencing rapid growth, driven by acceleration of electric vehicle adoptions, increasing consumer demand for cabin comfort, and stringent environmental and energy regulations. According to IMARC Group's latest research publication, "Automotive Climate Control Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global automotive climate control market size reached USD 11.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.06% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/automotive-climate-control-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Automotive Climate Control Market

- Acceleration of Electric Vehicle Adoption

The transition toward electric mobility is the primary driver for specialized climate control solutions. Unlike internal combustion engine vehicles that utilize waste heat for cabin warming, electric vehicles must rely on high-efficiency thermal management to preserve battery life and maximize driving range. For instance, global electric car sales surpassed 17 million units recently, with a sales share reaching approximately 20%. This volume necessitates the mass production of advanced components like heat pumps and electric compressors, which are significantly more complex than traditional belt-driven units. In response, countries like Canada have implemented mandates targeting a 20% zero-emission vehicle sales share for the current year. Consequently, manufacturers are prioritizing the development of systems that balance passenger comfort with the rigorous energy constraints of lithium-ion battery packs to prevent range depletion in extreme weather conditions.

- Increasing Consumer Demand for Cabin Comfort

Consumer expectations for a premium in-car experience are pushing automotive climate control systems into mid-range and mass-market vehicle segments. This surge is particularly evident in the passenger car segment, which currently accounts for more than 53% of the total market share. Modern buyers increasingly view features like multi-zone temperature settings and air purification as essential rather than luxury add-ons. In regions with high humidity and extreme temperatures, such as the Asia-Pacific, these systems serve a functional requirement that directly influences vehicle purchasing decisions. Market data indicates that the value of vehicles equipped with these sophisticated technologies is nearing $30 billion. Automakers are responding by integrating high-efficiency HVAC housings and smart sensors that maintain a stable environment regardless of external conditions, ensuring that cabin comfort remains a competitive differentiator in a crowded global marketplace.

- Stringent Environmental and Energy Regulations

Global regulatory frameworks are mandating a shift toward sustainable cooling technologies, forcing the industry to move away from high-global-warming-potential refrigerants. The Kigali Amendment to the Montreal Protocol has been a catalyst for this change, prompting the adoption of eco-friendly alternatives like R744 and CO2. Government initiatives, such as the India Cooling Action Plan, provide a roadmap for enhancing energy efficiency across the transport sector while reducing the carbon footprint of cooling systems. These regulations are complemented by building and transport codes that reward the use of star-rated, energy-efficient appliances. In the United States, updated fuel economy standards for passenger cars through 2027 are compelling original equipment manufacturers to refine HVAC energy consumption. This regulatory pressure ensures that thermal management innovation is not only a matter of luxury but also a requirement for legal compliance and environmental stewardship.

Key Trends in the Automotive Climate Control Market

- Integration of Artificial Intelligence and Smart Sensors

The market is shifting from manual adjustments to predictive, AI-driven climate environments. Modern systems now utilize a network of infrared sensors to monitor the surface temperature of passengers and adjust airflow dynamically. For example, smart/AI-based climate control is one of the fastest-growing technology segments, utilizing machine learning to memorize individual driver preferences and automate cabin pre-conditioning. These systems can detect the number of occupants and their specific locations within the cabin to optimize cooling zones, thereby reducing unnecessary energy expenditure. Companies like FORVIA are pioneering "hidden display" modules that integrate ventilation controls with AI-powered HMI (Human-Machine Interface), allowing the car to proactively manage brightness, heat, and energy use without manual intervention. This trend moves the vehicle toward a "software-defined" architecture where thermal comfort is managed by intelligent, self-learning algorithms.

- Widespread Adoption of Heat Pump Technology

To address the energy efficiency challenges inherent in electric and hybrid vehicles, the industry is rapidly adopting heat pump technology as a standard thermal management solution. Unlike traditional resistive heaters that drain battery power heavily, heat pumps scavenge heat from the outside air and the vehicle's powertrain components to warm the cabin efficiently. This application is critical for maintaining driving range in cold climates, where battery performance typically drops. Major automakers, including Hyundai and BMW, are increasingly standardizing heat pumps in their new electric platforms. The battery thermal management segment is currently expanding at a rate of 7.6%, reflecting the vital link between cabin climate control and the cooling requirements of high-voltage batteries. This trend ensures that the climate control system acts as an integrated energy management hub rather than a standalone peripheral.

- Enhanced Focus on In-Cabin Air Quality (ICAQ)

The focus of automotive HVAC systems has expanded beyond temperature to encompass the holistic health and safety of passengers. Emerging trends show a significant rise in the integration of medical-grade air filtration, including HEPA filters, ionizers, and ultraviolet-C (UV-C) light sterilization. These technologies are designed to remove particulate matter, allergens, and pathogens from the cabin air in real-time. In urban environments with high pollution levels, such as major cities in China and India, advanced air quality monitoring has become a key selling point. Some systems now include external sensors that automatically switch to recirculation mode when high levels of Nitrogen Dioxide or CO2 are detected outside the vehicle. This trend reflects a broader industry movement toward "wellness-focused" interiors, where the climate control system functions as a protective shield for the vehicle's occupants.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging automotive climate control market trends.

Leading Companies Operating in the Global Automotive Climate Control Industry:

- Air International Thermal Systems

- Calsonic Kansei Corporation

- Denso Corporation

- Eberspächer Group

- Hanon Systems

- Japanese Climate Systems Corporation

- Keihin Corporation

- Mahle GmbH

- Sanden Holdings Corporation

- Subros Limited

- Valeo SA Ltd

Automotive Climate Control Market Report Segmentation:

By Technology:

- Automatic

- Manual

Automatic climate control systems dominate the market due to their ability to maintain precise temperature control through advanced sensors.

By Component:

- Condenser

- Compressor

- Relays and Control Valves

- Evaporators and Thermostats

- Drier/Receiver

- Others

The compressor is the most critical component, pressurizing refrigerant for circulation, while evaporators and thermostats work together to maintain precise cabin temperature.

By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

Passenger cars account for approximately 70% of the market share, driven by increasing consumer demand for enhanced comfort and convenience features.

By Distribution Channel:

- OEMs

- Aftermarket

OEMs dominate with 64% market share due to the increasing focus on integrating high-performance climate control systems during vehicle manufacturing.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market with over 49% share, driven by rising vehicle production and technological adoption in countries like China and India. North America emphasizes comfort and smart integration, while Europe focuses on eco-friendly solutions and energy-efficient systems.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302