Running a one-person company is often described as having freedom with responsibility. You get flexibility, control, and speed. But the compliance expectations are just as serious as any other registered company. One form that frequently creates confusion for OPC owners is MGT-7A. Many directors hear the name, vaguely associate it with annual filings, and move on, only to realise later that a missed deadline has already triggered penalties. Here’s the thing. MGT-7A is not just another ROC form. It exists for a very specific reason and applies to a very specific category of companies. Understanding the MGT-7A form purpose, knowing who should file MGT-7A form, and tracking the due date for filing MGT-7A with ROC can save you from avoidable compliance stress and unnecessary fines. Let’s break it down clearly, without jargon, without filler, and without assumptions.

Understanding the MGT-7A Form Purpose

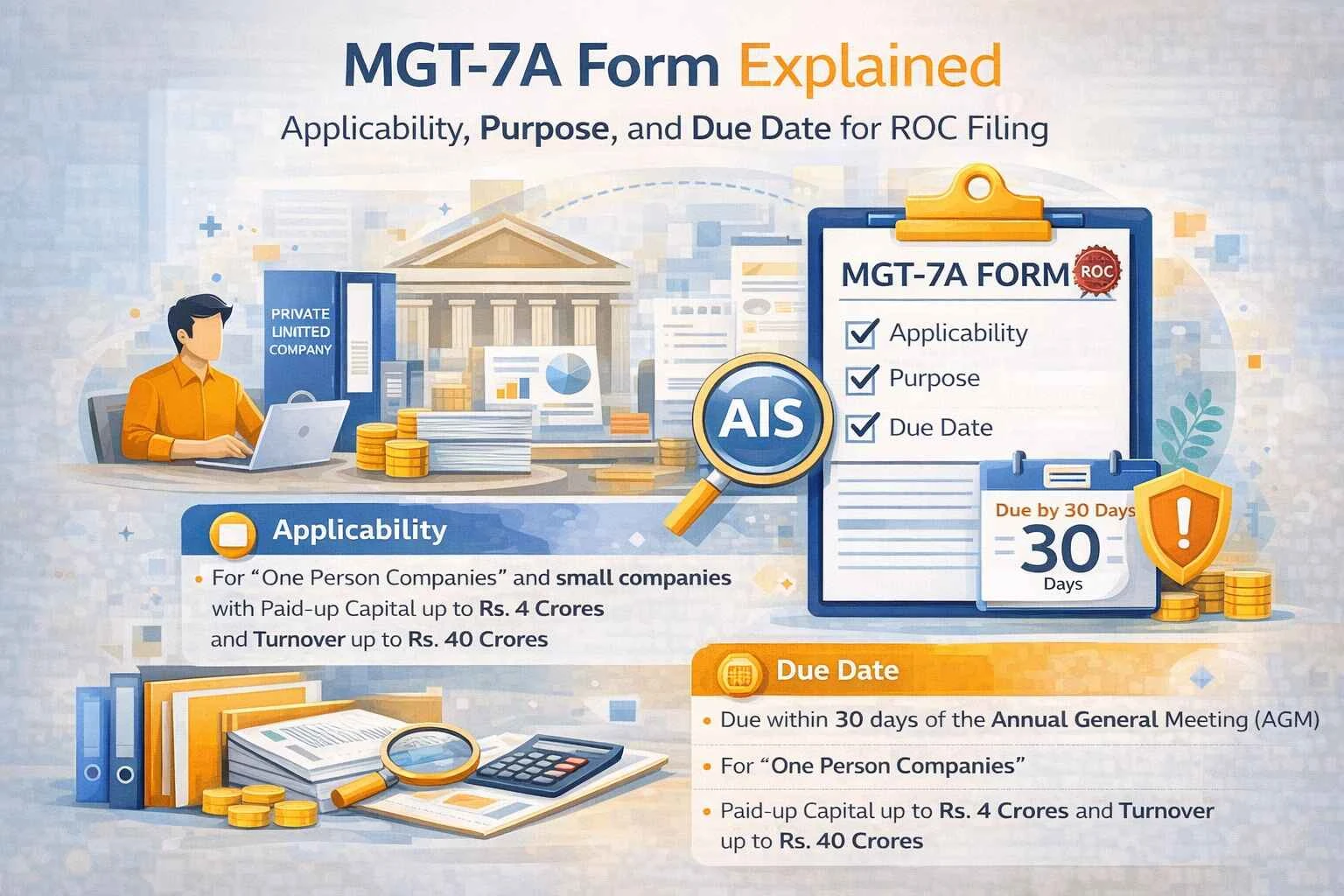

The MGT-7A form purpose is directly tied to how One Person Companies function under the Companies Act. Unlike other companies, an OPC is structured in a way that removes the need for an Annual General Meeting Since there is no AGM, the traditional annual return filing process needed an alternative route. That is exactly why MGT-7A exists. The MGT-7A form purpose is to serve as the annual return document for OPCs, capturing all statutory information that would otherwise be approved in an AGM. This includes shareholding details, directorship information, registered office confirmation, and changes in capital structure. What this really means is that MGT-7A replaces the AGM-based filing mechanism for OPCs. When MCA introduced MGT-7A, the intention was clarity and structure, not complication. The MGT-7A form purpose is compliance continuity. It ensures that even without an AGM, the Registrar of Companies receives updated and accurate data about the OPC every financial year. Without this filing, ROC records become outdated, which undermines regulatory transparency. Once you understand the MGT-7A form purpose, it becomes clear that skipping or delaying it is not a minor oversight. It is treated as non-filing of an annual return, with all associated consequences.

Who Should File MGT-7A Form

This is often the stage where business owners misinterpret the requirement. The answer to who should file MGT-7A form is very specific. MGT-7A applies exclusively to One Person Companies. It does not apply to private limited companies, public companies, or LLPs. If your business is registered as an OPC under the Companies Act, then you fall squarely under the category of who should file MGT-7A form. It does not matter whether your company had revenue or not. It does not matter whether there were operational activities. As long as the OPC exists and is not struck off, the requirement stands. Understanding who should file MGT-7A form also means understanding who does not. Directors of private companies sometimes mistakenly believe they can use MGT-7A if they have a single shareholder. That assumption is incorrect. The applicability is based on legal structure, not ownership count. The responsibility for filing lies with the director of the OPC. In many cases, that director is also the sole shareholder. But legally, the obligation remains at the company level. If you fall under who should file MGT-7A form and fail to comply, penalties are imposed on both the company and the officer in default.

Why MGT-7A Was Introduced Separately from MGT-7

Before MGT-7A existed, OPCs were filing MGT-7, which was originally designed for companies holding AGMs. That mismatch created compliance confusion and unnecessary technical errors. The introduction of MGT-7A was a correction, not an expansion. The MGT-7A form purpose is to align legal requirements with practical realities. OPCs operate differently, and the law now reflects that difference. This separation ensures that OPCs are not forced into AGM-related declarations that do not apply to them. Understanding this background helps clarify why the MGT-7A form purpose is non-negotiable. It is not an optional substitute. It is the only valid annual return form for OPCs. This also explains why the due date for filing MGT-7A with ROC is calculated differently from MGT-7.

Due Date for Filing MGT-7A with ROC

The due date for filing MGT-7A with ROC is one of the most critical compliance timelines for OPCs. Since there is no AGM, the filing deadline is linked to the financial year rather than a meeting date. The due date for filing MGT-7A with ROC is sixty days from the date on which the financial statements are required to be filed. In practical terms, this usually translates to sixty days from the due date of AOC-4 filing. Missing this window triggers daily penalties. What this really means is that you cannot treat MGT-7A as an afterthought. The due date for filing MGT-7A with ROC should be tracked alongside AOC-4. Filing one without planning for the other is a common mistake. The penalties for missing the due date for filing MGT-7A with ROC accumulate per day of delay. While the law caps the maximum penalty, repeated non-compliance can flag the company for scrutiny. For OPCs planning future funding or conversion, this compliance history matters.

Information Required While Filing MGT-7A

Understanding the MGT-7A form purpose also requires clarity on what information is disclosed. The form captures structural data rather than transactional details. This includes the registered office address, details of the sole member, directorship confirmation, shareholding pattern, and any changes during the year. The accuracy of this information is critical. ROC relies on MGT-7A to assess whether the OPC continues to meet eligibility criteria. Incorrect disclosures can raise compliance red flags even if the filing is done on time. This is where knowing who should file MGT-7A form intersects with responsibility. Since OPCs have fewer stakeholders, errors are often attributed directly to the director. That makes careful preparation essential.

Common Mistakes Made During MGT-7A Filing

One of the most frequent errors is misunderstanding the due date for filing MGT-7A with ROC. Many directors assume the timeline mirrors private company filings. Others believe that no filing is required if there are no changes. Both assumptions are incorrect. Another common issue is mismatched data between AOC-4 and MGT-7A. Since these forms are reviewed together, inconsistencies in capital structure or directorship details can result in resubmission requirements. Misunderstanding the MGT-7A form purpose often leads to casual filing. This is risky. The form is not procedural fluff. It is a legal declaration.

Consequences of Non-Compliance

Failing to comply with MGT-7A requirements carries financial and reputational consequences. Late filing fees accrue daily. Continued default can lead to notices from ROC. In extreme cases, non-compliance affects eligibility for conversion or closure. For directors, this matters personally. Penalties are not absorbed by the company alone. Understanding who should file MGT-7A form also means understanding who bears responsibility. The longer the delay beyond the due date for filing MGT-7A with ROC, the harder it becomes to justify the lapse. This is why proactive compliance is always cheaper than corrective compliance.

Relationship Between MGT-7A and Other Annual Filings

MGT-7A does not exist in isolation. It works alongside AOC-4. Together, they complete the annual compliance cycle for OPCs. AOC-4 reports financial performance. MGT-7A reports structural status. Understanding the MGT-7A form purpose in this context helps directors plan filings logically. One reports numbers. The other reports governance. Both are equally important. Treating MGT-7A as secondary is a mistake. ROC treats both forms with equal seriousness.

Practical Compliance Strategy for OPC Directors

A smart compliance strategy starts with clarity. Know who should file MGT-7A form. Track the due date for filing MGT-7A with ROC. Prepare information early. Align AOC-4 and MGT-7A data. Many OPC directors outsource this process to professionals, not because it is complex, but because accuracy matters. One wrong entry can undo timely filing. What this really means is that compliance should be intentional, not reactive.

Conclusion

The MGT-7A form purpose is straightforward once you strip away the confusion. It exists to ensure that One Person Companies remain transparent, accountable, and compliant without forcing them into AGM-based structures. Knowing who should file MGT-7A form removes ambiguity. Tracking the due date for filing MGT-7A with ROC prevents penalties.

This form is not about paperwork for the sake of paperwork. It is about maintaining your company’s legal standing. OPCs are designed for simplicity, but simplicity does not mean exemption from discipline. Filing MGT-7A correctly and on time is one of the clearest signals that an OPC director understands both freedom and responsibility. When you treat the MGT-7A form purpose with the seriousness it deserves, compliance stops being a burden and starts being a routine part of running a well-governed company.