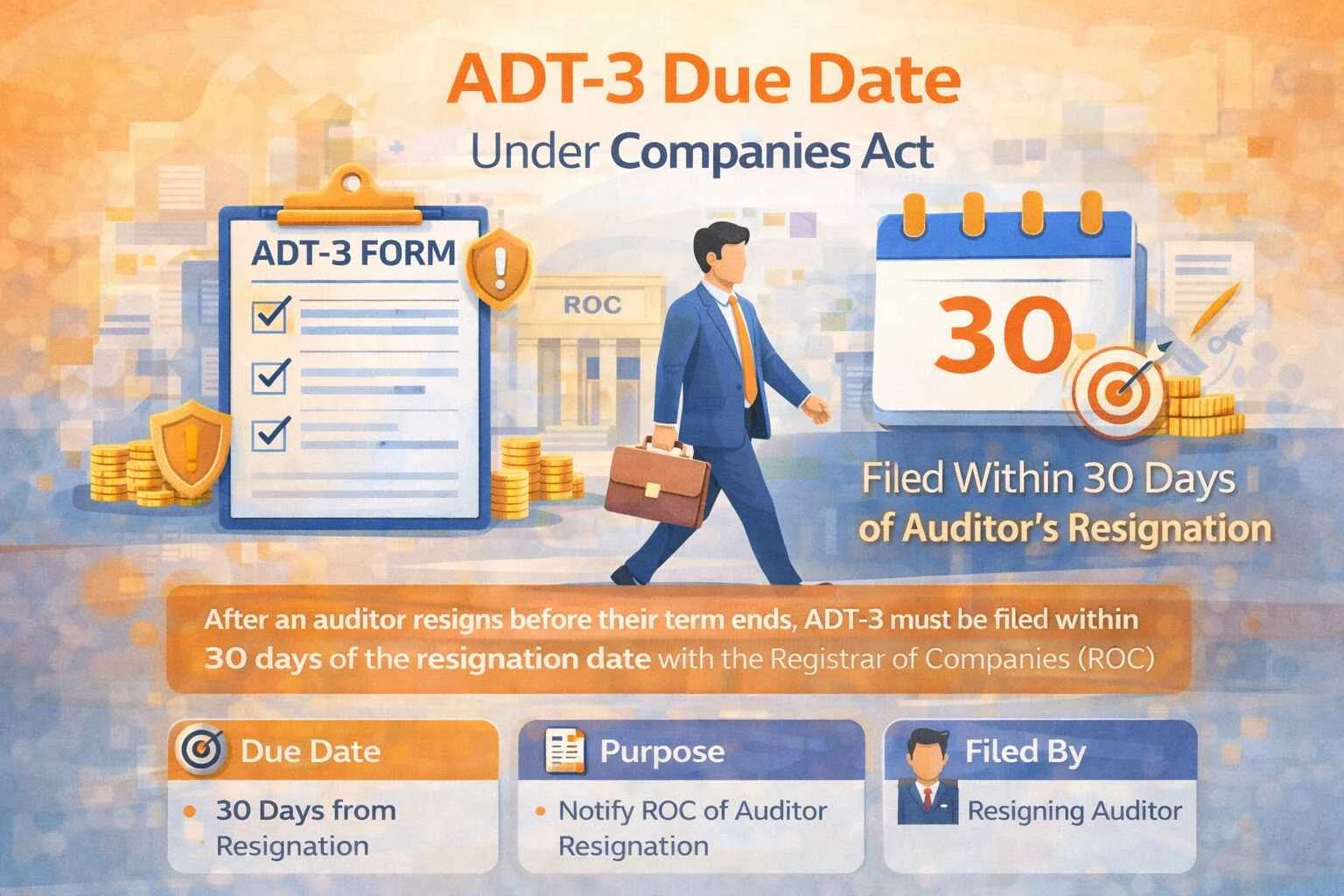

Here’s the thing. When an auditor resigns from a company, the law does not allow that exit to stay informal or undocumented. The Companies Act requires transparency, and ADT-3 is the formal channel through which that transparency is enforced. The ADT-3 due date becomes critical the moment an auditor steps down. ADT-3 is the form through which an auditor informs the Registrar of Companies about their resignation. This is not optional. The ADT-3 due date under Companies Act exists to ensure that regulators are aware of changes in statutory oversight without delay. What this really means is that the resignation only becomes legally complete once ADT-3 is filed within the prescribed time limit to file ADT-3 after auditor resignation. The law intentionally places this responsibility on the auditor, not the company. That distinction matters. It prevents companies from quietly pushing auditors out and ensures accountability on both sides. Missing the ADT-3 due date creates legal exposure for the auditor and raises compliance red flags for the company as well.

Legal Framework Governing ADT-3 Due Date

To understand the ADT-3 due date, you need to look at Section 140 of the Companies Act, 2013, read with the relevant rules. This section lays down the obligation clearly. When an auditor resigns, they must file ADT-3 with the ROC within the prescribed time limit to file ADT-3 after auditor resignation. The ADT-3 due date under Companies Act is not flexible or discretionary. It is a statutory deadline. The intent is simple. Regulators want immediate visibility into why an auditor resigned and whether the resignation raises governance concerns. This framework also ensures that auditors document their reasons in writing. Those reasons become part of the public record. That is why the ADT-3 due date is treated seriously by professionals who understand compliance risks. Once resignation takes effect, the clock starts ticking. From that point onward, the auditor must act within the time limit to file ADT-3 after auditor resignation, regardless of internal discussions or unresolved disputes with the company.

Exact Time Limit to File ADT-3 After Auditor Resignation

Let’s break this down cleanly. The time limit to file ADT-3 after auditor resignation is thirty days from the date of resignation. No extensions. No grace period. The ADT-3 due date is calculated strictly from the effective resignation date mentioned in the resignation letter. The ADT-3 due date under Companies Act applies uniformly across all eligible entities. Whether the company is active, dormant, profitable, or struggling makes no difference. The law focuses on the event, not the circumstances. This is where many professionals get tripped up. They assume the ADT-3 due date begins when the company acknowledges the resignation. That is incorrect. The time limit to file ADT-3 after auditor resignation starts from the auditor’s declared resignation date, not from board acceptance or ROC acknowledgment. Once that date passes, the default is automatic. Even a one-day delay technically violates the ADT-3 due date under Companies Act.

Applicability of ADT-3 Due Date Across Different Companies

The ADT-3 due date is not limited to listed companies or large corporations. It applies equally to private limited companies, public companies, OPCs, and section 8 companies wherever statutory audit is mandatory. What this really means is that the time limit to file ADT-3 after auditor resignation applies whenever an auditor appointed under the Companies Act resigns before completing their term. The ADT-3 due date under Companies Act does not depend on turnover, size, or sector. Even startups often overlook this requirement. Many assume informal communication is enough. It is not. The ADT-3 due date exists precisely to avoid informal exits that bypass regulatory scrutiny. If an auditor resigns due to professional reasons, ethical concerns, or internal disagreements, those reasons must still be reported within the ADT-3 due date under Companies Act.

Auditor Responsibility Versus Company Responsibility

One of the most misunderstood aspects of the ADT-3 due date is responsibility. Filing ADT-3 is the auditor’s legal duty, not the company’s. The time limit to file ADT-3 after auditor resignation applies to the auditor personally. That said, companies are not completely insulated. If an auditor misses the ADT-3 due date under Companies Act, it raises governance questions for the company as well. Regulators may question whether the company obstructed disclosure or failed to facilitate compliance. Smart companies track the ADT-3 due date internally even though the filing is not their task. This avoids complications during subsequent auditor appointments, annual filings, or ROC scrutiny. Clear coordination between auditor and company helps ensure the time limit to file ADT-3 after auditor resignation is respected without friction.

Information Required to Meet the ADT-3 Due Date

Meeting the ADT-3 due date is not just about logging into the MCA portal. The auditor must provide specific information that explains the resignation clearly. The ADT-3 due date under Companies Act exists to ensure meaningful disclosure, not superficial compliance. That is why the form requires reasons for resignation, date of resignation, and details of the company. Here’s the key point. Vague or evasive reasons defeat the purpose of ADT-3. Regulators expect clarity. The time limit to file ADT-3 after auditor resignation forces timely and honest disclosure, not delayed narratives. Auditors who rush filing without preparing accurate explanations risk scrutiny later. Filing within the ADT-3 due date with incomplete or misleading information creates long-term professional risk.

Consequences of Missing the ADT-3 Due Date

Missing the ADT-3 due date is not a procedural lapse. It is a statutory default. The Companies Act prescribes penalties for non-compliance, and they apply directly to the auditor. The ADT-3 due date under Companies Act is enforced through monetary penalties that increase with continued delay. Beyond financial impact, late filing damages professional credibility. Repeated non-compliance can trigger disciplinary attention from professional bodies as well. What this really means is that the time limit to file ADT-3 after auditor resignation protects the integrity of the audit profession. It ensures resignations are documented promptly and transparently. Companies associated with delayed filings may also face increased scrutiny during future ROC interactions, even if the default technically belongs to the auditor.

Common Misconceptions Around DT-3 Due Date

One common myth is that ADT-3 is required only when disputes exist. That is incorrect. The ADT-3 due date applies even if the resignation is smooth and mutual. Another misunderstanding is that informal emails or board minutes replace ADT-3. They do not. The ADT-3 due date under Companies Act mandates filing on the MCA portal only. Some believe that appointing a new auditor automatically resolves the requirement. It does not. The time limit to file ADT-3 after auditor resignation exists independently of new appointments. Clearing these misconceptions early prevents unnecessary defaults and professional embarrassment.

Relationship Between ADT-3 Due Date and New Auditor Appointment

The ADT-3 due date plays an indirect but important role in new auditor appointments. When an outgoing auditor files ADT-3 on time, it creates a clean compliance trail. This makes the appointment of a new auditor smoother and legally sound. If the ADT-3 due date under Companies Act is missed, complications arise. New auditors may hesitate to accept appointment until the resignation is properly recorded. ROC systems may flag inconsistencies. What this really means is that the time limit to file ADT-3 after auditor resignation protects continuity. It ensures there is no overlap, ambiguity, or regulatory gap between outgoing and incoming auditors.

Best Practices to Never Miss the ADT-3 Due Date

Professionals who handle resignations regularly treat the ADT-3 due date as a non-negotiable deadline. They document resignation dates clearly, prepare disclosures immediately, and schedule filing without delay. Maintaining resignation templates, internal checklists, and compliance calendars helps ensure the ADT-3 due date under Companies Act is met consistently. Companies can support this by acknowledging resignations promptly and sharing necessary details without friction. While the time limit to file ADT-3 after auditor resignation rests with the auditor, cooperation makes compliance faster and cleaner.

Conclusion

The ADT-3 due date is not just a procedural formality. It is a legal safeguard built into the Companies Act to preserve transparency, accountability, and trust in corporate governance. The ADT-3 due date under Companies Act ensures that auditor resignations are disclosed promptly, reasons are documented honestly, and regulators remain informed in real time. Ignoring or delaying this obligation creates legal risk for auditors and reputational exposure for companies. The time limit to file ADT-3 after auditor resignation exists to prevent silent exits and unresolved compliance gaps. When handled correctly, ADT-3 filing becomes a simple, disciplined step rather than a last-minute panic. Professionals who respect this timeline demonstrate integrity, clarity, and respect for the law. That is exactly what the system is designed to reward.