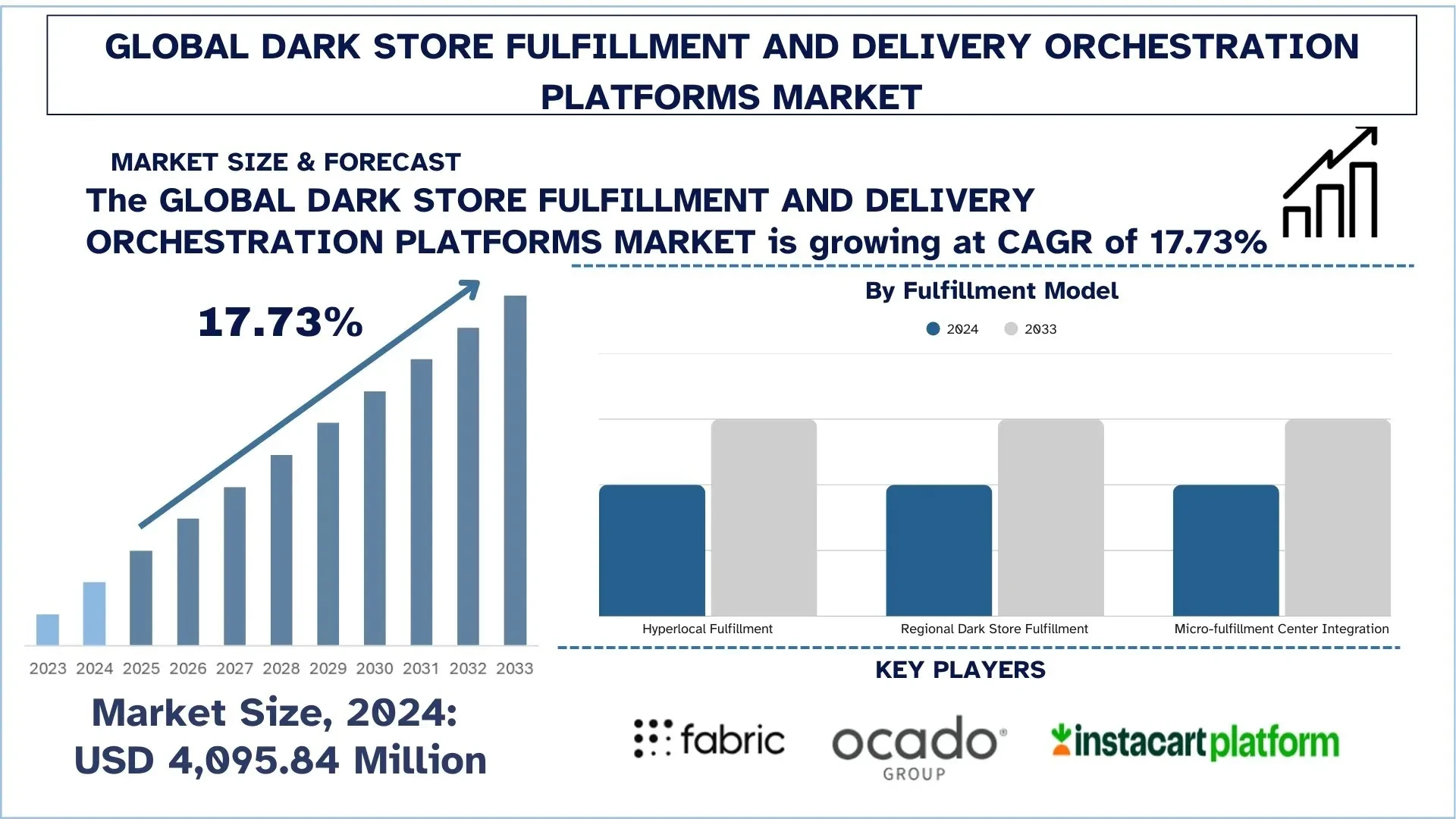

According to the UnivDatos “Dark Store Fulfillment and Delivery Orchestration Platforms Market” report, the global market was valued at USD 4,095.84 million in 2024 and is expected to grow at a CAGR of about 17.73% during the forecast period from 2025 - 2033, reaching USD million by 2033.

The orchestration of dark-store and delivery fulfillment is increasingly complex, and contemporary retail practice demands precise and reliable picking and last-mile delivery across a broad range of demand and traffic conditions. Increased customer demand is fueling the growth in the global dark store fulfillment and delivery orchestration market, which demands to be served by speed, accuracy, and transparency as omnichannel store retail and quick commerce gain momentum. As the primary interface among inventory, labor, couriers, and customers, orchestration platforms are regarded by retailers and logistics partners as vital to service quality, operational efficiency, and the customer experience. This is reinforced by the fact that manual siloed workflows are being replaced by high-performance, lightweight software architectures that enhance productivity, reduce costs, and increase delivery densities. At the same time, the advent of AI-driven personalization and intelligent routing last year has strained platforms that can interact well with POS, WMS, micro-fulfillment automation, and third-party delivery networks to make fulfillment architecture smarter, more responsive, and future-oriented.

Surging Quick-Commerce and E-Grocery Demand Boost Market Growth

The continuously growing number of online retail orders and parcel flows all over the world is among the strongest players in the international dark store fulfillment and delivery orchestration systems market, as it leads to growing demand to the adopted systems, as each digital order should be received, promised, allocated to stock, picked, packed, shipped, and monitored throughout the supply chain. UN Trade and Development (UNCTAD) forecasts that global e-commerce sales reached nearly USD 27 trillion in 2022, underscoring the growing scope of digital trade and the need for coordination across fulfillment and last-mile operations. The size can be observed in major demand hubs. According to the National Bureau of Statistics of China, the online retail sales of 15,522.5 billion yuan in 2024 reflect a sustained online buying process that strains inventory precision, picking, and delivery times. The U.S. Census Bureau reported that retail e-commerce sales totaled USD 352.9 billion in Q4 2024, underscoring the need for retailers and partners to manage high-throughput environments. Equally, the Internet and Mobile Association of India (IAMAI)/ICUBE report indicates a shopper base of 886 million internet users and 332 million online shoppers in 2024. Thereby increasing the number of orders that can be placed on time. The online ordering and parcel movement, indefinitely, is an irrevocable, ongoing demand force of the dark store fulfillment and delivery orchestration systems.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/dark-store-fulfillment-and-delivery-orchestration-platforms-market?popup=report-enquiry

Latest Trends in the Dark Store Fulfillment and Delivery Orchestration Platforms Market

AI-Driven Decisioning in Real Time

The global dark store fulfillment and delivery orchestration platforms market is increasingly adopting AI-driven, real-time decisioning, with operators shifting from fixed rules to continuously optimized execution. Rather than using fixed picking waves, predefined delivery zones, or manual exception handling, AI-enabled systems accept live signals, orders, inventory, labor availability, traffic, and perishable constraints to recalculate promises, reprioritize picks, rebalance capacity, and initiate proactive interventions before service levels are compromised. This shift is accelerating because dark-store economics depend on small improvements in accuracy, on-time performance, and courier utilization, especially during peaks when cancellations, substitutions, and delays can spike. To illustrate this momentum, the National Retail Federation (NRF) indicates that 59 percent of the surveyed retailers are already planning on or exploring the use of AI in their supply chains and warehouses, which underscores how quickly AI is becoming an integral part of operations rather than an experiment. All in all, AI-intermediated orchestration is refining fulfillment into a more predictive, responsive, and constantly learning operating model.

Advancing Toward AI-Enabled, Real-Time Dark Store Fulfillment and Delivery Orchestration Shows Promising Growth

The future of the dark store fulfillment and delivery orchestration market is driven by a structural shift, as retail demand is shifting toward high-frequency, time-compressed fulfillment, where the customer experience is defined by speed, precision, and visibility. Operational complexity increases non-linearly with order volumes, and in this context, inventory accuracy, labor productivity, and last-mile performance must be aligned in real time to safeguard fill rates and on-time delivery. This transforms orchestration platforms from an IT layer into a fundamental control system that translates demand into trusted execution, while reducing cost-to-serve by standardizing and automating workflows. The major market evidence suggests that the intensity of digital commerce is sufficient to sustain platform adoption over time and to enhance the strategic importance of integrations among POS, WMS, automation, and delivery partners. In this framework, the most obvious inflection point is AI-based real-time decisioning, which enables predictive and adaptive operations that enhance resilience during peak periods and periods of volatility.