Europe Sugar Confectionery Market Trends and Forecast 2025–2033

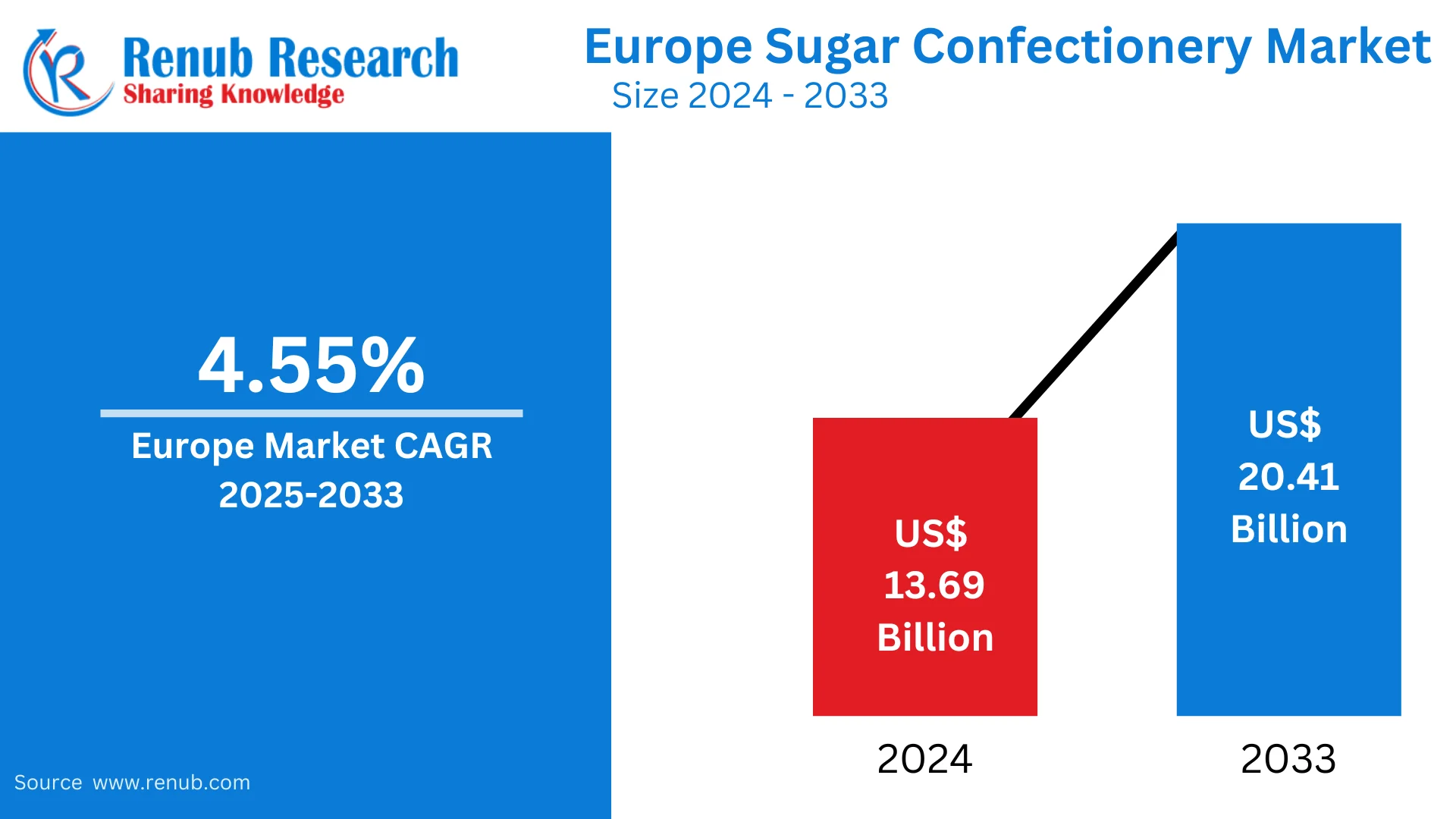

Market Summary: The Europe Sugar Confectionery Market was valued at US$ 13.69 billion in 2024 and is projected to reach US$ 20.41 billion by 2033, expanding at a CAGR of 4.55% from 2025 to 2033. Market growth is fueled by evolving consumer preferences for indulgent foods, innovative product offerings, expanding seasonal sales, and the rapid rise of online and offline retail channels. The surge in demand for sugar-free and functional confectionery variants is significantly reshaping the European market landscape.

Europe Sugar Confectionery Market Outlook

Sugar confectionery encompasses sweet products primarily made from sugar, including candies, gummies, hard-boiled sweets, lollipops, marshmallows, and nougats. These products are widely popular across Europe, celebrated for their diverse textures, flavors, and cultural relevance during major festive seasons like Christmas, Easter, and Halloween.

The market is increasingly driven by:

- Health-conscious consumer behavior favoring sugar-free, organic, and functional confectionery.

- A strong cultural heritage associated with iconic sweets such as Belgian chocolates, French nougat, and German marzipan.

Key Growth Drivers

1. Seasonal and Festive Demand

Europe’s strong cultural affinity for gifting confectionery during holidays propels seasonal sales. Limited-edition flavors, special packaging, and holiday-themed marketing campaigns stimulate significant revenue during festive periods.

2. Innovation in Flavors and Ingredients

To satisfy evolving palates, brands are launching products featuring exotic fruit, floral, spice blends, and even functional ingredients like probiotics, collagen, and vitamins. Rising demand for vegan, organic, and sugar-reduced options is further boosting market diversification.

3. Expansion of E-Commerce and Retail Distribution

The omnipresence of online retail platforms offers easy access to an expansive assortment of confectionery products. Simultaneously, supermarkets, hypermarkets, and convenience stores continue to be dominant sales channels through impulse buying and promotional activities.

New Publish Reports

· Europe Electric Vehicle Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Major Challenges

1. Growing Health Awareness and Sugar Regulations

Government-imposed sugar taxes and increasing consumer awareness about sugar-related health risks such as obesity and diabetes are pressuring manufacturers to innovate healthier alternatives without compromising taste and texture.

2. Rising Competition from Healthier Snacks

Functional and nutritious snack alternatives like protein bars, dried fruits, and nut-based snacks are drawing health-conscious consumers away from traditional sugary treats, necessitating greater innovation and reformulation among confectionery brands.

Segment Insights

Confectionery Variants:

- Hard Candy

- Lollipops

- Mints

- Pastilles, Gummies, and Jellies

- Toffees and Nougats

- Others

Notable Trends by Variant:

- Lollipops: Rise of sour flavors, layered designs, and vitamin-infused sugar-free options.

- Toffees and Nougats: Surge in artisanal, gourmet products emphasizing natural ingredients.

- Mints: Growth in functional mints promoting fresh breath and energy boosts.

Distribution Channel Insights

- Convenience Stores: Key for impulse buys, driven by grab-and-go culture.

- Online Retail Stores: Expanding through specialty offerings, subscription boxes, and e-commerce promotions.

- Supermarkets/Hypermarkets: Dominant due to wide assortments and promotional bundling.

Country Analysis

Germany

Leading in premium chocolates, marzipan, and sugar-free innovations. Traditional products thrive alongside modern healthier alternatives.

Russia

Local favorites like caramel candies dominate, while the growing e-commerce presence increases access to international and sugar-free offerings.

United Kingdom

Dynamic market driven by both heritage brands and emerging health-conscious products, including a boom in vegan and plant-based sweets.

Key Players in the Europe Sugar Confectionery Market

- August Storck KG

- Cloetta AB

- Ferrero International SA

- Lavdas SA

- Mars Incorporated

- Mondelēz International Inc.

- Nestlé SA

- Perfetti Van Melle BV

- Ricola AG

- Swizzels Matlow Ltd