Saudi Arabia E-commerce Market Analysis

Introduction

Saudi Arabia’s e-commerce market is experiencing explosive growth, driven by digital transformation, a tech-savvy population, and ambitious national policies like Vision 2030. What was once a cash-dominant, brick-and-mortar retail environment has rapidly evolved into a dynamic digital marketplace. With internet penetration exceeding 98% and smartphone adoption among the highest in the world, Saudi Arabia is becoming a regional e-commerce powerhouse.

This article explores the key trends, market dynamics, consumer behavior, and growth opportunities in the Saudi e-commerce ecosystem. Whether you're a brand looking to enter the market or a researcher exploring digital trends in the GCC, this deep-dive offers valuable insights into one of the Middle East’s most promising online retail landscapes.

Request a free sample copy of the report: https://www.renub.com/saudi-arabia-ecommerce-market-p.php

Market Overview

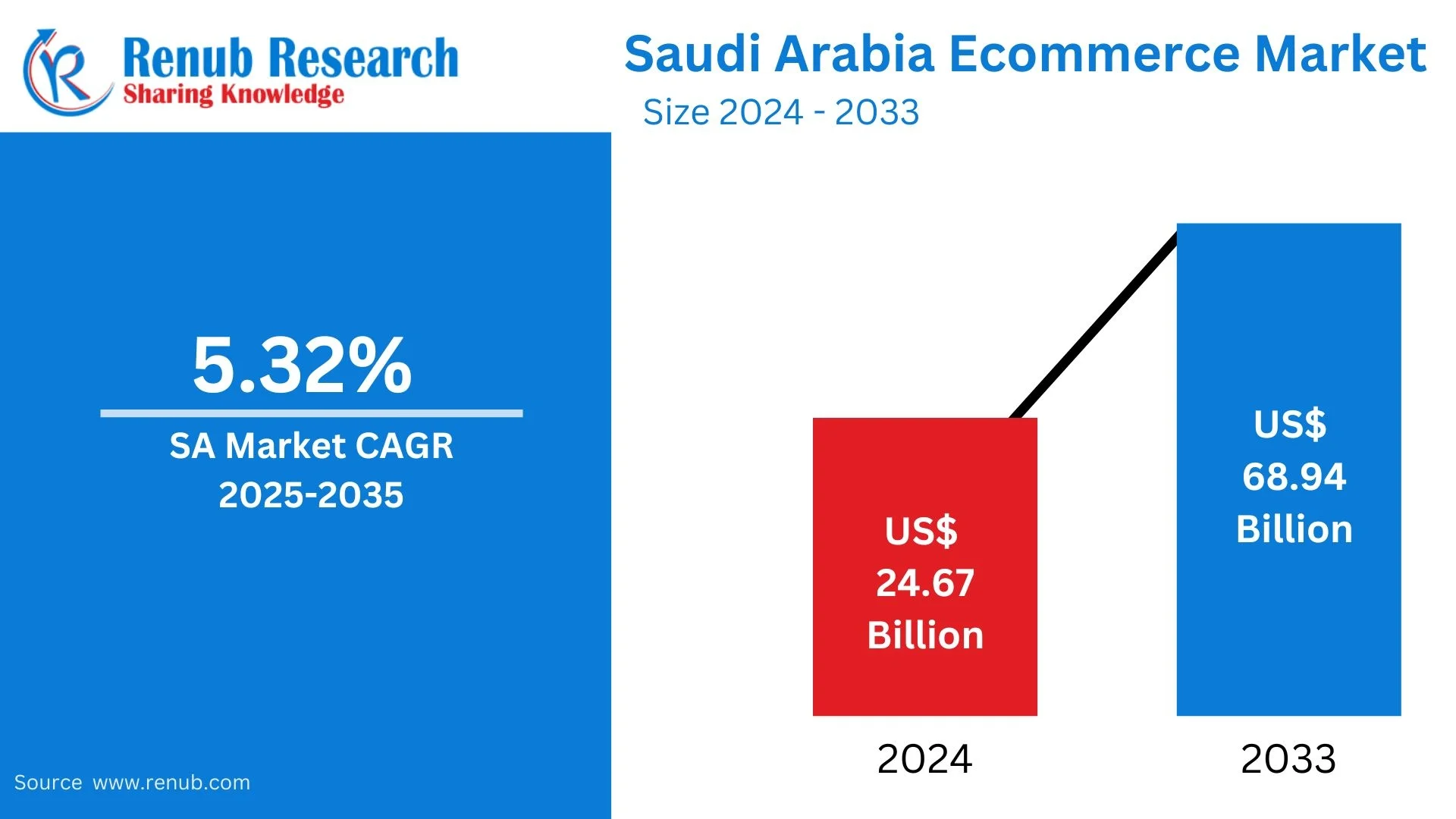

Saudi Arabia eCommerce market, which was worth US$ 24.67 billion in 2024, is expected to grow at a CAGR of 12.10% during the period from 2025 to 2033 and reach US$ 68.94 billion by 2033. A confluence of factors, including rising internet usage, changing consumer preferences, and government-led digital initiatives, is propelling this surge.

Key Market Stats (2024 Estimates):

- Active Online Shoppers: Over 25 million

- Average Basket Size: SAR 500–800

- Top-Selling Categories: Fashion, electronics, groceries, beauty & personal care

Key Drivers of E-commerce Growth in Saudi Arabia

1. Vision 2030 and Digital Transformation

Saudi Arabia’s Vision 2030 is at the heart of its e-commerce boom. The national strategy aims to diversify the economy and enhance digital infrastructure. Initiatives such as the National Transformation Program (NTP) and Saudi Data and AI Authority (SDAIA) have laid the foundation for a robust digital ecosystem.

2. High Internet & Smartphone Penetration

With a young, digitally connected population, over 98% of Saudis are online and over 93% use smartphones. This level of connectivity has created a fertile ground for digital commerce.

3. Government Support for E-commerce

Saudi Arabia has introduced policies to support the digital economy, including:

- E-commerce Law (2019): Governs consumer protection, e-contracts, and returns.

- Saudi Central Bank (SAMA) initiatives: Supports fintechs and digital payment solutions like Mada, Apple Pay, and STC Pay.

- ZATCA e-invoicing: Encourages transparency and digital accounting.

4. Rapid Logistics and Infrastructure Development

The country has invested heavily in logistics hubs, smart warehousing, and last-mile delivery startups. Companies like Aramex, SPL (Saudi Post), and Naqel Express are playing key roles in accelerating delivery efficiency.

5. Shift in Consumer Behavior

The pandemic was a turning point. More consumers became comfortable shopping online across categories, including essentials, electronics, and even luxury items. Post-pandemic, these habits are sticking.

Major E-commerce Platforms in Saudi Arabia

1. Amazon.sa

Amazon entered Saudi Arabia by acquiring Souq.com in 2017. Today, Amazon.sa is one of the most visited platforms, offering a wide range of products with fast delivery options.

2. Noon

A homegrown rival backed by the Saudi Public Investment Fund, Noon is aggressively expanding across the Kingdom with competitive pricing, regional warehousing, and strong brand partnerships.

3. Namshi

Namshi, focused on fashion and lifestyle, enjoys strong brand loyalty among Gen Z and millennial shoppers, particularly in urban centers like Riyadh and Jeddah.

4. Jarir Online & Extra

These retailers have successfully blended offline trust with online convenience, dominating the electronics and education categories.

5. Local Marketplaces & Niches

Platforms like Haraj, Sary (B2B), and Hnak are catering to niche and specialized audiences—from wholesale groceries to second-hand goods.

Top Product Categories in Saudi E-commerce

1. Fashion and Apparel

Saudi consumers love to shop for trendy, modest, and international brands. The segment is thriving due to personalized recommendations, virtual try-ons, and social commerce.

2. Electronics and Gadgets

Demand for smartphones, tablets, gaming consoles, and accessories is high. Fast delivery and easy return policies are critical for success in this segment.

3. Groceries and Food Delivery

Online grocery shopping has skyrocketed. Platforms like Carrefour, Danube Online, and Nana are providing scheduled delivery, live tracking, and subscription models.

4. Beauty and Personal Care

Driven by social influencers and beauty bloggers, this category is a goldmine. Consumers trust reviews and are willing to pay for premium products.

5. Home and Lifestyle

With more time spent at home post-pandemic, there’s been a rise in demand for home décor, furniture, and smart home devices.

Consumer Behavior Insights

Understanding the Saudi consumer is key to e-commerce success:

- Young Demographic: Over 60% of the population is under 35 years old—tech-savvy, mobile-first, and brand-conscious.

- Preference for Arabic: Websites with bilingual interfaces (Arabic-English) perform better.

- Mobile Shopping: Over 75% of e-commerce purchases happen via mobile apps.

- Trust and Reputation: Online reviews, influencer endorsements, and word-of-mouth heavily influence purchasing decisions.

- Cashless Payments: While COD was once dominant, over 60% of transactions are now digital.

Social Media and Influencer Commerce

Saudi Arabia has one of the highest social media penetration rates globally. Platforms like Instagram, TikTok, and Snapchat are not just for entertainment—they’re driving direct e-commerce.

Influencer Power:

Influencers, or "KOLs" (Key Opinion Leaders), hold immense sway. Collaborations, giveaways, and affiliate links often drive traffic directly to product pages, converting followers into buyers.

Live Shopping:

Inspired by China’s e-commerce boom, Saudi platforms are experimenting with live-streamed product demos and flash sales, offering an interactive shopping experience.

Fintech and Payment Innovations

Fintech is playing a pivotal role in removing friction from online shopping.

- Buy Now, Pay Later (BNPL): Services like Tamara and Tabby are wildly popular, allowing consumers to split payments over time.

- Digital Wallets: STC Pay, Apple Pay, and Mada are preferred over traditional cards.

- Secure Checkout: PCI-compliant platforms with fast, seamless checkouts increase conversion rates.

Logistics & Last-Mile Delivery

Reliable and fast delivery is crucial in Saudi Arabia’s vast geography. Innovations in logistics include:

- Dark Stores and Fulfillment Centers: Strategically located centers enable same-day or next-day delivery.

- Drone Deliveries & Autonomous Vehicles: Pilots are underway, showing the Kingdom's ambition to lead in logistics tech.

- Click and Collect: An increasingly popular option for consumers who want to save on shipping or prefer in-store pickup.

Challenges in the Saudi E-commerce Landscape

While the market is thriving, challenges persist:

- High Return Rates: Fashion and electronics see frequent returns due to size mismatches or technical issues.

- Digital Fraud: As volumes grow, so do risks. Cybersecurity and consumer protection laws must evolve continually.

- Rural Penetration: Logistics and awareness are still lacking in remote areas.

- Platform Competition: With many platforms vying for attention, acquiring and retaining customers can be expensive.

B2B and B2C Opportunities

The Saudi e-commerce market isn’t limited to B2C. B2B platforms are gaining traction in sectors like:

- Wholesale groceries (Sary)

- Medical supplies

- Industrial equipment

- Corporate gifting

Startups that simplify procurement, offer financing, or digitize supply chains are well-positioned to grow.

Future Trends to Watch

1. AI-Powered Personalization

E-commerce platforms are using AI to predict consumer preferences, suggest products, and optimize delivery routes.

2. Omnichannel Strategies

Retailers are blending online and offline experiences—offering try-in-store, buy-online-return-in-store, and virtual consultations.

3. Cross-Border E-commerce

Saudi shoppers are increasingly ordering from global retailers, especially for luxury goods and electronics.

4. Sustainability Focus

Eco-conscious packaging, carbon-neutral deliveries, and local sourcing are emerging themes in response to growing environmental awareness.

Government and Policy Landscape

Regulatory stability is essential for investor and consumer confidence.

- MCIT (Ministry of Communications and Information Technology): Leading digital infrastructure development.

- ZATCA: Ensuring tax compliance and digitized operations.

- SFDA (Food & Drug Authority): Regulating e-commerce in food, supplements, and health products.

- MCI (Ministry of Commerce): Oversees e-commerce licensing and consumer protection.

The government is actively nurturing a digital economy, encouraging startups, and fostering innovation.

Conclusion

Saudi Arabia’s e-commerce market is not just growing—it’s transforming the way people shop, live, and connect. With favorable demographics, strong infrastructure, and a supportive regulatory environment, the Kingdom is well on its way to becoming a global e-commerce hub.

Brands and businesses that understand local preferences, leverage technology, and prioritize trust and convenience will thrive in this exciting digital frontier.

About the Company:

Renub Research is a Market Research and Consulting Company. We have more than 15 years of experience especially in international Business-to-Business Researches, Surveys and Consulting. We provide a wide range of business research solutions that helps companies in making better business decisions. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our wide clientele comprises major players in Healthcare, Travel and Tourism, Food Beverages, Power Energy, Information Technology, Telecom Internet, Chemical, Logistics Automotive, Consumer Goods Retail, Building, and Construction, Agriculture. Our core team is comprised of experienced people holding graduate, postgraduate, and Ph.D. degrees in Finance, Marketing, Human Resource, Bio-Technology, Medicine, Information Technology, Environmental Science, and many more.

Media Contact:

Company Name: Renub Research

Contact Person: Rajat Gupta, Marketing Manager

Phone No: +91-120-421-9822 (IND) | +1-478-202-3244 (USA)

Email: mailto:rajat@renub.com