Market Overview

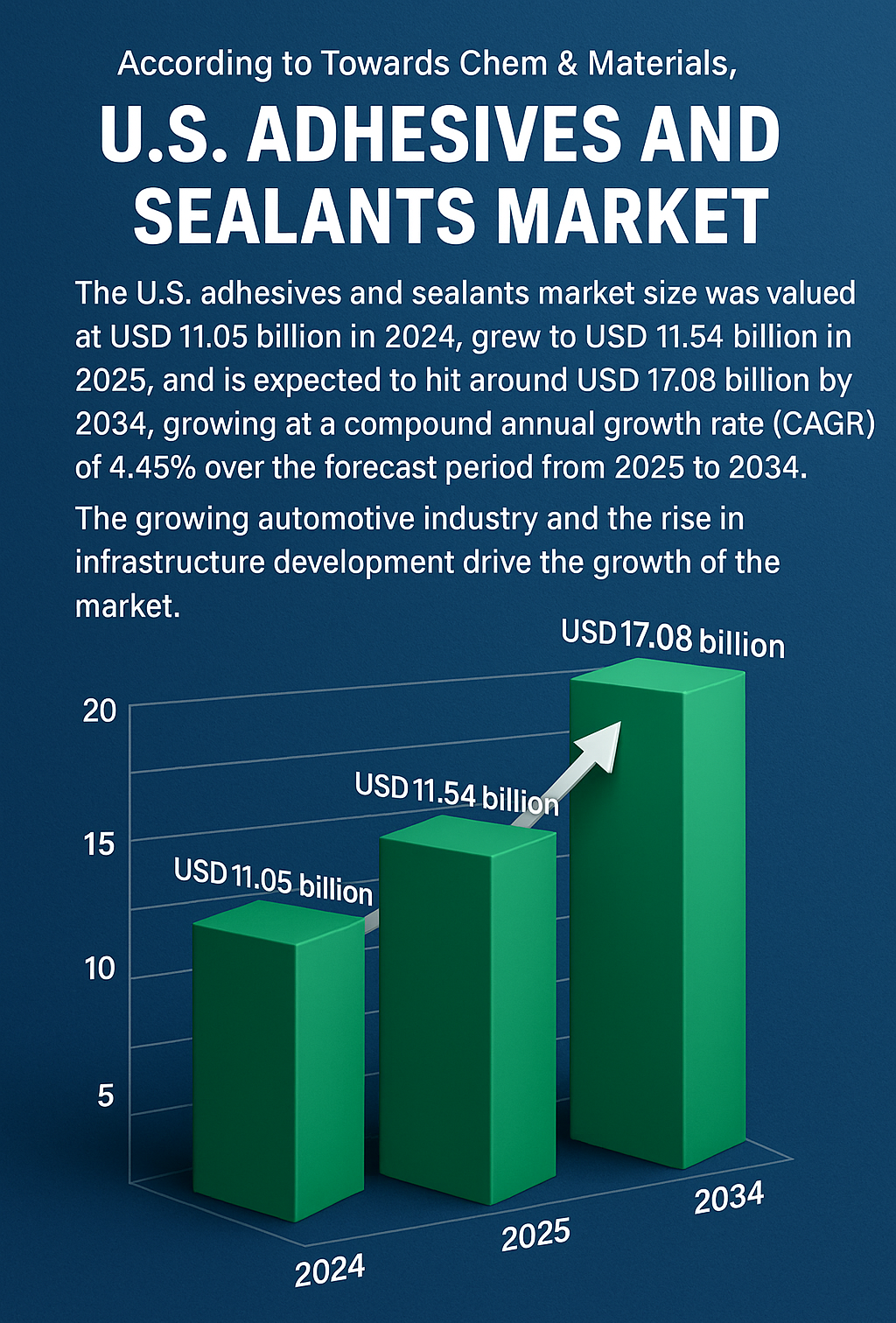

According to Towards Chem & Materials, the U.S. adhesives and sealants market is witnessing significant growth, driven by robust demand across construction, automotive, packaging, and electronics industries. Valued at USD 11.54 billion in 2025, the market is projected to reach USD 17.08 billion by 2034, growing at a CAGR of 4.45% between 2025 and 2034.

This growth is underpinned by innovations in eco-friendly formulations, the rising adoption of lightweight vehicle components, and the demand for advanced medical devices.

Download Sample Here : https://www.towardschemandmaterials.com/download-sample/5852

Key Market Highlights

-

By market type:

-

Adhesives held a 72% share in 2024, driven by construction activities.

-

Sealants are expected to grow at the fastest CAGR due to applications in lightweight vehicles.

-

-

By product form:

-

Water-borne/emulsion adhesives accounted for 30% share in 2024, supported by stricter environmental norms.

-

UV/EB curable adhesives are expected to expand rapidly, particularly in medical devices like catheters and needles.

-

-

By end-use industry:

-

Construction and building led the market with a 29% share in 2024, supported by rising housing projects.

-

Electronics and automotive are forecasted to grow at the fastest CAGR with surging consumer electronics demand.

-

More Insights in Towards Chemical and Materials:

- U.S. Glass Product Manufacturing Market: The U.S. glass product manufacturing market size is estimated at USD 25.46 billion in 2025 and is expected to hit around USD 39.90 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.12% over the forecast period from 2025 to 2034

- U.S. Nitrile Butadiene Rubber Market : The U.S. nitrile butadiene rubber market size is calculated at USD 395.73 million in 2025 and is anticipated to reach around USD 619.72 million by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period from 2025 to 2034.

- U.S. Pressure Vessels Market: The U.S. pressure vessels market size is calculated at USD 11.55 billion in 2025 and is expected to be worth around USD 15.41 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.25% over the forecast period 2025 to 2034.

- Essential Oils Market: The global essential oils market size is estimated at USD 28.49 billion in 2025 and is expected to hit around USD 62.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.11% over the forecast period from 2025 to 2034. Asia Pacific dominated the essential oils market with a market share of 34% in 2024.

- Foam Market: The foam market size is calculated at USD 120.51 billion in 2025 and is anticipated to reach around USD 201.02 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% over the forecast period from 2025 to 2034. Asia Pacific dominated the foam market with a market share of 36% in 2024.

U.S. Adhesives and Sealants Market – Top Companies

1. 3M

About: 3M is a global innovation powerhouse with a diversified product portfolio spanning adhesives, sealants, tapes, and specialty chemicals.

Products: Industrial adhesives, tapes, medical adhesives, and sealants.

Market Cap: Over USD 50 billion.

Segments Covered: Healthcare, construction, automotive, and packaging.

Takeaway: 3M continues to lead through R&D investments and eco-friendly solutions tailored for healthcare and automotive applications.

2. Henkel

About: Henkel is a leading German multinational with strong market presence in adhesives and functional coatings.

Products: Adhesives, sealants, surface treatments.

Market Cap: Approximately USD 28 billion.

Segments Covered: Automotive, packaging, consumer goods, electronics.

Takeaway: Henkel is driving sustainability by expanding its water-based and bio-based adhesive portfolio.

3. H.B. Fuller

About: H.B. Fuller is a U.S.-based adhesives specialist known for innovative bonding solutions.

Products: Industrial adhesives, construction adhesives, hygiene adhesives.

Market Cap: Nearly USD 4 billion.

Segments Covered: Packaging, hygiene, construction, electronics.

Takeaway: H.B. Fuller leverages its innovation pipeline to cater to packaging and healthcare industries.

4. Sika Bostik (TotalEnergies)

About: Sika and Bostik, under TotalEnergies, are global leaders in construction and industrial adhesives.

Products: Sealants, construction adhesives, waterproofing systems.

Market Cap: Sika – USD 40 billion; TotalEnergies – USD 170 billion.

Segments Covered: Construction, automotive, industrial assembly.

Takeaway: Their strength lies in sustainable building solutions and structural adhesives.

5. The Dow Chemical Company

About: Dow is a major U.S. chemical company with diversified materials solutions.

Products: Silicone sealants, structural adhesives, emulsion polymers.

Market Cap: Around USD 35 billion.

Segments Covered: Automotive, construction, electronics, packaging.

Takeaway: Dow focuses on performance materials and advanced sealants for construction and EV manufacturing.

6. RPM International Inc.

About: RPM is a leading manufacturer of specialty coatings, sealants, and adhesives.

Products: Building sealants, industrial adhesives, coatings.

Market Cap: USD 13 billion.

Segments Covered: Construction, industrial maintenance, consumer products.

Takeaway: Strong presence in building and renovation segments in the U.S.

7. Avery Dennison

About: Avery Dennison is a global leader in labeling and packaging solutions.

Products: Pressure-sensitive adhesives, tapes, labels.

Market Cap: USD 15 billion.

Segments Covered: Packaging, logistics, retail, automotive.

Takeaway: Growth fueled by e-commerce packaging and smart labeling technologies.

8. Huntsman Corporation

About: Huntsman specializes in advanced chemicals and adhesives.

Products: Polyurethanes, structural adhesives, epoxy systems.

Market Cap: USD 5 billion.

Segments Covered: Aerospace, automotive, construction.

Takeaway: Known for innovation in lightweight composites and epoxy adhesives.

9. Eastman Chemical Company

About: Eastman is a specialty chemicals leader.

Products: Adhesive resins, sealants, polymers.

Market Cap: USD 10 billion.

Segments Covered: Automotive, packaging, electronics.

Takeaway: Eastman invests heavily in sustainable materials and advanced resins.

10. Arkema

About: Arkema is a French multinational with growing U.S. presence.

Products: Sealants, adhesives, resins, coatings.

Market Cap: USD 8 billion.

Segments Covered: Industrial, packaging, construction.

Takeaway: Focus on specialty adhesives and bio-based solutions.

11. Wacker Chemie

About: Wacker is a German specialty chemicals company with strong silicone technology.

Products: Silicone sealants, adhesives, construction chemicals.

Market Cap: USD 6 billion.

Segments Covered: Construction, electronics, healthcare.

Takeaway: Leader in silicone-based adhesives and sealants for high-performance applications.

12. Momentive Performance Materials

About: Momentive is a global leader in silicone solutions.

Products: Silicone adhesives, sealants, specialty chemicals.

Market Cap: Privately held (~USD 3 billion revenue).

Segments Covered: Electronics, healthcare, construction.

Takeaway: Strength in high-performance silicone adhesives for electronics.

13. Carlisle Companies Incorporated

About: Carlisle is a diversified U.S. manufacturing company.

Products: Roofing sealants, construction adhesives.

Market Cap: USD 14 billion.

Segments Covered: Construction, building materials.

Takeaway: Leader in sealants for roofing and infrastructure projects.

14. Ashland

About: Ashland delivers specialty chemicals and adhesives.

Products: Adhesive resins, sealants, coatings.

Market Cap: USD 5 billion.

Segments Covered: Packaging, construction, automotive.

Takeaway: Innovation in water-based adhesives and specialty polymers.

15. Franklin International

About: Franklin is a U.S.-based adhesives company.

Products: Construction adhesives, wood adhesives.

Market Cap: Private company.

Segments Covered: Construction, woodworking, industrial.

Takeaway: Known for wood adhesives and construction bonding materials.

16. Soudal

About: Soudal is a global sealants and adhesives company headquartered in Belgium.

Products: Sealants, adhesives, PU foams.

Market Cap: Private (~USD 1 billion revenue).

Segments Covered: Construction, industrial, DIY.

Takeaway: Strong in sealants and foams for construction markets.

17. LORD Corporation

About: LORD, a subsidiary of Parker Hannifin, provides adhesives and coatings.

Products: Structural adhesives, coatings, sealants.

Market Cap: Parker Hannifin – USD 60 billion.

Segments Covered: Aerospace, automotive, industrial.

Takeaway: Expertise in bonding and vibration-damping adhesives.

18. Tesa SE

About: Tesa is a subsidiary of Beiersdorf AG and a global adhesives leader.

Products: Tapes, adhesives, sealants.

Market Cap: Parent company Beiersdorf – USD 28 billion.

Segments Covered: Consumer goods, automotive, electronics.

Takeaway: Strong in tapes and specialty adhesives for electronics.

19. Illinois Tool Works (ITW)

About: ITW is a U.S. industrial giant with diversified segments.

Products: Adhesives, sealants, coatings.

Market Cap: USD 70 billion.

Segments Covered: Automotive, industrial, consumer goods.

Takeaway: ITW drives innovation across multiple adhesive and sealant applications.

Segments Covered

By Market Type

- Adhesives

- Sealants

By Product Form

- Solvent-borne

- Water-borne / Emulsion

- Hot melt

- Reactive hot melt

- UV/EB curable

- Paste / Cream

- Tape (adhesive converted product)

- Film / Sheet

- Dispersion

By End-Use Industry

- Construction & Building

- Automotive

- Aerospace & Defense

- Packaging

- Woodworking & Furniture

- Electronics & Electrical

- Medical & Healthcare

- Industrial Assembly & General Manufacturing

- Marine & Shipbuilding

- Energy

- Footwear & Apparel

- Transportation (rail, off-highway)

- Consumer & DIY

- Printing & Graphics

FAQs on U.S. Adhesives and Sealants Market

Q1. What is the market size of the U.S. adhesives and sealants market in 2025

The market is valued at USD 11.54 billion in 2025.

Q2. What is the forecasted growth rate of the U.S. adhesives and sealants market

The market is projected to grow at a CAGR of 4.45% from 2025 to 2034.

Q3. Which end-use industries are driving demand in this market

Construction, automotive, packaging, and electronics are the major industries driving demand.

Q4. Which product form is expected to grow the fastest

UV/EB curable adhesives are expected to grow the fastest due to applications in medical devices.

Q5. Who are the leading players in the U.S. adhesives and sealants market

Key players include 3M, Henkel, H.B. Fuller, Dow, Sika Bostik, and Huntsman Corporation.

For a deeper dive into market intelligence, competitive strategies, and data-driven forecasts, access our Premium Global Insights Report. https://www.towardschemandmaterials.com/price/5852

Future Outlook of the U.S. Adhesives and Sealants Market

The future of the U.S. adhesives and sealants market looks promising as industries transition toward sustainability, performance efficiency, and advanced technologies. Several trends are expected to shape the market trajectory over the next decade:

-

Sustainability and Green Chemistry

Regulatory pressure and rising environmental awareness will drive innovation in bio-based, recyclable, and low-VOC adhesives and sealants. Companies will prioritize eco-friendly formulations to meet sustainability goals. -

Integration with Electric Vehicles (EVs)

The growth of the EV sector will accelerate demand for lightweight, high-strength adhesives and sealants that replace mechanical fasteners, improve crash performance, and enhance battery assembly. -

Smart Adhesives for Electronics

With miniaturization of consumer electronics, demand for high-precision, conductive, and heat-resistant adhesives will surge, especially in smartphones, wearables, and advanced medical devices. -

Construction and Infrastructure Growth

Rising investments in housing projects, smart cities, and commercial infrastructure will sustain demand for construction adhesives and sealants, particularly those offering durability and energy efficiency. -

Digitalization and Automation in Manufacturing

Adhesive and sealant applications will increasingly leverage automated dispensing systems and robotics, enabling faster production cycles and consistent quality in industrial assembly. -

Market Consolidation and Partnerships

Mergers, acquisitions, and collaborations among global players will continue as companies strive to expand product portfolios, optimize costs, and enhance distribution networks across the U.S.

Overall Outlook

By 2034, the U.S. adhesives and sealants industry will be defined by innovation, sustainability, and high-performance materials. Leaders who adapt to shifting consumer preferences, regulatory requirements, and advanced applications in EVs and electronics are likely to dominate the competitive landscape.

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044