South America Biopesticides Market to Hit USD 811.7 Million by 2030 | Fueled by Organic Farming, Sustainable Crop Protection, and Government SupportIntroduction: Accelerating Shift Toward Eco-Friendly Pest Management Solutions

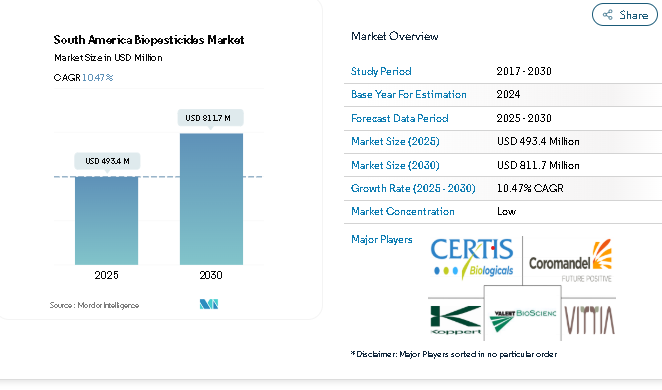

The South America biopesticides market is projected to grow from USD 493.4 million in 2025 to USD 811.7 million by 2030, registering a CAGR of 10.47% during the forecast period (2025–2030). This rapid expansion highlights the region’s strong transition toward environmentally sustainable pest control solutions, as governments, consumers, and producers increasingly prioritize organic and residue-free agriculture.

Countries like Brazil, Argentina, and Colombia are spearheading this transformation, driven by stricter pesticide regulations, heightened awareness of soil and crop health, and growing international demand for eco-certified produce. According to the South America biopesticides market analysis, government incentives, investment in biological research, and favorable registration frameworks are key enablers of the market’s expansion.

Get expert-backed research and strategic insights with complete analysis here - https://www.mordorintelligence.com/industry-reports/south-america-biopesticides-market?utm_source_globbook

Key Market Trends: Organic Farming and Integrated Pest Management Gain Momentum

The South America biopesticides industry is undergoing a paradigm shift, as farmers increasingly adopt organic farming and integrated pest management (IPM) practices to enhance yield quality and comply with global sustainability standards. Countries such as Argentina and Uruguay are seeing rapid expansion in organic acreage — with more than 670,000 hectares of certified organic land, primarily cultivated with crops like coffee, cocoa, sugarcane, and soybeans.

In Brazil, IPM systems incorporating biopesticides such as Bacillus thuringiensis (Bt) and Trichoderma species are becoming mainstream in soybean and corn farming. These biological control agents not only improve pest resistance management but also support long-term soil health and crop productivity.

At the same time, consumer preferences are reshaping demand. Surveys indicate that nearly 50% of consumers in Brazil, Argentina, and Colombia now prefer organically grown food and are willing to pay higher prices for pesticide-free produce. This evolving consumer mindset is encouraging both large-scale and smallholder farmers to integrate biopesticides into their crop protection regimes.

Advancements in biopesticide formulation technologies—including improved shelf life, UV stability, and bioefficacy—are strengthening their competitiveness versus chemical pesticides. Moreover, collaboration between research institutions, agritech startups, and multinational firms is fostering innovation in locally adapted biological pest control solutions across South America.

Market Segmentation: Diverse Applications Across Forms, Crops, and Countries

By Form

The South America biopesticides market is segmented into bioherbicides, bioinsecticides, biofungicides, and other biopesticides.

- Bioherbicides hold the dominant share due to their widespread use in row crops like corn and soybeans. These microbial-based herbicides, including Fusarium oxysporum and Alternaria cuscutacidae, effectively control weed proliferation without harming beneficial organisms.

- Bioinsecticides are growing steadily, especially in Brazil, where Bt-based solutions are extensively deployed against insect infestations in major grain crops.

- Biofungicides play a critical role in managing soilborne pathogens such as Fusarium and Rhizoctonia, promoting root health and yield improvement.

- Other biopesticides, including bionematicides and bioacaricides, are gaining traction for tackling region-specific pest challenges.

By Crop Type

Based on crop type, the market is categorized into row crops, cash crops, and horticultural crops.

- Row crops—including soybeans, corn, and wheat—account for more than three-fourths of total biopesticide use across South America.

- Cash crops, notably sugarcane and cotton, are key contributors to demand, as growers aim to maintain soil fertility while cutting chemical dependency.

- Horticultural crops, such as fruits and vegetables, are emerging as high-growth segments due to the surge in organic produce consumption in major urban centers.

By Country

The market landscape varies across Brazil, Argentina, Colombia, Peru, and the Rest of South America:

- Brazil dominates the regional market, benefiting from its vast agricultural base and a streamlined biopesticide registration process that encourages innovation and adoption.

- Argentina is expanding rapidly through research-driven advancements and a strong organic farming ecosystem.

- Colombia is gaining momentum in coffee, cocoa, and tropical fruit production, supported by public–private initiatives promoting biocontrol usage.

- Peru and Uruguay are emerging as promising markets driven by export-oriented organic farming practices and eco-certification programs.

Read the full report and access market snapshots that include both global views and Japan-specific analysis - https://www.mordorintelligence.com/ja/industry-reports/south-america-biopesticides-market?utm_source_globbook

Competitive Landscape: Innovation and Collaboration Drive Market Growth

According to the South America biopesticides market report, both multinational corporations and regional manufacturers are investing heavily in R&D, local partnerships, and farmer outreach programs to strengthen their market presence.

Prominent companies include Certis USA LLC, Koppert Biological Systems Inc., Coromandel International Ltd, Valent Biosciences LLC, and Vittia Group. These players are leveraging partnerships, acquisitions, and localized production to scale operations and improve distribution efficiency.

For example:

- Corteva Agriscience’s acquisition of Symborg in 2022 expanded its biologicals portfolio, integrating advanced microbial technologies into its Latin American product lines.

- Certis Biologicals’ collaboration with Novozymes aims to enhance fungal disease management for row crops using novel biofungicide formulations.

- Regional leaders like Vittia Group continue to innovate with locally adapted microbial strains suited to South America’s diverse agro-climatic conditions.

The market remains moderately fragmented, where success increasingly depends on technical training, farmer education, and localized formulations that match regional pest dynamics and crop patterns.

Conclusion: A Greener Future for South American Agriculture

The South America biopesticides market is on track to become one of the fastest-growing agricultural sectors in the region, supported by favorable policy frameworks, rising environmental consciousness, and growing investment in biological crop protection research.

As South American countries intensify their focus on reducing chemical pesticide use, biopesticides are emerging as a cornerstone of sustainable and profitable farming systems. Ongoing innovations in formulation stability, microbial efficacy, and distribution logistics will further enhance adoption among both large-scale farms and smallholders.

The region’s commitment to sustainable agriculture, led by Brazil and Argentina, positions South America as a global hub for green farming practices—demonstrating how biopesticides can secure food production, protect biodiversity, and sustain economic growth simultaneously.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries, please contact:

https://www.mordorintelligence.com/contact-us