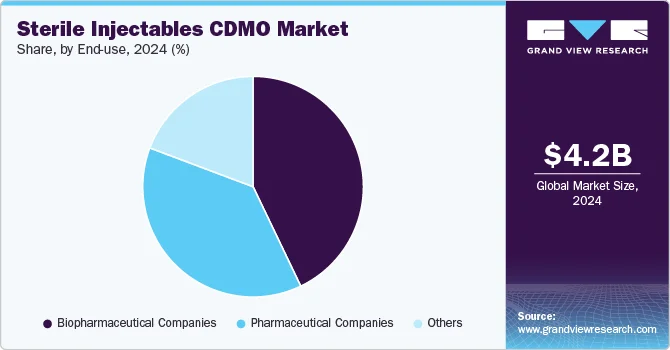

The global sterile injectables Contract Development and Manufacturing Organization (CDMO) market was valued at approximately USD 4.25 billion in 2024 and is projected to reach USD 7.29 billion by 2030, with a compound annual growth rate (CAGR) of 9.61% from 2025 to 2030. This growth is primarily fueled by the increasing pipeline and approvals for injectable medications.

Pharmaceutical companies are increasingly focused on developing injectable drugs due to their multiple advantages, including rapid onset of action, precise dosing, and improved patient adherence.

The rising demand for cellular and genetic therapies is further propelling market growth. As therapy pipelines expand, there is an escalating need for specialized manufacturing capabilities that contract manufacturing organizations (CMOs) offer. For example, as reported by the American Society of Gene & Cell Therapy (ASGCT), there are currently 3,866 therapies in development, ranging from preclinical phases to preregistration. Among these, 2,082 are classified as gene therapies, which include genetically modified cell therapies such as CAR T-cell therapies, accounting for 53% of all gene, cell, and RNA therapies. Additionally, 862 therapies represent nongenetically modified cell therapies, constituting 22% of the therapies under development. Therefore, a robust product pipeline and the increasing demand for advanced therapeutics are expected to uplift overall market demand.

Key Market Trends & Insights

- North America holds the largest revenue share of 40.64% in the sterile injectables CDMO market as of 2024, driven by the establishment of contract manufacturing facilities, the rise in chronic illnesses, and advancements in biotechnology.

- The Asia Pacific region is anticipated to experience the highest CAGR of 10.91% during the forecast period, benefiting from cost-effective services and supportive regulatory changes, particularly in India and China. FDA and EMA-approved R&D and manufacturing facilities in this area are expected to attract foreign investment.

- In terms of molecule type, the large molecule segment accounted for 66.00% of the market’s revenue in 2024, driven by increased investments in large molecule therapeutics, a growing pipeline of injectables, and regulatory approvals of biosimilars.

- Regarding services, the formulation development segment led the market with a revenue share of 39.04% in 2024. This includes small-volume parenteral formulations like vials and ampoules, as well as large-volume parenteral solutions such as glucose and sodium chloride solutions.

- The oncology segment led in revenue with 29.67% in 2024, attributed to the rising incidence of cancer worldwide, which has increased the demand for effective oncology treatments and sterile injectables manufacturing services from CDMOs.

Order a free sample PDF of the Sterile Injectables CDMO Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 4.25 Billion

- 2030 Projected Market Size: USD 7.29 Billion

- CAGR (2025-2030): 9.61%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Key players in the market are focusing on various inorganic strategic initiatives, such as mergers, partnerships, collaborations, and acquisitions, to enhance their market presence and revenue while gaining a competitive edge. For instance, in January 2024, Bora Pharmaceuticals acquired Emergent BioSolutions’ sterile manufacturing facility in Baltimore-Camden, Maryland, for approximately USD 30 million. This acquisition included asset and equipment transfers, along with around 350 Emergent employees, and is part of Emergent’s strategy to streamline its manufacturing network by concentrating on facilities in Lansing, Michigan, and Winnipeg, Canada.

Key Players

- Boehringer Ingelheim International GmbH

- Baxter (Simtra BioPharma Solutions)

- Vetter Pharma International GmbH

- Recipharm AB

- Aenova Group

- Fresenius Kabi Contract Manufacturing (Fresenius Kabi AG)

- Unither Pharmaceuticals

- FAMAR Health Care Services

- Ajinomoto Bio-Pharma

- PCI Pharma Services

- IDT Biologika GmbH

- Alcami Corporation

- Fareva Group

- Eurofins Scientific

- Siegfried AG

- Torbay Pharmaceuticals

- Pfizer CentreOne (Pfizer Inc)

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The sterile injectables CDMO market is poised for significant growth driven by an expanding pipeline of injectable drugs, increasing demand for advanced therapies, and strong investments in manufacturing capabilities. Key players are actively pursuing strategic initiatives to enhance their market share and maintain competitiveness amid rising opportunities in this evolving landscape.