Japan Orthopedic Prosthetics Analysis

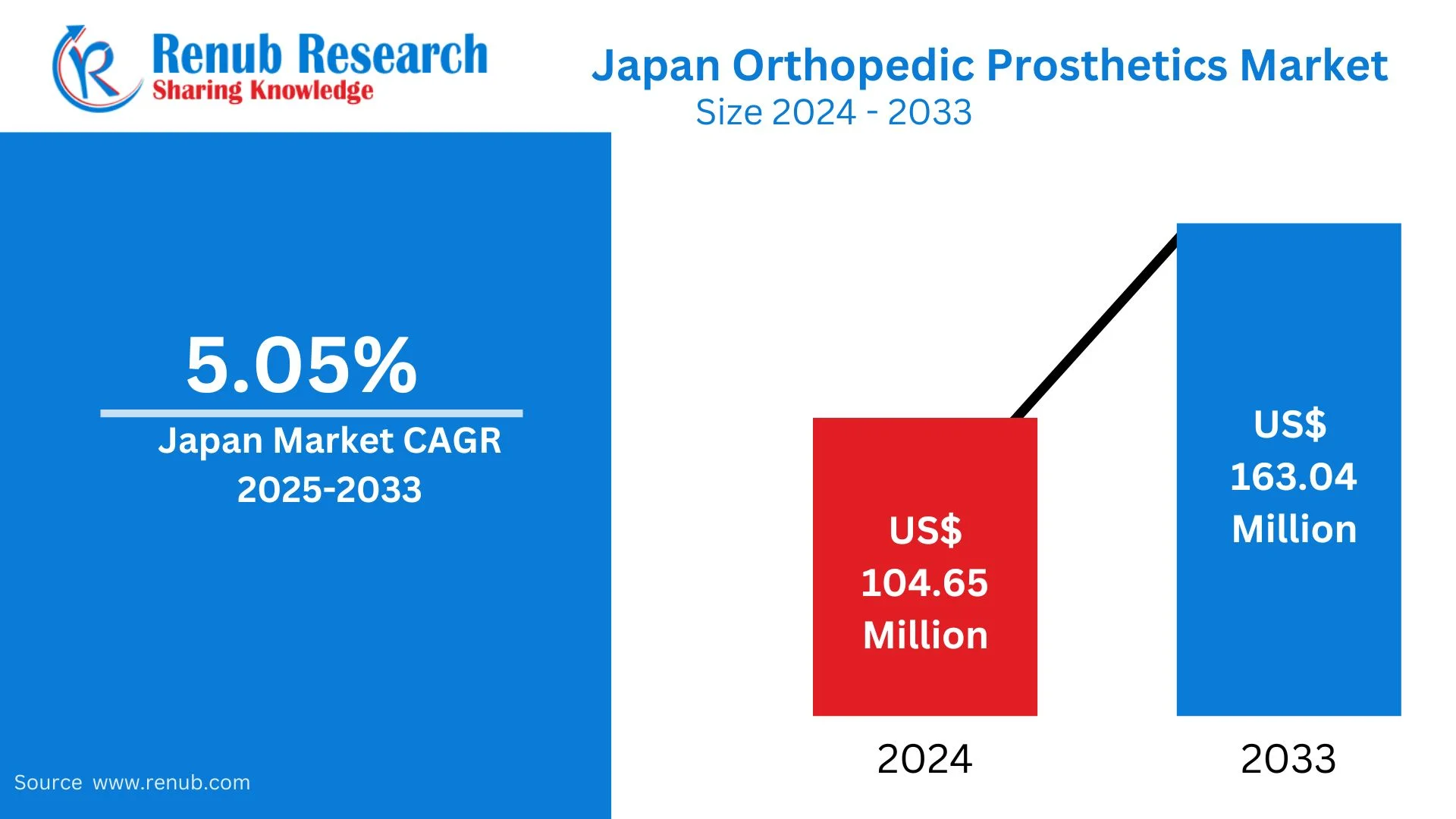

According to Renub Research Japan Orthopedic Prosthetics Market is projected to reach US$ 163.04 million by 2033, rising from US$ 104.65 million in 2024, registering a CAGR of 5.05% from 2025 to 2033. The strong rise in the aging population, higher prevalence of orthopedic disorders, increasing traumatic injuries, and growing awareness of advanced prosthetic solutions are the major forces shaping the industry. Demand is particularly high for technologically advanced prosthetic devices that improve mobility, comfort, and quality of life for users across Japan.

Market Definition and Research Scope

The Japan orthopedic prosthetics market covers devices and technologies designed to replace missing or impaired limbs and body parts. The scope includes product segmentation by upper extremity prosthetics, lower extremity prosthetics, liners, sockets, and modular components. It also analyzes key technologies such as conventional prosthetics, electric powered solutions, and hybrid orthopedic prosthetics. Major end users include hospitals, diagnostic laboratories, research institutes, and rehabilitation centers across leading Japanese regions including Tokyo, Kansai, Aichi, Kanagawa, and others.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=japan-orthopedic-prosthetics-market-p.php

Market Overview and Growth Outlook

The Japan orthopedic prosthetics market is witnessing steady development driven by demographic shifts and healthcare modernization. With Japan having one of the world’s largest elderly populations, musculoskeletal disorders and limb amputations are increasing, boosting demand for innovative prosthetic solutions. The healthcare ecosystem strongly supports adoption of advanced devices, enabling patients to regain independence and mobility.

A notable trend in the market is the rising use of myoelectric and electric-powered prosthetics, which enhance functional capability, mimic natural limb movement, and improve comfort. Robotics, AI-enabled prosthetics, and personalized fit technologies are gaining traction, ensuring better alignment, reduced pain, and improved rehabilitation outcomes. Both domestic and international manufacturers are strengthening their presence through collaborations with hospitals and prosthetic clinics to provide customized solutions suited to Japanese patients.

Government initiatives encouraging digital healthcare, rehabilitation technologies, and assistive devices play a supportive role. Innovations in lightweight materials and ergonomic design are improving patient satisfaction and durability. While aging populations are the primary demand source, increasing sports injuries, occupational accidents, and severe trauma cases are also expanding the user base.

Despite positive growth, the industry faces hurdles such as complex regulatory requirements, reimbursement limitations, and a shortage of prosthetic specialists. However, Japan’s commitment to healthcare innovation, accessibility, and patient-centered care positions the orthopedic prosthetics market for sustained future expansion.

Government Support and Healthcare Infrastructure Development

Government backing plays a crucial role in strengthening the Japan orthopedic prosthetics market. Policies supporting healthcare innovation and accessibility encourage greater adoption of advanced assistive devices. Public funding initiatives and reforms aim to make modern prosthetics more affordable for patients requiring mobility restoration. Investments in specialized rehabilitation centers, research institutions, and prosthetic care infrastructure ensure better clinical outcomes. Regulatory frameworks also encourage development and safe integration of next-generation prosthetic technologies.

Collaboration Between Local and Global Market Participants

Strategic partnerships between international prosthetic technology developers and local Japanese healthcare providers significantly accelerate market expansion. Global manufacturers bring advanced innovation, research expertise, and cutting-edge device engineering, while domestic partners offer deep understanding of patient needs, local regulations, and cultural expectations. These collaborations enable faster market penetration, enhanced customization, efficient distribution, and superior after-care services across Japan.

Rising Incidence of Trauma and Sports Injuries

Apart from age-related orthopedic issues, Japan is witnessing increasing cases of trauma and sports injuries leading to limb impairment and amputation. Active lifestyles, competitive sports participation, and accidental injuries have driven demand for durable, high-performance prosthetic devices. Patients increasingly seek prosthetics that support everyday mobility as well as athletic performance, encouraging manufacturers to innovate functional, strong, and ergonomically optimized prosthetic systems.

Challenges in the Japan Orthopedic Prosthetics Market

Despite strong prospects, the market faces several barriers. One key challenge is Japan’s stringent regulatory environment. While essential for ensuring safety and quality, regulatory approvals often involve lengthy processes, extensive documentation, and high compliance costs. This may slow technology introduction and discourage small companies and startups.

Another major constraint is the high cost associated with advanced prosthetic devices such as myoelectric prosthetics and robotic limbs. Although Japan’s healthcare framework provides reimbursement support, coverage remains inconsistent, and many devices are only partially reimbursed. This creates financial burdens for patients and limits widespread adoption of cutting-edge prosthetics.

Regional Market Insights – Tokyo Orthopedic Prosthetics Market

Tokyo stands as the strongest regional market due to its high population density, advanced healthcare network, and strong concentration of research institutes. Universities and rehabilitation centers in Tokyo support prosthetic innovation, clinical testing, and early adoption of next-generation technologies. Numerous local and global manufacturers have strong operations in Tokyo, offering a broad product portfolio ranging from conventional prosthetics to advanced electronic devices. Government initiatives for smart healthcare and medical research make Tokyo a leading hub in Japan’s orthopedic prosthetics sector.

Regional Market Insights – Kansai Orthopedic Prosthetics Market

The Kansai region, comprising Osaka, Kyoto, and Kobe, serves as another powerful market. Osaka hosts a strong medical device manufacturing base, while Kobe supports innovation through research facilities and healthcare clusters. Kyoto attracts medical tourism, especially for orthopedic treatments, adding to demand for high-quality prosthetics. Robust infrastructure, availability of skilled medical professionals, and supportive healthcare policies make Kansai a core contributor to Japan’s orthopedic prosthetics market.

Regional Market Insights – Aichi Orthopedic Prosthetics Market

Aichi Prefecture, home to Nagoya, plays a crucial role in Japan’s prosthetics manufacturing ecosystem. The region benefits from a powerful industrial base specializing in precision engineering, medical devices, and prosthetic production. Companies such as Matsumoto Prosthetics & Orthotics Manufacturing Co., Ltd. are prominent contributors, driving innovation, large-scale manufacturing, and product quality enhancements. Strong industrial support and skilled workforce make Aichi a vital manufacturing hub.

Market Segmentation by Product Type

The Japan orthopedic prosthetics market is segmented into upper extremity prosthetics, lower extremity prosthetics, liners, sockets, and modular components.

Lower extremity prosthetics currently dominate demand due to the high incidence of lower limb amputations and mobility-related disorders. However, demand for advanced upper limb prosthetics is steadily rising with increasing adoption of electric and hybrid prosthetics.

Market Segmentation by Technology

Based on technology, the market is categorized into conventional, electric powered, and hybrid orthopedic prosthetics. Conventional prosthetics maintain stable demand due to affordability and reliability. Electric powered prosthetics represent the fastest-growing segment as they offer enhanced movement precision, muscle signal interpretation, and natural limb functionality. Hybrid devices combine both benefits, offering balanced performance and affordability.

Market Segmentation by End User

Hospitals and rehabilitation centers account for the majority market share due to their role in treatment, surgical procedures, and patient rehabilitation programs. Research institutes contribute significantly by driving innovation and clinical advancements. Diagnostic laboratories and specialized prosthetic clinics also play key roles in fitting, customization, and long-term patient care.

Competitive Landscape and Key Market Players

The competitive landscape includes leading multinational companies and domestic manufacturers focused on innovation, patient comfort, durability, and technological advancement. Key companies operating in the Japan orthopedic prosthetics market include Johnson & Johnson, Össur hf., Smith & Nephew plc, Stryker Corporation, B. Braun Melsungen AG, Hanger Inc., and Zimmer Biomet. These firms emphasize research, product launches, strategic partnerships, and regional expansion to strengthen market presence.

Future Outlook of the Japan Orthopedic Prosthetics Market

Japan’s orthopedic prosthetics market is positioned for promising long-term growth supported by improved healthcare accessibility, technological innovation, strong government backing, and increasing patient awareness. Advances in robotics, AI-powered control systems, lightweight materials, and personalized prosthetic manufacturing will transform patient experience. Addressing reimbursement barriers, strengthening specialist training, and speeding regulatory approvals will further enhance market expansion.

This comprehensive and detailed outlook highlights Japan as one of the most technologically progressive markets for orthopedic prosthetics worldwide, ensuring improved mobility solutions and better quality of life for patients in the coming decade.