Global Aviation Test Equipment Market Size and Forecast 2025–2033

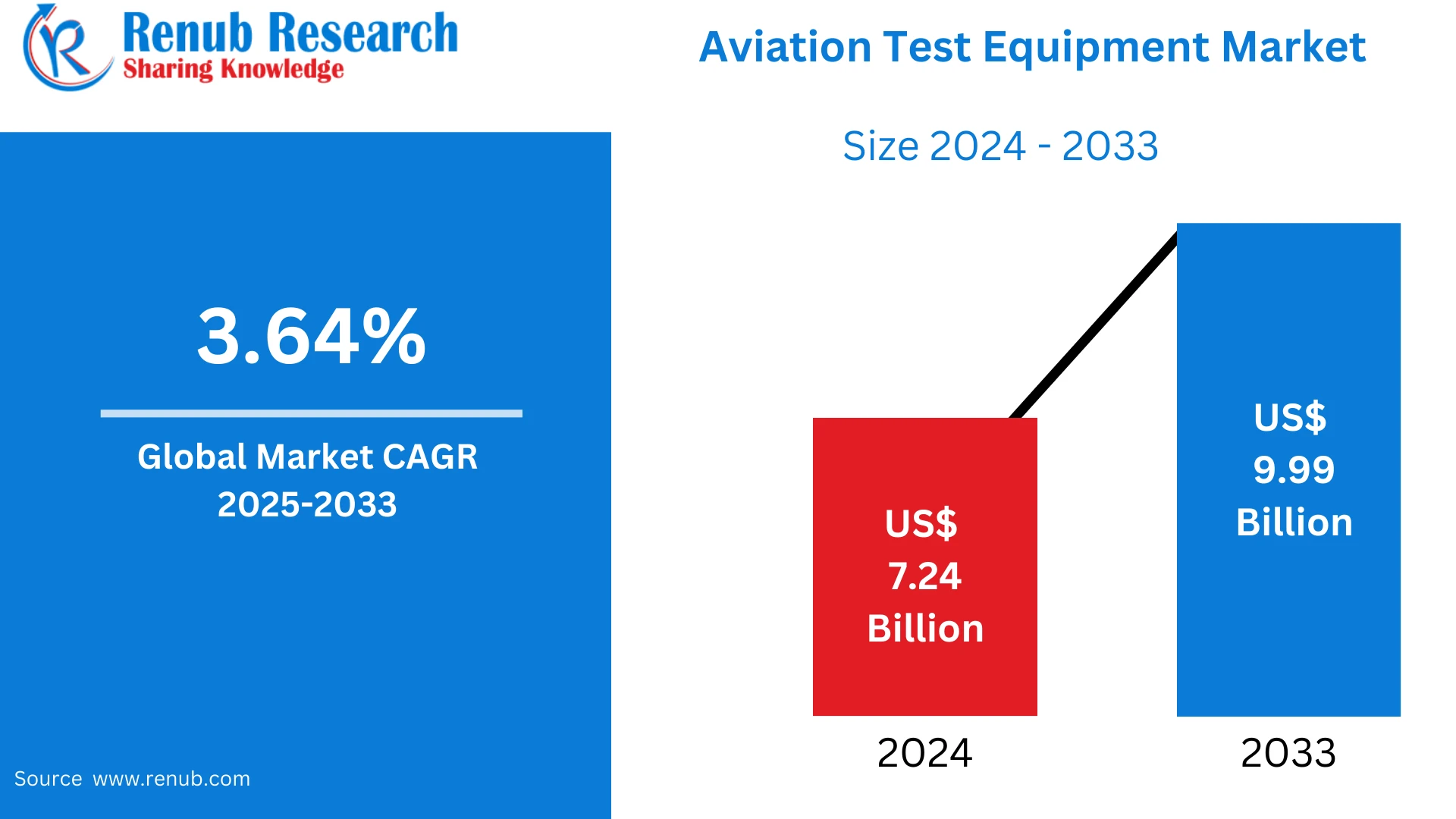

According to Renub Research Global Aviation Test Equipment Market is set for consistent expansion, projected to grow from US$ 7.24 billion in 2024 to US$ 9.99 billion by 2033, registering a promising CAGR of 3.64% between 2025 and 2033. This growth is fueled by rising global air traffic, continuous modernization of aircraft fleets, technological advancements in aviation systems, and stringent regulatory mandates that emphasize uncompromised aviation safety and performance reliability. As aircraft technology evolves, aviation test equipment becomes increasingly indispensable in ensuring precision diagnostics, system validation, and operational readiness across both civil and military aviation sectors.

Market Overview of the Global Aviation Test Equipment Industry

Aviation test equipment encompasses a comprehensive range of systems and devices designed to test, analyze, diagnose, calibrate, and maintain critical aircraft components. These include avionics analyzers, engine test stands, structural test rigs, communication system testers, pneumatic test units, hydraulic analyzers, and electronic diagnostic platforms. Their primary role is to ensure aircraft functionality, enhance safety, improve efficiency, and enable compliance with strict aviation standards. With modernization initiatives across global aviation and rapid development in autonomous and next-generation aircraft technologies, the need for advanced, automated, and high-accuracy test solutions continues to accelerate worldwide.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=aviation-test-equipment-market-p.php

Key Factors Driving Growth in the Aviation Test Equipment Market

Multiple macro and microeconomic elements influence market expansion. Among these, fleet modernization, technological transformation, increasing MRO activities, and strategic defense investments are the strongest market growth drivers shaping future demand for aviation test equipment.

Expansion and Modernization of Aircraft Fleets Fueling Demand

Rising passenger traffic, the resurgence of global aviation operations, and defense modernization programs are pushing airlines and military organizations to expand and upgrade their fleets. New-generation aircraft integrating fly-by-wire technology, digital avionics, advanced navigation, and electronic flight systems require highly sophisticated testing platforms. Simultaneously, aging aircraft fleets require frequent retrofitting and maintenance, amplifying the requirement for precise diagnostic tools. Automated testing solutions are gaining traction, reducing operational downtime and improving testing accuracy, making them critical assets for modern aviation ecosystems.

Technological Advancements and the Emergence of Automated Test Solutions

Technological evolution is transforming testing methodologies from manual inspection toward AI-powered, data-driven, and automated aviation test platforms. Smart systems equipped with predictive maintenance capabilities, cloud-based analytics, digital twins, IoT connectivity, and real-time monitoring enhance operational decision-making and system resilience. Automation significantly minimizes human error, accelerates maintenance cycles, and enhances repeatability and accuracy of aviation testing outcomes. Integration of intelligent test equipment supports preventive diagnostics and ensures aircraft systems remain mission-ready, safe, and operationally efficient.

Increasing MRO Sector Growth and Stringent Aviation Regulations

The rapid growth of the Maintenance, Repair, and Overhaul (MRO) sector remains one of the strongest growth catalysts for the aviation test equipment market. Regulatory bodies including FAA, EASA, ICAO, and defense authorities mandate rigorous inspections and scheduled testing to maintain airworthiness. Advanced test platforms ensure compliance, reduce in-flight risks, extend aircraft service life, and streamline maintenance workflows. As aircraft systems become more technologically complex, demand surges for multi-functional, high-precision, and integrated test systems capable of servicing diverse aviation platforms.

Challenges Restraining the Aviation Test Equipment Market

Despite strong growth opportunities, the aviation test equipment market faces certain constraints. These include high initial investment costs, the complexity of advanced systems, technology compatibility challenges, and stringent certification requirements. Many smaller airlines and regional MRO centers face affordability and integration barriers. Rapid technology advancement also raises concerns about equipment obsolescence, demanding continuous updates and operational expertise. Furthermore, increasing reliance on connected systems elevates cybersecurity risks, compelling manufacturers to strengthen data protection and secure communication infrastructures.

Electrical Aviation Test Equipment Market Outlook

Electrical aviation test equipment plays a vital role in analyzing and verifying electrical networks, avionics, power distribution, generators, wiring systems, and control modules. With aircraft rapidly transitioning toward More Electric Aircraft (MEA) architectures, demand for precision testing instruments such as multimeters, oscilloscopes, power analyzers, signal testers, and automated electrical diagnostic platforms is increasing. These systems ensure stable voltage performance, secure communication integrity, and enhanced aircraft safety while supporting digital transformation initiatives across aviation networks.

Pneumatic Aviation Test Equipment Market Dynamics

The pneumatic aviation test equipment segment focuses on systems that evaluate air pressure, vacuum operations, altimetry, airflow management, pitot-static performance, and environmental control systems. These instruments simulate real-flight conditions on the ground, ensuring dependable navigation accuracy and optimal flight control stability. Growth in advanced flight management systems, autopilot integration, and enhanced altimetry accuracy requirements continues to drive market adoption of next-generation pneumatic testing platforms with improved precision and calibration efficiency.

Commercial Aviation Test Equipment Market Growth Prospects

Commercial aviation remains the dominant market segment, driven by expanding airline fleets, fleet renewal programs, passenger traffic growth, and rising demand for operational reliability. Aviation test equipment enables airlines to minimize downtime, support predictive maintenance strategies, reduce operational costs, and enhance passenger safety. OEMs, airlines, and MRO service providers are investing in automated, digitalized, and analytics-enabled testing platforms, aligning with the industry’s commitment to efficiency and sustainability.

Defense and Military Aviation Test Equipment Market Expansion

Military and defense aviation require highly specialized and rugged test platforms to support combat aircraft, transport fleets, UAVs, and strategic defense aviation systems. Military aircraft operate in extreme environments, demanding robust diagnostic and performance verification equipment. Radar testing, electronic warfare analysis, mission system diagnostics, secure communication validation, and multi-domain integration require highly advanced test systems. Growing global defense modernization initiatives and increased investments in secure, automated, and field-deployable test platforms significantly enhance demand across this segment.

Aviation Test Equipment Market Trends in the United States

The United States remains a global leader in the aviation test equipment market due to its strong aerospace manufacturing base, extensive defense programs, and advanced commercial aviation infrastructure. Major OEMs rely heavily on cutting-edge testing solutions to comply with strict regulatory frameworks and ensure system excellence. Continued innovation in AI-driven diagnostics, electronic warfare testing platforms, and digital aviation ecosystems positions the United States as a dominant technological hub for aviation testing advancements.

Market Growth Outlook in the United Kingdom Aviation Test Equipment Sector

The United Kingdom exhibits strong market performance supported by leading aerospace manufacturers, sustained emphasis on aircraft safety, and defense modernization initiatives. The nation adopts predictive, automated, and digitally enabled test equipment while promoting sustainability and advanced aviation innovation. Collaborative defense programs and technological partnerships further accelerate adoption of sophisticated aviation testing platforms across the UK aerospace ecosystem.

Rapid Expansion of the Aviation Test Equipment Market in China

China represents one of the fastest-growing aviation test equipment markets driven by its rising commercial aviation demand, expanding aerospace manufacturing infrastructure, and ambitious defense modernization programs. National strategies promoting domestic aircraft production and technological independence fuel investment in intelligent, automated, and AI-enhanced test platforms. Both civil and military aviation sectors in China are increasingly adopting state-of-the-art aviation testing technologies to support operational readiness and global competitiveness.

Emerging Growth Opportunities in Brazil and Saudi Arabia

Brazil continues to strengthen its aviation ecosystem through strong commercial aircraft manufacturing capabilities and rapidly developing MRO facilities, boosting demand for efficient, automated aviation test systems. Meanwhile, Saudi Arabia, under Vision 2030 and expanding defense restructuring, demonstrates strong potential in aviation test equipment adoption. Investments in local aerospace development, advanced MRO centers, and commercial aviation expansion position the kingdom as a rising aviation technology hub in the Middle East.

Aviation Test Equipment Market Segmentation Overview

The aviation test equipment market is segmented by type, end-use sector, and geography. Key equipment categories include electrical, hydraulic, pneumatic, and other specialized testing systems. Major end-use sectors comprise commercial aviation, defense and military aviation, and additional specialized aviation applications. Regionally, the market covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with key countries contributing significantly to revenue growth.

Competitive Landscape and Leading Aviation Test Equipment Companies

The aviation test equipment market is highly competitive, featuring prominent global players continually innovating to enhance accuracy, automation, and system intelligence. Key contributors include Honeywell International, Boeing, SPHEREA Test & Services, Rolls-Royce, General Electric, Airbus, Rockwell Collins, Moog, Teradyne, 3M, and several other major aerospace technology developers. These companies focus on technological innovation, strategic partnerships, R&D investments, and advanced testing architecture development to maintain market leadership.

Future Outlook for the Global Aviation Test Equipment Market

Looking ahead, the aviation test equipment market will continue evolving toward automation, digitalization, predictive diagnostics, cybersecurity-secured testing platforms, AI-driven intelligence, IoT integration, and data-centric aviation testing strategies. Increasing reliance on advanced aviation technology, rising air travel, expanding defense modernization, and intensifying regulatory compliance requirements will ensure strong global market growth through 2033. As aviation continues to advance, reliable, intelligent, and high-precision aviation test equipment will remain fundamental to ensuring safety, efficiency, and innovation in the global aerospace industry.