GCC Bitterness Suppressors and Flavor Carriers Market Size, Trends, Growth Outlook (2025–2033)

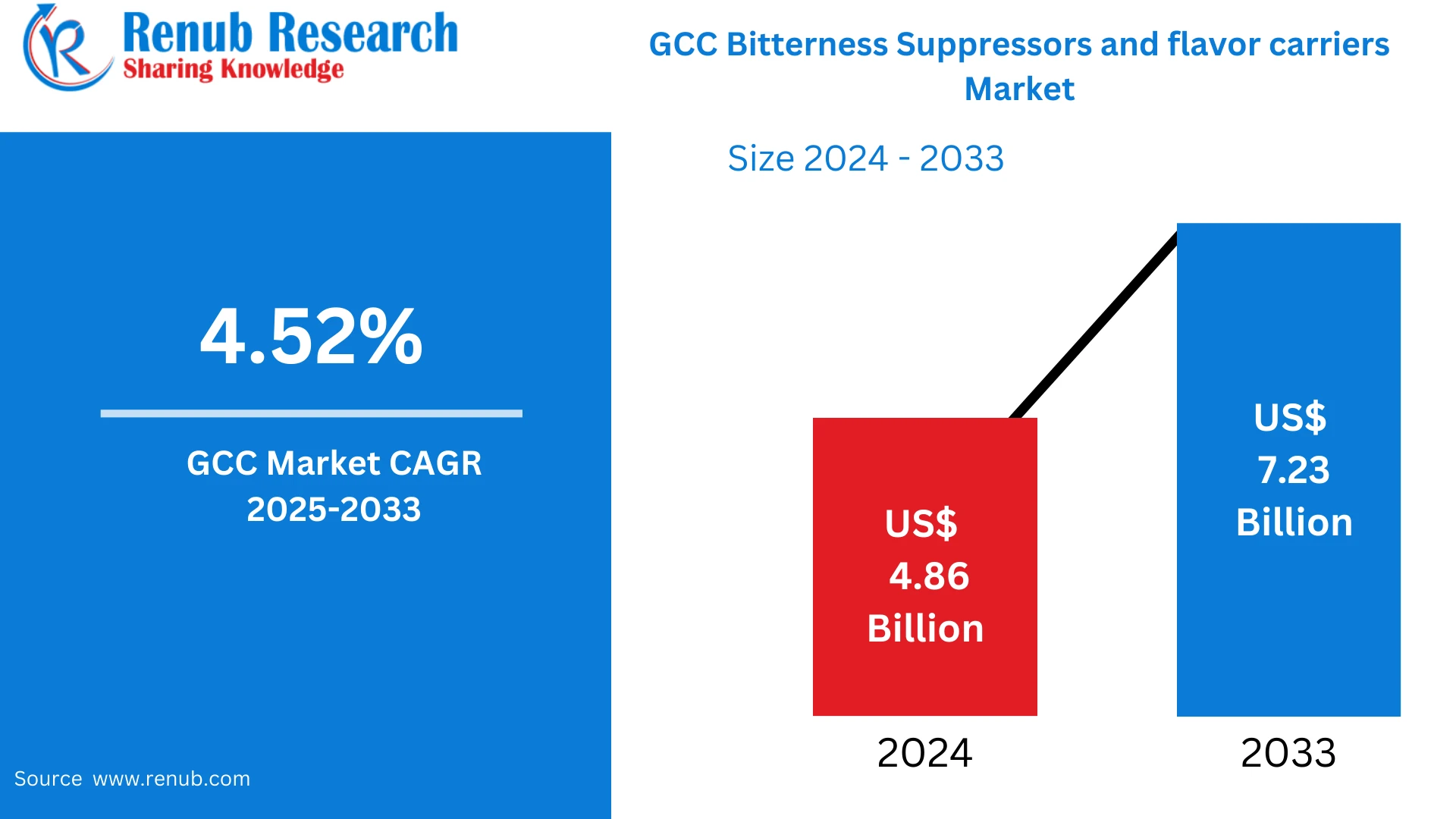

According to Renub Research GCC Bitterness Suppressors and Flavor Carriers Market has witnessed notable growth momentum over recent years, driven by the evolving consumer preference for flavorful, health-oriented, and functional products. Valued at USD 4.86 billion in 2024, the market is projected to reach USD 7.23 billion by 2033, expanding at a CAGR of 4.52% from 2025 to 2033. Increasing consumption of fortified foods, nutraceuticals, beverages, and pharmaceuticals, along with enhanced focus on taste optimization and product innovation, continues to strengthen market expansion across Gulf Cooperation Council (GCC) countries.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=gCC-bitterness-suppressors-and-flavor-carriers-market-p.php

Understanding Bitterness Suppressors and Flavor Carriers

Bitterness suppressors and flavor carriers play a critical role in improving taste perception and ensuring consumer acceptance.

Bitterness suppressors are used to neutralize or reduce unpleasant bitter tastes originating from ingredients such as caffeine, botanical extracts, proteins, vitamins, and certain pharmaceutical compounds.

Flavor carriers stabilize flavor compounds, enhance aroma delivery, prevent flavor degradation, and extend overall product shelf life. These ingredients are widely used in:

· Functional foods and beverages

· Dietary supplements and nutraceuticals

· Sports nutrition products

· Oral pharmaceutical formulations

In the GCC, rising health consciousness, increased supplement intake, and advancements in patient-centric pharmaceutical formulations are significantly boosting demand for these specialized ingredients.

GCC Market Outlook and Industry Landscape

The GCC region, encompassing Saudi Arabia, UAE, Kuwait, Qatar, Oman, and Bahrain, is rapidly transitioning towards health-driven consumer lifestyles. The demand for fortified beverages, protein-based nutrition, herbal supplements, and wellness products is accelerating. With this shift comes greater need to enhance palatability and taste masking, especially in products containing strong active ingredients.

Countries like Saudi Arabia and the UAE lead the market due to strong investments in food innovation, pharma manufacturing expansion, and advanced R&D infrastructure. Moreover, global companies and local producers are introducing technologically enhanced bitterness suppressors and natural flavor carriers that cater to regional preferences and regulatory standards.

Key Growth Drivers in the GCC Bitterness Suppressors and Flavor Carriers Market

Rising Popularity of Functional Foods and Nutraceuticals

The GCC population is increasingly adopting proactive health management habits. Rising incidences of obesity, diabetes, cardiovascular diseases, and lifestyle-related disorders have created a booming market for nutraceuticals and functional food products. However, these products often contain bioactive ingredients with undesirable taste profiles. Bitterness suppressors enable manufacturers to deliver health benefits without compromising taste quality.

Growing initiatives like participation in Arab Health 2025, where companies showcased natural healthcare, plant-based nutrition, and supplement solutions, further emphasize the regional shift toward wellness-focused consumption. As consumer awareness increases, the demand for effective taste-masking technologies continues to accelerate.

Expansion of the Pharmaceutical and Healthcare Sector

The GCC pharmaceutical sector is evolving rapidly with substantial investments in local drug manufacturing, patient-centric drug design, and healthcare modernization. Taste improvement is particularly crucial in oral medications for children and elderly populations. Incorporating bitterness suppressors and flavor carriers enhances medication compliance and overall user experience.

With governments encouraging pharmaceutical localization and better healthcare infrastructure, demand for advanced taste-masking solutions continues to grow, contributing significantly to market development.

Shift Toward Clean Label and Natural Ingredients

Consumers across the GCC increasingly prefer clean-label, organic, plant-based, and naturally sourced food and pharmaceutical products. Manufacturers are responding by replacing synthetic additives with natural bitterness suppressors and bio-based flavor carriers derived from herbs, fruits, and botanical extracts.

This shift is not only driven by health consciousness but also by sustainability priorities. Natural ingredients create strong consumer trust, help brands meet regulatory expectations, and enhance product positioning.

Market Challenges

Regulatory Complexity and Compliance Requirements

Although the GCC is moving toward unified standards, regulatory requirements still vary between countries. Manufacturers must secure approvals and comply with individual national bodies, which can be time-consuming and financially demanding. These hurdles may delay product launches and limit market penetration for certain compounds.

High Cost of Natural and Premium Ingredients

Natural flavor carriers and plant-derived bitterness suppressors often come with elevated sourcing and processing costs. While consumer demand is rising, price sensitivity—especially among small and medium manufacturers—can hinder full-scale adoption. Balancing affordability with innovation remains a central challenge for industry participants.

GCC Flavor Carriers Market Overview

Flavor carriers are essential in maintaining sensory integrity during manufacturing, packaging, and storage. The GCC’s growing processed food market, increasing household consumption of packaged goods, and expanding hospitality sector significantly contribute to rising demand.

Ready-to-eat meals, bakery products, dairy items, and beverages rely heavily on robust flavor carrier systems to retain product appeal in challenging climatic and logistical conditions prevalent in the region.

Growing Demand for Natural Bitterness Suppressors and Flavor Carriers

Natural solutions are becoming increasingly influential as brands align with clean label trends. Plant-derived flavor carriers and herbal-based bitterness suppressors resonate well with health-conscious consumers seeking safe alternatives. These natural additives are widely used in:

· Herbal beverages

· Organic supplements

· Infant nutrition

· Plant-based foods

Their sustainability benefits and minimal chemical exposure further elevate their market demand.

Liquid Bitterness Suppressors and Flavor Carriers Lead Usage

Liquid formulations dominate usage due to their excellent solubility, uniform dispersion, and ease of integration in beverage products, syrups, suspensions, and liquid pharmaceuticals. Their adaptability and time efficiency make them particularly valuable in industrial applications.

Expanding Pharmaceutical Applications Across GCC

Taste plays a crucial role in medication adherence. In pediatric syrups, chewable tablets, and elderly care medicines, poor taste can lead to skipped doses and reduced treatment effectiveness. Pharmaceutical manufacturers across GCC increasingly integrate bitterness suppressors and flavor carriers to ensure better therapeutic outcomes and patient satisfaction.

Food and Beverage Sector Adoption

From fortified juices and protein shakes to energy drinks and functional snacks, bitterness suppressors and flavor carriers are essential for masking unwanted tastes and maintaining flavor consistency. Growing health trends, premium product launches, and evolving consumer preferences further strengthen their necessity in the regional F&B sector.

Country-Wise Market Insights

Saudi Arabia

As the largest economy in the GCC, Saudi Arabia leads in market consumption. Growth is supported by government initiatives promoting food security, pharma localization, and manufacturing expansion. Increasing awareness regarding nutrition and healthcare quality accelerates demand for advanced taste modification technologies.

United Arab Emirates

The UAE remains a key innovation hub with world-class food manufacturing zones, pharma investments, global brand presence, and strong hospitality demand. Diverse consumer demographics encourage extensive product formulation advancements, enhancing adoption of bitterness suppressors and flavor carriers.

Kuwait

Kuwait’s growing healthcare investments, rising premium food demand, and expanding wellness trends support market progress. Economic diversification initiatives further promote modernized pharmaceutical and food production.

Other GCC Nations

Qatar, Oman, Bahrain, and the Rest of GCC are progressively strengthening their food technology capabilities and healthcare infrastructure, contributing to increasing adoption of taste-masking and flavor-enhancing solutions.

Market Segmentation Overview

By Product Type

· Bitterness Suppressors

· Flavor Carriers

By Nature

· Artificial

· Natural

By Form

· Liquid

· Solid

By Application

· Food & Beverages

· Pharmaceuticals

By Countries

· Saudi Arabia

· UAE

· Kuwait

· Qatar

· Oman

· Bahrain

· Rest of GCC

Competitive Landscape

Key companies influencing the GCC market include:

· Cargill Incorporated

· Koninklijke DSM N.V.

· Givaudan SA

· Takasago International Corporation

· International Flavors & Fragrances Inc.

· Kerry Group Plc

· Symrise AG

· Tate & Lyle PLC

These companies focus on innovation, clean-label product development, regional expansion, and strategic partnerships to strengthen market footprint. Their strategies include investments in advanced technologies, product diversification, capacity expansion, and R&D enhancement.

Future Outlook of the GCC Bitterness Suppressors and Flavor Carriers Market

The GCC market is set to evolve with continuous advancements in taste-masking technology, rise of plant-based formulations, improved pharmaceutical taste enhancement needs, and expansion of nutraceutical segments. Growing investments in food technology, healthcare modernization, and consumer wellness awareness will continue propelling market growth.

Natural ingredient innovation, localized manufacturing projects, stronger regulatory harmonization, and strategic collaboration between global and regional manufacturers will further shape the future of this industry.

Conclusion

The GCC Bitterness Suppressors and Flavor Carriers Market stands at a promising growth stage, powered by increasing demand for functional foods, nutraceuticals, pharmaceuticals, and flavored beverages. With a projected value of USD 7.23 billion by 2033, supported by a healthy CAGR, the market demonstrates strong long-term potential. As consumers prioritize taste, health, and quality, innovation in bitterness suppression and flavor delivery will remain central to product success across the GCC region.