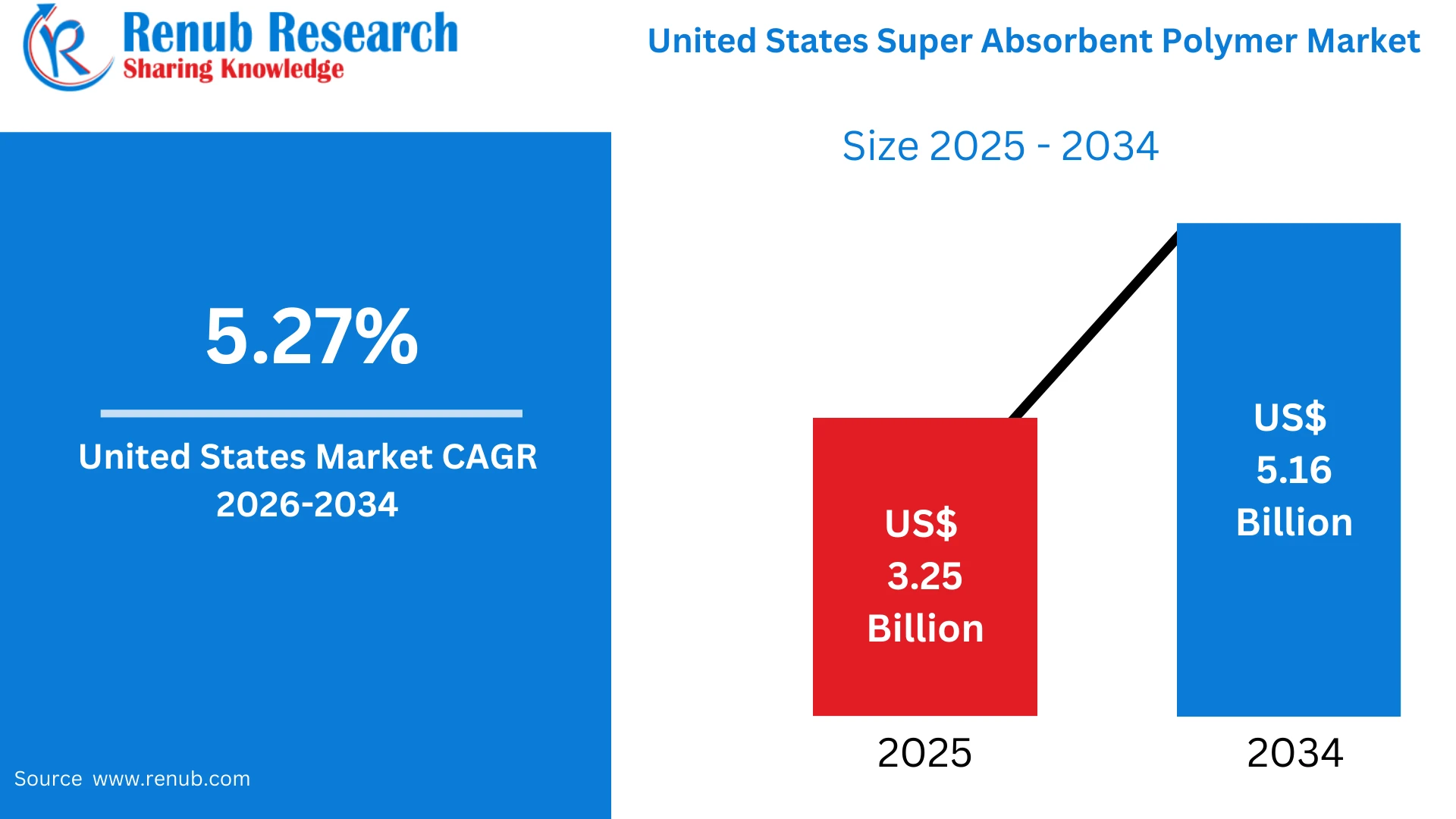

United States Super Absorbent Polymer Market Size and Forecast 2026–2034

According to Renub Research United States super absorbent polymer (SAP) market is projected to demonstrate consistent and resilient growth over the forecast period, expanding from a valuation of USD 3.25 billion in 2025 to approximately USD 5.16 billion by 2034. This reflects a compound annual growth rate of 5.27% from 2026 to 2034. Market expansion is primarily driven by rising demand from personal hygiene products, medical and healthcare applications, and increasing use of SAPs in agriculture and industrial moisture-control solutions. As consumer expectations evolve toward higher comfort, better fluid management, and sustainability, super absorbent polymers continue to play a critical role across multiple end-use sectors in the United States.

United States Super Absorbent Polymer Market Outlook

Super absorbent polymers are a class of advanced functional materials capable of absorbing and retaining large quantities of liquid relative to their own weight. These materials, typically based on cross-linked acrylic acid salts, swell into a gel-like structure upon contact with moisture, effectively locking in fluids and preventing leakage. Their ability to retain liquid under pressure makes SAPs indispensable in applications that require dryness, hygiene, and fluid control.

In the United States, SAPs are widely used in baby diapers, adult incontinence products, feminine hygiene items, medical dressings, and disposable healthcare products. Beyond hygiene and healthcare, SAPs are increasingly applied in agriculture for soil moisture retention and in industrial applications such as packaging, spill containment, and construction materials. Strong innovation pipelines, rising consumer awareness, and performance-driven product development continue to support SAP adoption across the country.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=united-states-super-absorbent-polymer-market-p.php

Strong Demand from Personal Hygiene and an Aging Population

Personal hygiene products remain the dominant demand driver for super absorbent polymers in the United States, accounting for the largest share of SAP consumption. Disposable baby diapers, training pants, feminine hygiene products, and adult incontinence items all rely heavily on SAPs to deliver superior absorbency, dryness, and comfort in lightweight and compact designs.

Demographic trends strongly support this demand. While birth rates influence baby diaper volumes, the rapidly aging U.S. population is driving sustained growth in adult incontinence products. Older consumers increasingly seek discreet, high-performance solutions that offer comfort and dignity, prompting manufacturers to use higher-performance SAP grades. Additionally, healthcare providers and homecare settings favor single-use hygienic products that reduce infection risk, further boosting SAP consumption in hygiene-related applications.

Expansion of Medical and Healthcare Applications

Medical and healthcare applications represent a fast-growing segment within the U.S. super absorbent polymer market. SAPs are increasingly used in advanced wound care dressings, surgical pads, disposable bed protectors, and medical packaging due to their excellent fluid management and containment properties. These materials help maintain optimal wound-healing environments, reduce dressing change frequency, and improve patient comfort.

The growing prevalence of chronic conditions such as diabetes, pressure ulcers, and post-surgical wounds is increasing demand for high-quality absorbent medical disposables. Hospitals, clinics, and long-term care facilities prioritize products that improve infection control and reduce nursing workload, making SAP-enhanced solutions highly attractive. As healthcare standards continue to rise, medical-grade SAPs with strict biocompatibility and safety requirements are expected to gain wider adoption.

Diversification into Agriculture, Construction, and Environmental Applications

Beyond hygiene and healthcare, SAPs are increasingly used in agriculture, construction, and environmental management, contributing to market diversification. In agriculture and landscaping, SAPs improve soil water retention, reduce irrigation frequency, and enhance seed germination. These benefits are particularly valuable in drought-prone regions and urban landscaping projects where water efficiency is critical.

In the construction sector, SAPs are used in concrete admixtures to regulate internal curing, minimize shrinkage cracks, and improve long-term durability. Environmental applications include spill containment products, animal sanitation pads, and wastewater treatment aids, where SAPs immobilize liquids and contaminants. These diversified applications help stabilize market growth and reduce dependence on hygiene-related demand alone.

Environmental Concerns and Regulatory Pressure

Environmental sustainability is one of the most significant challenges facing the U.S. super absorbent polymer market. Conventional SAPs are largely non-biodegradable polyacrylate materials, raising concerns about landfill persistence, particularly for single-use hygiene products. Increasing regulatory scrutiny and consumer awareness are pressuring manufacturers to develop recyclable, biodegradable, or bio-based SAP alternatives.

However, transitioning to environmentally friendly SAP chemistries presents technical and economic challenges. Maintaining high absorbency, gel strength, and cost efficiency while achieving biodegradability is complex. Compliance testing, certification, and product reformulation increase research and development costs. Despite these challenges, sustainability-driven innovation is expected to shape the future direction of the SAP market in the United States.

Feedstock Volatility and Production Cost Pressures

SAP production relies heavily on petrochemical feedstocks such as acrylic acid, sodium hydroxide, and specialty crosslinkers. Fluctuations in raw material prices and energy costs directly impact manufacturing economics and profit margins. Supply chain disruptions, logistical challenges, and geopolitical factors further increase procurement risks.

Smaller manufacturers are particularly vulnerable to feedstock price volatility and may face difficulties securing long-term supply contracts. To mitigate these risks, producers are exploring backward integration, supplier diversification, and strategic inventory management. While these strategies enhance supply security, they also increase capital and operational costs, influencing overall market dynamics.

United States Super Absorbent Sodium Polymer Market

Sodium-based super absorbent polymers, primarily sodium polyacrylates, dominate the U.S. SAP market due to their high swelling capacity, rapid absorption, and strong gel strength. These materials serve as the benchmark for disposable hygiene and medical products, offering reliable performance across a range of fluid viscosities and ionic conditions.

Sodium SAPs are manufactured as cross-linked powders or granules with controlled particle size distributions to ensure consistent quality and safety. In addition to hygiene and medical uses, sodium-based SAPs are applied in agriculture, industrial containment, and cable coatings. Quality control, low residual monomer content, and performance consistency are critical factors driving demand in this segment.

United States Super Absorbent Polymer Personal Hygiene Market

The personal hygiene segment represents the largest end-use category for SAPs in the United States. SAPs enable the production of thinner, lighter, and more absorbent hygiene products that enhance user comfort and reduce leakage. Manufacturers continuously optimize SAP placement, fluff pulp balance, and acquisition layers to improve performance while managing costs.

Consumer demand for discreet, high-performing products and the expanding adult incontinence segment are increasing per-capita SAP consumption. The hygiene market requires strict quality standards, odor control, and safety compliance, creating high technical barriers for suppliers and reinforcing the dominance of established SAP manufacturers.

United States Super Absorbent Polymer Medical Market

Medical applications of SAPs continue to grow as healthcare providers emphasize patient comfort, infection prevention, and efficient care delivery. Medical-grade SAPs are used in wound dressings, surgical pads, bed protection products, and disposable healthcare items. These applications require materials that provide high fluid retention, low extractables, and minimal adherence to tissues.

Advanced wound care products increasingly rely on SAP layers to manage exudate while maintaining a moist healing environment. Although regulatory compliance and quality assurance increase production costs, ongoing innovation in antimicrobial SAP composites and high-absorbency formulations supports continued growth in the medical segment.

United States Suspension Super Absorbent Polymer Market

Suspension polymerization is used to produce SAPs with controlled particle size, uniform crosslink density, and fast absorption kinetics. Suspension-based SAPs are favored in applications requiring precise dosing, consistent flow properties, and narrow particle size distributions, such as hygiene and medical products.

While suspension polymerization involves higher capital investment and process complexity, it delivers high-performance materials that meet stringent industry standards. Demand in this segment is driven by the need for reliable quality, low dust generation, and stable supply chains in critical applications.

United States Gel Super Absorbent Polymer Market

Gel-based SAP formulations are designed to deliver optimal fluid uptake and retention, particularly in saline and biological fluids where ionic strength can limit swelling. These SAPs are widely used in high-performance diaper cores, feminine hygiene products, and medical dressings that require fluid retention under pressure.

Gel SAPs often command premium pricing due to their advanced network structures and performance characteristics. Research and development efforts focus on improving ionic tolerance, minimizing extractables, and enhancing gel strength to meet evolving application requirements.

California Super Absorbent Polymer Market

California represents a major SAP market due to its large population, extensive healthcare infrastructure, and significant agricultural activity. High consumption of hygiene products, strong demand from medical institutions, and widespread use of water-retention solutions in agriculture support robust SAP demand.

The state’s innovation ecosystem and focus on sustainability also encourage research into advanced and environmentally friendly SAP chemistries. California’s diverse application base makes it a key contributor to national market growth.

New York Super Absorbent Polymer Market

New York’s SAP market is driven by dense urban populations, high healthcare consumption, and strong institutional procurement. Hospitals, long-term care facilities, and homecare providers generate substantial demand for SAP-based medical and hygiene products.

Efficient distribution networks and e-commerce infrastructure support rapid product movement across the region. Bulk purchasing by institutions further strengthens demand for absorbent materials used in healthcare and sanitation.

New Jersey Super Absorbent Polymer Market

New Jersey benefits from its strategic location, strong logistics infrastructure, and proximity to major ports. The state serves as a key distribution and processing hub for SAPs used in hygiene, pharmaceutical, and medical products.

Local nonwoven converters and pharmaceutical manufacturers drive demand for specialty SAP grades, while the presence of research and manufacturing facilities supports innovation and regional supply stability.

Washington Super Absorbent Polymer Market

Washington State’s SAP market reflects a mix of agricultural, healthcare, and environmental applications. SAPs are used in irrigation-saving products, horticultural projects, and medical disposables across the state.

Universities and research centers contribute to polymer innovation, while port infrastructure supports efficient import and export of raw materials and finished products. These factors position Washington as an important regional SAP market.

Market Segmentation Overview

The United States super absorbent polymer market is segmented by type, application, production method, and state. Types include sodium polyacrylate, polyacrylate and polyacrylamide copolymers, and other specialty SAPs. Applications span personal hygiene, agriculture, medical, industrial, and other uses. Production methods include suspension, solution, and gel polymerization, while geographic segmentation highlights demand across major U.S. states.

Competitive Landscape and Key Market Participants

The competitive landscape of the U.S. SAP market is characterized by global chemical leaders and specialized polymer manufacturers focused on innovation, scale, and sustainability. Key companies operating in the market include BASF, Evonik Industries, Kao Corporation, LG Chem Ltd., and Nippon Shokubai. These players compete through product innovation, capacity expansion, cost optimization, and development of sustainable SAP solutions.

Future Outlook of the United States Super Absorbent Polymer Market

The United States super absorbent polymer market is expected to maintain healthy growth through 2034, supported by strong hygiene demand, expanding medical applications, and diversification into agriculture and industrial uses. Innovation in high-performance and environmentally responsible SAP formulations will play a central role in shaping future market dynamics.

Although challenges related to sustainability, feedstock volatility, and regulatory compliance persist, ongoing research, scale efficiencies, and supportive end-use demand are likely to offset these constraints. As consumer expectations and healthcare standards continue to rise, super absorbent polymers will remain a critical material underpinning multiple high-growth industries across the United States.