Saudi Arabia Enhanced Oil Recovery Market Size and Forecast 2026–2034

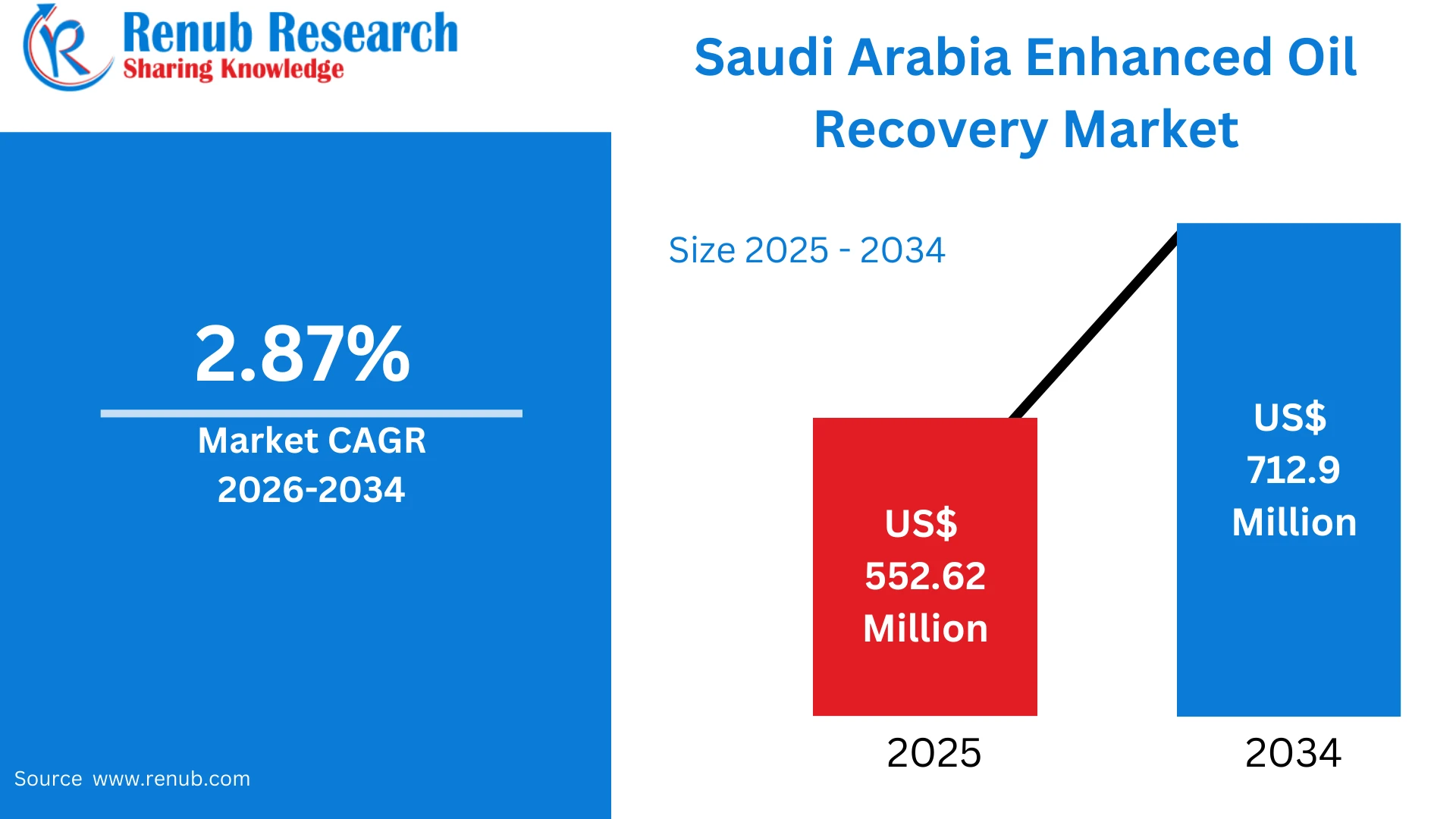

According to Renub Research Saudi Arabia Enhanced Oil Recovery Market is expected to record steady growth over the forecast period, expanding from US$ 552.62 million in 2025 to approximately US$ 712.9 million by 2034, at a compound annual growth rate (CAGR) of 2.87% from 2026 to 2034. This growth is strongly linked to the Kingdom’s long-term strategy of maximizing production from mature oil fields, improving recovery efficiency, and sustaining output levels without excessive reliance on new field discoveries. Continuous investment in advanced recovery technologies, including thermal, gas, and chemical methods, alongside data-driven reservoir optimization, is expected to support the gradual expansion of the market.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=saudi-arabia-enhanced-oil-recovery-market-p.php

Saudi Arabia Enhanced Oil Recovery Market Outlook

Enhanced Oil Recovery (EOR) refers to advanced extraction techniques designed to increase the amount of crude oil recovered from reservoirs beyond what is possible through primary and secondary recovery methods. While primary recovery depends on natural reservoir pressure and secondary recovery commonly relies on water injection, EOR modifies reservoir conditions to improve oil mobility and displacement. Techniques such as thermal injection, gas injection, chemical flooding, and hybrid processes help reduce oil viscosity, increase reservoir pressure, or alter rock-fluid interactions to release trapped hydrocarbons.

In Saudi Arabia, enhanced oil recovery has become an increasingly important component of upstream operations due to the country’s extensive portfolio of mature oil fields. As a global leader in oil production, Saudi Arabia places strategic emphasis on sustaining output levels over the long term by maximizing recovery from existing assets. EOR aligns closely with national objectives related to production efficiency, resource optimization, and long-term energy security. Strong technical expertise, access to capital, and a well-established oilfield services ecosystem further support widespread adoption of enhanced recovery methods across the Kingdom.

Growth Drivers in the Saudi Arabia Enhanced Oil Recovery Market

High Concentration of Mature Oil Fields

Saudi Arabia’s oil industry is characterized by a large number of mature reservoirs that have been producing for decades. In many of these fields, natural reservoir pressure has declined and conventional recovery methods have reached their economic limits. Enhanced oil recovery techniques enable operators to extract a higher percentage of the original oil in place by improving sweep efficiency and mobilizing residual oil.

EOR provides a cost-effective alternative to the exploration and development of new fields, particularly in a country where extensive infrastructure already exists around mature assets. By extending field life and stabilizing production levels, EOR reduces the need for large-scale capital expenditure on new developments. This structural reliance on mature reservoirs continues to drive sustained investment in enhanced recovery technologies across Saudi Arabia.

National Focus on Maximizing Resource Efficiency

Saudi Arabia’s long-term energy strategy emphasizes efficient utilization of hydrocarbon resources while maintaining production leadership in global oil markets. Enhanced oil recovery plays a critical role in achieving this objective by increasing recovery factors and reducing the volume of stranded reserves. Government-backed initiatives and national oil operators continue to invest heavily in EOR research, pilot testing, and full-field deployment.

Advanced reservoir management techniques, supported by real-time data analytics and simulation tools, further improve the effectiveness of EOR projects. As production efficiency and cost optimization become increasingly important, EOR is viewed as a strategic tool for sustaining output while minimizing operational risks. This policy-driven focus on efficiency provides a stable foundation for the growth of the Saudi Arabia EOR market.

Technological Advancements and Operational Expertise

Continuous technological advancement is strengthening the adoption of enhanced oil recovery in Saudi Arabia. Improvements in thermal recovery systems, chemical formulations, and gas injection techniques have increased recovery rates while reducing operational complexity. Saudi operators benefit from extensive operational experience, large-scale field deployment capabilities, and advanced reservoir modeling expertise.

Digital technologies, including real-time monitoring, predictive analytics, and reservoir simulation, enhance decision-making and project optimization. These innovations reduce uncertainty and improve project economics, encouraging broader deployment of EOR techniques across both onshore and offshore assets. The presence of leading international oilfield service providers further accelerates technology transfer and implementation across the Kingdom.

Challenges in the Saudi Arabia Enhanced Oil Recovery Market

High Capital and Operating Costs

One of the primary challenges facing the Saudi Arabia enhanced oil recovery market is the high capital and operating costs associated with EOR projects. Thermal and chemical recovery methods often require significant upfront investment in infrastructure, specialized equipment, and consumable materials. Energy-intensive processes, such as steam generation, contribute to higher operating expenses.

Although Saudi Arabia benefits from economies of scale and relatively low energy costs, managing project economics remains critical, particularly during periods of oil price volatility. Operators must carefully balance recovery efficiency with cost control to ensure long-term project viability, making cost optimization a persistent challenge in EOR deployment.

Reservoir Complexity and Technical Risks

The performance of EOR techniques is highly dependent on reservoir-specific characteristics such as permeability, temperature, pressure, and fluid composition. Variability across reservoirs introduces technical uncertainty and performance risk. Issues such as chemical degradation, scaling, injectant loss, and uneven sweep efficiency can reduce recovery effectiveness.

Designing customized EOR solutions for complex reservoirs requires extensive laboratory testing, pilot programs, and advanced modeling. These processes can increase project timelines and costs, limiting rapid deployment in certain field conditions. Managing technical risks remains a key consideration for operators seeking to expand EOR implementation across diverse reservoir types.

Saudi Arabia Thermal-Enhanced Oil Recovery Market

Thermal-enhanced oil recovery represents one of the most established segments of the Saudi EOR market, particularly in heavy oil and highly viscous reservoirs. Techniques such as steam injection reduce oil viscosity, allowing hydrocarbons to flow more easily toward production wells. Saudi Arabia’s experience with large-scale thermal operations supports efficient implementation of these methods.

Despite their high energy requirements, thermal EOR techniques remain highly effective in boosting production from challenging reservoirs. Ongoing improvements in heat efficiency, steam generation technologies, and process control systems continue to enhance the economic viability of thermal EOR, reinforcing its importance within the Saudi market.

Saudi Arabia Chemical-Enhanced Oil Recovery Market

Chemical-enhanced oil recovery focuses on improving oil displacement efficiency through the injection of polymers, surfactants, and alkaline solutions. These chemicals reduce interfacial tension between oil and water and improve sweep efficiency across the reservoir. In Saudi Arabia, significant research efforts are directed toward developing chemical formulations suitable for high-temperature and high-salinity reservoir conditions.

While chemical costs and degradation risks remain challenges, advances in formulation chemistry and injection strategies are improving feasibility. Chemical EOR is increasingly adopted as part of integrated recovery strategies, particularly in mature reservoirs where thermal or gas methods alone may not be sufficient.

Saudi Arabia Onshore Enhanced Oil Recovery Market

Onshore oil fields account for the majority of Saudi Arabia’s oil production, making onshore EOR a dominant market segment. Extensive infrastructure, well-developed logistics, and established operational practices support large-scale EOR deployment across onshore assets. Onshore projects benefit from easier access, lower logistics costs, and greater flexibility in implementation compared to offshore operations.

Continuous optimization of mature onshore fields through water, gas, thermal, and chemical injection drives sustained demand for enhanced recovery technologies. As Saudi Arabia continues to prioritize production stability, onshore EOR remains a critical focus area.

Saudi Arabia Offshore Enhanced Oil Recovery Market

Offshore enhanced oil recovery in Saudi Arabia is developing steadily as offshore reservoirs mature. Offshore EOR projects face unique challenges, including space constraints, higher installation costs, and complex logistics. However, advancements in compact injection systems, subsea technologies, and reservoir monitoring are improving feasibility.

Although offshore EOR adoption is more gradual than onshore deployment, it plays an increasingly important role in sustaining offshore production over the long term. Continued technological progress is expected to support further growth in this segment.

Riyadh Enhanced Oil Recovery Market

Riyadh serves as a strategic center for policy formulation, research coordination, and high-level decision-making in Saudi Arabia’s enhanced oil recovery market. While not a major production region, the city hosts government institutions, national energy organizations, and corporate headquarters that guide EOR investment strategies.

Riyadh supports research and development initiatives focused on improving recovery efficiency, cost optimization, and reservoir management. Collaboration between research institutions, engineering firms, and energy companies strengthens innovation in EOR technologies, influencing nationwide deployment strategies.

Jeddah Enhanced Oil Recovery Market

Jeddah contributes to the EOR market primarily through logistics, engineering support, and supply chain coordination. As a major commercial hub with strong port infrastructure, Jeddah facilitates the movement of equipment, chemicals, and technical resources required for EOR projects.

The city supports offshore and western-region operations by providing access to engineering expertise and service providers. While direct field operations are limited, Jeddah’s logistical capabilities enhance project efficiency and reduce downtime, indirectly supporting market growth.

Dammam Enhanced Oil Recovery Market

Dammam is a core operational center for enhanced oil recovery in Saudi Arabia due to its proximity to major onshore oil fields. The city hosts operational teams, service providers, and technical specialists responsible for day-to-day EOR execution and monitoring.

Its established energy ecosystem enables rapid scaling of pilot projects into full-field applications. Access to skilled labor, equipment suppliers, and maintenance services positions Dammam as a backbone of field-level EOR activities, playing a vital role in sustaining production from mature reservoirs.

Market Segmentation Overview

The Saudi Arabia enhanced oil recovery market is segmented by technology, application, and geography. Technology segments include thermal-enhanced oil recovery, gas-enhanced oil recovery, chemical-enhanced oil recovery, and other hybrid methods. Applications are divided into onshore and offshore operations. Geographic segmentation highlights key cities and operational hubs that support policy, logistics, and field execution.

Competitive Landscape of the Saudi Arabia Enhanced Oil Recovery Market

The Saudi Arabia EOR market is highly competitive, supported by the presence of leading global oilfield service providers and international energy companies. Major participants include Baker Hughes Company, Halliburton Company, Schlumberger Limited, Exxon Mobil Corp., Chevron Corporation, Shell PLC, TotalEnergies SE, Weatherford International PLC, BP PLC, and Praxair Technology Inc. These companies focus on technology innovation, integrated service offerings, and long-term partnerships to strengthen their market presence.

Saudi Arabia Enhanced Oil Recovery Market Outlook 2026–2034

The Saudi Arabia enhanced oil recovery market is expected to grow steadily through 2034, driven by the need to sustain production from mature oil fields, optimize resource utilization, and support long-term energy strategies. Continued advancements in recovery technologies, digital reservoir management, and operational expertise will enhance EOR performance and economics. As Saudi Arabia balances production leadership with efficiency and sustainability, enhanced oil recovery will remain a critical component of the Kingdom’s upstream oil and gas strategy.