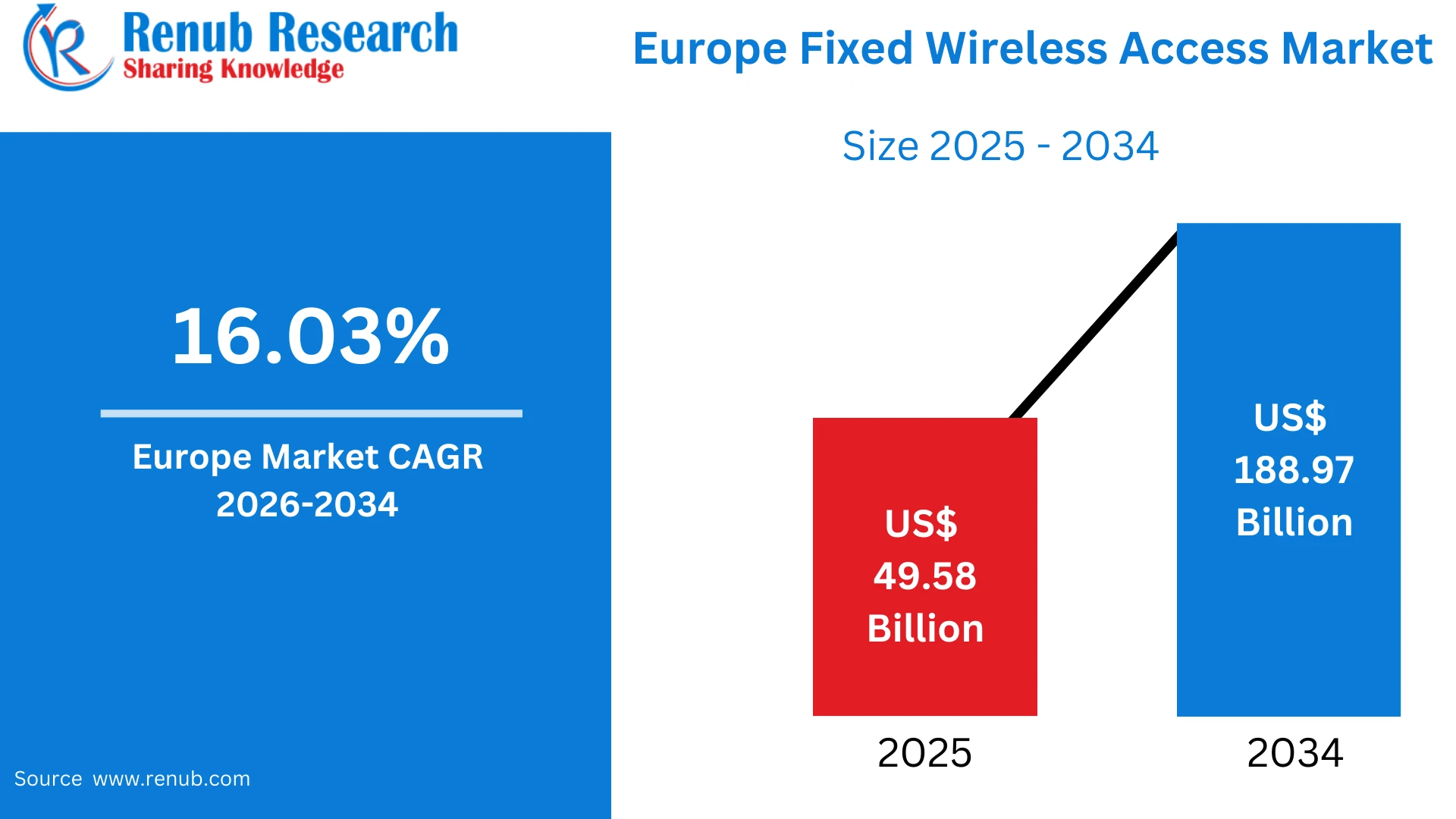

Europe Fixed Wireless Access Market Size and Forecast 2026–2034

According to Renub Research Europe Fixed Wireless Access (FWA) market is poised for substantial expansion over the next decade, reflecting the region’s accelerating demand for high-speed, reliable, and cost-efficient broadband connectivity. Valued at US$ 49.58 billion in 2025, the market is forecast to reach approximately US$ 188.97 billion by 2034, registering a strong compound annual growth rate (CAGR) of 16.03% from 2026 to 2034. This growth trajectory is underpinned by rapid 5G network rollouts, rising digital consumption across households and enterprises, and an increasing policy focus on bridging connectivity gaps in rural and semi-urban regions. As Europe continues to prioritize digital transformation, FWA is emerging as a strategic complement to fiber-based broadband, offering faster deployment and attractive economics.

Download Free Sample Report: https://www.renub.com/request-sample-page.php?gturl=europe-fixed-wireless-access-market-p.phphttps://www.renub.com/request-sample-page.php?gturl=europe-fixed-wireless-access-market-p.php

Europe Fixed Wireless Access Market Overview

Fixed Wireless Access refers to the provision of broadband internet services using wireless radio links rather than traditional wired infrastructure such as fiber-optic or copper networks. In an FWA setup, data is transmitted from a nearby base station to a customer’s premises through 4G, 5G, or millimeter-wave (mmWave) technology, using either indoor or outdoor customer premises equipment (CPE). This approach enables rapid service rollout with minimal civil works, making it especially suitable for regions where fiber deployment is costly, slow, or logistically complex.

Across Europe, FWA adoption is accelerating due to robust growth in data-intensive applications, including cloud computing, remote work, e-learning, video streaming, and smart home services. While major cities often benefit from extensive fiber coverage, many rural, semi-urban, and suburban areas still face limited broadband options. FWA provides an effective solution to close these last-mile connectivity gaps, aligning with national and EU-level digital inclusion goals. Governments and telecom operators increasingly view FWA as a practical tool to meet broadband coverage targets while optimizing capital expenditure.

Growth Drivers in the Europe Fixed Wireless Access Market

One of the primary growth drivers in the Europe FWA market is the increasing demand for broadband in underserved and suburban areas. Europe’s diverse geographic landscape includes densely populated metropolitan centers alongside vast rural and peripheral regions. Extending fiber networks to these areas often involves high costs, lengthy permitting processes, and complex civil engineering works. FWA allows operators to leverage existing radio access infrastructure to deliver high-speed internet more quickly and affordably. For households and small businesses transitioning from legacy ADSL or low-speed cable connections, FWA represents a significant performance upgrade with shorter installation times and lower disruption.

Another key driver is the rapid deployment of 5G New Radio (NR) technology and the availability of mid-band and high-band spectrum. Frequencies such as 3.5 GHz and mmWave bands enable higher throughput, lower latency, and improved capacity, making FWA services increasingly competitive with fiber in terms of speed and quality of service. Advanced technologies like Massive MIMO, beamforming, and carrier aggregation enhance spectral efficiency and coverage, supporting multi-gigabit offerings in suitable environments. These capabilities allow operators to address both residential and enterprise demand with differentiated service tiers.

Cost economics and speed-to-revenue further strengthen the case for FWA. Compared with full fiber rollouts, FWA requires significantly less upfront investment, as it minimizes trenching, reduces deployment timelines, and reuses existing mobile network assets. Operators can enter new markets with lower risk, scale capacity incrementally based on demand, and achieve faster returns on investment. Remote provisioning, over-the-air updates, and standardized CPE also reduce operational costs, making FWA particularly attractive for smaller operators, mobile virtual network operators, and regional ISPs.

Challenges in the Europe Fixed Wireless Access Market

Despite its strong growth potential, the Europe FWA market faces several challenges that can constrain adoption and scalability. Spectrum fragmentation and regulatory variability remain significant hurdles. Spectrum allocation, licensing frameworks, and usage conditions vary widely across European countries, creating complexity for operators aiming for multi-country deployments. Differences in power limits, channelization, and coexistence rules increase equipment complexity and costs, as vendors must support multiple band configurations and certification requirements. Regulatory uncertainty can delay deployments and increase commercial risk, particularly for smaller players.

Technical limitations associated with high-frequency spectrum also pose challenges. While mmWave and higher bands enable very high data rates, they are more susceptible to propagation issues such as limited range, obstruction by buildings or foliage, and sensitivity to weather conditions. In dense urban environments, interference and signal attenuation require careful network planning and densification, which can increase costs. In rural areas, longer distances and obstacles may necessitate higher-gain antennas or additional relay sites, partially offsetting FWA’s simplicity advantage. These constraints mean that FWA must be carefully engineered to balance coverage, capacity, and cost.

Europe Fixed Wireless Access Hardware Market

The hardware segment plays a critical role in the evolution of the European FWA market. Key components include macro and small-cell base stations, indoor and outdoor CPE, antennas, and backhaul equipment. Demand is increasingly focused on multiband and multimode devices capable of supporting both 4G and 5G, with upgrade paths to accommodate evolving spectrum policies. Operators prioritize compact, weather-resistant outdoor CPE with high-gain antennas to improve non-line-of-sight performance, as well as self-installation options to reduce deployment costs.

On the network side, virtualization and open RAN-compatible hardware are gaining traction, enabling more flexible and cost-effective deployments. Edge computing capabilities integrated into gateways and CPE improve performance for latency-sensitive applications. Key purchasing criteria include interoperability, energy efficiency, modular design, and long-term software support. The competitive landscape features established telecom equipment vendors alongside specialized wireless hardware providers and white-label manufacturers catering to ISPs and MVNOs.

Europe 24–39 GHz Fixed Wireless Access Market

The 24–39 GHz frequency range occupies a strategic position within the European FWA spectrum landscape. These bands offer a balance between high capacity and more manageable propagation characteristics compared with higher mmWave frequencies. Wider channel bandwidths support multi-hundred-megabit to multi-gigabit services, making them suitable for suburban areas and targeted urban deployments where fiber availability is limited.

However, deployments in this range require careful planning due to reduced cell radius and indoor penetration compared with sub-6 GHz spectrum. National regulatory requirements for certification and power limits vary, adding complexity. Typical use cases include business parks, new residential developments, and city outskirts where demand density justifies selective densification. Point-to-multipoint architectures and reusable small cells help improve economics, but long-term scalability depends on greater spectrum harmonization and vendor support for flexible radio platforms.

Europe Urban Fixed Wireless Access Market

Urban FWA deployments focus on dense residential clusters and enterprise zones where high demand can justify network densification. In cities, operators deploy small cells on street furniture, rooftops, and building facades to deliver competitive bandwidth and low latency. Urban FWA supports premium residential tiers, smart building connectivity, and enterprise-grade broadband alternatives, often complementing existing fiber and cable networks.

Municipal infrastructure such as lamp posts and smart city assets reduces site acquisition challenges, while advanced interference management and traffic engineering are essential in congested radio environments. Urban FWA also enables specialized use cases, including temporary high-capacity connectivity for events and wireless backup links for mission-critical facilities. Success in this segment depends on balancing capital investment with high average revenue per user and navigating local permitting and aesthetic considerations.

Europe Fixed 5G Wireless Access Market

Fixed 5G Wireless Access combines the capabilities of 5G NR with fixed broadband service models, positioning it as a key growth engine in Europe. Operators increasingly bundle 5G FWA with home entertainment, IPTV, and enterprise services, using SIM-based CPE for simplified provisioning. Network slicing and edge computing enable differentiated quality of service for residential and business customers, supporting applications such as remote offices, retail connectivity, and IoT aggregation.

From an economic perspective, fixed 5G allows operators to reuse existing mobile spectrum and infrastructure, improving return on investment. Challenges include ensuring consistent indoor coverage, integrating fixed services into OSS and BSS platforms, and delivering reliable service-level guarantees. Nonetheless, fixed 5G is a strategic tool for mobile network operators to compete with fiber and cable providers while expanding their footprint in the fixed broadband market.

Europe Commercial Fixed Wireless Access Market

The commercial FWA segment targets businesses ranging from small enterprises to large campuses and retail chains. Enterprises value FWA for its rapid provisioning, predictable latency, and flexibility, using it as a primary connection, backup link, or part of a hybrid networking strategy. Service differentiation is achieved through SLAs, managed networking equipment, static IP addresses, and integrated security services.

Industries such as hospitality, logistics, construction, and event management benefit from FWA’s ability to deliver temporary or rapidly scalable connectivity. For larger enterprises, point-to-point microwave and millimeter-wave links complement point-to-multipoint FWA solutions. Commercial FWA typically commands higher margins due to value-added services and installation complexity, making it an attractive segment for operators with strong enterprise capabilities.

Germany Fixed Wireless Access Market

Germany represents one of the most significant FWA markets in Europe, driven by its large population, diverse geography, and ambitious broadband objectives. While urban centers benefit from strong fiber and cable competition, FWA plays a crucial role in suburbs, multi-dwelling units, and rural areas where fiber deployment is less economical. Hybrid strategies combining fiber backbones with wireless last-mile access are common.

Regulatory emphasis on universal broadband coverage and associated subsidy programs support FWA adoption. High consumer expectations for quality and reliability push operators toward robust network design and high-performance CPE. Challenges include navigating permitting processes in historic urban areas and coordinating with local authorities, but the market outlook remains strong due to sustained demand for flexible broadband solutions.

United Kingdom Fixed Wireless Access Market

The UK FWA market is characterized by its role in addressing rural broadband gaps and enhancing competition in urban areas. Fixed wireless solutions complement fiber rollouts, particularly in remote communities and islands where physical infrastructure costs are high. Operators leverage licensed mid-band spectrum and point-to-multipoint architectures to deliver rapid connectivity for households and small businesses.

Government-supported voucher schemes and rural broadband programs stimulate demand, while urban use cases focus on business continuity and high-capacity hotspots. Consumer acceptance of outdoor CPE is generally positive when performance gains are clear. Effective radio planning, strong customer support, and alignment with public funding mechanisms are critical success factors in the UK market.

Netherlands Fixed Wireless Access Market

In the Netherlands, high population density and extensive fiber coverage shape a distinct FWA market dynamic. FWA is often deployed in suburban areas, for temporary connectivity needs, and in niches where fiber installation is constrained. Progressive municipal policies and smart city infrastructure facilitate small-cell deployment, supporting urban FWA initiatives.

Operators emphasize high-quality CPE, rapid provisioning, and environmentally conscious installations to meet local expectations. FWA is also used to deliver symmetric business services to SMEs in industrial zones lacking fiber. Regulatory clarity and collaborative local governance reduce deployment friction, positioning the Netherlands as a testing ground for innovative FWA service models.

Europe Fixed Wireless Access Market Segmentation

The Europe Fixed Wireless Access market can be segmented by type into hardware and services, reflecting the importance of both infrastructure and connectivity offerings. By operating frequency, the market includes sub-6 GHz, 24–39 GHz, and above 39 GHz bands, each serving different coverage and capacity needs. Demographic segmentation covers urban, semi-urban, and rural areas, while technology segmentation distinguishes between 4G and 5G deployments. Applications span residential, commercial, industrial, and government use cases. Geographically, the market encompasses major European countries such as France, Germany, Italy, Spain, the United Kingdom, Belgium, the Netherlands, and others, highlighting its broad regional scope.

Overall, the Europe Fixed Wireless Access market is set to play a pivotal role in the continent’s digital future, offering a flexible, scalable, and economically viable pathway to universal broadband connectivity.