Mexico Chicken Market Size and Forecast 2025–2033

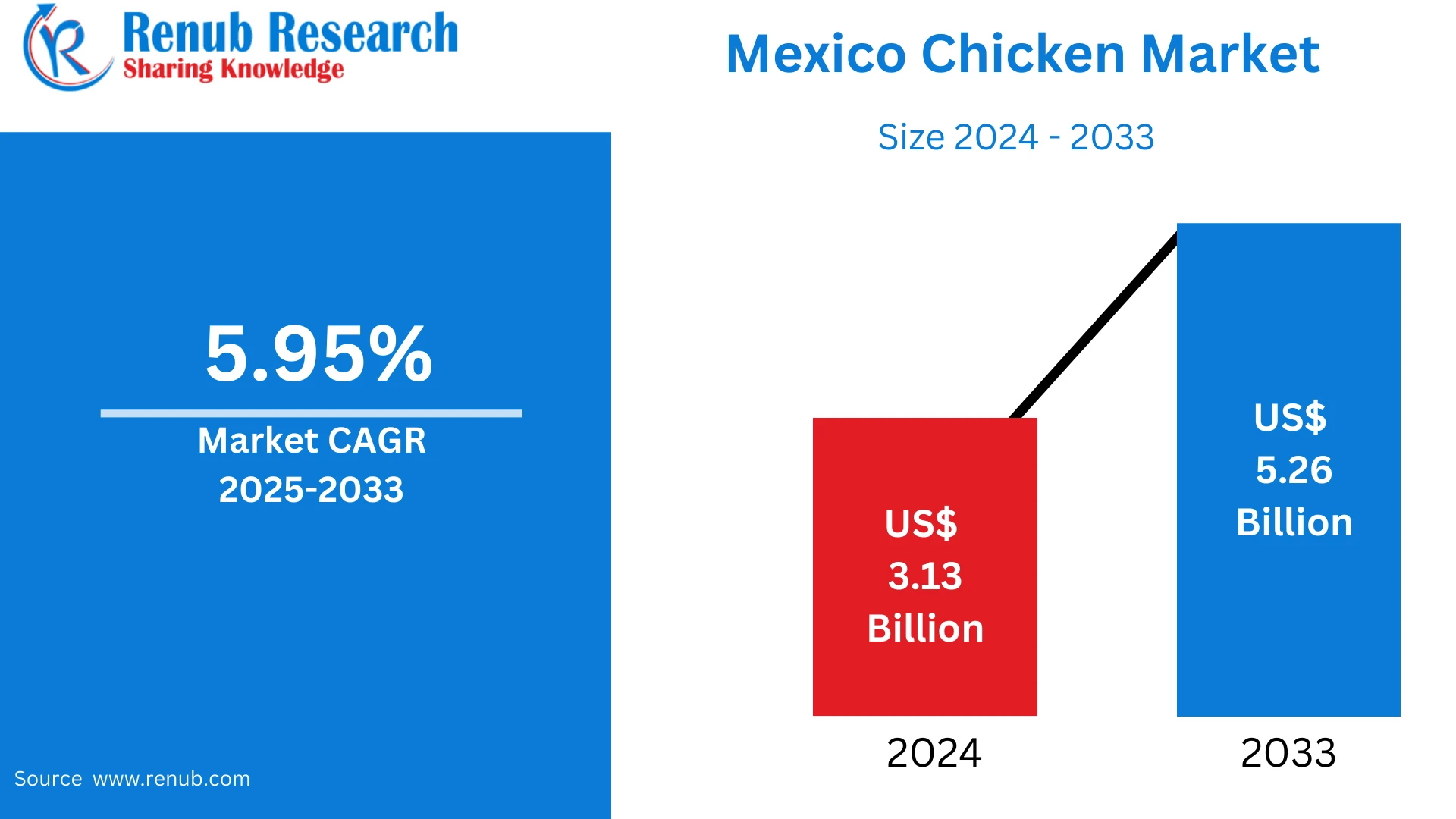

According To Renub Research Mexico chicken market is positioned for steady and resilient growth between 2025 and 2033, driven by rising consumer demand for affordable, nutritious, and versatile protein sources. Valued at approximately US$ 3.13 billion in 2024, the market is projected to reach nearly US$ 5.26 billion by 2033, registering a compound annual growth rate of about 5.95% during the forecast period. Chicken continues to strengthen its position as the most widely consumed animal protein in Mexico due to its cost-effectiveness, cultural acceptance, and adaptability across traditional and modern food formats. Increasing urbanization, population growth, and the expansion of foodservice channels are reinforcing long-term market momentum.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=mexico-chicken-market-p.php

Mexico Chicken Market Outlook

Chicken meat refers to the edible flesh of domesticated chickens and is globally recognized as one of the most accessible sources of animal protein. In Mexico, chicken holds a particularly strong place in daily diets due to its affordability, mild flavor, and high nutritional value. It offers high-quality protein along with essential vitamins and minerals, while remaining comparatively lower in fat and cholesterol than many red meats. These attributes make chicken an appealing choice for both cost-conscious and health-aware consumers.

Mexican cuisine relies heavily on chicken across a wide variety of dishes, including soups, stews, tacos, enchiladas, grilled preparations, and festive meals. The meat’s versatility allows it to adapt to regional spices, sauces, and cooking methods, supporting consistent demand across the country. Strong domestic production capacity and a well-established distribution network further ensure a stable supply, reinforcing chicken’s role as a staple protein for households and foodservice providers alike.

Growing Importance of Chicken in Mexican Diets

Chicken has become one of the most consumed meats in Mexico due to its relative price advantage over beef and pork. For low- and middle-income households, chicken provides an economical way to meet daily protein requirements without sacrificing nutrition or taste. Whole chicken purchases remain particularly popular, as they offer better value per kilogram and can be used across multiple meals.

Cultural familiarity also supports consumption, as chicken-based dishes are deeply rooted in home cooking traditions. From everyday meals to special occasions, chicken fits seamlessly into Mexican food culture. This combination of affordability, familiarity, and flexibility continues to expand its appeal across diverse demographic groups.

Key Growth Drivers in the Mexico Chicken Market

Rising Demand for Affordable Protein Sources

One of the strongest drivers of growth in the Mexico chicken market is the increasing need for cost-effective protein options. As food inflation and economic uncertainty influence household spending, consumers are prioritizing value-for-money foods with high nutritional benefits. Chicken meets these requirements by delivering lean protein at a lower price point than alternative meats.

Producers also benefit from chicken’s shorter production cycles and efficient feed conversion ratios, which help maintain consistent supply and stable pricing. These structural advantages enable the industry to respond quickly to demand fluctuations while keeping products accessible to a broad consumer base. Population growth further strengthens demand, as a larger consumer pool continues to rely on chicken as a primary protein source.

Expansion of Quick-Service Restaurants and Modern Retail

The rapid growth of quick-service restaurants and modern retail formats has significantly boosted chicken consumption in Mexico. Fried chicken, grilled sandwiches, rotisserie products, and ready-to-eat meals have gained popularity among urban consumers seeking fast, affordable dining options. Chicken is widely favored by foodservice operators due to its broad consumer acceptance and ease of preparation.

At the same time, the expansion of supermarkets, hypermarkets, and convenience stores has improved product availability and quality. Investments in cold-chain infrastructure ensure that fresh, chilled, and frozen chicken products reach consumers in optimal condition. As eating habits increasingly shift toward convenience-driven choices, modern retail and foodservice channels remain essential catalysts for market growth.

Increasing Health Awareness and Preference for Lean Meats

Health consciousness is playing an increasingly important role in shaping protein consumption patterns in Mexico. Consumers are becoming more aware of the links between diet and long-term well-being, prompting a shift away from high-fat red meats toward leaner alternatives. Chicken is widely perceived as a healthier option due to its lower fat content and high protein quality.

This trend is reinforced by fitness culture, nutritional education, and growing awareness of lifestyle-related health issues. Families and individuals alike are incorporating chicken into balanced diets that support weight management and muscle development. Foodservice providers and retailers are also responding by offering grilled, baked, and low-sodium chicken products, further strengthening chicken’s health-oriented image.

Challenges in the Mexico Chicken Market

Disease Outbreak Risks and Biosecurity Concerns

Despite its growth potential, the Mexico chicken market faces notable challenges related to disease outbreaks and biosecurity. Poultry farming is particularly vulnerable to illnesses such as avian influenza, which can disrupt production, restrict trade, and undermine consumer confidence. Outbreaks often lead to large-scale culling, reducing supply and increasing price volatility.

Maintaining effective biosecurity measures requires continuous investment in vaccination programs, sanitation, and farm management practices. Smaller producers, in particular, may struggle with the financial and operational demands of these measures. Ensuring consistent disease prevention remains a critical priority for sustaining long-term market stability.

High Production Costs and Feed Price Volatility

Feed costs account for the largest share of poultry production expenses, making the industry highly sensitive to fluctuations in global corn and soybean prices. Rising energy and transportation costs further increase financial pressure on producers. For small- and medium-scale operations, these cost challenges can limit profitability and reduce supply consistency.

Producers face difficulty passing higher costs on to consumers, as chicken demand is highly price-sensitive. To remain competitive, the industry must focus on improving feed efficiency, adopting modern production technologies, and optimizing supply chains. These investments are essential but can be difficult to implement uniformly across the sector.

Mexico Fresh and Chilled Chicken Meat Market

Fresh and chilled chicken remains the most preferred segment in Mexico due to strong consumer perceptions of freshness, taste, and quality. Many households favor purchasing fresh chicken for daily cooking, aligning with traditional meal preparation practices. Supermarkets, butcher shops, local markets, and specialty poultry stores dominate distribution in this segment.

Advancements in cold-chain logistics and improved hygiene standards have enhanced product safety and availability, even in semi-urban areas. Fresh and chilled chicken is widely used in soups, stews, grilled dishes, and regional specialties, reinforcing its cultural relevance. Although price sensitivity persists, freshness often takes priority for home cooking, supporting continued growth in this segment.

Mexico Processed Chicken Meat Market

The processed chicken meat segment is experiencing rapid expansion as consumer lifestyles become busier and more convenience-oriented. Products such as nuggets, sausages, breaded fillets, patties, deli meats, and marinated cuts appeal strongly to urban households and young professionals. Dual-income families and time-constrained consumers increasingly rely on easy-to-prepare meal options.

Processors are responding with product innovation, offering healthier formulations, reduced sodium content, and diverse flavor profiles. Improved processing and packaging technologies have extended shelf life and enhanced product consistency. As convenience foods become more embedded in everyday diets, processed chicken is expected to play an increasingly important role in overall market growth.

Mexico Chicken Specialty Stores Market

Specialty poultry stores and traditional butcher shops continue to hold an important position in Mexico’s chicken distribution landscape. These outlets attract consumers who value freshness, customization, and personal trust in sourcing. Services such as specific cuts, trimming, and marination provide added value and differentiate specialty stores from large retail chains.

Local markets and neighborhood shops benefit from strong customer relationships and perceptions of authenticity. While competition from supermarkets is increasing, many specialty stores have adapted by improving hygiene standards, refrigeration, and packaging. Their ability to balance traditional practices with modern expectations ensures their continued relevance in the market.

Online Retail Market for Chicken in Mexico

Online grocery shopping is gaining momentum in Mexico, and chicken is becoming an increasingly popular category within this channel. E-commerce platforms offer convenience, flexible delivery options, and access to a wide range of fresh, frozen, and processed chicken products. Urban households and younger consumers are particularly drawn to the time-saving benefits of online purchasing.

Retailers are investing in insulated packaging, cold-chain management, and real-time delivery tracking to maintain product quality. Detailed product descriptions, reviews, and digital promotions further enhance consumer confidence. As digital payments and food delivery services continue to expand, online retail is expected to become one of the fastest-growing distribution channels for chicken.

Mexico Chicken Market Segmentation Overview

The Mexico chicken market can be segmented by product type and distribution channel. Product categories include fresh and chilled chicken, frozen and canned chicken, and processed chicken products. Distribution channels span on-trade outlets such as restaurants and foodservice providers, as well as off-trade channels including supermarkets, hypermarkets, specialty stores, online retail, and other retail formats. This diversified structure allows the market to serve a wide range of consumer preferences and purchasing behaviors.

Mexico Chicken Market Price Trends

Chicken prices in Mexico have experienced fluctuations in recent years due to changes in feed costs, processing expenses, and transportation rates. Between 2020 and 2024, pricing reflected volatility in global commodity markets and energy costs. Looking ahead to 2025–2033, pricing dynamics will continue to be influenced by climate conditions, input costs, and competition from alternative protein sources. Despite these factors, chicken is expected to remain one of the most affordable animal proteins available.

Mexico Chicken Market Import and Export Dynamics

Mexico’s chicken trade is shaped by domestic production capacity, regional demand, and international trade policies. Import and export flows are influenced by tariffs, sanitary regulations, and sustainability standards. While domestic production satisfies a large share of demand, trade remains important for balancing supply and addressing temporary shortages. Regulatory frameworks and biosecurity measures will continue to play a central role in shaping trade patterns.

Competitive Landscape and Company Analysis

The competitive landscape of the Mexico chicken market includes a mix of multinational corporations and strong domestic players. Companies are evaluated across multiple viewpoints, including overall business strategy, leadership structure, recent developments, and revenue performance. Key industry participants continue to invest in production efficiency, product innovation, and distribution expansion to strengthen their market positions. Strategic partnerships, technological upgrades, and sustainability initiatives are increasingly important for maintaining competitiveness in a growing yet challenging market environment.