Jordan Water Desalination Market Overview

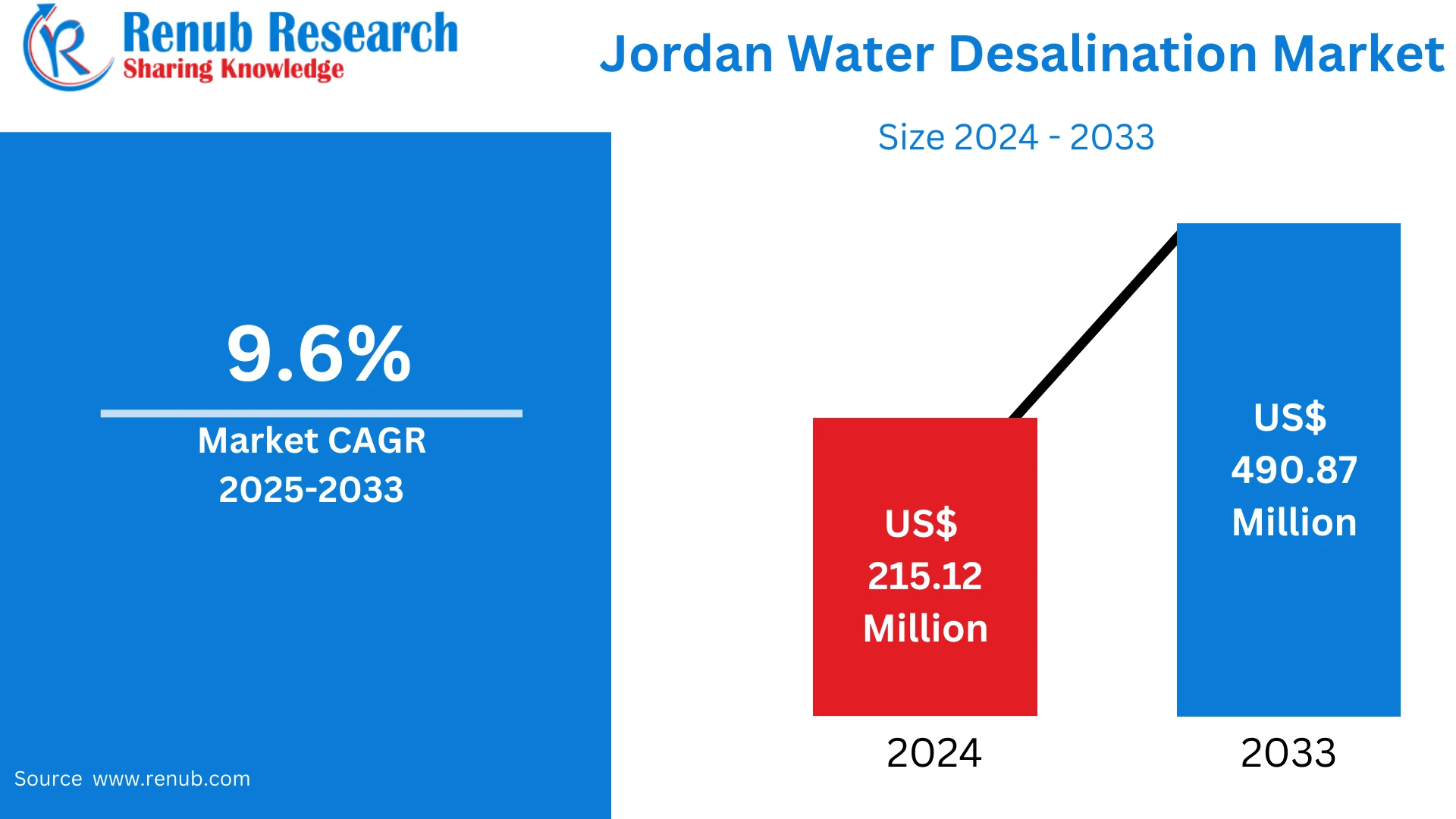

According To Renub Research Jordan Water Desalination Market is emerging as a critical pillar of national water security amid escalating freshwater scarcity. Valued at US$ 215.12 million in 2024, the market is projected to reach US$ 490.87 million by 2033, expanding at a compound annual growth rate (CAGR) of 9.6% during 2025–2033. This growth is primarily driven by extreme water stress, rapid urbanization, population growth, refugee inflows, and strong government commitment toward long-term water sustainability projects.

Jordan is one of the most water-deprived countries globally, with renewable freshwater resources far below internationally recognized scarcity thresholds. Groundwater overextraction, climate variability, and declining precipitation have significantly reduced natural water availability. Under these conditions, desalination has transitioned from an alternative solution to a national necessity, supporting municipal supply, industrial operations, agriculture, and humanitarian needs.

The increasing adoption of reverse osmosis desalination technology, along with major infrastructure investments such as the Red Sea–Dead Sea and Aqaba–Amman water conveyance initiatives, continues to reshape the water management landscape in Jordan.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=jordan-desalination-market-p.php

Jordan Water Desalination Market Outlook

Water desalination refers to the process of removing salts, minerals, and contaminants from seawater, brackish water, or river water to produce potable or industrial-grade freshwater. In Jordan, desalination plays a vital role in addressing chronic water shortages caused by arid climatic conditions, limited surface water, and excessive groundwater depletion.

Municipal water supply remains the dominant application of desalination in Jordan, particularly in densely populated urban centers such as Amman. Desalinated water is also increasingly used by industrial sectors, including energy generation, mining, pharmaceuticals, and manufacturing, where consistent access to high-quality water is essential for operational efficiency. In agriculture, desalination provides a supplementary irrigation source in regions facing severe water deficits.

Government-backed desalination initiatives, coupled with private sector participation, have significantly improved technical capacity and operational efficiency. Reverse osmosis systems, multi-effect distillation, and hybrid desalination technologies are being deployed to meet rising demand while optimizing energy use and reducing operational costs.

Key Growth Drivers in the Jordan Water Desalination Market

Extreme Water Scarcity

Jordan ranks among the most water-stressed nations in the world. Per capita water availability has fallen to critically low levels, far below the international water poverty threshold. Renewable water resources are estimated at less than 100 cubic meters per capita annually, intensifying pressure on existing supplies.

Desalination provides a reliable and climate-independent source of freshwater, enabling Jordan to meet domestic, industrial, and humanitarian water requirements. As water scarcity worsens due to climate change and population growth, reliance on desalination continues to expand, driving sustained market growth.

Government Investment and Strategic Initiatives

The Jordanian government has placed desalination at the core of its national water security strategy. Long-term programs such as the National Water Strategy 2023–2040 emphasize integrated water resource management, groundwater protection, wastewater reuse, and alternative water sourcing.

Large-scale infrastructure projects, including national water carrier systems and seawater desalination plants, have attracted significant international financing and public-private partnerships. These initiatives enhance desalination capacity while strengthening regulatory frameworks, technical standards, and institutional efficiency across the water sector.

Rapid Urbanization and Population Growth

Jordan’s population has increased dramatically over recent decades, driven by natural growth and large refugee inflows. Urban centers, particularly Amman, face intense pressure on water distribution networks due to rising domestic consumption.

Desalination facilities offer a scalable and long-term solution to urban water shortages, supporting residential supply, commercial demand, and public services. As urban expansion continues, desalinated water will remain essential to maintaining social stability and economic development.

Challenges Facing the Jordan Water Desalination Market

High Capital and Operational Costs

Desalination infrastructure requires substantial upfront investment in plant construction, intake systems, pipelines, energy supply, and distribution networks. Operating costs remain high due to energy consumption, membrane replacement, chemical use, and skilled labor requirements.

For a resource-constrained economy like Jordan, financing large-scale desalination projects often depends on international loans, grants, and private sector participation. Cost recovery through tariffs remains a sensitive issue, requiring careful policy balancing to ensure affordability and financial sustainability.

Energy Dependence and Environmental Concerns

Desalination is energy-intensive, posing challenges in a country with limited domestic energy resources. Electricity costs significantly influence overall desalination expenses, while brine discharge raises environmental concerns related to marine ecosystems.

To mitigate these challenges, Jordan is increasingly integrating renewable energy sources, such as solar power, into desalination projects. Energy-efficient reverse osmosis systems and environmentally responsible brine management practices are becoming critical to long-term market viability.

Technology Analysis

Reverse Osmosis Desalination Market

Reverse osmosis (RO) dominates the Jordan water desalination market due to its high efficiency, lower energy consumption compared to thermal methods, and suitability for both seawater and brackish water treatment. RO technology is widely adopted in municipal, industrial, and decentralized desalination systems.

Continuous advancements in membrane materials, energy recovery devices, and automation are improving system performance and reducing operating costs. Government support for energy-efficient technologies further strengthens the outlook for reverse osmosis desalination in Jordan.

Application-Based Market Analysis

Municipal Water Desalination Market

The municipal segment represents the largest share of the Jordan water desalination market. Urban populations depend heavily on desalinated water for drinking, sanitation, and household use. Major cities are integrating desalinated water into public supply networks to offset declining groundwater availability.

Planned commissioning of large-scale desalination plants is expected to significantly increase municipal supply capacity by 2030, ensuring long-term water security for urban residents.

Industrial Water Desalination Market

Industrial sectors are increasingly adopting desalination to secure uninterrupted access to high-quality water. Manufacturing facilities, power plants, and mining operations rely on desalinated water to reduce dependence on overexploited aquifers.

Industrial desalination supports operational efficiency, regulatory compliance, and corporate sustainability goals, contributing to steady growth in this segment.

Water Source Analysis

Seawater Desalination Market

Seawater desalination is gaining momentum in Jordan, particularly through projects linked to the Red Sea and Gulf of Aqaba. Large-scale plants utilizing reverse osmosis and thermal technologies convert seawater into potable and industrial-grade water.

Seawater desalination significantly reduces pressure on inland freshwater resources while enabling long-distance water conveyance to northern population centers.

Brackish and River Water Desalination Market

Brackish groundwater and river water desalination play a complementary role, especially in rural and semi-urban regions. These systems support agricultural irrigation, municipal supply, and localized water needs where seawater desalination is not feasible.

City-Level Market Insights

Amman Water Desalination Market

Amman is the largest consumer of desalinated water in Jordan. High population density, urban expansion, and industrial activity drive continuous demand. Both centralized desalination plants and smaller brackish water systems contribute to the city’s water supply.

Russeifa Water Desalination Market

Russeifa is experiencing growing desalination demand due to industrial growth and residential expansion. Localized desalination facilities reduce reliance on groundwater while supporting municipal and industrial needs.

Rukban Water Desalination Market

Rukban faces unique water challenges due to its remote location and refugee population. Modular and mobile desalination units are increasingly used to supply safe drinking water, making this a niche but strategically important market.

Madaba Water Desalination Market

Madaba relies on brackish groundwater desalination to support municipal supply and agriculture. Tourism growth and population increases continue to drive investment in small- and medium-scale desalination plants.

Recent Developments in the Jordan Water Desalination Market

Jordan has witnessed significant progress in desalination infrastructure through large-scale concession agreements and international partnerships. Multi-billion-dollar investments are underway to construct some of the world’s largest desalination facilities, capable of supplying water to millions of people.

These projects integrate advanced reverse osmosis technology, renewable energy solutions, and long-distance conveyance systems to ensure sustainable, efficient, and environmentally responsible water supply.

Market Segmentation

By Technology

- Reverse Osmosis

- Multi-Stage Flash Distillation

- Multi-Effect Distillation

- Others

By Application

- Municipal

- Industrial

- Others

By Water Source

- Seawater

- Brackish Water

- River Water

- Others

By City

- Amman

- Zarqa

- Irbid

- Russeifa

- Ajloun

- Aqaba

- Rukban

- Madaba

- Rest of Jordan

Competitive Landscape and Key Players

The Jordan water desalination market features a mix of international technology providers, engineering firms, and water management companies. Market participants focus on innovation, operational efficiency, and long-term concession models to strengthen their presence.

Key players are evaluated across multiple parameters, including company overview, leadership, recent developments, SWOT analysis, revenue performance, and strategic positioning.

Conclusion

The Jordan Water Desalination Market is poised for robust growth through 2033, supported by severe water scarcity, proactive government policies, technological advancements, and rising urban demand. Despite challenges related to cost and energy intensity, continued investment in reverse osmosis technology, renewable energy integration, and large-scale infrastructure projects will ensure desalination remains central to Jordan’s water security strategy.

As desalination capacity expands, the market will play a decisive role in supporting economic development, public health, industrial growth, and long-term environmental sustainability across the Kingdom of Jordan.