Greece Watch Market Size & Forecast 2025–2033

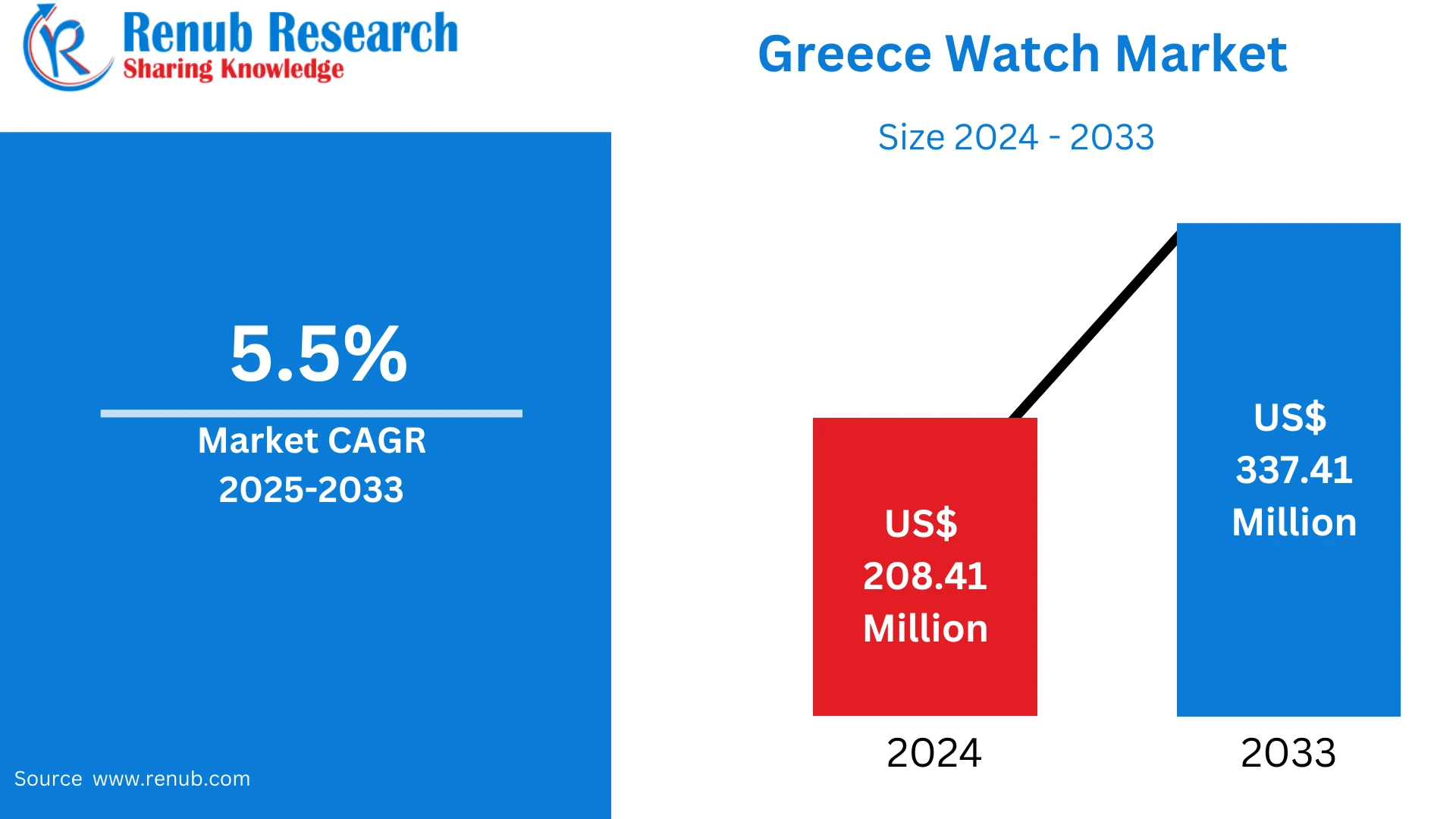

According To Renub Research Greece watch market is experiencing steady and sustainable growth, supported by evolving consumer lifestyles, expanding tourism activity, and increasing demand for both luxury and smart wearable products. The market was valued at US$ 208.41 million in 2024 and is projected to reach US$ 337.41 million by 2033, growing at a compound annual growth rate (CAGR) of 5.5% during the forecast period 2025–2033. This upward trajectory reflects a balanced blend of traditional watchmaking appreciation and the rapid adoption of advanced wearable technologies.

Watches in Greece are no longer viewed solely as timekeeping devices. They have become essential fashion accessories, personal status symbols, and functional tools that align with modern lifestyles. From premium mechanical watches to feature-rich smartwatches, the Greek market demonstrates strong diversity across price ranges, consumer groups, and distribution channels.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=greece-watch-market-p.php

Greece Watch Market Outlook

A watch is a personal timepiece designed to display time and, in many cases, additional functions such as date display, alarms, fitness tracking, heart rate monitoring, GPS navigation, and smartphone connectivity. In Greece, watches hold both functional and aesthetic value, making them popular across age groups and income levels.

The Greek consumer base shows a strong preference for well-designed watches that complement personal style while offering reliability and durability. Urban populations, particularly in metropolitan areas, favor premium and branded watches as indicators of sophistication and social standing. At the same time, younger consumers and professionals increasingly opt for smart and electronic watches that support health monitoring, productivity, and digital connectivity.

Tourism significantly influences watch sales, as Greece remains one of Europe’s most visited destinations. Tourists often purchase watches as luxury souvenirs or gifts, boosting sales in duty-free outlets, city centers, and island destinations. This combination of local demand and tourist-driven consumption makes the watch market resilient and seasonally dynamic.

Growth Drivers in the Greece Watch Market

Increasing Demand for Luxury and Fashion Accessories

Luxury and fashion watches continue to be a major growth driver in the Greek market. Watches are widely perceived as long-term investments, heirloom pieces, and symbols of refined taste. High-income consumers in cities such as Athens and Thessaloniki actively seek premium designs, limited editions, and mechanically crafted timepieces.

Additionally, gifting culture plays a vital role in sustaining luxury watch sales, particularly during festive seasons, weddings, anniversaries, and professional milestones. Tourists, especially from high-spending regions, also contribute significantly by purchasing luxury watches during their visits, strengthening both retail and duty-free sales channels.

Rising Adoption of Smart and Electronic Watches

The rapid advancement of wearable technology has transformed consumer preferences in Greece. Smartwatches and electronic watches are increasingly popular due to their multifunctional capabilities, including fitness tracking, health monitoring, notifications, and seamless smartphone integration.

Health awareness among Greek consumers has grown substantially, encouraging the adoption of wearable devices that support active lifestyles. Younger demographics, office professionals, and tech-savvy users are the primary adopters of smartwatches, ensuring sustained growth for this segment throughout the forecast period.

Expansion of Tourism and Retail Infrastructure

Tourism remains a cornerstone of the Greek economy and plays a critical role in driving watch sales. Tourist destinations, airports, cruise ports, and luxury shopping districts benefit from high foot traffic and strong purchasing power. Watches are frequently bought as souvenirs, gifts, or luxury fashion items, contributing to higher average transaction values.

Simultaneously, the expansion of organized retail, shopping malls, and online platforms has improved product accessibility across the country. E-commerce growth enables consumers in smaller cities and islands to access a wide range of domestic and international watch brands, supporting market expansion.

Challenges Facing the Greece Watch Market

Competition from International and Online Retailers

One of the primary challenges facing the Greek watch market is intense competition from international brands and cross-border e-commerce platforms. Consumers often compare prices online and purchase from overseas sellers offering competitive pricing or exclusive models.

This trend places pressure on local retailers and independent watch dealers, particularly those operating in smaller cities with limited brand representation. Maintaining competitive pricing and brand differentiation remains a key challenge for domestic players.

Price Sensitivity and Economic Uncertainty

Despite positive growth trends, price sensitivity among Greek consumers continues to affect market expansion. Economic fluctuations and inflationary pressures can reduce discretionary spending, particularly on high-value luxury watches.

Import duties, taxes, and operational costs further elevate retail prices for foreign watch brands, limiting affordability for middle-income consumers. As a result, market growth in the luxury segment remains dependent on high-income buyers and tourism performance.

Greece Electronic Watch Market

The electronic watch market in Greece is expanding rapidly, driven by growing interest in smartwatches and digital sports watches. Consumers are increasingly attracted to features such as step tracking, calorie monitoring, heart rate measurement, sleep analysis, and mobile connectivity.

This segment appeals primarily to younger consumers, fitness enthusiasts, and professionals seeking convenience and functionality. Strong availability through electronics stores and online platforms has accelerated adoption, particularly in urban centers. Continuous product innovation and competitive pricing are expected to sustain growth in this category.

Greece Mechanical Watch Market

Mechanical watches maintain a strong presence in Greece, particularly among collectors, luxury buyers, and traditional watch enthusiasts. These watches are valued for their craftsmanship, engineering precision, and timeless appeal.

Although mechanical watches account for a smaller share of total unit sales compared to electronic watches, they dominate the high-value segment. Demand remains strong in luxury boutiques, jewelry stores, and duty-free outlets, supported by affluent locals and international tourists seeking premium, long-lasting timepieces.

Greece Men Watch Market

The men’s watch segment represents a significant portion of overall market revenue. Male consumers in Greece show diverse preferences, ranging from luxury mechanical watches for formal and business use to smartwatches for everyday wear and fitness activities.

Professionals, collectors, and tourists are key contributors to this segment. Continuous product launches featuring versatile designs, enhanced durability, and advanced technology support sustained growth across both premium and mid-range categories.

Greece Luxury Watch Market

The luxury watch market in Greece is primarily driven by affluent consumers and international visitors. High-end mechanical watches, limited editions, and premium craftsmanship define this segment.

Luxury watch sales are concentrated in major cities and tourist destinations, with peak demand during holiday seasons and high tourist inflow periods. Gifting traditions, weddings, and corporate milestones further contribute to steady demand throughout the year.

Greece Watch Convenience Stores Market

Convenience stores in Greece play an important role in distributing affordable and casual watches. These outlets primarily sell low-to-mid-priced analog, digital, and electronic watches catering to impulse buyers, tourists, and price-conscious consumers.

High foot traffic in urban centers, transport hubs, and tourist areas ensures consistent sales volumes. While margins are lower than luxury retail, convenience stores provide stable revenue streams for mass-market watch brands.

Regional Market Analysis

Athens Watch Market

Athens represents the largest and most lucrative watch market in Greece. The city benefits from a dense population, strong tourism activity, and a well-developed retail infrastructure. Luxury boutiques, shopping districts, and duty-free outlets drive high sales of premium mechanical watches and smartwatches alike.

Volos Watch Market

Volos serves as a regional hub for affordable and mid-range watches. Local jewelers and retailers cater to residents and domestic tourists seeking functional and stylish timepieces. Growing awareness of smartwatches and increased online shopping are gradually expanding product diversity in this market.

Patras Watch Market

Patras exhibits steady demand for fashion and electronic watches, supported by its status as a port city and regional commercial center. Seasonal festivals, tourism activity, and gift-giving occasions drive periodic sales spikes, reinforcing overall market stability.

Market Segmentation

By Type

· Quartz Watches

· Electronic Watches

· Mechanical Watches

By Gender

· Men

· Women

· Unisex

By Price Range

· Luxury

· Non-Luxury

By Distribution Channel

· Hypermarkets/Supermarkets

· Convenience Stores

· Online

By City

· Athens

· Thessaloniki

· Patras

· Piraeus

· Heraklion

· Larissa

· Volos

· Peristeri

· Acharnes

· Kallithea

Competitive Landscape and Key Players

The Greece watch market features a mix of global watchmakers and technology-driven brands. Companies compete on the basis of product innovation, brand reputation, pricing strategy, and distribution reach. Each major player is analyzed across five viewpoints: company overview, key leadership, recent developments, SWOT analysis, and revenue performance.

Leading market participants include Fossil Group Inc., Titan Company Limited, LVMH Group, Apple Inc., Compagnie Financière Richemont S.A., The Swatch Group Ltd., Citizen Watch Co. Ltd., and Seiko Group Corporation.

Conclusion

The Greece watch market is poised for consistent growth through 2033, driven by rising demand for luxury accessories, expanding smartwatch adoption, and strong tourism-led retail sales. While economic uncertainty and international competition present challenges, diversification across product categories and distribution channels ensures long-term market resilience. As consumer preferences continue to evolve, innovation, accessibility, and brand positioning will remain critical to success in the Greek watch industry.