United States Foodservice Market Size & Forecast 2025–2033

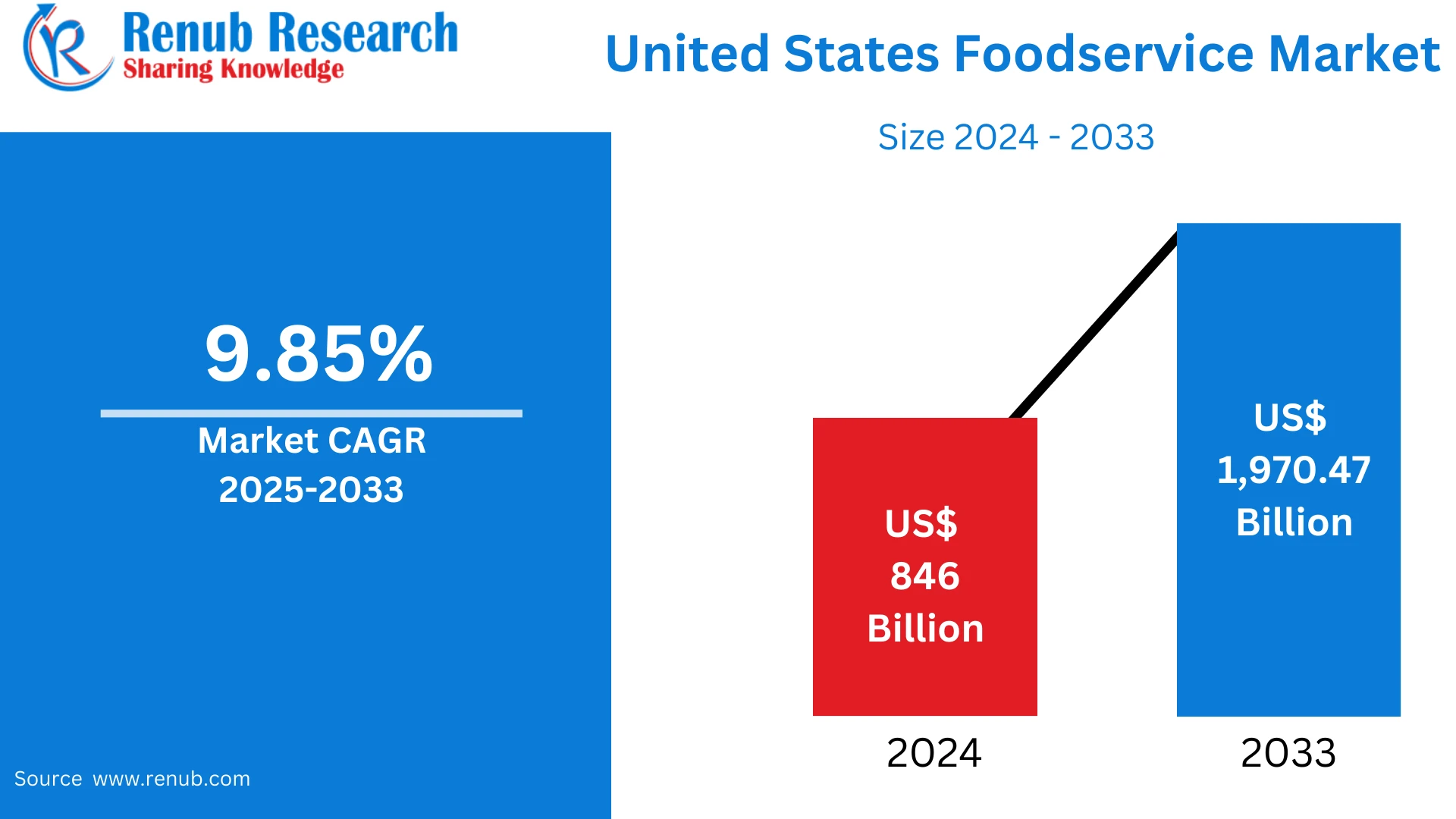

According To Renub Research United States foodservice market represents one of the largest and most dynamic segments of the global hospitality and consumer services industry. Valued at US$ 846 billion in 2024, the market is projected to reach US$ 1,970.47 billion by 2033, expanding at a compound annual growth rate (CAGR) of 9.85% from 2025 to 2033. This strong growth outlook reflects evolving consumer lifestyles, rising demand for convenience dining, rapid digitalization of food ordering, and the continued expansion of quick-service and premium restaurant formats across the country.

Foodservice plays a critical role in the U.S. economy, supporting millions of jobs and serving as a cornerstone of social interaction, tourism, and urban living. The market continues to adapt to shifting consumer expectations related to health, sustainability, speed, and personalization.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=us-foodservice-market-p.php

United States Foodservice Market Outlook

Foodservice refers to the preparation, distribution, and sale of meals and beverages intended for immediate consumption outside the home. It encompasses a broad ecosystem that includes restaurants, cafés, fast-food outlets, catering companies, hotels, institutional kitchens, and specialty food operators. In the United States, foodservice has become deeply embedded in everyday life, driven by long working hours, urbanization, and a strong cultural preference for dining out.

The diversity of American food culture supports a wide range of foodservice formats, from affordable fast-food chains to high-end fine dining establishments. Consumers increasingly seek variety, speed, and experiential value, making foodservice a continuously evolving industry. Technological innovation, menu creativity, and service flexibility are now essential competitive factors across all segments.

Key Growth Drivers in the United States Foodservice Market

Rising Demand for Convenience and On-the-Go Dining

One of the primary growth drivers of the U.S. foodservice market is the increasing need for convenience. Busy work schedules, longer commute times, and dual-income households have significantly increased reliance on quick meals and ready-to-eat food options. Fast-food restaurants, fast-casual dining outlets, food trucks, and grab-and-go concepts are thriving as consumers prioritize speed and accessibility.

Extended operating hours, drive-thru services, and 24/7 dining models further support this trend. Convenience-focused offerings appeal particularly to students, professionals, and urban residents who value efficiency without compromising taste or affordability.

Expansion of Online Food Ordering and Delivery Platforms

Digital transformation has reshaped the U.S. foodservice landscape. Online food ordering and delivery platforms have revolutionized how consumers access meals, offering convenience, menu variety, and contactless payment options. Restaurants benefit from expanded customer reach, improved order accuracy, and data-driven marketing opportunities.

The growth of mobile apps, loyalty programs, and subscription-based meal services has strengthened customer engagement and repeat business. Smaller and independent restaurants now compete more effectively by leveraging digital platforms without significant investments in physical expansion.

Growing Health and Lifestyle Awareness

Health consciousness among American consumers continues to influence menu development and dining choices. Demand for organic, plant-based, gluten-free, low-calorie, and allergen-friendly options is rising steadily. Foodservice operators are responding with cleaner ingredient labels, transparent sourcing, and nutritionally balanced offerings.

Trends such as farm-to-table dining, sustainable sourcing, and reduced food waste enhance brand credibility and attract environmentally and health-conscious customers. These shifts drive continuous menu innovation and support long-term market growth.

Challenges in the United States Foodservice Market

Labor Shortages and Rising Operating Costs

Labor shortages remain a persistent challenge for the U.S. foodservice industry. Rising wages, high employee turnover, and competition for skilled kitchen and service staff have increased operational costs. Additionally, fluctuations in food prices, supply chain disruptions, and energy costs place pressure on profit margins.

While automation, self-service kiosks, and digital ordering systems help offset labor challenges, implementation costs can be high, particularly for small and mid-sized operators.

Intense Competition and Changing Consumer Preferences

The U.S. foodservice market is highly fragmented and intensely competitive. National restaurant chains, independent eateries, meal-kit providers, and grocery store foodservice sections all compete for consumer spending. Rapidly evolving consumer tastes require frequent menu updates, branding refreshes, and service enhancements.

Failure to adapt to health trends, sustainability expectations, or digital convenience can result in loss of market share. Customer retention, pricing strategies, and brand differentiation remain critical success factors.

United States Commercial Foodservice Market

The commercial foodservice segment includes restaurants, cafés, bars, catering companies, and hospitality venues that serve consumers directly. This segment accounts for the largest share of the overall market, supported by urbanization, tourism growth, and a strong dining-out culture.

Quick-service restaurants and casual dining establishments dominate commercial foodservice due to their affordability and accessibility. Premium dining venues cater to higher-income consumers seeking experiential and gourmet offerings. Post-pandemic recovery has been accelerated by delivery platforms, mobile ordering, and flexible dining formats.

United States Centralized Foodservice System Market

Centralized foodservice systems involve preparing meals at a single facility and distributing them to multiple service locations such as schools, hospitals, corporate cafeterias, and correctional institutions. This model improves efficiency, ensures consistent quality, and reduces food waste.

In the United States, demand for centralized foodservice systems is increasing in healthcare and educational institutions where large-scale, cost-effective, and compliant meal production is essential. Technological integration and standardized processes further enhance operational efficiency.

United States Fast Food Restaurants Market

Fast food restaurants represent the backbone of the U.S. foodservice industry. This segment benefits from strong brand recognition, nationwide presence, and consistent consumer demand. Speed, affordability, and menu familiarity make fast food a preferred option across age groups.

Drive-thru services, mobile app ordering, and promotional offers continue to drive volume growth. Menu diversification, including healthier alternatives and limited-time offerings, helps fast-food chains remain competitive in a changing consumer environment.

United States Special Food Services Restaurants Market

Special food services cater to niche and event-based dining needs, including catering companies, food trucks, banquet services, and pop-up dining experiences. This segment benefits from corporate events, weddings, festivals, and private celebrations.

Customization, themed menus, and experiential dining concepts differentiate specialty food service providers. Growing interest in unique culinary experiences and social events supports steady expansion of this segment.

Regional Insights

California Foodservice Market

California stands as one of the most influential foodservice markets in the United States. Its multicultural population, strong tourism industry, and innovation-driven food culture support diverse dining formats. Health-focused, plant-based, and sustainable dining trends are particularly prominent.

Major metropolitan areas host a mix of fine dining, casual eateries, food trucks, and technology-enabled delivery services, making California a leader in foodservice innovation.

New Jersey Foodservice Market

New Jersey’s foodservice market benefits from its proximity to major metropolitan centers and a vibrant local dining scene. The state features a balanced mix of fast-casual chains, independent diners, and ethnic restaurants.

Catering services play a significant role due to high demand for corporate and social events. Online ordering and delivery platforms have expanded market reach for small and mid-sized operators.

Texas Foodservice Market

Texas represents a robust and fast-growing foodservice market driven by population growth, cultural diversity, and economic strength. The state is known for barbecue, Tex-Mex, and innovative casual dining concepts.

Large urban centers and suburban expansion create strong demand for fast food, casual dining, and catering services. Drive-thru convenience and delivery services are essential for serving Texas’s vast geographic area.

Market Segmentation Overview

By Sector

· Commercial

· Non-Commercial

By System

· Conventional Foodservice System

· Centralized Foodservice System

· Ready-Prepared Foodservice System

· Assembly-Serve Foodservice System

By Restaurant Type

· Fast Food Restaurants

· Full-Service Restaurants

· Limited-Service Restaurants

· Special Food Services Restaurants

By Top States

· California

· Texas

· Florida

· Illinois

· Pennsylvania

· Ohio

· Georgia

· Washington

· New Jersey

· Rest of the United States

Competitive Landscape and Key Players

The U.S. foodservice market is characterized by the presence of well-established global brands alongside strong regional and independent operators. Market leaders focus on menu innovation, digital transformation, supply chain efficiency, and brand loyalty to maintain competitive advantage.

Key companies operating in the United States foodservice market include:

· Bloomin' Brands, Inc.

· Brinker International, Inc.

· Chipotle Mexican Grill, Inc.

· Darden Restaurants, Inc.

· Doctor's Associates, Inc.

· Domino's Pizza Inc.

· Inspire Brands, Inc.

· McDonald's Corporation

· MTY Food Group Inc.

· Northland Properties Corporation

Each company is analyzed across multiple dimensions, including company overview, leadership, recent developments, SWOT analysis, and revenue performance.

Conclusion

The United States foodservice market is entering a high-growth phase driven by convenience dining, digital ordering, health-focused menus, and regional innovation. Despite challenges related to labor costs and competition, the market remains resilient and adaptive.

With strong consumer demand, technological advancement, and diverse dining preferences, the U.S. foodservice industry is well positioned for sustained expansion through 2033, offering significant opportunities for operators, investors, and stakeholders across the value chain.