Artisanal Ice Cream Market Size and Forecast

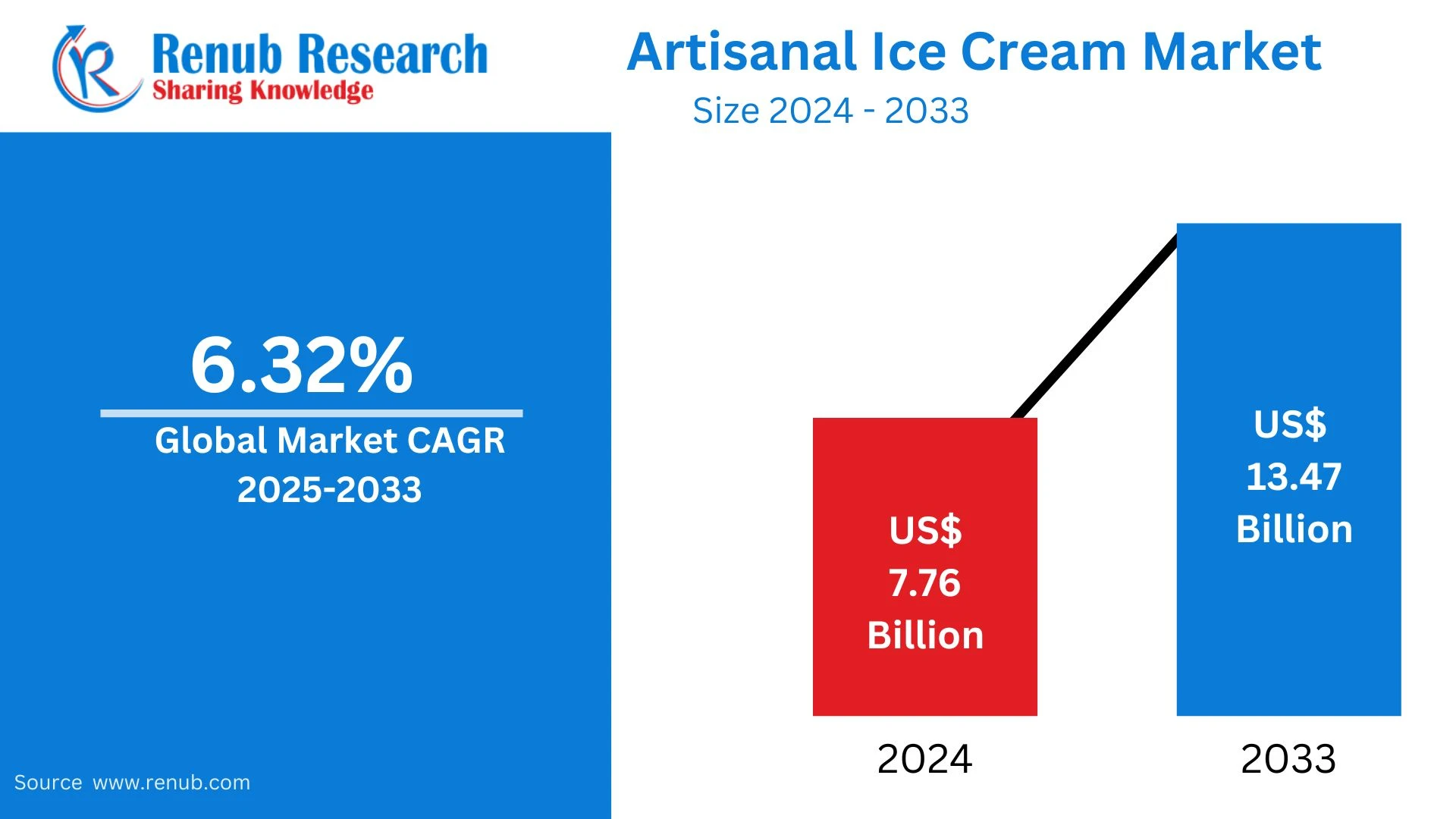

According To Renub Research artisanal ice cream market is experiencing strong global momentum, driven by evolving consumer preferences for premium, natural, and experience-driven food products. Valued at approximately US$ 7.76 billion in 2024, the market is projected to reach nearly US$ 13.47 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.32% from 2025 to 2033. This consistent expansion reflects a broader shift away from mass-produced frozen desserts toward handcrafted alternatives that emphasize quality, authenticity, and creativity. Artisanal ice cream producers are particularly well positioned to meet growing demand for distinctive flavors, cleaner labels, and sustainable practices, making the segment one of the most dynamic within the global frozen dessert industry.

Global Artisanal Ice Cream Market Overview

The global artisanal ice cream market is shaped by consumers’ increasing desire for high-quality, handcrafted products made with natural and thoughtfully sourced ingredients. Unlike industrial ice creams that rely on artificial flavors, stabilizers, and preservatives, artisanal ice creams are typically produced in small batches using fresh dairy, real fruits, nuts, spices, and premium inclusions. This emphasis on craftsmanship resonates strongly with consumers seeking transparency and authenticity in their food choices.

Changing lifestyles and rising disposable incomes, especially in urban areas, have accelerated demand for indulgent yet mindful treats. Millennials and Generation Z play a pivotal role in shaping market trends, as these groups value sustainability, ethical sourcing, and brand storytelling. For them, artisanal ice cream represents not just a dessert, but an experience tied to local culture, creativity, and social values.

Large food companies are also responding to this shift. For example, Nestlé has continued to refine its premium and artisanal-inspired offerings, focusing on unique flavor combinations and higher-quality ingredients to align with health-conscious and gourmet consumer expectations. Similarly, boutique brands such as Carmela Ice Cream have built loyal followings by highlighting organic ingredients, freshness, and distinctive flavor profiles.

Geographically, North America and Europe remain the most mature markets due to strong premium food cultures and well-developed cold-chain infrastructure. However, Asia-Pacific and the Middle East are emerging rapidly, supported by urbanization, tourism, and a growing appetite for premium food experiences. Despite strong growth potential, the market remains fragmented, with numerous small and regional players competing on quality, innovation, and brand identity.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=artisanal-ice-cream-market-p.php

Key Factors Driving the Artisanal Ice Cream Market Growth

Rising Demand for Premium and Natural Ingredients

One of the most important growth drivers in the artisanal ice cream market is the increasing consumer preference for premium, natural, and minimally processed ingredients. Shoppers are becoming more label-conscious and are actively avoiding artificial colors, synthetic flavors, and chemical preservatives. Artisanal ice cream brands respond to this demand by using organic milk, free-range eggs, non-GMO sweeteners, and locally sourced fruits and nuts.

This commitment to ingredient quality allows artisanal producers to command higher price points while building trust and long-term customer loyalty. Consumers increasingly view artisanal ice cream as a healthier indulgence, particularly when compared with mass-produced alternatives. The perception of freshness, transparency, and craftsmanship plays a crucial role in repeat purchases and word-of-mouth marketing.

Innovation in Flavors and Dietary Options

Flavor innovation is at the heart of the artisanal ice cream market. Producers consistently experiment with bold, unconventional, and globally inspired flavor combinations such as miso caramel, saffron rose, chili chocolate, and lavender honey. These creative offerings appeal to adventurous consumers seeking novel taste experiences that cannot be found in conventional retail freezers.

In addition to flavor creativity, dietary inclusivity is expanding the market’s reach. Many artisanal brands now offer plant-based, lactose-free, low-sugar, and keto-friendly options. Coconut milk, almond milk, oat milk, and cashew bases are increasingly common, allowing producers to cater to vegans, lactose-intolerant consumers, and health-focused buyers. Seasonal and region-specific flavors further enhance product differentiation, encouraging customers to try limited editions and return frequently for new experiences.

Growth of Online and Direct-to-Consumer Channels

The rise of e-commerce and direct-to-consumer (DTC) sales has significantly reshaped the artisanal ice cream landscape. Traditionally constrained by geography and limited shelf life, small producers can now reach wider audiences through online platforms, subscription services, and social media engagement. DTC models allow brands to control their messaging, pricing, and customer relationships while bypassing traditional retail margins.

Advancements in cold-chain logistics and insulated packaging have made nationwide and even cross-border shipping more viable. Limited-edition releases, curated gift boxes, and subscription plans have become popular strategies to increase customer engagement and brand exclusivity. As digital adoption continues to grow, online channels are expected to remain a critical driver of market expansion.

Challenges in the Artisanal Ice Cream Market

High Production and Distribution Costs

Despite its strong growth prospects, the artisanal ice cream market faces notable cost-related challenges. High-quality ingredients, small-batch manufacturing, and labor-intensive processes significantly increase production expenses. Unlike large commercial brands, artisanal producers often lack economies of scale, making it difficult to reduce unit costs without compromising quality.

Distribution adds another layer of complexity. Ice cream requires strict temperature control throughout transportation and storage, leading to high cold-chain logistics costs. For small and independent producers, maintaining profitability while expanding distribution can be challenging, particularly in price-sensitive markets dominated by lower-cost mass brands.

Regulatory and Shelf-Life Constraints

Artisanal ice creams generally have shorter shelf lives due to the absence of preservatives, limiting their distribution range and increasing the risk of product waste. Inventory management becomes more complex, especially when supplying multiple retail locations or expanding internationally.

Additionally, compliance with food safety regulations, labeling requirements, and import standards can be resource-intensive. These regulatory hurdles are particularly challenging for small producers attempting to enter new markets. Navigating different national standards requires expertise and investment, which can slow expansion plans and increase operational risks.

Artisanal Ice Cream Market Overview by Regions

United States Artisanal Ice Cream Market

The United States represents one of the most developed and competitive artisanal ice cream markets globally. Consumers prioritize clean labels, locally sourced ingredients, and sustainable packaging. Urban centers, particularly along the West Coast and Northeast, are hotspots for independent creameries and gourmet dessert shops.

Flavor innovation and plant-based options are key trends, with ingredients such as matcha, avocado, and oat milk gaining popularity. Online subscriptions, food delivery partnerships, and pop-up events help brands expand their reach. Even as large corporations introduce artisanal-style products, small producers maintain loyalty through authenticity, community engagement, and distinctive brand stories.

United Kingdom Artisanal Ice Cream Market

The UK artisanal ice cream market benefits from strong heritage food traditions and growing consumer interest in locally produced, premium products. Boutique brands often emphasize British dairy, seasonal ingredients, and sustainability credentials. Demand for vegan, organic, and reduced-sugar options is particularly high in urban areas.

Specialty grocers, farm shops, food festivals, and cafés serve as important distribution channels. Brands such as Jude’s and Northern Bloc have gained recognition for their quality and innovation. However, rising production costs and economic uncertainty present challenges, making efficient supply chain management essential for long-term growth.

India Artisanal Ice Cream Market

India’s artisanal ice cream market is expanding rapidly, driven by urbanization, rising disposable incomes, and a growing interest in experiential dining. Producers often blend traditional Indian flavors such as saffron, cardamom, mango, and pistachio with modern techniques and healthier formulations.

Cafés, dessert parlors, and premium retail outlets are key sales channels, while online food delivery platforms are opening new opportunities. Challenges include high temperatures, limited cold-storage infrastructure, and price sensitivity. Nevertheless, strong storytelling, regional identity, and innovation are helping artisanal brands build loyal urban consumer bases.

United Arab Emirates Artisanal Ice Cream Market

The UAE’s artisanal ice cream market thrives on a cosmopolitan consumer base, strong tourism sector, and year-round demand due to its hot climate. Premium presentation, exotic flavors, and halal-certified or plant-based options are particularly valued. Gourmet retailers, luxury hotels, and high-end cafés play a major role in distribution.

High operating and storage costs, driven by the need for advanced cold-chain systems, remain a challenge. However, brand differentiation through exclusivity, quality, and innovation continues to fuel growth in this niche but lucrative market.

Recent Developments in the Artisanal Ice Cream Industry

Recent years have seen strategic partnerships and acquisitions aimed at strengthening production capabilities and expanding market reach. In June 2024, Bidcorp UK acquired Northern Bloc Ice Cream Ltd., integrating the brand into its broader manufacturing network. In May 2024, Van Leeuwen Ice Cream partnered with Ollie to launch a premium, dog-friendly ice cream range, highlighting the sector’s creativity and diversification into new consumer segments.

Market Segmentation Analysis

Segmentation by Flavor

The artisanal ice cream market includes a wide range of flavors, with fruit and nut variants leading due to their natural appeal. Chocolate and vanilla remain strong performers, often elevated with gourmet ingredients or unique twists.

Segmentation by Type

Conventional artisanal ice cream continues to dominate, while lactose-free and plant-based variants are growing rapidly in response to dietary trends and health concerns.

Segmentation by Distribution Channel

Specialty stores remain the primary sales channel, supported by hypermarkets, supermarkets, convenience stores, and online platforms. E-commerce is gaining traction as logistics improve.

Competitive Landscape and Key Players

The market features a mix of global companies and boutique producers. Key players include Unilever, Nye’s Cream Sandwiches, Van Leeuwen Ice Cream, Nestlé, Carmela Ice Cream, Toscanini’s, McConnell’s Fine Ice Creams, L'Artisan des Glaces, and Gelato Messina. Competition is based on product quality, flavor innovation, brand storytelling, and sustainability practices.

Conclusion

The artisanal ice cream market is set for sustained growth through 2033, driven by premiumization, health-conscious indulgence, and evolving consumer tastes. While challenges related to cost, regulation, and logistics persist, innovation, digital channels, and strong brand identities continue to unlock new opportunities. As consumers increasingly seek meaningful, high-quality food experiences, artisanal ice cream is poised to remain a vibrant and influential segment of the global frozen dessert industry.